One of the time-tested investment methods is the “buy and hold strategy”. Popularized by investment guru Warren Buffett, this strategy attempts to take emotion out of market peaks and valleys, and relies on holding the stock while the fundamentals of the company’s finances, management, and business model all remain solid, so that the underlying value will be recognized.

24/7 Wall St. has tracked a number of stocks over the period of a decade that have made triple and even quadruple digit percentage returns for those investors intuitive enough to have taken the plunge early.

One such company is Intuitive Surgical, Inc. (NASDAQ: ISRG).

A Robotic Surgery Pioneer

Founded in 1995, Intuitive Surgical, Inc. is a pioneer in Robotic Assisted Surgery (RAS), and was one of the first companies to expand its use to urology and other areas of surgery not normally deployed. These developments led to the creation of Intuitive Surgical’s da Vinci surgical systems, which are now used for such surgical tasks as: incisions, stapling, endoscopy, and others.

The da Vinci system reduces many open, invasive surgeries to a series of robot-assisted microsurgeries with built-in endoscopy so the surgeons can view organs while minimizing the surgical area to foster accelerated healing and recovery.

Two Forward Stock Splits

ISRG stock executed a 3-for-1 forward stock split in 2017, and a second one in 2021. Therefore, for each share of stock purchased in 2014, a shareholder now had nine in 2021.

This run coincided with the introduction of Intuitive Surgical’s Ion Robotic Bronchoscopy platform, which minimizes the invasive nature of lung biopsy procedures in the treatment and diagnosis of lung cancer.

What Are Intuitive Surgical’s Future Prospects?

At the end of 2023, Intuitive Surgical had sold and installed 8,606 da Vinci systems. Demand continues to grow, and one can easily add Ion’s sales to the future prognostications. The Baby Boomers are getting older and living longer, thanks to medical developments and devices like da Vinci and Ion. The demand will only continue to expand for the foreseeable future, since the market only has roughly 5% saturation at this stage in time.

Looking back at what a 2014 investment of $5,000 in Intuitive Surgical Stock would be worth now

As of the time of this writing, ISRG stock is trading at $385.29. Back in 2014, at the end of Q1, split-adjusted stock price was in the $56-57 price range.

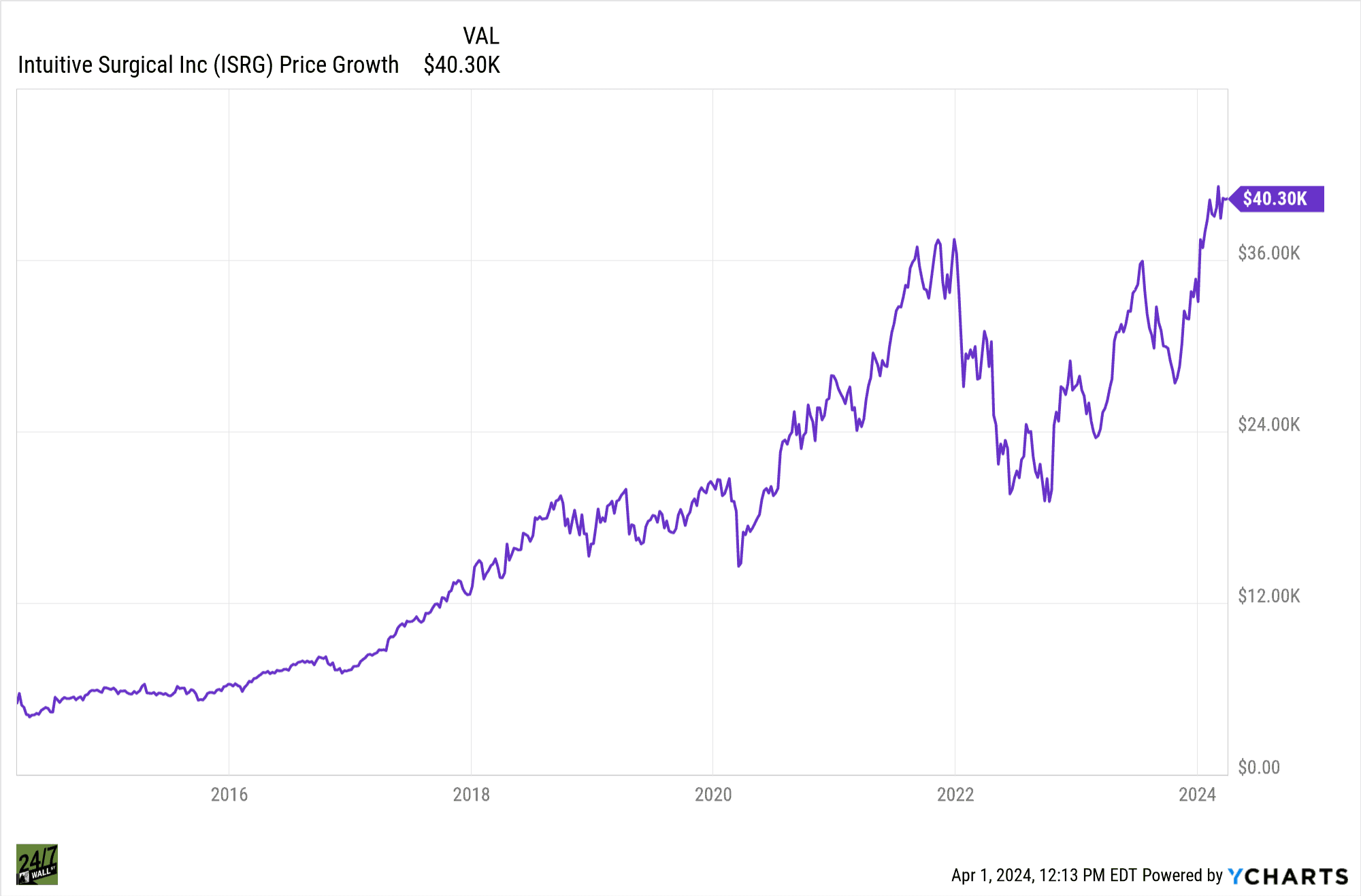

In 2017, Intuitive Surgical, Inc. announced a 3-for-1 forward stock split. repeating in 2021 with another 3-for-1 forward stock split. A $5000 investment 10 years ago in Intuitive Surgical, would have turned into over $40,000 today.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.