Digital payments processor PayPal Holdings Inc. (NASDAQ: PYPL) reported fiscal fourth-quarter earnings after U.S. markets closed on Wednesday. PayPal stock traded up about 4% in after-hours trading.

After a good night’s sleep, investors pushed PayPal stock up by around 7% in premarket trading Thursday morning.

Third-quarter results

| Estimate | Actual | Surprise | |

|---|---|---|---|

| Revenue ($B) | 7.39 | 7.40 | 0.1% |

| Adj EPS | 1.23 | 1.30 | 5.7% |

Compared to the third quarter of last year, revenue was up 8.1% and EPS was up 20.4%.

The headline numbers are good, but looking beyond the headlines reveals at least three good reasons to consider adding PayPal stock to a portfolio.

Revenue growth

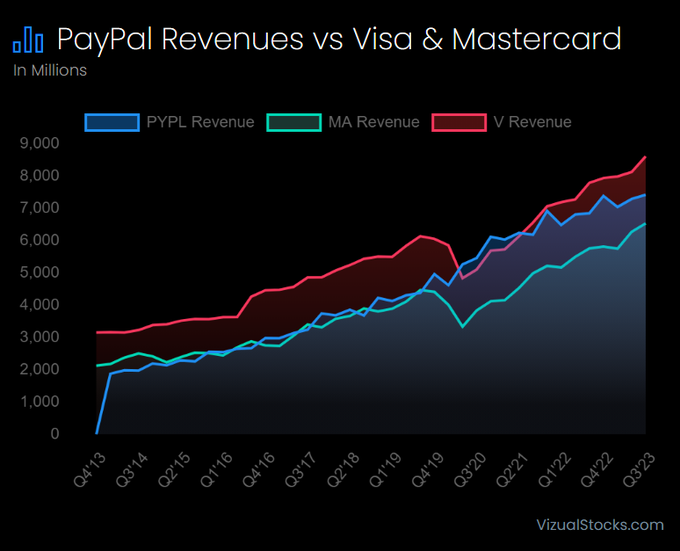

PayPal’s revenue growth has kept pace with that of the payment industry’s two giants.

But PayPal’s market cap lags, by a lot:

- PayPal market cap: $56.73 billion (at Wednesday’s closing price)

- Mastercard market cap: $354.31 billion

- Visa market cap: $493.59 billion

Over the past 12 months, PayPal revenue totals $28.56 billion to Mastercard’s $9.4 billion and Visa’s $32.65 billion.

Free cash flow yield

- PayPal: 6.4%

- Mastercard: 2.96%

- Visa: 4.1%

Because PayPal does not pay a dividend, the FCF yield depends primarily on share buybacks. When Visa reported quarterly results last week, it announced a new $25 billion buyback program. In fiscal 2022, PayPal repurchased $4.9 billion in stock, Visa repurchased $11.7 billion in stock, and Mastercard bought back $8.75 billion in stock.

Profitability

Put simply, PayPal gets no investor love.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.