As the U.S. continues to struggle with the health and economic consequences of the COVID-19 pandemic, school staff and teachers across the country have returned to work.

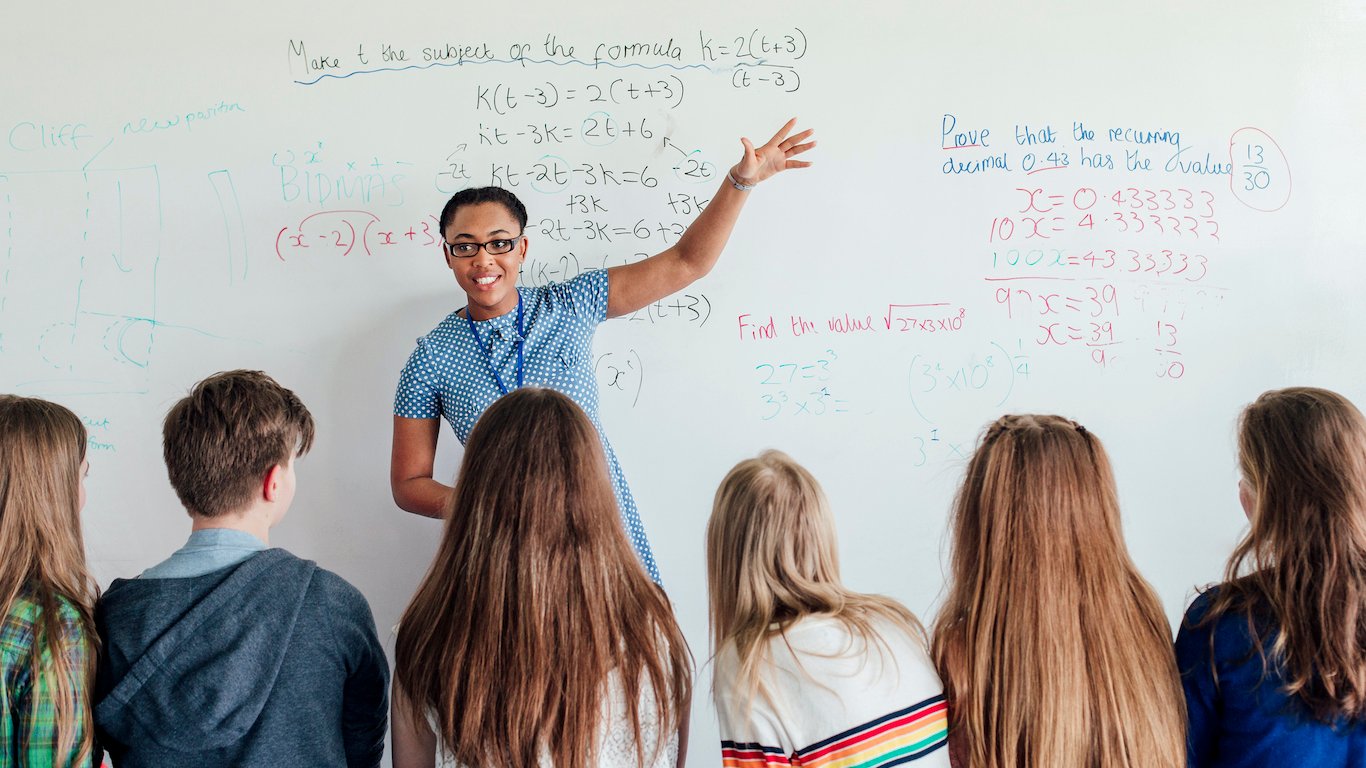

Many occupations deemed essential to the economy, or for which remote work is not an easy option, are low-wage jobs. The same appears to be true for teachers, who are paid lower wages compared to non-teacher, college-educated workers, even after controlling for education, experience, and other factors known to affect earnings.

Public high school teachers in the United States earned approximately 19.2% less than other college-educated workers in 2019, according to the report, “Teacher pay penalty dips but persists in 2019,” published Sept. 17, 2020 by the Economic Policy Institute, a nonprofit think tank.

With the exception of a period during the 1960s when teachers across the country earned slightly more on average than other college-educated workers, teachers in the United States have consistently earned less than non-teacher college graduates. Since at least 1980, the wage gap between the two worker groups has steadily increased. In 1996, teachers made approximately 6% less than other college-educated workers. Here are the states where teachers are paid the most and least.

On average across the United States, a high school teacher working in a public school earns $65,930 a year. The average occupation in the U.S. that requires at least a college degree pays $92,175 a year — according to government labor force data for May 2019.

School spending per student tends to be higher in states with smaller gaps between teacher and non-teacher pay compared to states with larger gaps. Of the 25 states with the smallest teacher wage penalties, public school spending per student is greater than the national average of $12,612 per student in 13 states. Of the states with the largest teacher wage penalties, public school spending per student is higher than the national average in only four states.

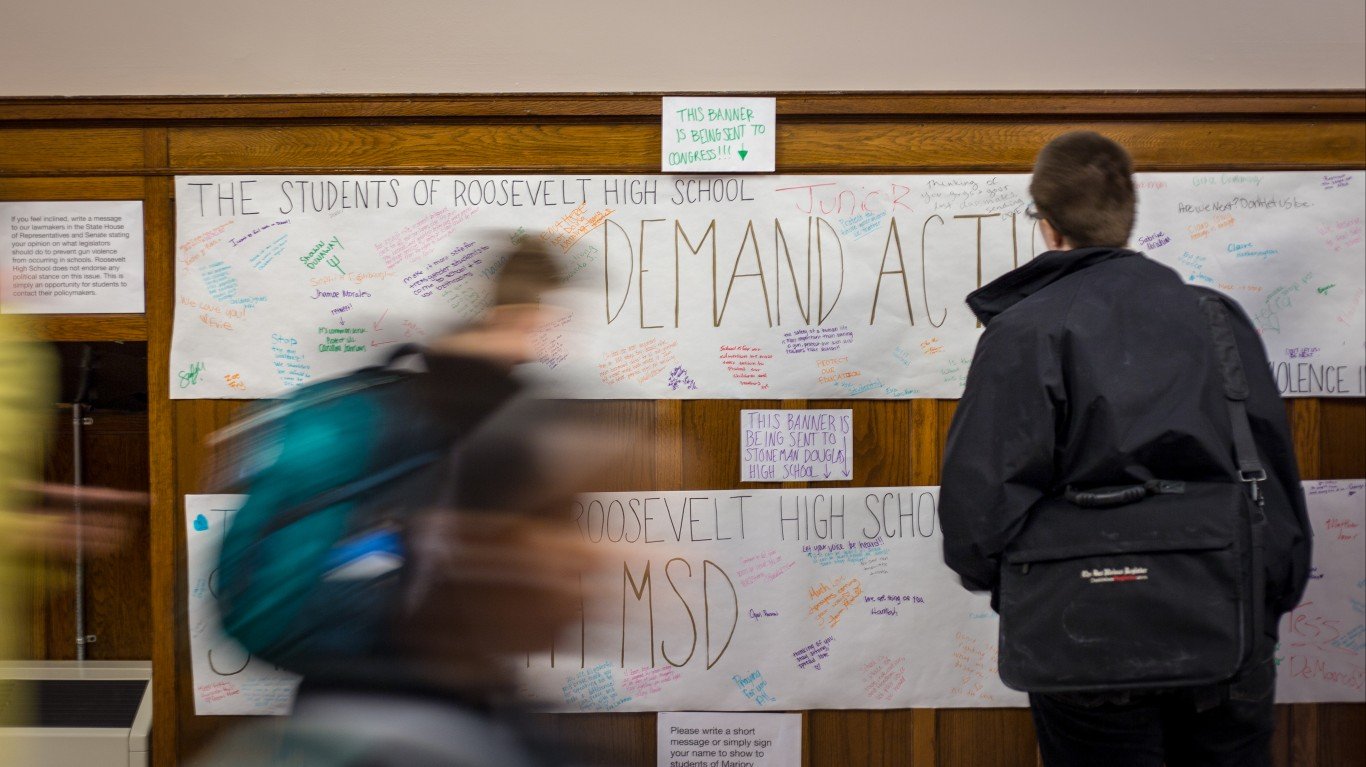

The public education system in the United States lags behind those of many wealthy nations. According to an annual study conducted by the Organization for Economic Cooperation and Development, the U.S. trails 24 other countries — Australia, Canada, China, Germany, Japan, and the U.K. among them — in student performance in core subjects like mathematics, science, and reading.

Nationwide, only about 33% of public school students about to enter high school are considered proficient in math and 32% proficient in reading, according to the National Assessment of Educational Progress. Here is a list of the school districts where children are least likely to succeed in every state.

Click here to see the states with the most underpaid teachers

Click here to read our methodology

50. Wyoming

> Teacher wage penalty: -2.0%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $66,235 — 19th highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $83,597 — 11th lowest

> HS teachers working in Wyoming, May 2019: 1,690

> Cost of living, 2018: 7.3% less than average — 23rd lowest

> Current spending on public schools, 2018: $16,224 per pupil — 9th highest

[in-text-ad]

49. Rhode Island

> Teacher wage penalty: -2.1%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $76,485 — the highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $94,621 — 4th highest

> HS teachers working in Rhode Island, May 2019: 4,840

> Cost of living, 2018: 0.7% less than average — 17th highest

> Current spending on public schools, 2018: $16,121 per pupil — 10th highest

48. New Jersey

> Teacher wage penalty: -3.1%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $67,786 — 13th highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $88,799 — 20th highest

> HS teachers working in New Jersey, May 2019: 30,230

> Cost of living, 2018: 15.2% more than average — 4th highest

> Current spending on public schools, 2018: $20,021 per pupil — 3rd highest

47. Alaska

> Teacher wage penalty: -9.7%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $72,347 — 8th highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $87,818 — 25th lowest

> HS teachers working in Alaska, May 2019: 2,790

> Cost of living, 2018: 4.8% more than average — 10th highest

> Current spending on public schools, 2018: $17,726 per pupil — 5th highest

[in-text-ad-2]

46. Delaware

> Teacher wage penalty: -9.8%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $67,733 — 14th highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $89,827 — 19th highest

> HS teachers working in Delaware, May 2019: 3,330

> Cost of living, 2018: 1.2% less than average — 18th highest

> Current spending on public schools, 2018: $15,639 per pupil — 12th highest

45. Hawaii

> Teacher wage penalty: -10.9%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $52,989 — 3rd lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $72,776 — 2nd lowest

> HS teachers working in Hawaii, May 2019: 4,320

> Cost of living, 2018: 18.1% more than average — the highest

> Current spending on public schools, 2018: $15,242 per pupil — 13th highest

[in-text-ad]

44. Maryland

> Teacher wage penalty: -11.4%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $71,079 — 9th highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $90,491 — 17th highest

> HS teachers working in Maryland, May 2019: 17,150

> Cost of living, 2018: 8.4% more than average — 6th highest

> Current spending on public schools, 2018: $14,762 per pupil — 14th highest

43. New York

> Teacher wage penalty: -12.0%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $74,948 — 3rd highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $93,663 — 7th highest

> HS teachers working in New York, May 2019: 75,360

> Cost of living, 2018: 16.4% more than average — 2nd highest

> Current spending on public schools, 2018: $24,040 per pupil — the highest

42. Vermont

> Teacher wage penalty: -12.7%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $64,718 — 20th highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $72,163 — the lowest

> HS teachers working in Vermont, May 2019: 2,770

> Cost of living, 2018: 3.0% more than average — 11th highest

> Current spending on public schools, 2018: $19,340 per pupil — 4th highest

[in-text-ad-2]

41. Pennsylvania

> Teacher wage penalty: -13.0%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $68,636 — 11th highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $90,844 — 16th highest

> HS teachers working in Pennsylvania, May 2019: 46,130

> Cost of living, 2018: 2.5% less than average — 20th highest

> Current spending on public schools, 2018: $16,395 per pupil — 8th highest

40. South Carolina

> Teacher wage penalty: -13.4%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $62,272 — 24th lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $86,424 — 18th lowest

> HS teachers working in South Carolina, May 2019: 14,050

> Cost of living, 2018: 8.9% less than average — 18th lowest

> Current spending on public schools, 2018: $10,856 per pupil — 19th lowest

[in-text-ad]

39. Connecticut

> Teacher wage penalty: -13.5%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $74,025 — 4th highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $96,886 — the highest

> HS teachers working in Connecticut, May 2019: 15,820

> Cost of living, 2018: 6.1% more than average — 8th highest

> Current spending on public schools, 2018: $20,635 per pupil — 2nd highest

38. Iowa

> Teacher wage penalty: -14.7%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $63,419 — 23rd highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $87,130 — 21st lowest

> HS teachers working in Iowa, May 2019: 11,950

> Cost of living, 2018: 10.8% less than average — 11th lowest

> Current spending on public schools, 2018: $11,732 per pupil — 25th lowest

37. Mississippi

> Teacher wage penalty: -15.2%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $54,163 — 5th lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $79,566 — 5th lowest

> HS teachers working in Mississippi, May 2019: 8,850

> Cost of living, 2018: 14.0% less than average — 2nd lowest

> Current spending on public schools, 2018: $8,935 per pupil — 5th lowest

[in-text-ad-2]

36. Ohio

> Teacher wage penalty: -15.2%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $72,862 — 7th highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $95,150 — 3rd highest

> HS teachers working in Ohio, May 2019: 47,510

> Cost of living, 2018: 11.6% less than average — 8th lowest

> Current spending on public schools, 2018: $13,027 per pupil — 17th highest

35. California

> Teacher wage penalty: -15.5%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $73,726 — 6th highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $91,613 — 14th highest

> HS teachers working in California, May 2019: 109,840

> Cost of living, 2018: 15.4% more than average — 3rd highest

> Current spending on public schools, 2018: $12,498 per pupil — 20th highest

[in-text-ad]

34. Michigan

> Teacher wage penalty: -15.9%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $68,182 — 12th highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $92,859 — 9th highest

> HS teachers working in Michigan, May 2019: 22,820

> Cost of living, 2018: 7.6% less than average — 21st lowest

> Current spending on public schools, 2018: $12,345 per pupil — 22nd highest

33. North Dakota

> Teacher wage penalty: -16.4%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $62,086 — 23rd lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $86,347 — 17th lowest

> HS teachers working in North Dakota, May 2019: 2,800

> Cost of living, 2018: 9.4% less than average — 16th lowest

> Current spending on public schools, 2018: $13,758 per pupil — 16th highest

32. Nevada

> Teacher wage penalty: -16.6%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $59,579 — 18th lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $88,086 — 23rd highest

> HS teachers working in Nevada, May 2019: 5,760

> Cost of living, 2018: 2.5% less than average — 20th highest

> Current spending on public schools, 2018: $9,417 per pupil — 8th lowest

[in-text-ad-2]

31. Arkansas

> Teacher wage penalty: -17.7%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $60,809 — 21st lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $83,961 — 12th lowest

> HS teachers working in Arkansas, May 2019: 11,940

> Cost of living, 2018: 14.7% less than average — the lowest

> Current spending on public schools, 2018: $10,139 per pupil — 14th lowest

30. Nebraska

> Teacher wage penalty: -17.7%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $67,598 — 16th highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $87,477 — 22nd lowest

> HS teachers working in Nebraska, May 2019: 6,890

> Cost of living, 2018: 10.5% less than average — 13th lowest

> Current spending on public schools, 2018: $12,491 per pupil — 21st highest

[in-text-ad]

29. South Dakota

> Teacher wage penalty: -18.0%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $50,751 — the lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $80,554 — 7th lowest

> HS teachers working in South Dakota, May 2019: 3,500

> Cost of living, 2018: 12.1% less than average — 6th lowest

> Current spending on public schools, 2018: $10,073 per pupil — 13th lowest

28. Massachusetts

> Teacher wage penalty: -18.0%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $73,902 — 5th highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $95,307 — 2nd highest

> HS teachers working in Massachusetts, May 2019: 27,120

> Cost of living, 2018: 9.7% more than average — 5th highest

> Current spending on public schools, 2018: $17,058 per pupil — 6th highest

27. West Virginia

> Teacher wage penalty: -18.2%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $54,226 — 6th lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $80,940 — 8th lowest

> HS teachers working in West Virginia, May 2019: 4,460

> Cost of living, 2018: 12.2% less than average — 5th lowest

> Current spending on public schools, 2018: $11,334 per pupil — 21st lowest

[in-text-ad-2]

26. New Hampshire

> Teacher wage penalty: -18.2%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $57,283 — 12th lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $86,622 — 19th lowest

> HS teachers working in New Hampshire, May 2019: 5,000

> Cost of living, 2018: 6.0% more than average — 9th highest

> Current spending on public schools, 2018: $16,893 per pupil — 7th highest

25. Illinois

> Teacher wage penalty: -18.7%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $75,780 — 2nd highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $94,415 — 5th highest

> HS teachers working in Illinois, May 2019: 44,810

> Cost of living, 2018: 1.9% less than average — 19th highest

> Current spending on public schools, 2018: $15,741 per pupil — 11th highest

[in-text-ad]

24. Florida

> Teacher wage penalty: -19.3%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $57,535 — 14th lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $82,956 — 10th lowest

> HS teachers working in Florida, May 2019: 50,640

> Cost of living, 2018: 0.6% more than average — 15th highest

> Current spending on public schools, 2018: $9,346 per pupil — 6th lowest

23. Montana

> Teacher wage penalty: -19.4%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $56,120 — 11th lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $74,453 — 3rd lowest

> HS teachers working in Montana, May 2019: 3,670

> Cost of living, 2018: 6.7% less than average — 25th lowest

> Current spending on public schools, 2018: $11,680 per pupil — 24th lowest

22. Wisconsin

> Teacher wage penalty: -19.9%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $64,396 — 21st highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $88,693 — 21st highest

> HS teachers working in Wisconsin, May 2019: 17,880

> Cost of living, 2018: 8.1% less than average — 20th lowest

> Current spending on public schools, 2018: $12,285 per pupil — 23rd highest

[in-text-ad-2]

21. Idaho

> Teacher wage penalty: -20.9%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $54,746 — 8th lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $78,217 — 4th lowest

> HS teachers working in Idaho, May 2019: 6,210

> Cost of living, 2018: 7.5% less than average — 22nd lowest

> Current spending on public schools, 2018: $7,771 per pupil — 2nd lowest

20. Indiana

> Teacher wage penalty: -21.3%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $59,518 — 17th lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $88,036 — 24th highest

> HS teachers working in Indiana, May 2019: 21,180

> Cost of living, 2018: 10.7% less than average — 12th lowest

> Current spending on public schools, 2018: $10,262 per pupil — 16th lowest

[in-text-ad]

19. Tennessee

> Teacher wage penalty: -21.4%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $61,246 — 22nd lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $87,693 — 24th lowest

> HS teachers working in Tennessee, May 2019: 20,690

> Cost of living, 2018: 10.1% less than average — 14th lowest

> Current spending on public schools, 2018: $9,544 per pupil — 9th lowest

18. Kansas

> Teacher wage penalty: -21.8%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $57,833 — 15th lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $84,604 — 14th lowest

> HS teachers working in Kansas, May 2019: 12,310

> Cost of living, 2018: 10.0% less than average — 15th lowest

> Current spending on public schools, 2018: $11,653 per pupil — 23rd lowest

17. Texas

> Teacher wage penalty: -21.9%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $59,917 — 19th lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $91,794 — 13th highest

> HS teachers working in Texas, May 2019: 107,190

> Cost of living, 2018: 3.2% less than average — 23rd highest

> Current spending on public schools, 2018: $9,606 per pupil — 11th lowest

[in-text-ad-2]

16. Kentucky

> Teacher wage penalty: -22.2%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $62,756 — 25th lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $84,483 — 13th lowest

> HS teachers working in Kentucky, May 2019: 12,280

> Cost of living, 2018: 12.2% less than average — 5th lowest

> Current spending on public schools, 2018: $11,110 per pupil — 20th lowest

15. Minnesota

> Teacher wage penalty: -22.5%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $66,626 — 17th highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $94,220 — 6th highest

> HS teachers working in Minnesota, May 2019: 20,130

> Cost of living, 2018: 2.5% less than average — 20th highest

> Current spending on public schools, 2018: $12,975 per pupil — 19th highest

[in-text-ad]

14. Maine

> Teacher wage penalty: -23.1%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $55,260 — 9th lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $80,417 — 6th lowest

> HS teachers working in Maine, May 2019: 5,400

> Cost of living, 2018: 0.0% more than average — 16th highest

> Current spending on public schools, 2018: $14,145 per pupil — 15th highest

13. Louisiana

> Teacher wage penalty: -23.3%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $58,462 — 16th lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $85,606 — 16th lowest

> HS teachers working in Louisiana, May 2019: 14,810

> Cost of living, 2018: 10.9% less than average — 10th lowest

> Current spending on public schools, 2018: $11,452 per pupil — 22nd lowest

12. Utah

> Teacher wage penalty: -23.3%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $63,199 — 24th highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $82,561 — 9th lowest

> HS teachers working in Utah, May 2019: 8,920

> Cost of living, 2018: 3.4% less than average — 24th highest

> Current spending on public schools, 2018: $7,628 per pupil — the lowest

[in-text-ad-2]

11. Missouri

> Teacher wage penalty: -24.1%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $57,410 — 13th lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $88,181 — 22nd highest

> HS teachers working in Missouri, May 2019: 30,640

> Cost of living, 2018: 11.2% less than average — 9th lowest

> Current spending on public schools, 2018: $10,810 per pupil — 18th lowest

10. Alabama

> Teacher wage penalty: -24.6%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $60,127 — 20th lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $92,629 — 10th highest

> HS teachers working in Alabama, May 2019: 15,230

> Cost of living, 2018: 13.6% less than average — 3rd lowest

> Current spending on public schools, 2018: $9,696 per pupil — 12th lowest

[in-text-ad]

9. Georgia

> Teacher wage penalty: -25.1%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $64,366 — 22nd highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $92,433 — 12th highest

> HS teachers working in Georgia, May 2019: 26,500

> Cost of living, 2018: 7.0% less than average — 24th lowest

> Current spending on public schools, 2018: $10,810 per pupil — 17th lowest

8. North Carolina

> Teacher wage penalty: -25.3%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $54,390 — 7th lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $93,416 — 8th highest

> HS teachers working in North Carolina, May 2019: 24,030

> Cost of living, 2018: 8.2% less than average — 19th lowest

> Current spending on public schools, 2018: $9,377 per pupil — 7th lowest

7. Oregon

> Teacher wage penalty: -27.3%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $70,999 — 10th highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $87,548 — 23rd lowest

> HS teachers working in Oregon, May 2019: 8,840

> Cost of living, 2018: 1.1% more than average — 14th highest

> Current spending on public schools, 2018: $11,920 per pupil — 25th highest

[in-text-ad-2]

6. Washington

> Teacher wage penalty: -28.1%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $66,503 — 18th highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $90,408 — 18th highest

> HS teachers working in Washington, May 2019: 14,810

> Cost of living, 2018: 7.8% more than average — 7th highest

> Current spending on public schools, 2018: $12,995 per pupil — 18th highest

5. Colorado

> Teacher wage penalty: -28.8%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $55,319 — 10th lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $91,181 — 15th highest

> HS teachers working in Colorado, May 2019: 17,580

> Cost of living, 2018: 1.9% more than average — 13th highest

> Current spending on public schools, 2018: $10,202 per pupil — 15th lowest

[in-text-ad]

4. Oklahoma

> Teacher wage penalty: -29.0%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $53,529 — 4th lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $85,188 — 15th lowest

> HS teachers working in Oklahoma, May 2019: 11,680

> Cost of living, 2018: 11.6% less than average — 8th lowest

> Current spending on public schools, 2018: $8,239 per pupil — 4th lowest

3. New Mexico

> Teacher wage penalty: -29.5%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $63,019 — 25th highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $88,017 — 25th highest

> HS teachers working in New Mexico, May 2019: 6,880

> Cost of living, 2018: 8.9% less than average — 18th lowest

> Current spending on public schools, 2018: $9,582 per pupil — 10th lowest

2. Arizona

> Teacher wage penalty: -31.8%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $52,145 — 2nd lowest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $87,098 — 20th lowest

> HS teachers working in Arizona, May 2019: 16,990

> Cost of living, 2018: 3.5% less than average — 25th highest

> Current spending on public schools, 2018: $8,239 per pupil — 3rd lowest

[in-text-ad-2]

1. Virginia

> Teacher wage penalty: -32.7%

> Cost-of-living-adjusted annual wage of public HS teacher, May 2019: $67,716 — 15th highest

> Cost-of-living-adjusted annual wage of college-educated worker, May 2019: $92,514 — 11th highest

> HS teachers working in Virginia, May 2019: 25,620

> Cost of living, 2018: 2.0% more than average — 12th highest

> Current spending on public schools, 2018: $12,216 per pupil — 24th highest

Methodology

To identify the states with the most underpaid teachers, 24/7 Wall St. reviewed each state’s teacher pay penalty from the report, “Teacher pay penalty dips but persists in 2019,” published Sept. 17, 2020 by the Economic Policy Institute, a nonprofit think tank.

The teacher wage penalty is regression-adjusted and represents how much less, in percentage terms, public school teachers are paid in weekly wages relative to other college-educated workers (after accounting for factors known to affect earnings such as education, experience, and state residence). The EPI used data pooled from 2014 to 2019 from the Bureau of Labor Statistics and the U.S. Census Bureau’s Current Population Survey to calculate the pay penalty. The wage sample was restricted to full-time workers (working at least 35 hours per week), 18 to 64 years old with at least a bachelor’s degree. Click here to see EPI’s full methodology.

It is important to note that because teachers tend to enjoy more attractive benefits packages than other professionals, the measure of relative teacher wages overstates the teacher disadvantage in total compensation.

To supplement and provide context for the ranking, we calculated the average wage of public high school teachers in every state using data from the BLS’ Occupational Employment Survey. We calculated a weighted average annual income of non-teacher college-educated workers in each state using BLS employment projections for 2019-2029 for occupations that require at least a bachelor’s degree.

Current spending by each state on public elementary and secondary schools came from the U.S. Census Bureau’s 2018 Annual Survey of School System Finances. Spending includes instruction, salaries, employee benefits, general administration, and school administration.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.