The so-called 1% of a nation’s highest earners have become one of the most politicized cohorts in our society. They have been criticized for exercising disproportionate power in the economy and in government, and have been pilloried for not paying their fair share of taxes.

In this country, they have become the bête noire of progressives. Filmmaker Jamie Johnson made a movie actually called “The One Percent,” about how the very richest segment of American society has accumulated so much power that it is a threat to democracy.

To find the 50 countries with the richest rich people, 24/7 Wall St. reviewed the World Inequality Database’s 2022 World Inequality Report, ranking countries by the highest percentage of each country’s wealth controlled by the top 1% of their earners. In the countries on this list, the 1% hold at least 31% of total household wealth.

The world’s richest countries are by no means necessarily the same as those countries where the 1% controls the most wealth. The list of countries includes some of the world’s poorest nations, including Rwanda, Malawi, and Benin. Still, the list also includes some of the world’s wealthiest nations, including Switzerland, Qatar, and the U.S., which ranks 30th. (These are the richest countries in the world.)

Most of the nations whose richest 1% hold at least 31% of total household wealth are African and Asian countries whose economies are the fastest growing in the world. In the course of this development, wealth has been accumulated by a select few in industries such as energy, communications, technology, and agriculture. As a result, some of these countries have the greatest disparity of wealth in the world. (These are the countries with the biggest income gaps.)

While the 1% in the United States have become ever richer, their share of our nation’s wealth is significantly lower than that in some other countries among the 50 on this list. While the top 1% of households hold nearly 36% of wealth in the United States, the top 1% hold a whopping 55% share of wealth in the No. 1 ranked country.

Click here to see the countries with the richest rich people

Click here to see our methodology

50. Israel

> Household wealth share top 1%: 31.11% of all household wealth

> Household wealth top 10%: 62.32% — #60 highest of 174 countries

> Household wealth mid 40%: 32.72% — #56 lowest of 174 countries

> Household wealth bottom 50%: 4.96% — #76 lowest of 174 countries

> Average income: $40,963 — #16 highest of 150 countries

[in-text-ad]

49. Comoros

> Household wealth share top 1%: 31.20% of all household wealth

> Household wealth top 10%: 64.23% — #47 highest of 174 countries

> Household wealth mid 40%: 31.62% — #46 lowest of 174 countries

> Household wealth bottom 50%: 4.15% — #54 lowest of 174 countries

> Average income: No data

48. Singapore

> Household wealth share top 1%: 31.24% of all household wealth

> Household wealth top 10%: 62.08% — #62 highest of 174 countries

> Household wealth mid 40%: 32.86% — #58 lowest of 174 countries

> Household wealth bottom 50%: 5.06% — #82 highest of 174 countries

> Average income: $71,326 — #4 highest of 150 countries

47. Switzerland

> Household wealth share top 1%: 31.50% of all household wealth

> Household wealth top 10%: 62.85% — #54 highest of 174 countries

> Household wealth mid 40%: 33.44% — #62 lowest of 174 countries

> Household wealth bottom 50%: 3.71% — #48 lowest of 174 countries

> Average income: $50,140 — #9 highest of 150 countries

[in-text-ad-2]

46. Madagascar

> Household wealth share top 1%: 32.01% of all household wealth

> Household wealth top 10%: 65.00% — #45 highest of 174 countries

> Household wealth mid 40%: 31.07% — #44 lowest of 174 countries

> Household wealth bottom 50%: 3.94% — #51 lowest of 174 countries

> Average income: $2,537 — #11 lowest of 150 countries

45. Philippines

> Household wealth share top 1%: 32.02% of all household wealth

> Household wealth top 10%: 62.83% — #55 highest of 174 countries

> Household wealth mid 40%: 32.28% — #49 lowest of 174 countries

> Household wealth bottom 50%: 4.89% — #73 lowest of 174 countries

> Average income: $9,871 — #61 lowest of 150 countries

[in-text-ad]

44. Cyprus

> Household wealth share top 1%: 32.19% of all household wealth

> Household wealth top 10%: 66.41% — #41 highest of 174 countries

> Household wealth mid 40%: 29.48% — #38 lowest of 174 countries

> Household wealth bottom 50%: 4.11% — #53 lowest of 174 countries

> Average income: $32,360 — #27 highest of 150 countries

43. Palestine

> Household wealth share top 1%: 32.61% of all household wealth

> Household wealth top 10%: 65.57% — #44 highest of 174 countries

> Household wealth mid 40%: 30.65% — #43 lowest of 174 countries

> Household wealth bottom 50%: 3.77% — #49 lowest of 174 countries

> Average income: No data

42. Estonia

> Household wealth share top 1%: 32.70% of all household wealth

> Household wealth top 10%: 66.44% — #40 highest of 174 countries

> Household wealth mid 40%: 32.30% — #50 lowest of 174 countries

> Household wealth bottom 50%: 1.26% — #22 lowest of 174 countries

> Average income: $27,388 — #36 highest of 150 countries

[in-text-ad-2]

41. India

> Household wealth share top 1%: 33.01% of all household wealth

> Household wealth top 10%: 64.64% — #46 highest of 174 countries

> Household wealth mid 40%: 29.46% — #37 lowest of 174 countries

> Household wealth bottom 50%: 5.90% — #32 highest of 174 countries

> Average income: $7,095 — #46 lowest of 150 countries

40. Colombia

> Household wealth share top 1%: 33.18% of all household wealth

> Household wealth top 10%: 63.94% — #48 highest of 174 countries

> Household wealth mid 40%: 31.44% — #45 lowest of 174 countries

> Household wealth bottom 50%: 4.62% — #63 lowest of 174 countries

> Average income: $13,417 — #75 highest of 150 countries

[in-text-ad]

39. Hungary

> Household wealth share top 1%: 33.47% of all household wealth

> Household wealth top 10%: 67.26% — #36 highest of 174 countries

> Household wealth mid 40%: 28.84% — #32 lowest of 174 countries

> Household wealth bottom 50%: 3.90% — #50 lowest of 174 countries

> Average income: $20,965 — #53 highest of 150 countries

38. Bahrain

> Household wealth share top 1%: 33.48% of all household wealth

> Household wealth top 10%: 66.41% — #41 highest of 174 countries

> Household wealth mid 40%: 30.06% — #42 lowest of 174 countries

> Household wealth bottom 50%: 3.53% — #44 lowest of 174 countries

> Average income: $41,268 — #15 highest of 150 countries

37. Tanzania

> Household wealth share top 1%: 33.75% of all household wealth

> Household wealth top 10%: 66.45% — #39 highest of 174 countries

> Household wealth mid 40%: 29.99% — #41 lowest of 174 countries

> Household wealth bottom 50%: 3.56% — #45 lowest of 174 countries

> Average income: $4,311 — #25 lowest of 150 countries

[in-text-ad-2]

36. Equatorial Guinea

> Household wealth share top 1%: 34.11% of all household wealth

> Household wealth top 10%: 67.01% — #38 highest of 174 countries

> Household wealth mid 40%: 29.64% — #40 lowest of 174 countries

> Household wealth bottom 50%: 3.35% — #42 lowest of 174 countries

> Average income: $21,874 — #48 highest of 150 countries

35. Myanmar

> Household wealth share top 1%: 34.16% of all household wealth

> Household wealth top 10%: 67.06% — #37 highest of 174 countries

> Household wealth mid 40%: 29.60% — #39 lowest of 174 countries

> Household wealth bottom 50%: 3.34% — #40 lowest of 174 countries

> Average income: $6,808 — #45 lowest of 150 countries

[in-text-ad]

34. Cameroon

> Household wealth share top 1%: 35.03% of all household wealth

> Household wealth top 10%: 67.90% — #33 highest of 174 countries

> Household wealth mid 40%: 29.01% — #36 lowest of 174 countries

> Household wealth bottom 50%: 3.09% — #38 lowest of 174 countries

> Average income: $5,354 — #34 lowest of 150 countries

33. Costa Rica

> Household wealth share top 1%: 35.06% of all household wealth

> Household wealth top 10%: 67.93% — #32 highest of 174 countries

> Household wealth mid 40%: 28.99% — #35 lowest of 174 countries

> Household wealth bottom 50%: 3.08% — #36 lowest of 174 countries

> Average income: $17,933 — #60 highest of 150 countries

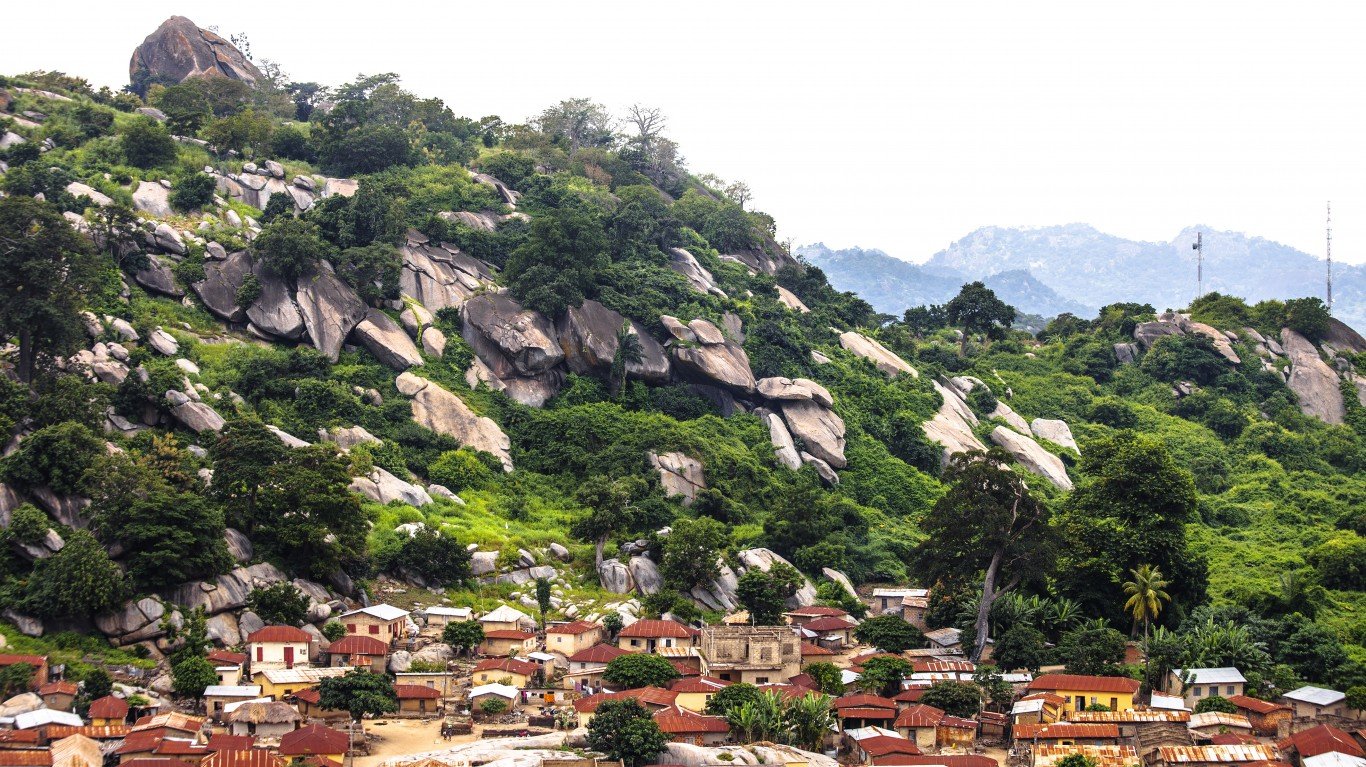

32. Uganda

> Household wealth share top 1%: 35.15% of all household wealth

> Household wealth top 10%: 68.01% — #31 highest of 174 countries

> Household wealth mid 40%: 28.94% — #34 lowest of 174 countries

> Household wealth bottom 50%: 3.06% — #35 lowest of 174 countries

> Average income: $3,424 — #17 lowest of 150 countries

[in-text-ad-2]

31. Seychelles

> Household wealth share top 1%: 35.31% of all household wealth

> Household wealth top 10%: 68.17% — #30 highest of 174 countries

> Household wealth mid 40%: 28.83% — #31 lowest of 174 countries

> Household wealth bottom 50%: 3.01% — #34 lowest of 174 countries

> Average income: $26,730 — #39 highest of 150 countries

30. USA

> Household wealth share top 1%: 35.88% of all household wealth

> Household wealth top 10%: 71.12% — #29 highest of 174 countries

> Household wealth mid 40%: 27.39% — #30 lowest of 174 countries

> Household wealth bottom 50%: 1.48% — #25 lowest of 174 countries

> Average income: $51,894 — #7 highest of 150 countries

[in-text-ad]

29. Turkey

> Household wealth share top 1%: 36.90% of all household wealth

> Household wealth top 10%: 67.47% — #35 highest of 174 countries

> Household wealth mid 40%: 28.86% — #33 lowest of 174 countries

> Household wealth bottom 50%: 3.67% — #47 lowest of 174 countries

> Average income: $25,788 — #40 highest of 150 countries

28. Iraq

> Household wealth share top 1%: 39.05% of all household wealth

> Household wealth top 10%: 71.84% — #28 highest of 174 countries

> Household wealth mid 40%: 26.30% — #29 lowest of 174 countries

> Household wealth bottom 50%: 1.86% — #30 lowest of 174 countries

> Average income: No data

27. Rwanda

> Household wealth share top 1%: 39.47% of all household wealth

> Household wealth top 10%: 72.25% — #26 highest of 174 countries

> Household wealth mid 40%: 26.02% — #28 lowest of 174 countries

> Household wealth bottom 50%: 1.73% — #29 lowest of 174 countries

> Average income: $2,990 — #14 lowest of 150 countries

[in-text-ad-2]

26. Saudi Arabia

> Household wealth share top 1%: 39.57% of all household wealth

> Household wealth top 10%: 72.36% — #25 highest of 174 countries

> Household wealth mid 40%: 25.95% — #27 lowest of 174 countries

> Household wealth bottom 50%: 1.70% — #28 lowest of 174 countries

> Average income: $53,732 — #6 highest of 150 countries

25. Kuwait

> Household wealth share top 1%: 39.93% of all household wealth

> Household wealth top 10%: 72.71% — #24 highest of 174 countries

> Household wealth mid 40%: 25.71% — #25 lowest of 174 countries

> Household wealth bottom 50%: 1.58% — #26 lowest of 174 countries

> Average income: $78,903 — #3 highest of 150 countries

[in-text-ad]

24. Benin

> Household wealth share top 1%: 40.85% of all household wealth

> Household wealth top 10%: 73.63% — #22 highest of 174 countries

> Household wealth mid 40%: 25.09% — #23 lowest of 174 countries

> Household wealth bottom 50%: 1.28% — #23 lowest of 174 countries

> Average income: $3,456 — #18 lowest of 150 countries

23. Zimbabwe

> Household wealth share top 1%: 41.64% of all household wealth

> Household wealth top 10%: 72.05% — #27 highest of 174 countries

> Household wealth mid 40%: 25.64% — #24 lowest of 174 countries

> Household wealth bottom 50%: 2.31% — #33 lowest of 174 countries

> Average income: $4,383 — #26 lowest of 150 countries

22. Congo

> Household wealth share top 1%: 42.43% of all household wealth

> Household wealth top 10%: 75.23% — #18 highest of 174 countries

> Household wealth mid 40%: 24.02% — #19 lowest of 174 countries

> Household wealth bottom 50%: 0.75% — #21 lowest of 174 countries

> Average income: $6,734 — #44 lowest of 150 countries

[in-text-ad-2]

21. Qatar

> Household wealth share top 1%: 42.86% of all household wealth

> Household wealth top 10%: 73.25% — #23 highest of 174 countries

> Household wealth mid 40%: 24.82% — #22 lowest of 174 countries

> Household wealth bottom 50%: 1.94% — #31 lowest of 174 countries

> Average income: $94,211 — #2 highest of 150 countries

20. Oman

> Household wealth share top 1%: 43.03% of all household wealth

> Household wealth top 10%: 74.30% — #19 highest of 174 countries

> Household wealth mid 40%: 24.30% — #20 lowest of 174 countries

> Household wealth bottom 50%: 1.40% — #24 lowest of 174 countries

> Average income: No data

[in-text-ad]

19. Malawi

> Household wealth share top 1%: 43.14% of all household wealth

> Household wealth top 10%: 75.95% — #17 highest of 174 countries

> Household wealth mid 40%: 23.55% — #18 lowest of 174 countries

> Household wealth bottom 50%: 0.50% — #20 lowest of 174 countries

> Average income: $1,892 — #6 lowest of 150 countries

18. United Arab Emirates

> Household wealth share top 1%: 43.47% of all household wealth

> Household wealth top 10%: 76.29% — #16 highest of 174 countries

> Household wealth mid 40%: 23.32% — #17 lowest of 174 countries

> Household wealth bottom 50%: 0.39% — #18 lowest of 174 countries

> Average income: No data

17. Thailand

> Household wealth share top 1%: 43.61% of all household wealth

> Household wealth top 10%: 73.99% — #21 highest of 174 countries

> Household wealth mid 40%: 24.31% — #21 lowest of 174 countries

> Household wealth bottom 50%: 1.70% — #28 lowest of 174 countries

> Average income: $13,703 — #71 highest of 150 countries

[in-text-ad-2]

16. Angola

> Household wealth share top 1%: 44.67% of all household wealth

> Household wealth top 10%: 77.53% — #14 highest of 174 countries

> Household wealth mid 40%: 22.51% — #14 lowest of 174 countries

> Household wealth bottom 50%: -0.04% — #16 lowest of 174 countries

> Average income: No data

15. Peru

> Household wealth share top 1%: 44.72% of all household wealth

> Household wealth top 10%: 76.78% — #15 highest of 174 countries

> Household wealth mid 40%: 22.82% — #16 lowest of 174 countries

> Household wealth bottom 50%: 0.40% — #19 lowest of 174 countries

> Average income: $13,638 — #72 highest of 150 countries

[in-text-ad]

14. Botswana

> Household wealth share top 1%: 45.57% of all household wealth

> Household wealth top 10%: 78.47% — #13 highest of 174 countries

> Household wealth mid 40%: 21.90% — #13 lowest of 174 countries

> Household wealth bottom 50%: -0.37% — #13 lowest of 174 countries

> Average income: $17,575 — #61 highest of 150 countries

13. Guinea-Bissau

> Household wealth share top 1%: 46.04% of all household wealth

> Household wealth top 10%: 78.96% — #10 highest of 174 countries

> Household wealth mid 40%: 21.59% — #12 lowest of 174 countries

> Household wealth bottom 50%: -0.55% — #11 lowest of 174 countries

> Average income: No data

12. Zambia

> Household wealth share top 1%: 46.80% of all household wealth

> Household wealth top 10%: 79.76% — #9 highest of 174 countries

> Household wealth mid 40%: 21.07% — #9 lowest of 174 countries

> Household wealth bottom 50%: -0.83% — #8 lowest of 174 countries

> Average income: $6,012 — #39 lowest of 150 countries

[in-text-ad-2]

11. Mexico

> Household wealth share top 1%: 46.90% of all household wealth

> Household wealth top 10%: 78.71% — #11 highest of 174 countries

> Household wealth mid 40%: 21.49% — #11 lowest of 174 countries

> Household wealth bottom 50%: -0.20% — #15 lowest of 174 countries

> Average income: $18,501 — #58 highest of 150 countries

10. Namibia

> Household wealth share top 1%: 47.39% of all household wealth

> Household wealth top 10%: 80.38% — #6 highest of 174 countries

> Household wealth mid 40%: 20.68% — #8 lowest of 174 countries

> Household wealth bottom 50%: -1.06% — #7 lowest of 174 countries

> Average income: $13,248 — #75 lowest of 150 countries

[in-text-ad]

9. Mozambique

> Household wealth share top 1%: 47.45% of all household wealth

> Household wealth top 10%: 80.44% — #4 highest of 174 countries

> Household wealth mid 40%: 20.64% — #7 lowest of 174 countries

> Household wealth bottom 50%: -1.08% — #6 lowest of 174 countries

> Average income: $2,106 — #7 lowest of 150 countries

8. Central African Republic

> Household wealth share top 1%: 47.51% of all household wealth

> Household wealth top 10%: 80.51% — #3 highest of 174 countries

> Household wealth mid 40%: 20.60% — #6 lowest of 174 countries

> Household wealth bottom 50%: -1.11% — #5 lowest of 174 countries

> Average income: $1,318 — #2 lowest of 150 countries

7. Russian Federation

> Household wealth share top 1%: 47.69% of all household wealth

> Household wealth top 10%: 74.12% — #20 highest of 174 countries

> Household wealth mid 40%: 22.79% — #15 lowest of 174 countries

> Household wealth bottom 50%: 3.09% — #38 lowest of 174 countries

> Average income: $21,131 — #50 highest of 150 countries

[in-text-ad-2]

6. São Tomé and Principe

> Household wealth share top 1%: 47.88% of all household wealth

> Household wealth top 10%: 80.90% — #2 highest of 174 countries

> Household wealth mid 40%: 20.35% — #4 lowest of 174 countries

> Household wealth bottom 50%: -1.25% — #4 lowest of 174 countries

> Average income: No data

5. Lebanon

> Household wealth share top 1%: 48.22% of all household wealth

> Household wealth top 10%: 78.65% — #12 highest of 174 countries

> Household wealth mid 40%: 21.20% — #10 lowest of 174 countries

> Household wealth bottom 50%: 0.14% — #17 lowest of 174 countries

> Average income: $13,630 — #73 highest of 150 countries

[in-text-ad]

4. Brazil

> Household wealth share top 1%: 48.91% of all household wealth

> Household wealth top 10%: 79.81% — #8 highest of 174 countries

> Household wealth mid 40%: 20.55% — #5 lowest of 174 countries

> Household wealth bottom 50%: -0.36% — #14 lowest of 174 countries

> Average income: $13,931 — #70 highest of 150 countries

3. Chile

> Household wealth share top 1%: 49.55% of all household wealth

> Household wealth top 10%: 80.43% — #5 highest of 174 countries

> Household wealth mid 40%: 20.14% — #3 lowest of 174 countries

> Household wealth bottom 50%: -0.57% — #10 lowest of 174 countries

> Average income: $22,256 — #47 highest of 150 countries

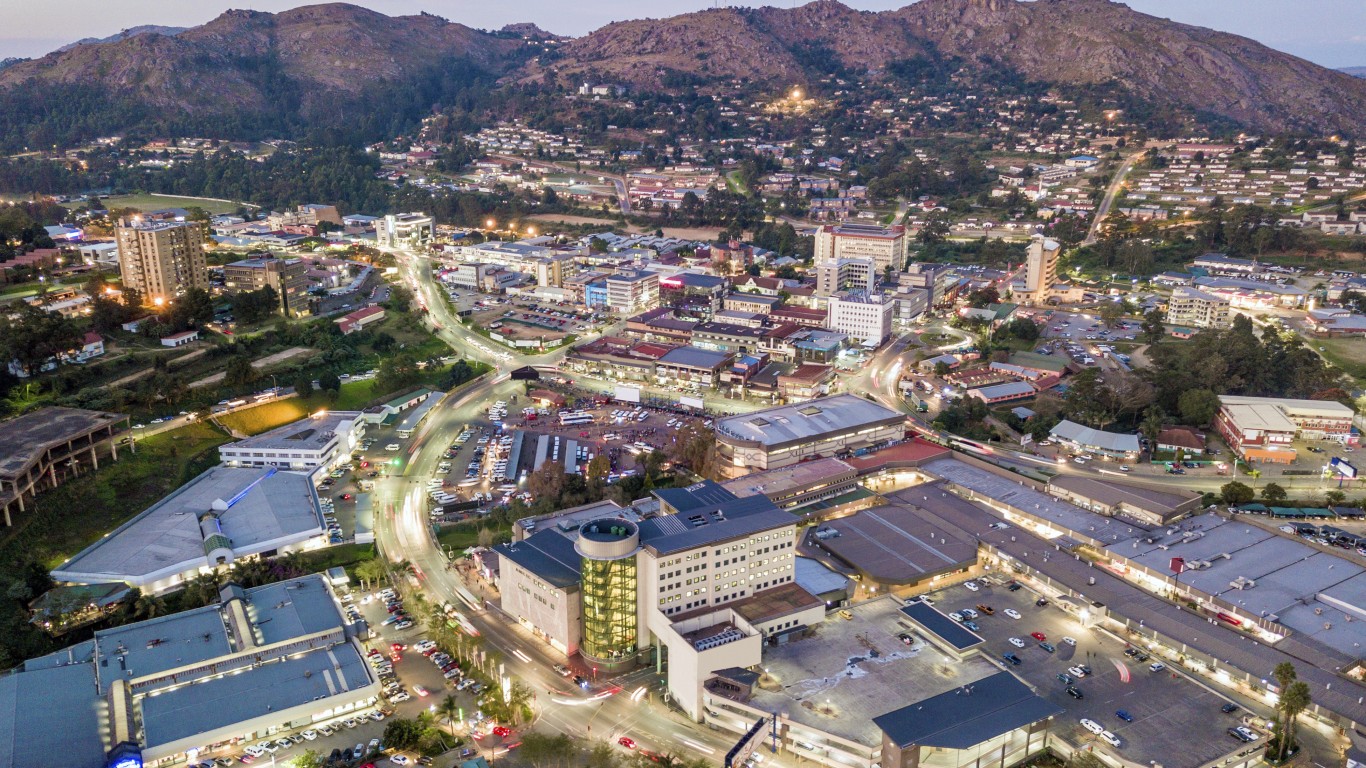

2. Swaziland

> Household wealth share top 1%: 49.85% of all household wealth

> Household wealth top 10%: 80.34% — #7 highest of 174 countries

> Household wealth mid 40%: 20.11% — #2 lowest of 174 countries

> Household wealth bottom 50%: -0.45% — #12 lowest of 174 countries

> Average income: $12,950 — #72 lowest of 150 countries

[in-text-ad-2]

1. South Africa

> Household wealth share top 1%: 55.03% of all household wealth

> Household wealth top 10%: 85.67% — #1 highest of 174 countries

> Household wealth mid 40%: 16.78% — #1 lowest of 174 countries

> Household wealth bottom 50%: -2.44% — #2 lowest of 174 countries

> Average income: $13,205 — #74 lowest of 150 countries

Methodology:

To find the 50 countries with the richest rich people, 24/7 Wall St. reviewed the World Inequality Database’s 2022 World Inequality Report, ranking countries by the highest percentage of wealth controlled by the top 1% of their earners. All 174 countries in the report are included. Data is as of 2021.

Data on how much wealth the top 10%, mid 40%, and bottom 50% control, as well as average income is also drawn from the report. Average national income is defined in the report as “the sum of all pretax personal income flows accruing to the owners of the production factors, labor and capital, including social insurance benefits (and removing corresponding contributions), but excluding other forms of redistribution (income tax, social assistance benefits, etc.).” The report uses purchasing power parity for inequality estimates. Estimates correct for inflation using the national income deflator (base 2021). The population whose income is recorded comprises individuals over age 20.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.