Reputation is one of the most important assets a company can have, no matter what industry the company is in. Companies can spend millions of dollars each year on public relations, advertising, and brand research. The biggest brands in the world are valued at hundreds of billions of dollars. A single PR scandal, or any other misstep that draws the public’s ire, can be devastating to a company’s brand value. These are the biggest corporate scandals of the last decade.

Sometimes, rather than a single event damaging the reputation, a company’s business practices — and especially its customer service experience — can slowly erode the respect and trust of its employees, its customers, and the public at large.

24/7 Wall St. reviewed major news events from the last year, customer survey results from the American Customer Satisfaction Index, ratings on employee review website Glassdoor, and more to determine America’s 10 most hated companies.

Many of the companies on this list are in sectors that are generally more disliked than others. Service providers are among the most widely disliked industries, so it makes sense that the least liked companies in these areas rank as the least liked companies overall. These are the companies with the best and worst reputations.

Click here to see the 10 most hated companies in America

Click here to see our methodology

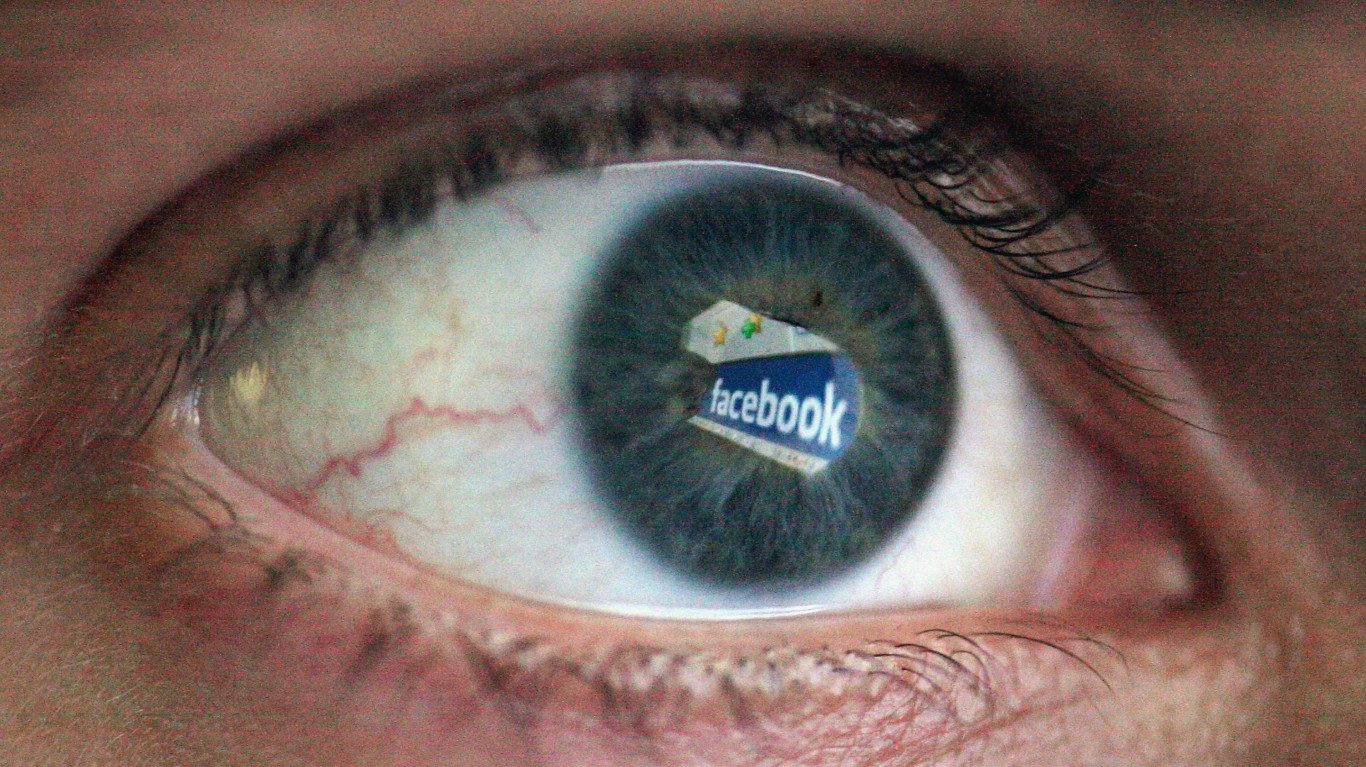

1. Facebook

Facebook and its co-founder and CEO Mark Zuckerberg have come under fire in recent years — from both the public and legislators — after the popular social media site was used to spread misinformation, causing election interference in 2016 and contributing to political polarization in the U.S. and abroad.

The company’s reputation took another serious hit when it was discovered that consultant group Cambridge Analytica harvested personal data from as many as 87 million users without their knowledge or consent, using it to tailor ads used in the 2016 presidential election and other political campaigns.

[in-text-ad]

2. WeWork

Shared office space company WeWork appeared to be headed for a great 2019. It was preparing for an initial public offering, with the company valued at $47 billion. Then some reports surfaced of strange behavior and erratic management from CEO Adam Neumann, including potential conflicts of interest. The IPO filing showed the company was bleeding cash, forcing it to halt its IPO.

With investors increasingly dissatisfied, Neumann eventually stepped down. His golden parachute was reportedly worth over $1 billion — even though his apparent mismanagement of the company led to 2,400 employees being laid off. Japanese conglomerate SoftBank is now the majority owner of the company, after its valuation plummeted to $5 billion.

3. Pacific Gas & Electric

In November 2018, the deadliest and most destructive wildfire in California’s history blazed through Butte County, killing 85 people and destroying over 18,000 structures. A report released by state regulators at the end of 2019 confirmed what had already been largely believed — that energy utility PG&E was directly responsible for the blaze.

The report found that the company had violated a dozen state safety rules, and that the violations were not unique to the events that caused the 2018 fire but rather “indicative of an overall pattern of inadequate inspection and maintenance of PG&E’s transmission facilities.” A 2019 Wall Street Journal report found the company was responsible for over 1,500 fires in a six year span. In 2019, PG&E agreed to two settlements related to fires it was responsible for — an $11 billion insurance settlement and a $13.5 billion settlement to individual victims. In December, the company filed for Chapter 11 bankruptcy.

Besides the public outrage over the fires, PG&E has not done its reputation any favors based on reviews by customers. The company has a D-minus rating on the Better Business Bureau site. It is also tied with another company as the third worst-rated energy utility out of the 26 investor-owned companies scored by the ACSI in 2019.

4. Purdue Pharma

5. Boeing

Once a trusted aviation brand, Boeing now faces intense scrutiny and a slew of lawsuits following several recent accidents and incidents related to its 737 Max jetliner. In October 2018, a Boeing 737 Max crashed shortly after takeoff. A similar accident took place in March 2019. Over 150 people were killed in both accidents. The FAA grounded all further flights of the 737 Max, and Boeing suspended its production.

After the crashes, it was revealed that Boeing knew of the issue for years but did not disclose the information. Company engineers told CNN that the 737 Max relied on a single sensor that is prone to malfunctions and would only work effectively with an optional safety feature most of its customers did not purchase. In both crashes, it appears this sensor sent a signal that the plane was stalling when it was not. This caused the aircraft to pitch down. Though Boeing first learned of the issue in 2017, company executives did not think it would make the planes less safe. Since March 2019, Boeing’s stock price has fallen by more than 25%.

6. Frontier Communication

Like many modern corporations, Frontier Communications provides several services to its customers, yet none are well reviewed. Three of the 20 worst reviewed services on the ACSI are Frontier’s: the company’s fixed-line telephone service received a score of 61 compared to the industry average of 71; its subscription TV service scored a 57 compared to an industry average of 62; and its internet service received a score of 55, the lowest score awarded out of the more than 300 company services reviewed in 2019.

According to its employees, Frontier is also one of the worst places to work. It has a score of 2.4 out of 5.0 on employee review site Glassdoor, tied for the third worst score among more than 800 large companies. Barely one out of five employees who left reviews on the site would recommend their friends to work there. The company has an average of 1 star out of 5 among customer responses on the Better Business Bureau website, and the BBB gives the service provider a score of F.

7. Houston Astros

In 2020, the MLB reported that since their 2017 World Series-winning season, the Houston Astros had used a video feed in their dugout to see what the opposing pitcher planned to throw. Someone would relay the information to their batters by banging on a trash can or making some other noise. Rumors of rule-breaking had circulated for years, but no action was taken until former Astros pitcher Mike Fiers admitted the team cheated in late 2019.

Hinch and general manager Jeff Luhnow were each banned for a season then fired. The Astros were fined $5 million and stripped of four draft picks. Alex Cora, who was Houston’s bench coach in 2017 before becoming manager for the Boston Red Sox, parted ways with Boston.

Before the cheating scandal broke, the Astros had already made themselves less than likeable. After securing a trip to the 2019 World Series, assistant general manager Brandon Taubman taunted female journalists, saying “thank god we got Osuna.” The team was criticized for trading for relief pitcher Roberto Osuna after he was suspended for violating the league’s domestic violence policy. When the journalists wrote about the incident, the team released a statement saying there was an “attempt to fabricate a story” but later apologized and fired Taubman.

8. Wells Fargo

Wells Fargo’s customer service score of 76 is tied for the worst of any of the major banks rated by the ACSI. While many banks sustained serious damage to their reputations in the years following the subprime mortgage crisis because of their involvement and complicity in the events leading up to it, Wells Fargo’s PR woes continue.

The bank took a serious hit to its reputation in 2016 after it came to light that company employees had been creating fake customer accounts in order to meet quotas and inflate company revenue. The company was fined millions of dollars, and in the aftermath of the scandal, Wells Fargo CEO John Stumpf stepped down. Even after Stumpf left, however, revelations about the company’s underhanded dealings continued to pile up.

In January 2020, a report by the Office of the Comptroller of the Currency, a federal banking regulator, issued new damning charges against Stumpf and the bank, with documents and testimony that workers were effectively coerced by the bank’s management to break the law. Stumpf agreed to pay a $17.5 million fine and was permanently banned from working in banking. A number of other former Wells Fargo executives face charges from the OCC.

[in-text-ad]

9. Johnson & Johnson

For years, Johnson & Johnson had faced accusations from customers that its talcum product, such as baby powder, had caused their cancer. It is facing roughly 17,000 lawsuits related to the issue, including one by the state of New Mexico. In July 2018, a Missouri jury awarded $4.69 billion to 22 women who claimed J&J talcum powder gave them ovarian cancer.

Further damaging the company’s reputation was a 2018 Reuters report that claimed the over 130-year-old health care company knew for more than 40 years that its baby powder contained asbestos, which is known to cause cancer. The company called the article “false and inflammatory.” Still, in October 2019, the company issued a nationwide recall of baby powder after finding asbestos in the product. Though it claims the product is now safe, J&J’s reputation is in tatters.

J&J received an F rating from the Better Business Bureau due to government action taken against the company as well as a number of unaddressed complaints.

10. Juul

After years of declining tobacco use among teenagers, American high school students are picking up the habit again. E-cigarette use has more than doubled among high schoolers from 2017 to 2019. Many have blamed e-cigarette maker Juul, and its small portable e-cigarettes, for contributing to the rise in underage nicotine use and addiction. The Campaign for Tobacco-Free Kids says Juuls may have especially high doses of nicotine that can hook users.

Juul Labs agreed to pull some fruity, sweet-flavored pods off brick-and-mortar store shelves in 2018 because they may be more appealing to children. In early 2020, the Trump administration banned all fruity, dessert, or mint flavors from cartridge-based e-cigarettes like Juuls.

Methodology:

To identify the most hated companies in America, 24/7 Wall St. reviewed a variety of metrics on customer service, employee satisfaction, brand value, and financial performance. We considered consumer surveys from several sources, including the American Customer Satisfaction Index (ACSI), as well as large declines in a brand’s value from sources like BrandZ and Interbrand. Employee satisfaction is based on worker opinion scores on workplace review site Glassdoor — this is not a Glassdoor commissioned report. We also accounted for current events that have impacted the public’s perception of the companies.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.