You work hard for your money, it’s only reasonable to expect that those institutions that you trust to protect it actually, well, protect it. Unfortunately, that hasn’t always been the case. Greed and ignorance have often led to hardworking people losing all their savings and being left on the hook for bankers’ bad decisions.

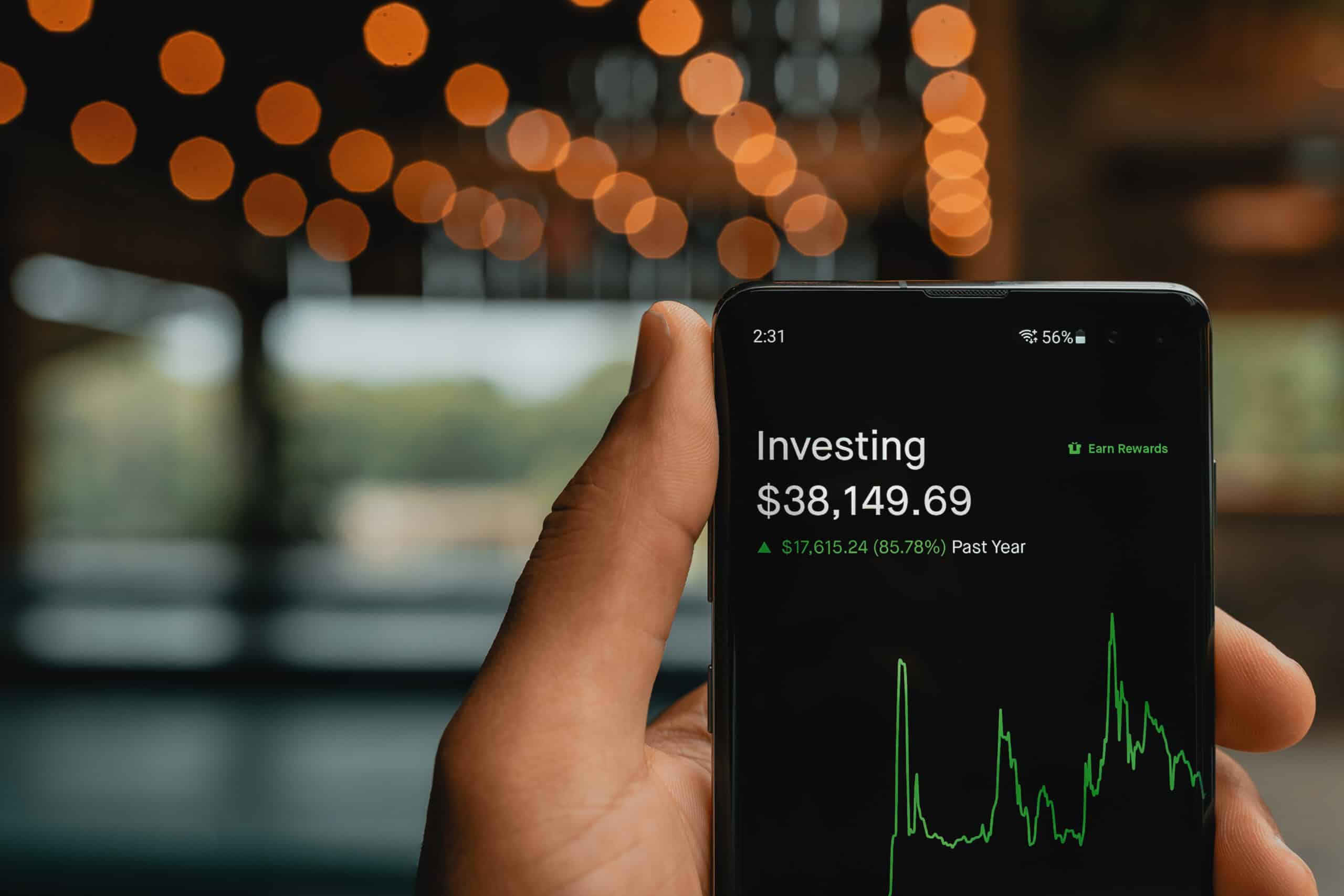

Enter the Federal Deposit Insurance Corporation, more commonly known as the FDIC. If you have savings deposited with a bank, you’re probably familiar with the FDIC, but did you know that investment companies like Robinhood can also offer FDIC protection? If you are like a majority of Robinhood’s customers, you probably don’t have a deep knowledge of what the FDIC is or what it does. The good thing is, you don’t need to in order to take advantage of it. You can, however, take advantage of Robinhood’s free money match.

Here is everything you need to know about Robinhood’s FDIC insurance, how to qualify for it, and what it means for your money.

What is FDIC Insurance?

The FDIC was created in 1933 in response to the Great Depression in order to help restore Americans’ trust in the banking system. Before the creation of the FDIC, any money held in deposit with a bank was at risk of being lost when the bank failed. As a result, bank runs were extremely common as more than one-third of all banks failed during the Great Depression. If you happened to be slow getting to the bank that day, you lost all your money.

Today, the FDIC insures up to $250,000 for each category of deposits for each customer at each bank. So, you can qualify for more insurance than just $250,000 depending on where and with whom your money is kept. This insurance has been so successful that the entire banking and finance industry relies on it to continue making high-risk and profitable business ventures. Even the FDIC says that no depositor has ever lost a single penny of FDIC-insured money.

The great thing is that you don’t have to pay for this insurance (not directly anyway, these large companies always find a way to pass the cost onto their customers). The member banks of the FDIC pay the premiums and almost entirely fund the insurance. These premiums increase based on the risk of each bank in question. The FDIC also covers all IRA accounts like those offered by Robinhood.

How Can You Qualify for Robinhood’s FDIC Insurance?

Normally, Robinhood would not qualify for FDIC insurance. As it is a trading platform, instead it has something called SIPC, which stands for Securities Investor Protection Corporation. Like the FDIC, it is a member-funded insurance corporation that was created in 1970 to protect customers in the event an investment firm fails. So, even if you have all your cash in an investment firm like Robinhood, you’re still protected, but not by the FDIC. The SIPC covers customers for up to $500,000 of lost equity, including up to $250,000 for any uninvested cash held by the company.

In addition to the SIPC coverage, Robinhood has purchased additional insurance for its customers if the SIPC coverage proves insufficient. This insurance covers securities and cash up to $1 billion and will cover each customer for $50 million in stock and $1.9 million in cash.

However, Robinhood does offer a way for its customers to qualify for FDIC insurance through something called a Cash Sweep program.

The Cash Sweep program allows Robinhood customers to have their uninvested cash in their account automatically deposited at participating banks to earn interest and qualify for FDIC insurance. Customers still retain access to their cash and can trade and invest with it as normal. Read more about how the Cash Sweep program works.

The FDIC insurance also covers the money normally, up to $250,000 per customer, per bank.

When you sign up for the program, your cash will automatically be divided between the participating banks with a maximum of $248,000 at each bank (even though the FDIC covers up to $250,000, some space is reserved for any accrued interest). If you have any cash already deposited at any of the participating banks, that amount will be included in the total amount insured at that bank. So, if you already have the maximum insurable amount, you can exclude that bank from your list of Cash Sweep options at Robinhood.

You don’t need to pay for the Robinhood Gold account to qualify for the Cash Sweep program, though doing so will let you earn 3% interest on your cash deposits instead of the 1% for free accounts. See if Robinhood Gold is right for you.

If you’re curious about any other part of the Robinhood process, check out this page: a regularly updated list of all our Robinhood guides, news coverage, and lists of benefits.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.