With the first week of the June-quarter earnings season behind us, we are looking ahead to what the coming week has in store. On Friday, we previewed three companies scheduled to report quarterly results after Monday’s closing bell: IBM, PPG and Steel Dynamics. We also have previewed four firms that are set to report earnings before markets open on Tuesday morning: Halliburton, HCA, Philip Morris and Synchrony Financial.

[in-text-ad]

Earlier this morning we previewed three companies reporting results after markets close Tuesday afternoon: Chipotle Mexican Grill, Netflix and United Airlines.

Here’s a look at five reports due out before markets open Wednesday.

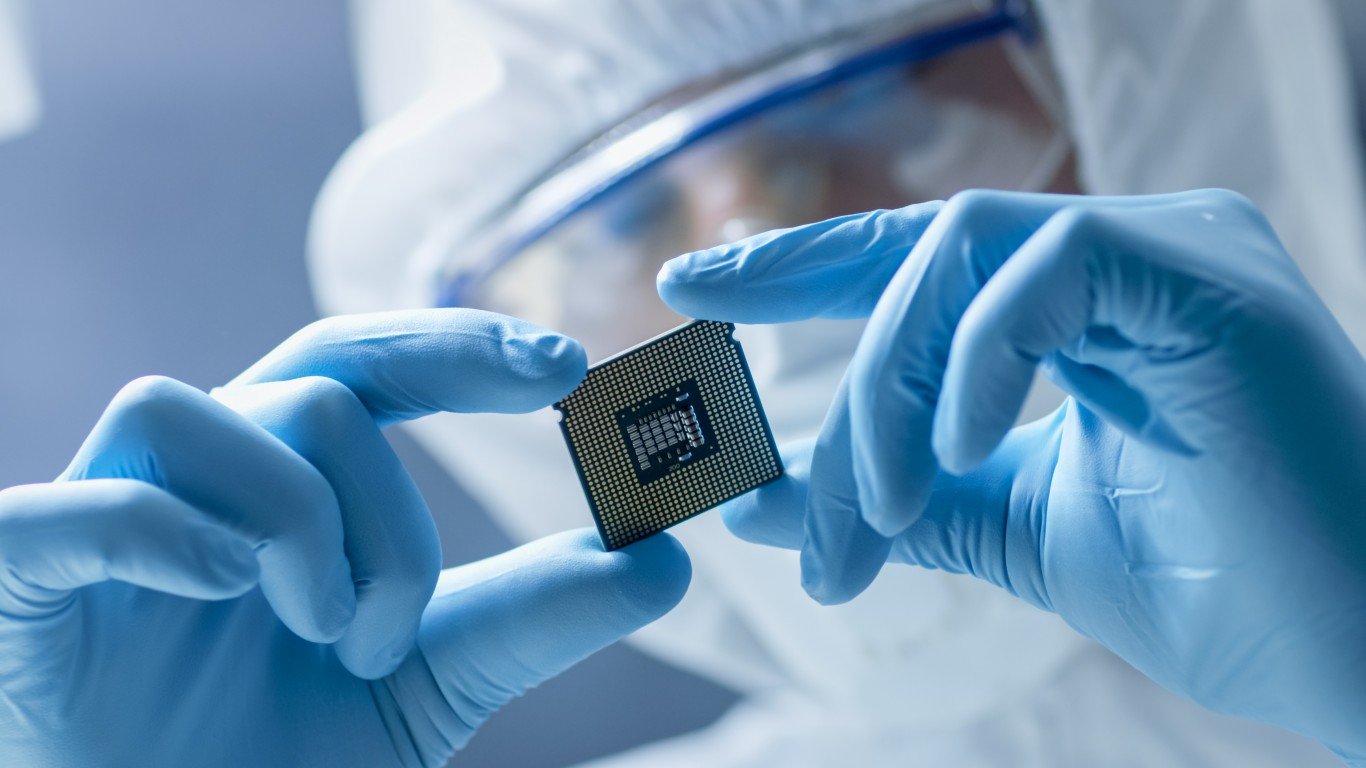

ASML

Semiconductor manufacturing equipment maker ASML N.V. (NASDAQ: ASML) has added more than 77% to its share price over the past 12 months, including a year-to-date gain of 39%. It is probably safe to say that the company could sell all the photolithography machines it could build right now, as chipmakers like TSMC, Intel and Samsung expand production to keep up with demand. Its monopoly on extreme ultraviolet technology sets the company up for more success as semiconductors adopt 5-nanometer and smaller processes.

Of 32 surveyed analysts following the stock, 23 rate the shares a Buy or Strong Buy, while five rate the stock a Hold and four rate the shares a Sell or Strong Sell. At a recent price of around $675, the implied upside based on a median price target of about $718 is about 6.4%. At the high price target of $799, upside potential reaches 18.4%.

Analysts expect the company to report revenue of $4.85 billion for the June quarter, down about 5.6% sequentially and up by nearly 30% year over year. Earnings per share (EPS) would be down $2.93 is down by 22% sequentially and up nearly 46% year over year. For the full year, analysts are forecasting EPS of $14.81, up about 43% year over year, on revenue of $21.23 billion, up 24.3%.

At the current price, ASML stock trades at around 45.7 times expected 2021 EPS, 38 times estimated 2022 EPS and 34.1 times estimated 2023 earnings. The 52-week trading range is $343.25 to $723.01. The company pays an annual dividend of $3.27 per share (yield of 0.48%).

Coca-Cola

Dow Jones industrial average component Coca-Cola Co. (NYSE: KO) watched its stock price plunge by more than 30% in late March of last year. Since then, the stock has added more than 50% to its share price, but the recovery has slowed and shares are up less than 3% so far in 2021. Coke took a bigger hit during the pandemic than its competitors because its sales to restaurants and other beverage vendors are a bigger part of its revenue stream. When that dried up, the company revenue sank. Wednesday’s report will reveal the strength of that recovery.

Analysts are mostly bullish on the stock, with 16 of 26 rating the stock a Buy or Strong Buy. The other 10 rate the stock a Hold. With a median price target of $60 and a current price near $56, the upside potential is about 7.1%. At the high price target of $67, the upside potential is 19.6%.

June quarter revenue is forecast at $9.3 billion, up 3.1% sequentially and up 30% year over year. Adjusted EPS are forecast to rise by one penny sequentially, to $0.56, and by 14 cents (33%) year over year. For the full year, the current EPS estimate is $2.18, up 12% year over year. Revenue is forecast to rise to $36.9 billion, up 11.8% compared with 2020.

Coca-Cola stock trades at around 25.4 times expected 2021 EPS, 23.5 times estimated 2022 EPS and 21.9 times estimated 2023 earnings. The 52-week range is $45.85 to $56.68. The company pays an annual dividend of $1.68 per share (yield of 2.98%).

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.