In late-morning trading on Tuesday, the Dow Jones industrials were down 0.27%, the S&P 500 down 0.14% and the Nasdaq 0.17% lower.

Before markets opened on Tuesday, Bank of America reported better-than-expected earnings per share (EPS) and revenue. Net interest income rose 25% year over year, while deposits declined by just 1%. Shares traded down about 1% Tuesday.

Goldman Sachs beat analysts’ consensus EPS estimate but missed on revenue. The bank’s global banking and markets segment posted lower revenue that was only partially offset by higher revenue in the asset and wealth management and platform solutions segments. Shares traded down 1.9% Tuesday morning.

BNY Mellon beat the consensus EPS estimate by a penny and missed the revenue estimate. Shares traded basically flat.

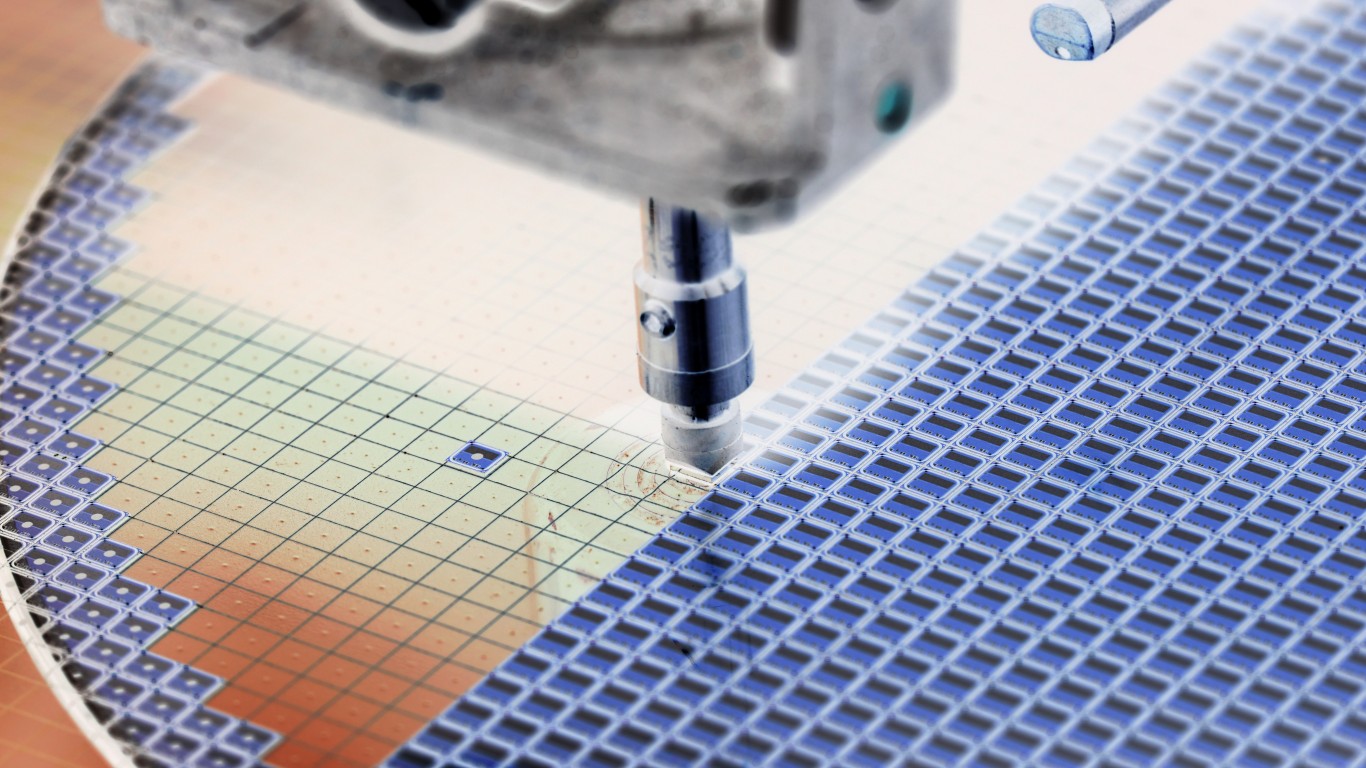

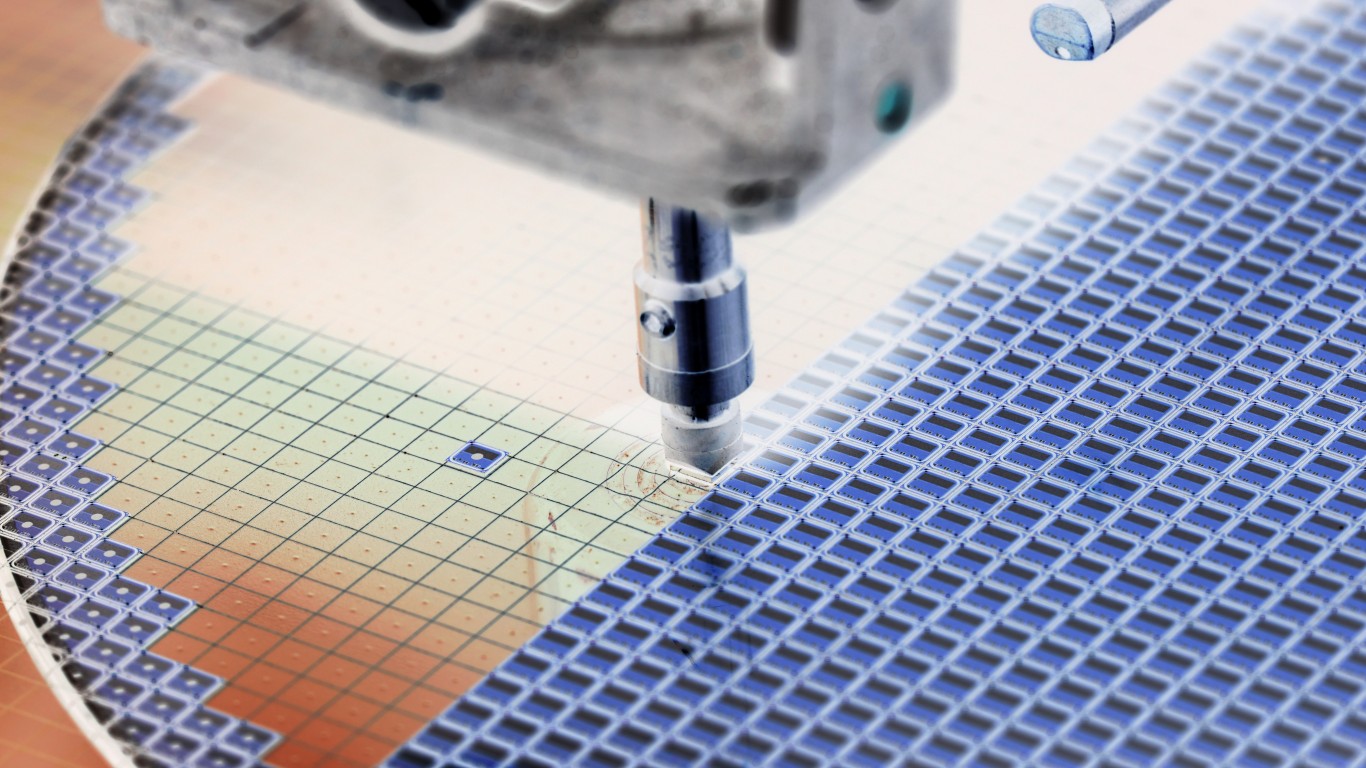

Ericsson missed the consensus EPS estimate but did beat revenue expectations. Sales in developed markets declined but were stronger in developing economies like India. The stock traded down about 7.9%.

Johnson & Johnson beat estimates on both the top and bottom lines. The company also raised fiscal 2023 EPS and revenue guidance. Shares traded down 2.7%.

Lockheed Martin beat both top-line and bottom-line estimates and reaffirmed full-year EPS and revenue guidance. The stock traded up 2.3% Tuesday.

After U.S. markets close Tuesday, Netflix, United Airlines and Western Alliance Bancorp are on deck to post quarterly results. Look for reports from Abbott Labs, ASML, Baker Hughes and Morgan Stanley the following morning. Then later on Wednesday, IBM, Kinder Morgan, Las Vegas Sands and Tesla take their turns in the earnings spotlight.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.