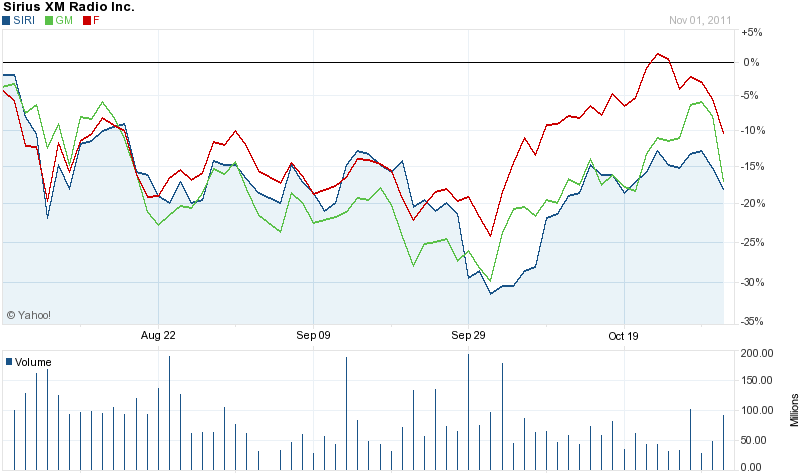

Sirius XM Radio Inc. (NASDAQ: SIRI) has gone off the steadily climbing share price trajectory. We argued before that Sirius in many cases may now be tied to Ford Motor Co. (NYSE: F) and General Motors Corp. (NYSE: GM) more than anything else, and its 3-month comparative chart at the end of this shows that it is actually lagging.

Sirius XM Radio Inc. (NASDAQ: SIRI) has gone off the steadily climbing share price trajectory. We argued before that Sirius in many cases may now be tied to Ford Motor Co. (NYSE: F) and General Motors Corp. (NYSE: GM) more than anything else, and its 3-month comparative chart at the end of this shows that it is actually lagging.

Net income hit $0.02 EPS on $104.2 million and revenue was up 6% to $762.5 million. The Thomson Reuters estimates were $0.01 EPS and $just over $764 million in revenues.

The most recent earnings report showing that it added 334,000 net subscribers during the last quarter to end with right at 21.35 million subscribers; net adds so far in 2011 have been 1.16 million. Some were hoping for 350,000 or more in net subscribers. What is more important than the last additions was the projection for the holiday season with some 440,000 net subscriber adds in the fourth quarter. This earnings report was met with a day where Ford and GM both got hit over less robust car sales figures.

The satellite radio monopoly reported a 16% gain to $197 million in EBITDA and margins are going up as its content costs are actually lower. The company also expects some $400 million in free cash flow during 2011.

Investors should pay attention to the fact that Mel Karmazin hinted at using extra cash to make acquisitions. We are also looking at the company’s ongoing roll-out of the certified used car sales market.

Sirius XM may have stumbled a bit on its net subscriber additions, but it should have some strong support in the $1.55 to $1.60 area.

Shares were down only $0.06 at $1.72 by the close on Tuesday when the broad market was way off as well. That might be considered a win under many circumstances. Analysts still have a consensus price target objective of $2.30 but that may change at any moment and the group of firms covering it is rather small.

JON C. OGG

Smart Investors Are Quietly Loading Up on These “Dividend Legends” (Sponsored)

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.