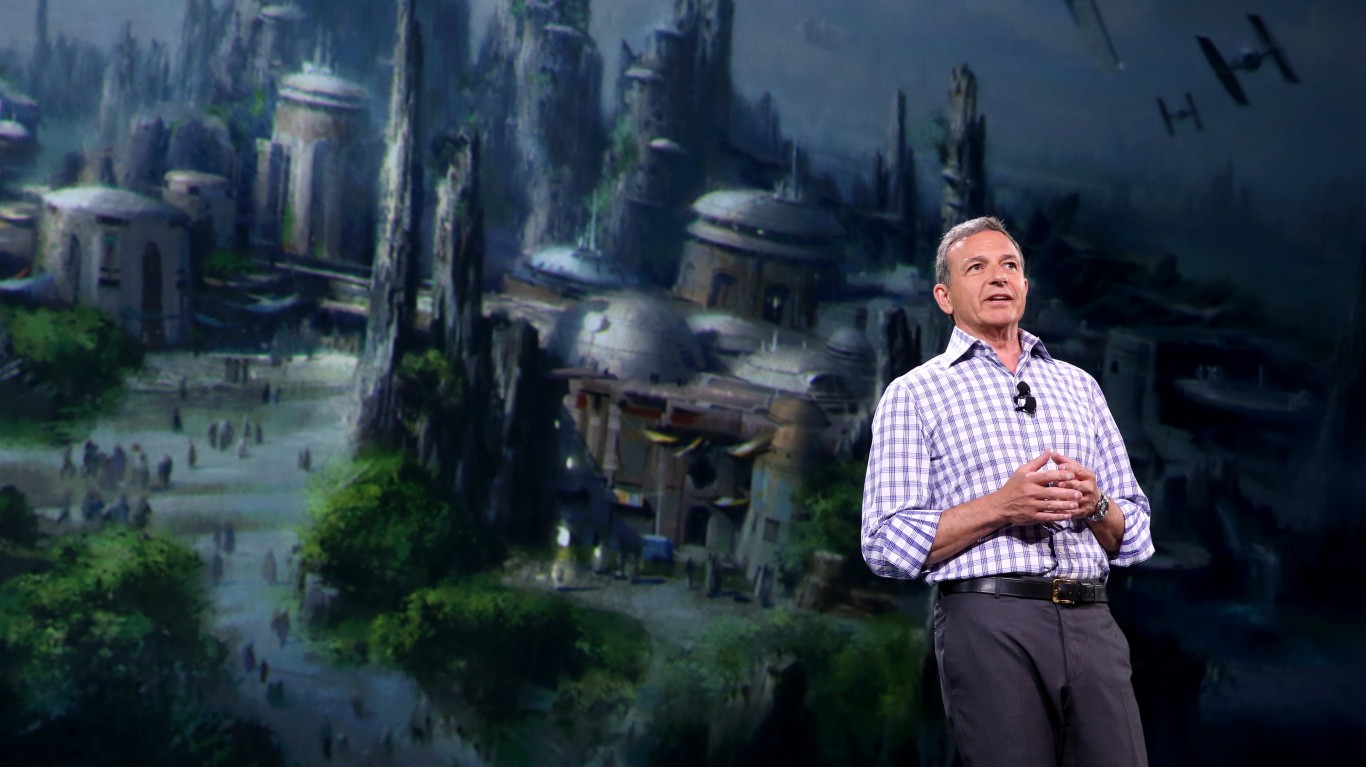

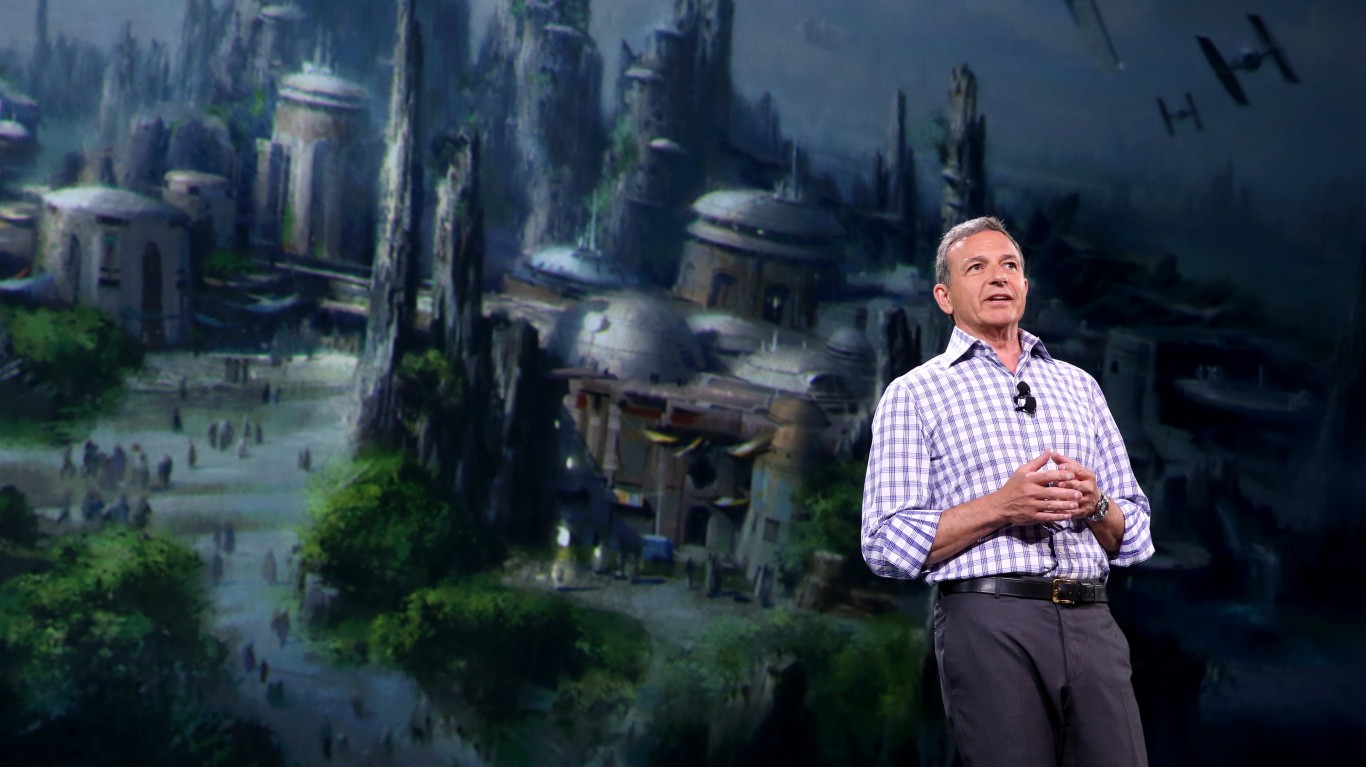

As Walt Disney Co. (NYSE: DIS) stumbled through a horrible year financially, CEO Bob Iger, who was brought back to fix the company in November 2021, made $31.6 million. He ran Disney for 15 years until 2020. Investors hoped he would bring the magic back to Disney’s businesses and its financial results.

In the past year, which includes the time since he returned, Disney’s stock is down 6%, while the market is 19% higher. Troubles with Disney’s streaming business, legacy media and movie units have all hindered turnaround efforts. (Discover the 20 best animated films of all time.)

Iger’s base salary was $865,485, and the balance of his compensation was stock awards and options. According to the company’s new proxy, his pay was also 595 times that of the median pay for Disney workers.

Iger’s tenure shows his decision to launch Disney+ in November 2019 with a base price of $6.99 a month was a mistake. Rivals Amazon and Netflix charged almost twice that. Disney lost billions of dollars, even as its subscriber count soared.

In the most recent quarter, Disney’s direct-to-consumer business lost $420 million. The division includes streaming. In the same quarter a year ago, the loss was $1.4 billion. Disney+ had 150 million subscribers at the end of the quarter, up by 4 million from the previous quarter. Disney said it would increase prices, but this could add to “churn,” an industry term for cancellations.

ESPN, once a cash cow, has stopped growing. Disney may bring in a partner in an attempt to reverse that. Legacy media, which include ABC, are up against a difficult advertising market. Disney’s movie business, once the industry leader in revenue, has stumbled and did not have a major hit in 2022.

Disney also nominated a new slate of board members in part to keep raider Nelson Peltz’s nominees off the board. Peltz has taken a stock position, arguing Disney is poorly run. If so, Bob Iger got $31 million last year to run it.

Smart Investors Are Quietly Loading Up on These “Dividend Legends” (Sponsored)

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.