Early trading Tuesday did some recovery work after Monday’s slide. The three major U.S. indexes all recovered at least half of the prior day’s losses, with the energy and tech sectors leading the way (up 3.0% and 2.3%, respectively). The monthly consumer price index (CPI) is due out before markets open on Wednesday. The index is expected to rise by 0.2%, with core CPI, which excludes food and energy, expected to jump by 0.4%. Both estimates are below April’s actual readings.

[in-text-ad]

After markets closed Monday, AMC Entertainment reported better-than-expected revenue and per-share loss. Shares traded up more than 4% in the first hour of trading on Tuesday.

Marijuana grower and products developer Cronos posted a loss that was smaller than expected and also missed the consensus revenue estimate. The posted revenue was double last year’s first-quarter total, and the shares traded up almost 17% Tuesday morning.

China-based electric vehicle maker Li Auto beat the top-line and bottom-line estimates and revised second-quarter guidance sharply. Shares traded up about 6.8%.

Peloton missed both the consensus profit and revenue estimates. The company also plans to run off inventory for the rest of this year, which will be a headwind before it becomes a tailwind next year. Shares traded down more than 12% Tuesday morning.

We already have previewed four companies set to report results after markets close on Tuesday: Coinbase, Kinross Gold, Occidental Petroleum and SoFi Technologies.

Here is a look at four companies set to report results after Wednesday’s closing bell.

Bakkt

Digital asset marketplace Bakkt Holdings Inc. (NYSE: BKKT) came public through a SPAC merger last October and has shed almost 75% of its share price since the IPO. Since its peak in late October, the stock is down nearly 94%. A lawsuit was filed on April 21 alleging that the blank check company behind Bakkt misled investors, and the shares have dropped nearly 40% since. The stock posted a new 52-week low Tuesday morning.

Only one analyst has rated or placed a price target on the stock. That is a Hold rating and target of $7. At the recent price of $2.75 per share, the upside potential based on that price target is about 155%.

That same analyst has forecast first-quarter revenue of $13.6 million and a per-share loss of $0.17. For the full 2022 fiscal year, the analyst has forecast a loss per share of $0.75 on sales of $72.3 million. In 2021, Bakkt reported sales of $39.47 million.

The stock’s 52-week range is $2.69 to $50.80. The average daily trading volume is around 5.4 million shares.

[in-text-ad]

Coupang

South Korean e-commerce giant, Coupang Inc. (NYSE: CPNG) has seen its share price drop by about 73% in the past 12 months. The company has to figure out how to grow in a more competitive landscape without spending so much cash. This may not be a dead business, and it may not even be on life support, but Coupang has to come up with a get-well plan and not just hope for a miracle.

Of 11 analysts covering the stock, eight have a Buy or Strong Buy rating and the other three have Hold ratings. At a share price of around $10.40, the upside potential based on a median price target of $28.00 is 169%. At the high target of $37.00, the upside potential on the stock is 256%.

The consensus estimate for first-quarter revenue is $5.25 billion, up 3.4% sequentially and nearly 25% year over year. Coupang is also expected to post an adjusted loss per share of $0.17, better than the prior quarter’s loss of $0.23 per share. For the full 2022 fiscal year, the adjusted loss per share is expected to be $0.52 compared to a loss of $0.88 per share last year. Sales of $23.04 billion would beat last year’s total by 25.2%.

Coupang is not expected to post a profit in 2022 or 2023. The stock trades at a 2024 sales to enterprise value multiple of 287.4 times. The stock’s 52-week range is $9.08 to $46.00. Coupang does not pay a dividend. Total shareholder return for the past year is negative 72.2%.

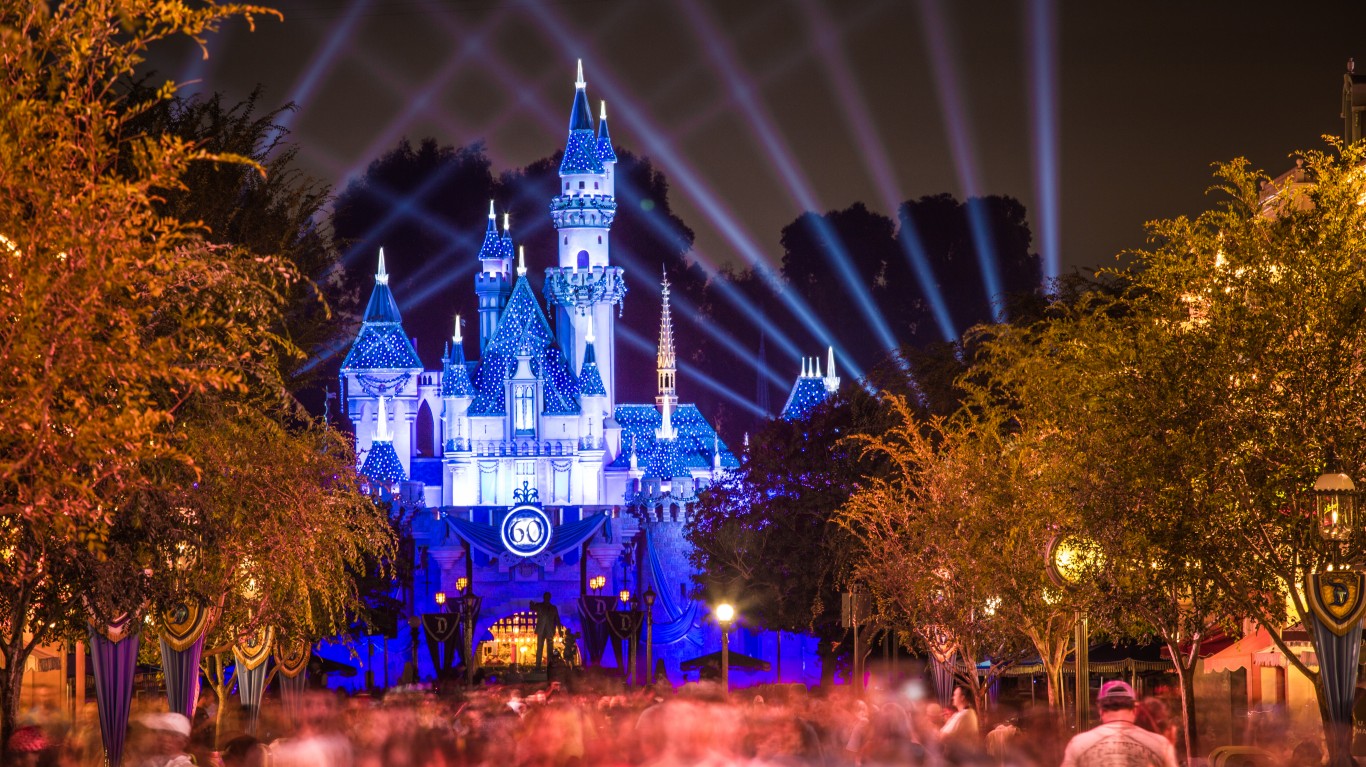

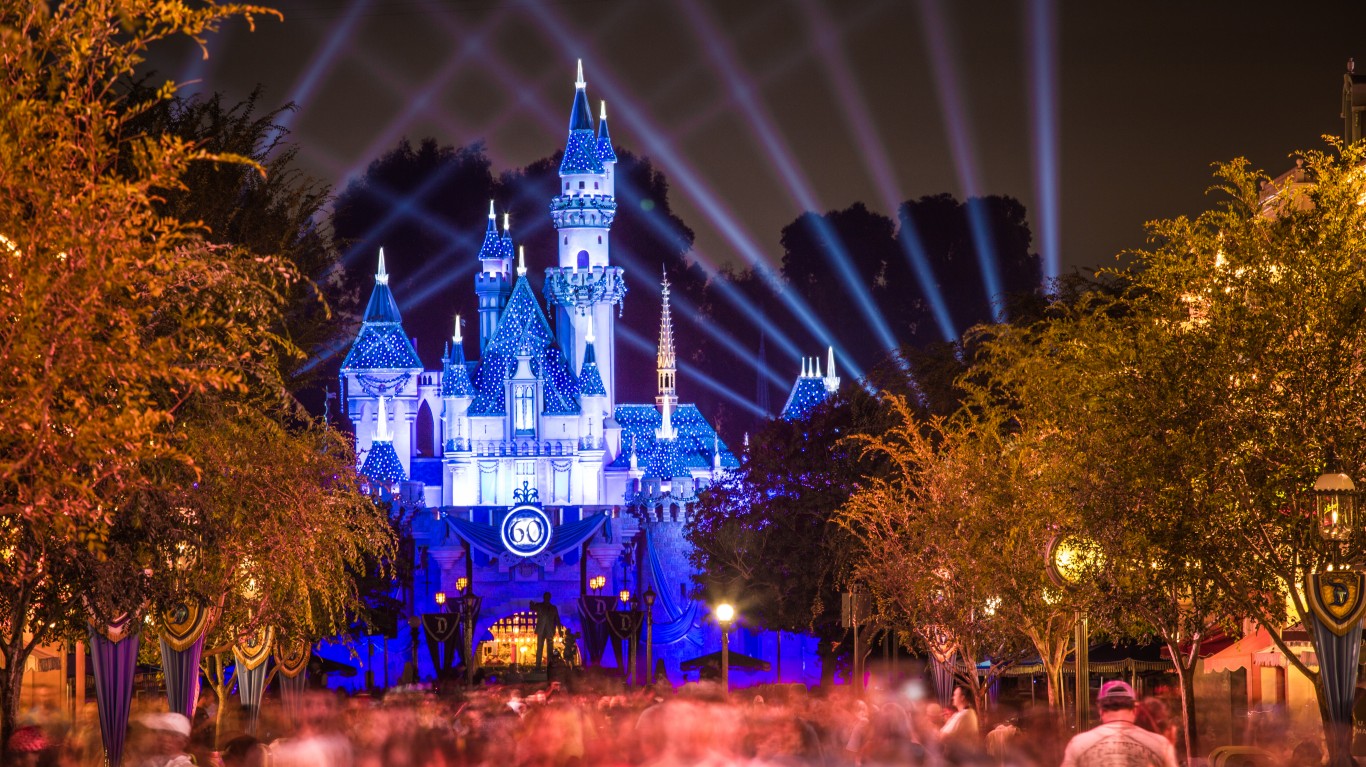

Disney

Walt Disney Co. (NYSE: DIS) continues to suffer through a tough year. Over the past 12 months, the Dow Jones industrial average component has posted a share price decline of nearly 42%. That is double its 21% decline for the 12 months ended last December. Investors will be focused on the company’s streaming business following the Netflix disaster. Disney’s theme park business is recovering but still trails its pre-pandemic revenue by about 65%.

In the streaming business, analysts are looking for subscriber additions of 5.3 million and about double that number for the current quarter. The company’s goal is 230 million to 260 million total subscribers by September 2024, and if it hits the analysts’ target for the March quarter, Disney will be slightly more than halfway there.

Analysts remain bullish on the stock. Of 29 brokerages covering the firm, 22 have a Buy or Strong Buy rating, and the rest rate the stock at Hold. At a share price of around $106.70, the upside potential based on a median price target of $182.00 is about 79.3%. At the high target of $229.00, the upside potential is 122.3%.

[in-text-ad]

Fiscal second-quarter revenue is forecast at $20.04 billion, down 8.2% sequentially but up 28.4% year over year. Adjusted earnings per share (EPS) are pegged at $1.19, up 12.1% sequentially and 50.6% year over year. For fiscal 2022, analysts currently expect Disney to report EPS of $4.43, up 90.4%, on sales of $84.67 billion, up 25.6%.

Disney stock trades at 24.0 times expected 2022 earnings, 18.9 times estimated 2023 earnings of $5.63 per share and 16.0 times estimated 2024 earnings of $6.65 per share. The stock’s 52-week range is $106.48 to $187.58. The low was posted Monday. Disney has suspended its dividend. Total shareholder return for the past year was negative 42.2%.

Rivian

Since its initial public offering in early November of last year, shares of Rivian Automotive Inc. (NASDAQ: RIVN) soared to a gain of nearly 120%, before dropping to their current level of down 78% since the IPO. The stock took a big hit Monday, the day its lockup period for insiders and early investors ended. Following a report that Ford would sell 8 million shares (about 7.8% of its total stake in Rivian) and that Amazon also would be selling, retail investors picked up some of the slack, but not enough to keep the stock from tumbling to a new post-IPO low earlier in the morning.

Of 16 analysts covering the stock, 11 have a Buy or Strong Buy rating and four more have a Hold rating. At a share price of around $21.90, the upside potential based on a median price target of $84.50 is 286%. At the high target of $147.00, the upside potential is 531%.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.