Source: Thinkstock

One company that seems still to like the fiber optic business is Zayo Group Holdings Inc. (NYSE: ZAYO), which priced an initial public offering (IPO) of 21 million shares at $19 a share on Thursday and began trading Friday morning at $21.51. The company had originally planned to sell 28.9 million shares in an IPO price range of $21 to $24.

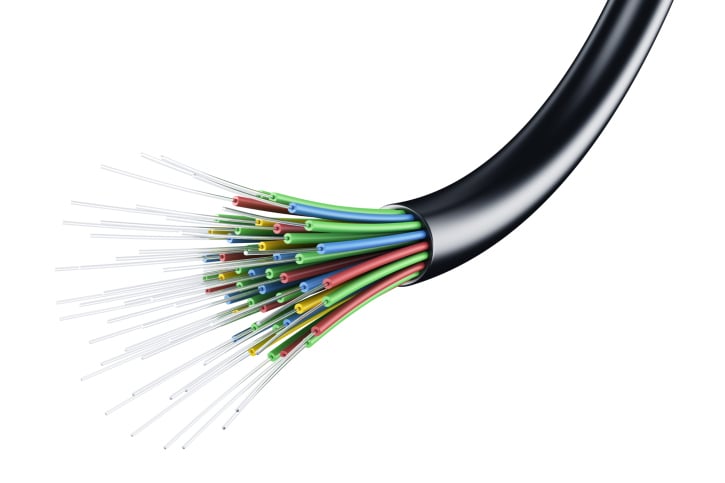

Zayo’s primary businesses are installing leased dark fiber, fiber to cellular towers and small cell sites, dedicated wavelength connections, Ethernet and IP connectivity and other high-bandwidth offerings.

Selling shareholders offered slightly more than 5 million shares in the IPO and the company offered some 16 million. The underwriters had an option to acquire another 3.03 million shares from the selling stockholders. The original plan called for the company to sell 11 million shares and selling stockholders to sell 17.8 million shares.

At the IPO price, the company’s market cap is around $4.54 billion. Zayo raised about $300 million, while selling shareholders pocketed around $100 million.

In the noon hour on Friday, the stock traded at $22.07, up more than 16%, after earlier hitting a high of $22.85.

ALSO READ: The Best and Worst Performing Dow Stocks of 2014

[protected-iframe id=”c14e3de8bfbfebd4dddd16f52c4fbeec-5450697-30366712″ info=”//ipo.findthebest.com/w/6XHUlNPKEf3″ width=”600″ height=”400″ frameborder=”0″ scrolling=”no”]

Smart Investors Are Quietly Loading Up on These “Dividend Legends” (Sponsored)

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.