Yet again, the Oracle of Omaha has bolstered his stake in a media giant’s tracking stocks. However, Warren Buffett was not the only one making notable insider purchases in the past week or so. An NFL team owner also picked up shares in a local energy company, a beneficial owner made big buys in two separate biopharmaceutical companies, and a new CEO showed his love for his company as well.

A well-known adage reminds us that corporate insiders and 10% owners really only buy shares of a company because they believe the stock price will rise and they want to profit from it. Thus, insider buying can be an encouraging signal for potential investors. This is all the more so during times of uncertainty in the markets, and even when markets are near all-time highs.

Remember that even with the earnings-reporting season all but over, some insiders may be prohibited from buying or selling shares. Below are some of the more notable insider purchases that were reported in the final days of March and the first quarter.

Liberty Media

- Buyer(s): 10% owner Berkshire Hathaway

- Total shares: almost 8.9 million

- Price per share: $28.61 to $29.50

- Total cost: more than $257.9 million

After scooping up almost $177 million worth of Liberty Media Corp. (NASDAQ: LSXMK) stock recently, Berkshire Hathaway has increased its stake in the holding company again to almost 65.5 million shares. The series C shares were last seen trading above the top of that purchase price range. However, the share price is up 3% or so since the beginning of the year. Note that Liberty Media and Sirius XM Holdings Inc. (NASDAQ: SIRI) plan to merge, and Liberty Media recently completed an acquisition of its own. Also check out five top Buffett stocks that will remain long after he’s gone.

More Liberty Media

- Buyer(s): 10% owner Berkshire Hathaway

- Total shares: around 3.8 million

- Price per share: $28.93 to $30.00

- Total cost: over $110.3 million

Buffett also has increased the stake in Liberty Media Corp. (NASDAQ: LSXMA) again to more than 32.7 million shares. This after picking up over $111 million worth last week. The shares of this holding company were last seen trading within the purchase price range, even though the stock has trended lower since mid-January. As mentioned above, Liberty Media and Sirius XM are in the process of merging, and Liberty Media also recently posted its fourth-quarter and 2023 results.

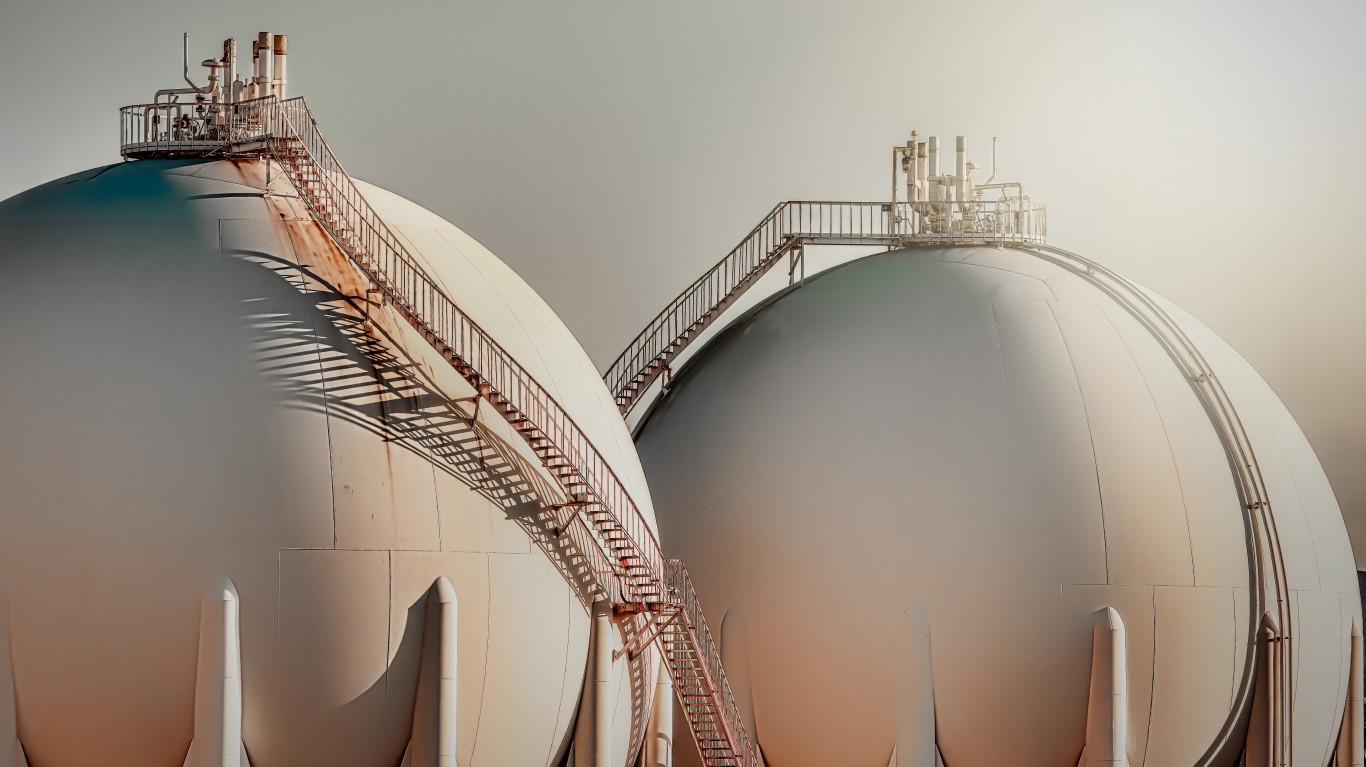

Comstock Resources

- Buyer(s): 10% owner Blue Star Exploration

- Total shares: 12.5 million

- Price per share: about $8.04

- Total cost: over $100.4 million

Comstock Resources Inc. (NYSE: CRK) posted disappointing quarterly results in February, but now Dallas Cowboys owner Jerry Jones has boosted this stake in this Texas-based independent energy company to over 194.8 million shares. That is a 67% stake. Shares fell to a 52-week low of $7.07 after the earnings report. But they are now almost 5% higher to date and well above the buyer’s purchase price, as well as about the same as the consensus price target. Analysts on average recommend holding shares.

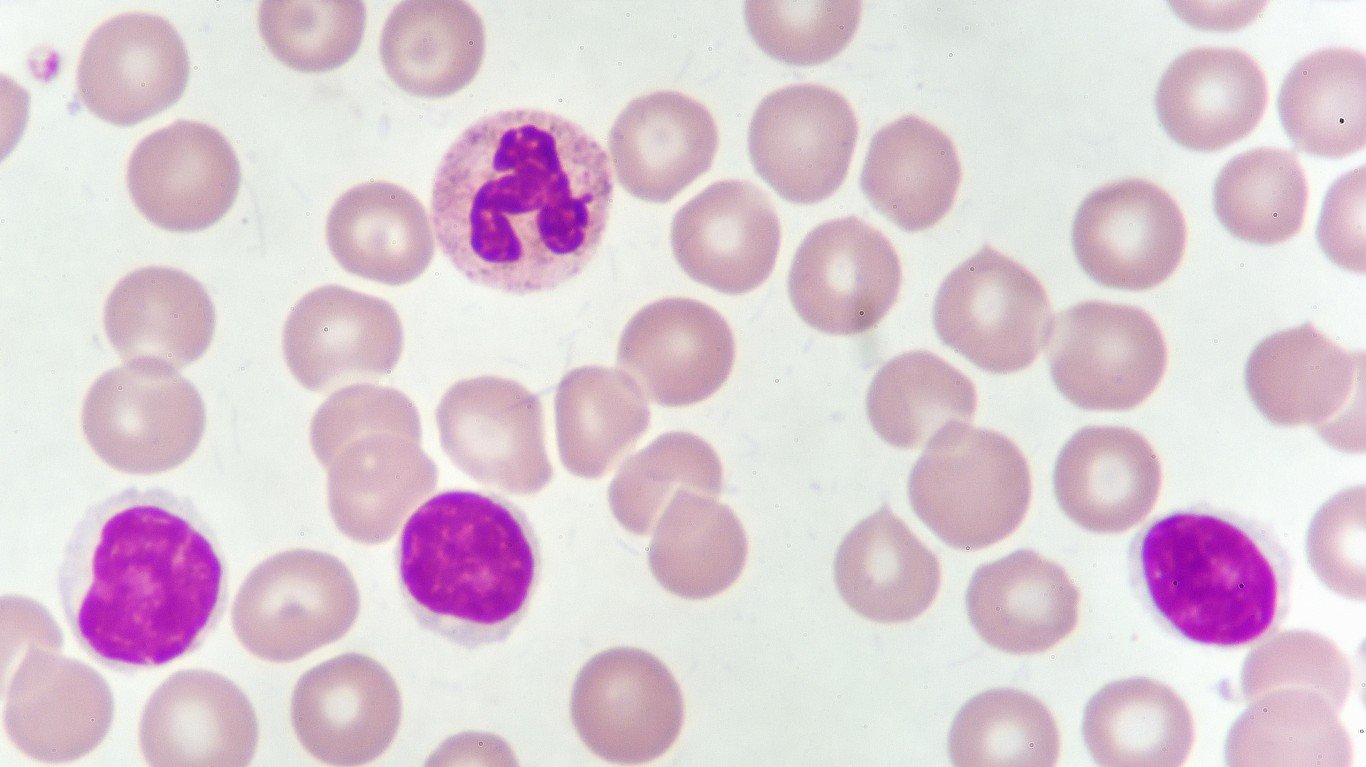

Nkarta

- Buyer(s): a director

- Total shares: 2.0 million

- Price per share: $10.00

- Total cost: $20.0 million

This director took advantage of a public offering of Nkarta Inc. (NASDAQ: NKTX) shares that followed recent better-than-expected earnings but disappointing trial results. Despite pulling back in recent days, the stock is still up almost 64% year to date. Shares of this cancer-focused biotech ended the week trading at $10.81, above the offering price. Analysts have a consensus rating of Buy, and their $19.25 mean price target represents a share price gain of about 78% more in the coming year.

LENZ Therapeutics

- Buyer(s): 10% owner R.A. Capital Management

- Total shares: about 998,000

- Price per share: $15.03

- Total cost: around $15.0 million

Clinical-stage biopharmaceutical company LENZ Therapeutics Inc. (NASDAQ: LENZ) recently completed its merger with Graphite Bio. The buyer’s stake is more than 3.3 million shares, and the purchase was well-timed as the stock has popped more than 39% in the past week. The 52-week high is now near $24 a share. The only posted price target is at $28, and the consensus recommendation (of two analysts) is to buy shares. Note that this same beneficial owner also just purchased shares of ARS Pharmaceuticals (see below).

ARS Pharmaceuticals

- Buyer(s): 10% owner R.A. Capital Management

- Total shares: about 1.4 million

- Price per share: $8.89 to $10.00

- Total cost: nearly $13.3 million

While the CEO and another officer together have sold more than 600,000 ARS Pharmaceuticals Inc. (NASDAQ: SPRY) shares in recent weeks, this beneficial owner bucked that trend. Its stake in this San Diego-based biopharmaceutical company is now up to more than 9.9 million shares. The company recently reported encouraging clinical data and better-than-expected quarterly earnings. The share price is up over 86% year to date and above the buyer’s purchase price range. The $19 consensus price target suggests the stock has almost another 75% upside in the next 12 months. Also note that the buyer picked up shares of LENZ Therapeutics (see above).

Snowflake

- Buyer(s): CEO Sridhar Ramaswamy

- Total shares: more than 31,500

- Price per share: $158.52

- Total cost: about $5.0 million

The prior CEO of Montana-based tech company Snowflake Inc. (NYSE: SNOW) recently stepped down. The share price plunged afterward and is now almost 19% lower year to date. However, it is also still up more than 19% from a year ago, as well as above the new CEO’s purchase price. This is one of Warren Buffet’s top AI stock picks, and analysts on average recommend buying shares. Their mean price target is up at $220.68, in a wide range of $125 to $600 per share.

And Other Insider Buying

In the past week or so, some insider buying was reported at Advance Auto Parts, CME, Dollar General, Grocery Outlet, Herbalife, Lululemon Athletica, Reddit, Rocket Companies, Summit Therapeutics, and Synopsys as well.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.