The futures were trading lower after some of the risk-off selling returned on Tuesday. The Dow Jones industrials squeezed out a small gain right at the close. Meanwhile, the small-cap Russell 2000 closed 1.2% higher on the day. Stocks closed mostly lower despite a massive upside surprise to September retail sales. They came in at 0.7%, versus expectations for 0.3%. Yet headwinds for traders persist: higher interest rates and rising inflation. (Some feel the latter added to the robust retail sales print.) There is also the lagging effect of a year and a half of Federal Reserve tightening, which is starting to weigh heavily on some sectors.

Treasury yields spiked higher again on the huge retail sales numbers. The three-year to 10-year maturities were hit the hardest. The 10-year note closed the day at 4.84%, the highest since the fall of 2007. The two-year paper was last seen at 5.22%, topping highs hit back in March. While the inversion between the two has tightened, history says a recession is coming.

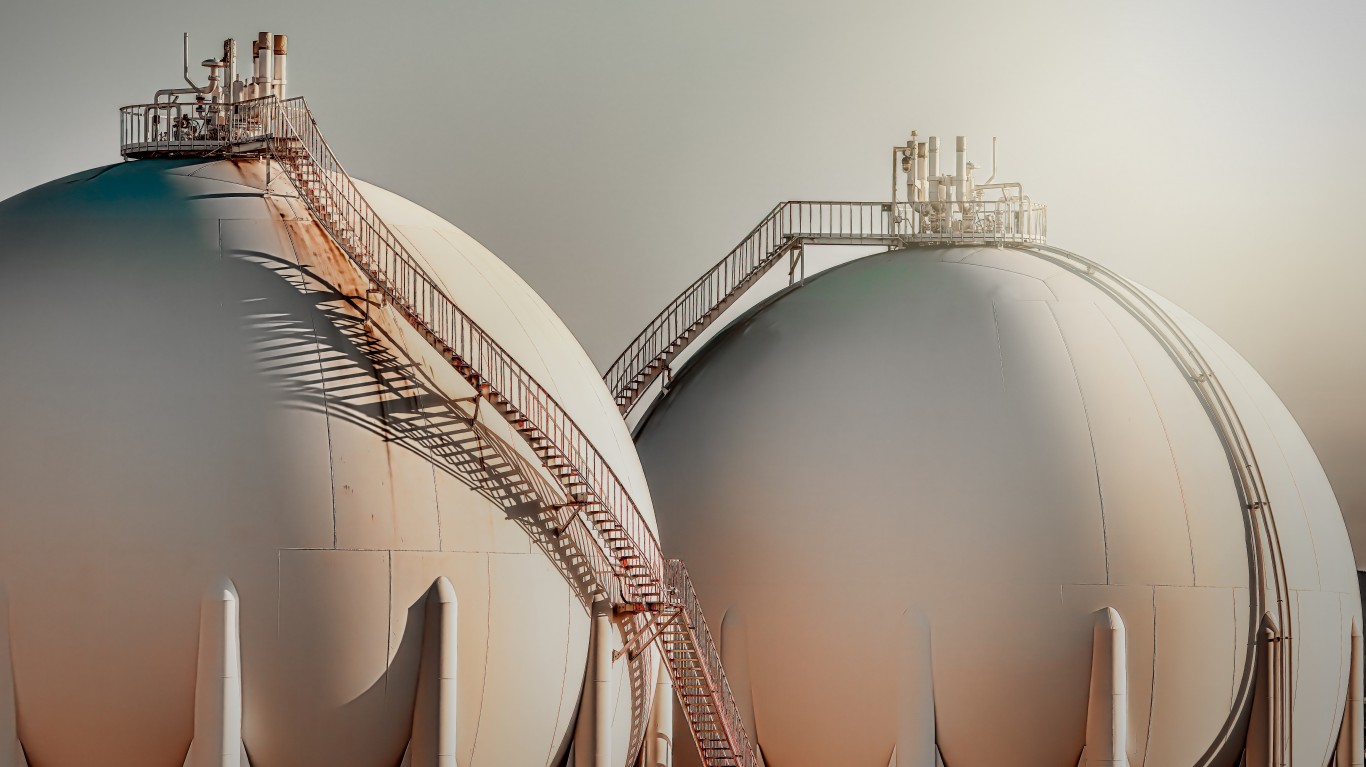

Brent and West Texas Intermediate crude both traded higher on Tuesday. This was after some profit-taking hit the energy complex on Monday. The big catalysts remain Saudi and OPEC production cuts, as well as the escalating war in the Middle East. This year, crude oil will become the biggest U.S. export for the first time in history. Brent was last seen at $90.36, while WTI finished the day at $87.20. Furthermore, natural gas closed lower again on Tuesday, at $3.06. There was a big run-up last week.

Gold resumed its climb on Tuesday, despite initially trading lower after the strong retail sales report. Gold still faces the headwinds in rising Treasury yields and a strengthening dollar. (The dollar actually fell on Tuesday.) The December contract closed the day at $1,937.70, up 0.18%. Bitcoin closed flat at $28,517.80. It exploded higher on Monday on reports an exchange-traded fund could be approved soon.

24/7 Wall St. reviews dozens of analyst research reports each weekday with a goal of finding fresh ideas for investors and traders alike. Some of these daily analyst calls cover stocks to buy. Other calls cover stocks to sell or avoid. Remember that no single analyst call should ever be used as a basis to buy or sell a stock. Consensus analyst target data is from Refinitiv.

These are the top analyst upgrades, downgrades and initiations seen on Wednesday, October 18, 2023.

The Upgrades

Air Products and Chemicals Inc. (NYSE: APD): Wells Fargo upgraded the stock to Overweight from Equal Weight and boosted its $307 target price to $345. The consensus target is $331.73. The stock closed on Tuesday at $290.69.

Array Technologies Inc. (NASDAQ: ARRY): Morgan Stanley’s upgrade to Equal Weight from Underweight included a target price hike to $23 from $18. The consensus target price is up at $30.68. Tuesday’s closing share price was $19.01.

Consolidated Edison Inc. (NYSE: ED): Though Wells Fargo upgraded the stock to Equal Weight from Underweight, its $96 target price slipped to $94. The consensus target is $88.50. The final trade on Tuesday was for $88.20 a share.

CyberArk Software Ltd. (NASDAQ: CYBR): J.P. Morgan upgraded the cyber security giant to Overweight from Neutral and lifted the target price on the stock to $200 from $182. The consensus is posted at $188.39. Shares were last seen trading at $171.35 on Tuesday.

Dollar Tree Corp. (NASDAQ: DLTR): Goldman Sachs upgraded the shares to Buy from Neutral. However, its $150 target price shrank to $137. The consensus target is $150.70. Tuesday’s close at $114.97 was up almost 5% for the day, following the upgrade.

Lennox International Inc. (NYSE: LII): When Mizuho upgraded the stock to Buy from Neutral, its $380 target price jumped to $460. The consensus target is $397.50. The stock closed on Tuesday at $378.19.

Mondelez International Inc. (NASDAQ: MDLZ): The Exane BNP Paribas upgrade was from Neutral to Outperform with a $75 target price. The $80.67 consensus target is higher, but Tuesday’s close was at $63.24.

Ollie’s Bargain Outlet Holdings Inc. (NASDAQ: OLLI): Goldman Sachs boosted its Neutral rating to Buy and its $75 target price to $83. The consensus target is $83.40. The shares closed on Tuesday at $72.51.

Progressive Corp. (NYSE: PGR): Citigroup’s Sell rating is now at Neutral. And its $120 target price popped to $158, above the consensus target of $153.33. However, the shares closed on Tuesday at $157.95.

Vitesse Inc. (NYSE: VTS): Northland Capital’s upgrade to Outperform from Market Perform came with a target price bump to $28 from $24. The consensus target is $26.63. Shares closed almost 5% higher on Tuesday at $24.66 due to the upgrade.

The Downgrades

APA Corp. (NASDAQ: APA): Bernstein cut its Outperform rating to Market Perform and trimmed its target price to $50 from $51. The consensus target is $50.44, and Tuesday’s close was at $42.62.

BJ’s Wholesale Club Holdings Inc. (NYSE: BJ): As Goldman Sachs lowered its Buy to Neutral, its $75 target price slipped to $73. That compares with a $78.44 consensus target and Tuesday’s closing print of $69.66.

Patterson-UTI Energy Inc. (NASDAQ: PTEN): Morgan Stanley’s downgrade to Equal Weight from Overweight included a price target trim to $17 from $20. The consensus target is $18.84. The stock closed on Tuesday at $14.10.

Sabra Healthcare REIT Inc. (NYSE: SBRA): BMO Capital Markets downgraded the stock to Market Perform from Outperform. The firm’s $16 target is still above the consensus target of $14.29. Shares closed above that consensus target on Tuesday at $14.55.

SunPower Corp. (NASDAQ: SPWR): Citigroup downgraded the shares to Sell from Neutral. The analyst cut the target price in half, to $4.50 from $10, as well. The consensus target is $8.80. The stock closed at $5.84 on Tuesday.

Initiations

Applied Materials Inc. (NASDAQ: AMAT): Raymond James initiated coverage with an Outperform rating and a $160 target price. The consensus target is $155.46. The shares closed on Tuesday at $141.86.

Etsy Inc. (NASDAQ: ETSY): Stifel initiated coverage with a Hold rating and a $54 target price. The consensus target is up at $99.93. Tuesday’s $70.06 close was up more than 5% for the day.

Exxon Mobil Corp. (NYSE: XOM): Bernstein set an Outperform rating and has a $140 target price. The consensus target is $128.05. Tuesday’s final trade was for $111.29 a share.

Microsoft Corp. (NASDAQ: MSFT): Loop Capital started covering the stock with a Buy rating and a $425 price objective. The consensus target is $391.58. Tuesday’s close was at $330.24.

Toll Brothers Inc. (NYSE: TOL): Wells Fargo initiated coverage with an Overweight rating and a $80 target price. The consensus target is higher at $93.23. Tuesday’s closing share price was $72.40.

And More

With oil prices rising and demand expected to grow over the coming years, five top exploration and production companies could be the next takeover targets.

Tuesday’s top analyst upgrades and downgrades included Colgate-Palmolive, Crown Castle, Dollar General, D.R. Horton, Enphase Energy, Instacart, Netflix, Pfizer, Southern Company, UnitedHealth, Walt Disney and Wayfair.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.