Source: Thinkstock

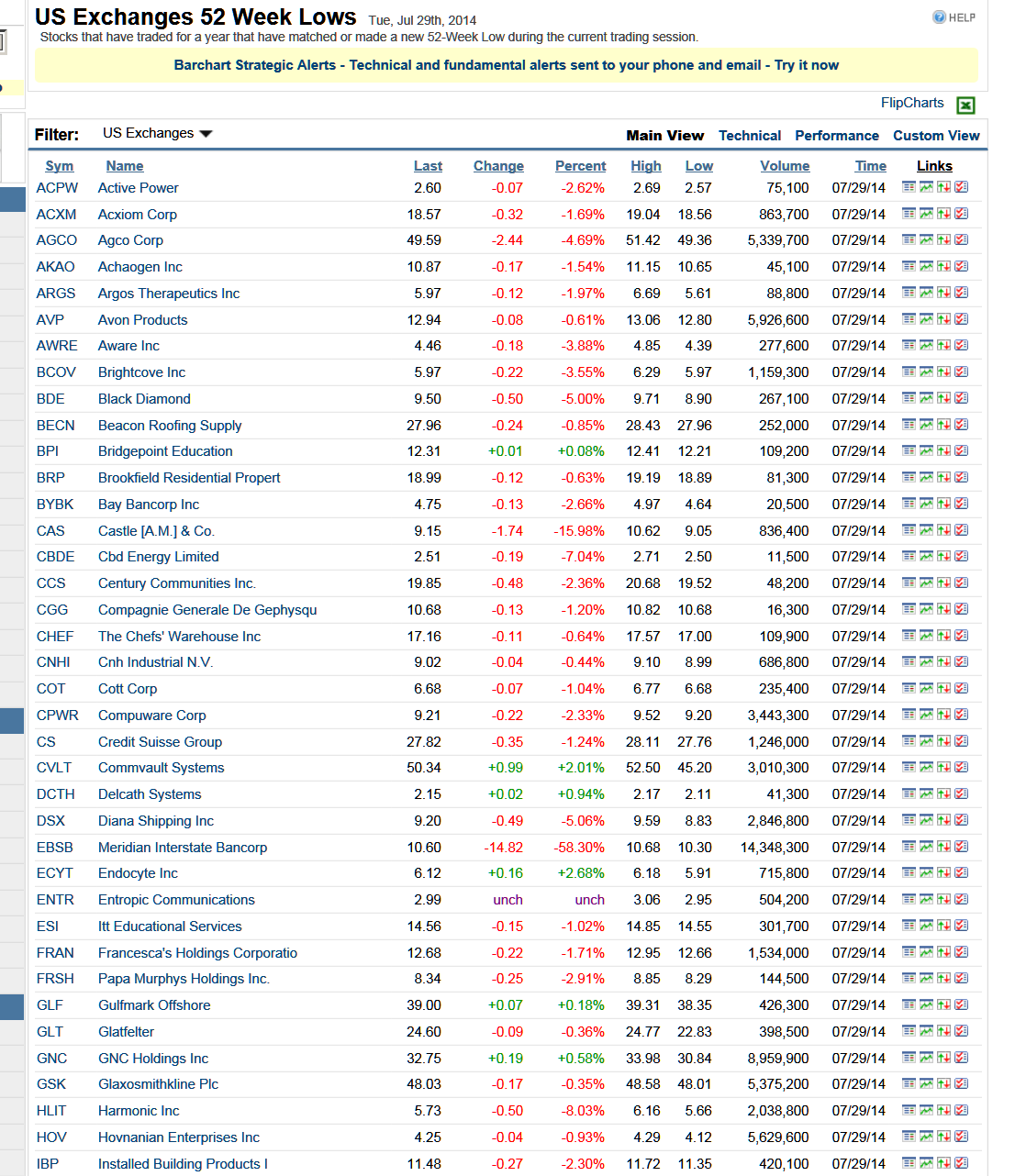

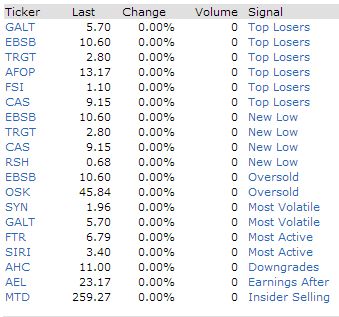

Meridian Bancorp Inc. (NASDAQ: EBSB) has been updated on Wednesday and should perhaps not be on this list of true 52-week lows. This was listed on the 52-week club at both Finviz and at Barcharts websites, but WSJ data using NASDAQ did not include it. The new adjusted 52-week trading range on Yahoo! Finance is listed as $7.91 to $11.53. The original note said – dropped nearly 59% following the completion of a stock offering that replaced shares in Meridian Interstate Bancorp Inc. with 32.5 million shares in the newly named company, Meridian Bancorp. The conversion rate was 2.4484 shares of the new company for each share of the old. Shares closed on Monday at $25.42 before the conversion took place. (See images below)

Targacept Inc. (NASDAQ: TRGT) announced Monday after markets closed that it will abandon further development of its treatment for overactive bladder after see disappointing results in a mid-stage study. The stock is down 27.8% today in a 52-week range of $2.79 to $6.11.

A.M. Castle & Co. (NYSE: CAS) reported a quarterly net loss Tuesday morning of $72.3 million or $3.10 per diluted share. Shares are down about 15.2% in a 52-week range of $9.18 to $17.54. The company is a distributor of metal and plastic products and supply chain services.

Education Management Corp. (NASDAQ: EDMC) shares fell more than 8.5% today, after the company said that William R. Johnson will not stand for election to the company’s board. Johnson is the former CEO of H.J. Heinz and was elected to Education Management’s board in November of last year. The stock’s 52-week range is $1.25 to $16.94.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.