Nvidia (Nasdaq:NVDA) is the hottest stock on the planet. The company’s earnings release are a must watch event, with the results frequently moving the entire tech-biased Nasdaq in a given day. The company has become so large that so goes Nvidia, so goes the market.

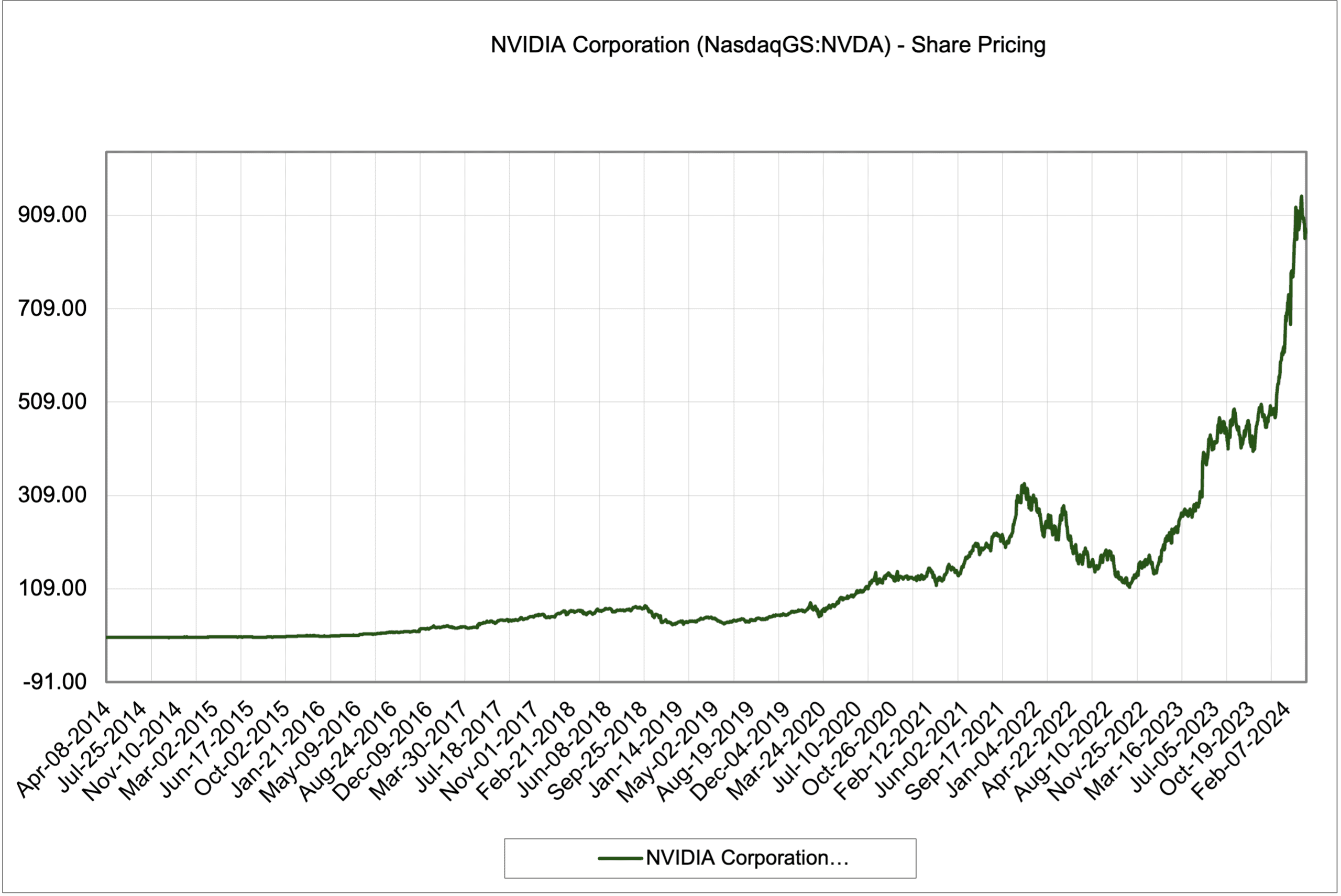

And, it has the returns to show for it. In the last decade Nvidia has returned over 20,000% for investors, and absolutely unimaginable return. But, just how much would that be worth today, if you’d invested $1,000 a decade ago? Let’s wind back the clocks and take a look.

Nvidia A Decade Ago

Way back in 2014 Nvidia was more or less a niche GPU company for gamers. The company saw modest top line revenue declines as flagship GeForce GPUs weakened in 2013, then returned to moderate growth in 2014. CEO Jensen Huang indicated that the future for Nvidia included more gaming, and potentially self-driving vehicles. At the time there were 6 million cars using Nvidia processors on the road from the likes of Honda, Audi, and fellow supernova stock Tesla (Nasdaq:TSLA). LLMs and AI were not even on the horizon.

At the time, shares were reliably trading below $5 a share. A decade ago, $1,000 would have bought you a little more than 210 shares. Today those same shares are nearly $900, each. If you’d invested $1,000 into Nvidia a decade ago, the position would be worth nearly $185,000 today.

It’s hard to imagine turning $1,000 into $185,000 in only 10 years. For context, the S&P 500 returned a respectable 180% over the same time frame.

Nvidia’s Next 10 Years

After a phenomenal run like this it’s natural to wonder what the next decade could look like for Nvidia.

A decade ago the main business was gaming GPUs, with some hopeful growth from autonomous vehicles. Those are both still major divisions today, so it seems likely they will continue to be meaningful in another 10 years. It’s very hard to predict where the next big breakthrough will come for the company, and perhaps it’s just ongoing servicing of AI and LLMs. Beyond that, the cloud and data center divisions will likely become more meaningful than they are today as compute heavy tasks become more mainstream, affordable, and in high demand.

With Nvidia’s prior work on vehicle autonomy, AI, and mobile it also seems inevitable the company becomes a major player in robotics next. Companies like Tesla (Nasdaq: TSLA) are building humanoid robots with the promise of solving everyday tasks from folding laundry to walking today. Those machines will need powerful and energy efficient chips to run localized AI. Nvidia seems perfectly positioned here.

But what about the shares? First, with shares trading at $871 today, it’s likely that the company will announce a stock split sooner than later. But more importantly, will they continue to grow at a torrid rate? It’s extremely unlikely the next decade puts up the same sort of returns, and even tech bulls like Cathie Wood have called Nvidia a massive bubble, comparing it to Cisco in 2000. At one point Nvidia was the largest position for Wood and her team, but it was completely divested in January 2023, citing valuation.

At this point one thing is clear, Nvidia is riding a very large wave of AI hype and enthusiasm and will need to grow revenue at a torrid rate to meet the expectations. That’s certainly possible, but far from guaranteed.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.