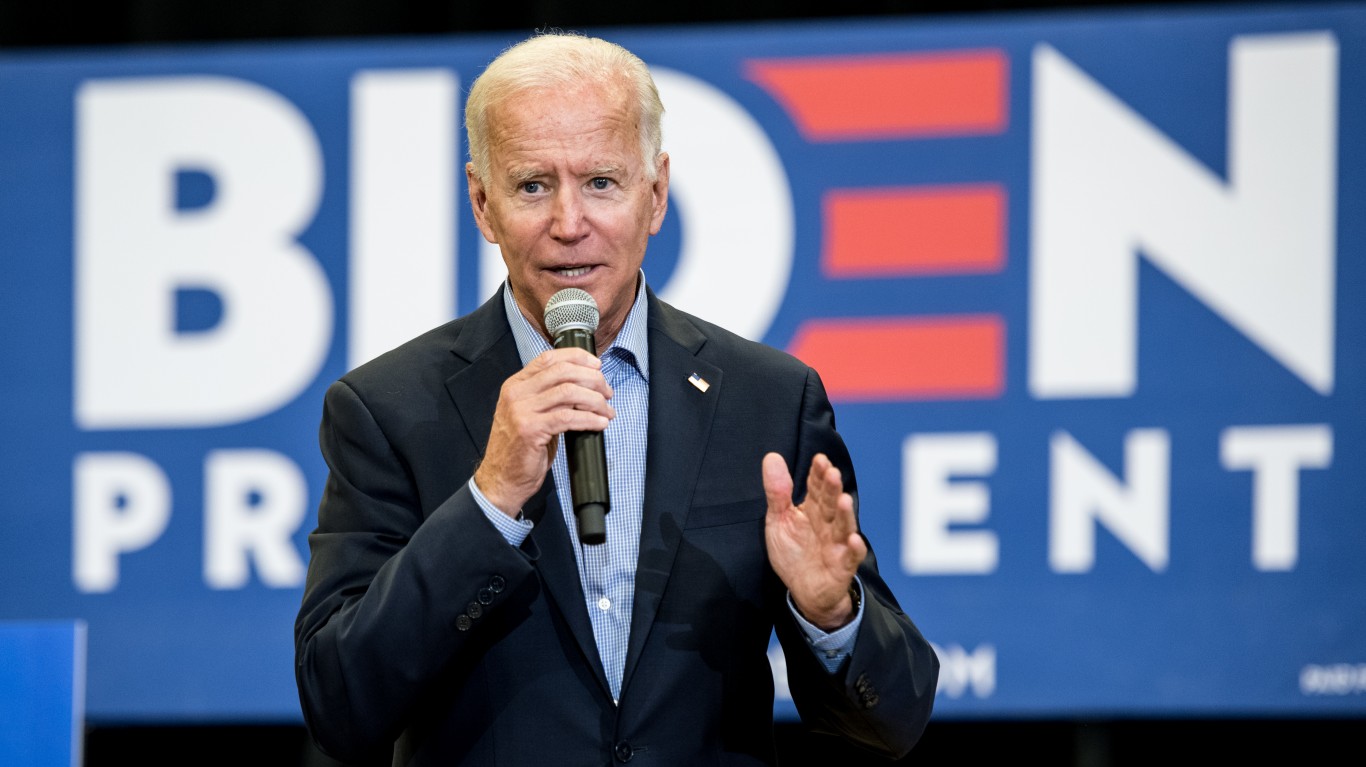

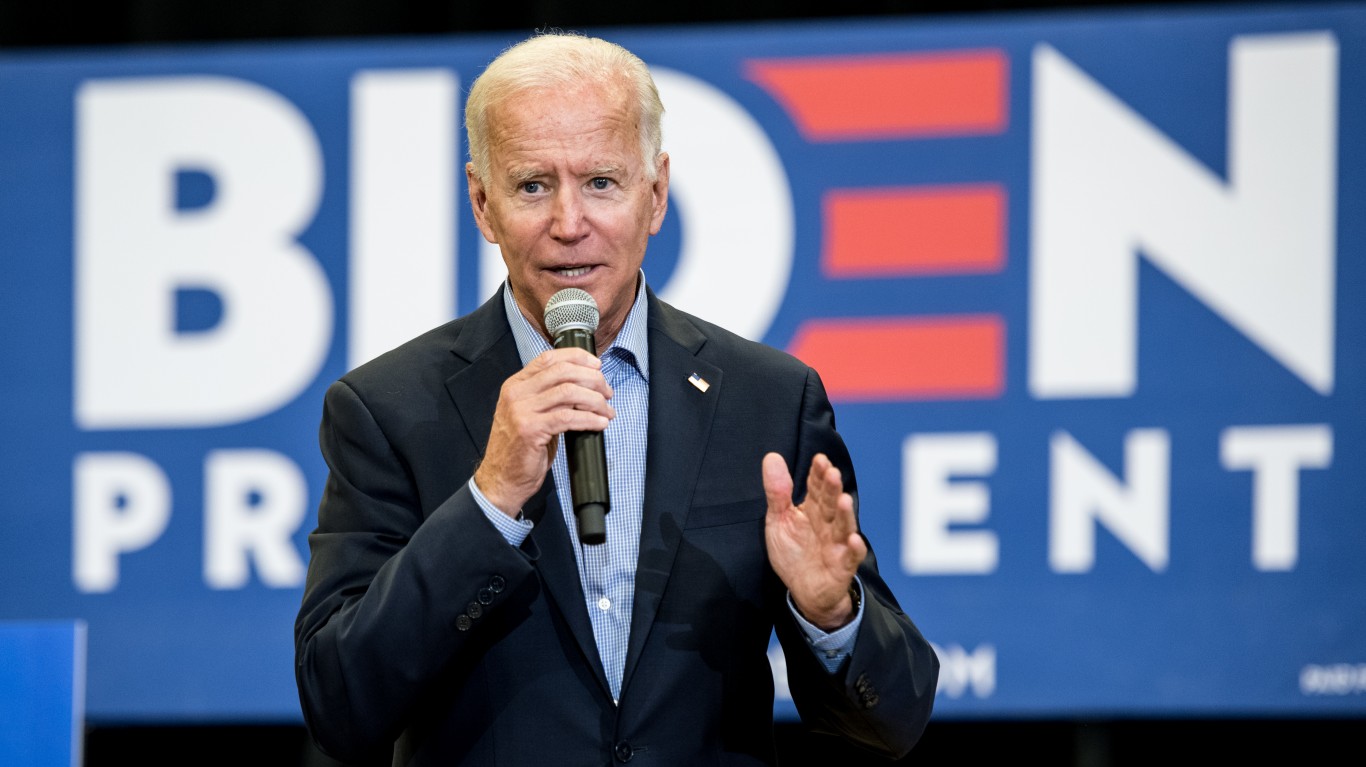

One thing we learned well in 2016 is not to trust the polls, regardless of what side you are rooting for. Just a week before the election, Hillary Clinton was considered a lock to win the presidency, but she ended up losing the electoral vote by a wide margin. The early handicapping has the former Vice President, Joe Biden, with a sizable lead over President Trump. If that holds up, after three past tries for the highest office in the land, Biden could be sworn in as the 46th president of the United States.

[in-text-ad]

A new and outstanding UBS report handicaps every angle of this year’s races for president and Congress. They show the results of a blue wave with the Democrats regaining the presidency and the Senate, and they also show a red wave where Trump is reelected and the Republicans take back the house. Plus, they show the scenario if things remain the same as they are now.

To avoid a problem that we have encountered more and more in media and reporting these days, the UBS team said this as a forward to the report:

This report focuses exclusively on the investment aspect of the upcoming election. The authors are citizens and residents of the United States and, like all people around the world, hold a range of opinions and concerns about the issues of the day. You will not find those opinions in this report. Our jobs require us to be impartial observers, to view the world as it is, not as we think it should be. In line with that perspective, the objective of this report is straightforward. We aim to help investors prepare, as effectively as possible, for the upcoming US presidential election, which will be held on 3 November 2020.

Here we focus on the stocks the UBS team likes for investors to own with a Biden win. While 34 stocks make the list, we selected 10 in various sectors with solid upside potential. It is important to remember that no single analyst report should be used as a sole basis for any buying or selling decision.

American Electric Power

This is one of the largest public utilities in the United States and is on the Merrill Lynch US 1 list of top stock picks. American Electric Power Co. Inc. (NYSE: AEP) is one of the largest electric utilities in the United States, delivering electricity to more than 5.4 million customers in 11 states.

The company ranks among the nation’s largest generators of electricity, owning nearly 38,000 megawatts of generating capacity in the United States. It also owns the nation’s largest electricity transmission system, a more than 40,000-mile network that includes more 765-kilovolt extra-high voltage transmission lines than all other U.S. transmission systems combined.

The stock was considered a good one for retiring baby boomers.

Shareholders receive a 3.30% dividend. The Wall Street consensus price target is $90.63. American Electric Power stock closed trading on Tuesday at $85.35 a share.

Apple

This technology giant has been on a roll since the sell-off, but there are some concerns on forward iPhone demand. Apple Inc. (NASDAQ: AAPL) designs, manufactures and markets consumer electronics and computers, and has developed its own proprietary iOS and Mac OS X operating systems and related software platform/ecosystem.

Revenues are derived principally from the iPhone line of smartphones, hardware sales of the Macintosh family of notebook and desktop computers, iPad tablets and iPod portable digital music players. The company also realizes revenue from software, peripherals, digital media and services.

Shareholders receive a 0.85% dividend. The consensus price target is $350.33. Apple stock closed most recently at $388.23.

Caterpillar

This large-cap leader was hit by trade worries in 2019, but it is offering a very solid entry point. Caterpillar Inc. (NYSE: CAT) is the world’s leading manufacturer of construction and mining equipment, and it is also a leading manufacturer of diesel engines and turbines for transport and industrial applications, as well as diesel-electric locomotives. Caterpillar also provides financing and related services through its Financial Products segment.

Caterpillar stock investors receive a 3.01% dividend. The $132.35 consensus price target is less than Tuesday’s close at $136.88.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.