Despite seemingly being the way of the future, the electric vehicle industry is not an easy one. Rivian, which had a very promising IPO in November of 2021, has seen its stock plummet from $129.95 to less than $15 as of late June, 2023. Rivian is not the only struggling EV automaker, and others have completely failed.

To find failed and struggling American electric vehicle companies, 24/7 Wall St. scoured financial and automotive media. We aimed to select some well-known failed EV manufacturers and some of the most struggling EV car companies based on recent news and stock performance and stock price (less than $3 per share) as of Feb. 6. The companies are listed alphabetically.

Sales of low-emission vehicles, including both all-electric and plug-in hybrid cars, doubled from 308,000 in 2020 to 608,000 in 2021, according to the U.S. Department of Energy. A report from Kelley Blue Book reveals that while overall car sales slumped by 8% in 2022, purchases of electric vehicles soared by 65%. Cox Automotive, Kelley Blue Book’s parent company, forecasts 1 million EV sales in the U.S. for the first time in 2023. The U.S. government is getting behind the EV movement, aiming to have half of all new cars sold in 2030 be electric vehicles or plug-in.

Given growing sales and government support, many EV startups have found an eager investor pool. Yet some of these companies have struggled to get on the road due to fiscal shortfalls and internal turmoil, which often led to bankruptcies. Missed deadlines and low production often meant these companies struggled to get more financing. Shady practices by some top execs at these companies did not help the cause. (Also see, America’s favorite pickup trucks.)

Several companies on this list went public through special purpose acquisition company mergers. SPAC deals allow investors in an industry to raise capital through an initial public offering for the purpose of then merging with a private company and taking it public. But the SPAC deals that fueled the EV market in 2020 and 2021 have fizzled as investors have become more wary following years of new SPAC-backed startups failing to deliver on their promises, and as the Securities and Exchange Commission has investigated these deals. Several such companies have gone bankrupt or are struggling.

Though many large automakers often invest in the smaller startups, they also develop their own EVs. (Here are the most efficient cars on the market.)

Interestingly, EVs are not a modern phenomenon. Several automakers turned out a few EVs at the turn of the 20th century. Baker Motor Vehicle Co. rolled out its electric Baker Electric in 1899. One of its first buyers was Thomas Edison. Even Studebaker – a name now synonymous with old-fashioned, boxy autos – produced an electric car in 1902.

Click here to see the 13 biggest electric vehicle business failures in American history.

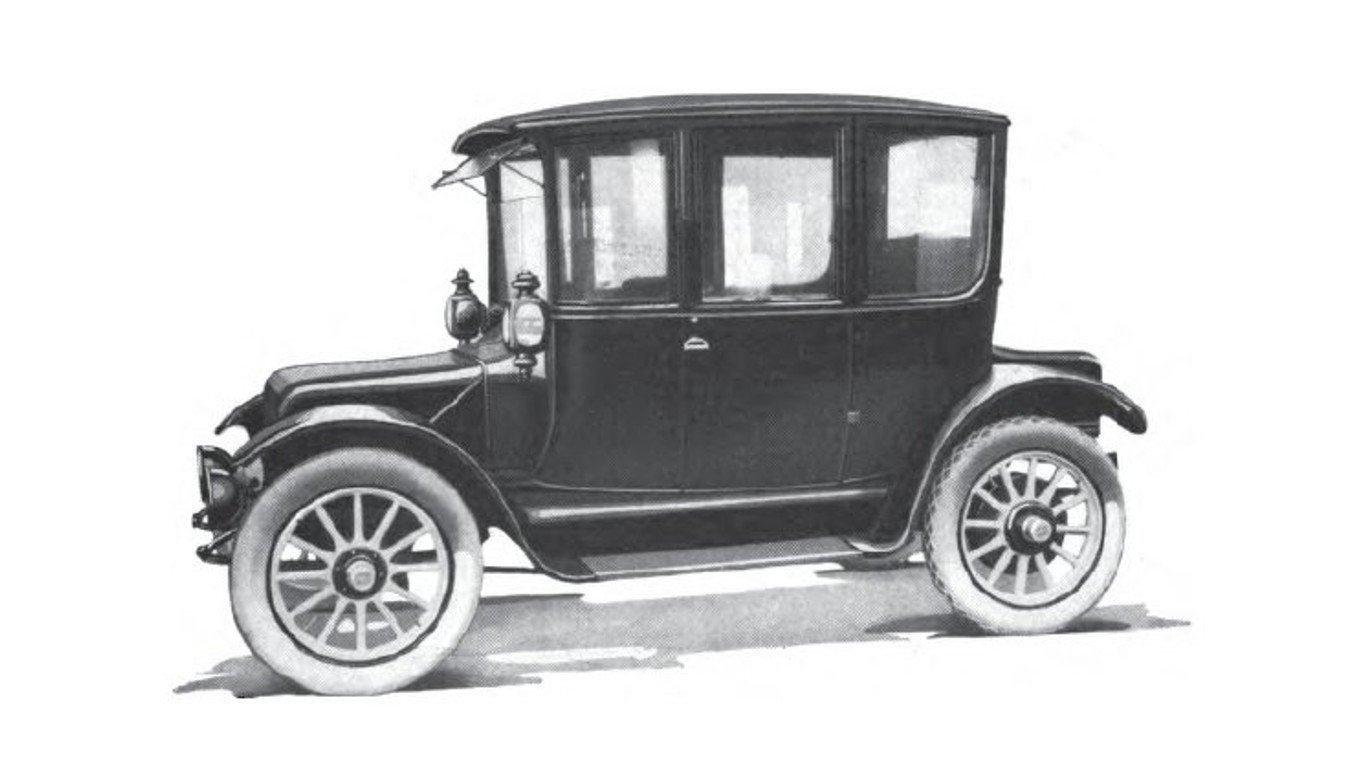

Anderson Electric Car Company

> Headquarters: Detroit, MI

> Years in business: 1907-1939

> Current status: Dissolved. The Detroit Electric brand was revived in 2008.

In 1907, Anderson Detroit Electric Car Co. built its first electric car, the Detroit Electric, which was actually quite popular in the late 1910 and early 1920s. At the time, the quiet and pollution-free electric cars were especially popular with women. Even Clara Ford, Henry’s wife, drove one. The company built 13,000 electric cars from 1907 to 1939. In 2008, a group of entrepreneurs revived the brand.

[in-text-ad]

Aptera Motors

> Headquarters: San Diego, CA

> Years in business: 2005-2011, 2019-

> Current status: Relaunched in 2019 as a solar electric vehicle

Originally founded in 2005, Aptera Motors set out to build an ultra-efficient three-wheel electric car, the Aptera 2e, but had trouble getting funding for this type of vehicle. It then created the 4e, a four-wheeled car. Still, it failed to secure funding from the Department of Energy and shuttered in 2011. Aptera was relaunched in 2019 thanks to a $2.8 million crowdfunding campaign and announced in January its Launch Edition. The three-wheeler is integrated with solar charging.

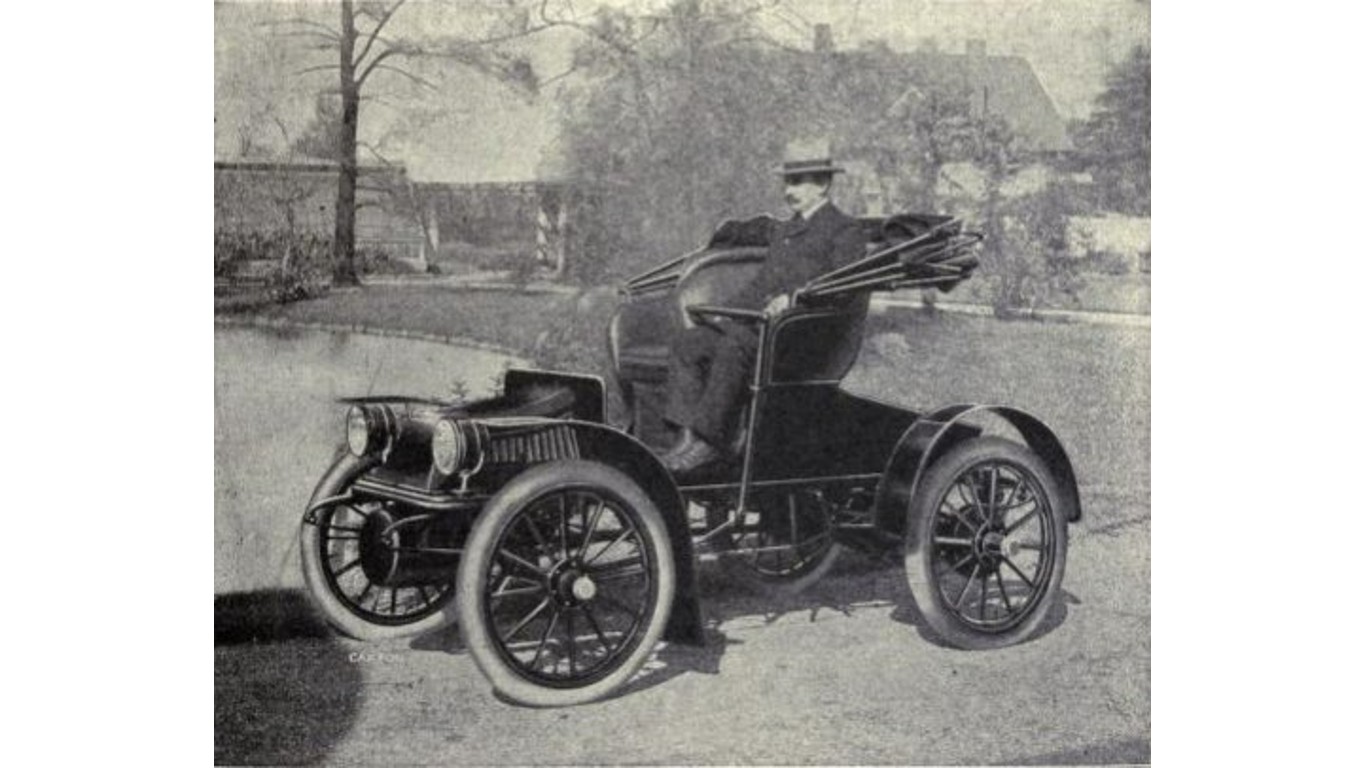

Baker Motor Vehicle Company

> Headquarters: Cleveland, OH

> Years in business: 1899-1914

> Current status: Merged with Rauch and Lang in 1914 to become Baker, Rauch & Lang

Said to be the first electric vehicle manufacturer, Baker Motor Vehicle Co. rolled out its first model, the Baker Imperial Runabout, at the Automobile Club of America’s First Annual Automobile Show in New York City in 1899. With 3-4 horsepower, the car revved up to a top speed of 12 mph. The car got a boost when Thomas Edison bought one. In 1914, Baker merged with another electric vehicle maker at the time, Rauch and Lang, which is also on this list. Comedian and car collector Jay Leno famously owns a Baker Electric Coupe.

Bright Automotive

> Headquarters: Anderson, IN

> Years in business: 2008-2012

> Current status: Defunct

Bright Automotive closed down in 2012 after failing to get a low-interest loan from the Department of Energy. The manufacturer had received $5 million from General Motors but was unable to secure government funding. Bright executives blamed onerous loan terms from the Department of Energy for the failure. The Bright Automotive IDEA was a plug-in hybrid light cargo vehicle designed to get about 100 miles per gallon.

[in-text-ad-2]

Canoo

> Headquarters: Torrance, CA

> Years in business: 2017-

> Current status: 1-yr stock performance (NASDAQ: GOEV): -82%

After losing three top executives and then announcing substantial risk about the company’s future in May 2022, EV SPAC Canoo took an optimistic tone in its third quarter report in November, saying Walmart has placed orders for 4,500 vehicles. All told, the company estimated it had $750 million of binding orders on the books as of the third quarter. Still, the company also said it was low on cash, and in February this year announced selling $52 million in shares to stay alive.

Coda Automotive

> Headquarters: Los Angeles, CA

> Years in business: 2009-2013 bankruptcy protection

> Current status: After exiting bankruptcy became energy storage company Coda Energy and was eventually acquired by Exergonix in 2016

At one point, Coda Automotive raised $344 from investors, including former U.S. Treasury Secretary Henry Paulson. After selling fewer than 100 of its electric-powered sedans, it filed for bankruptcy protection in 2013. Its five-passenger car, introduced in 2012, had a range of 125 miles on a single charge and was priced at $37,250.

[in-text-ad]

Electric Last Mile Solutions

> Headquarters: Troy, MI

> Years in business: 2019-2022

> Current status: Mullen bought company

Electric Last Mile Solutions, which had been developing a commercial electric vehicle and went public through an SPAC deal in 2021, was valued at $1.4 billion at the time. But the company has been under investigation by the SEC. The company’s chairman and CEO resigned in February 2022, and ELMS announced it was running out of cash. It filed for Chapter 7 bankruptcy in June last year.

Mullen Automotive, an electric car startup that also went public in an SPAC merger, acquired Electric Last Mile Solutions in October of last year. Mullen’s share price (NASDAQ: MULN) declined 64% in the past year.

Faraday Future

> Headquarters: Los Angeles, CA

> Years in business: 2014-

> Current status: 1-yr stock performance (NASDAQ: FFIE): -82%

Beset by internal turmoil, including executive departures, and government investigations, Faraday Future announced it had secured enough funding in February to start production of its sport utility vehicle, the FF 91 Futurist, in March. The company’s major stockholder, FF Top Holdings, has reportedly agreed to a plan to increase the auto manufacturer’s outstanding stock to raise capital.

Fisker Automotive

> Headquarters: Anaheim, CA

> Years in business: 2007-2014

> Current status: Defunct

Fisker Automotive raised $1.4 billion in private and public investment, including a $529 million Department of Energy loan in 2009. However, it repeatedly missed production deadlines, and production of the Fisker Karma, a luxury plug-in sports car, was suspended in November 2012 after only building about 2,450 units. A year later, the company filed for Chapter 11 bankruptcy protection, and in 2014, Wanxiang Group, China’s largest auto parts company, bought the assets of Fisker Automotive.

The founder of Fisker Automotive, Henrik Fisker, launched Fisker Inc. (NYSE: FSR) in 2016 and the company is collaborating with Foxconn to produce EVs.

[in-text-ad-2]

Lordstown Motors Corp

> Headquarters: Lordstown, OH

> Years in business: 2018-

> Current status: 1-yr stock performance (NASDAQ: RIDE): -55%

Two years after the EV pickup maker was founded, Lordstown Motors went public through an SPAC merger. According to Crunchbase, it raised a total of $1.1B in funding over five rounds. By March 2022, GM sold its stake in the company, and by May, the company said it would need more financing if it was to stay in business. In November, Taiwan’s Foxconn Technology Group indeed invested $170 million in the company, which started production though at a slow rate. It announced that it had produced 31 vehicles for sale as of Jan. 3, of which six had been delivered to customers.

Nikola Motor

> Headquarters: Phoenix Arizona

> Years in business: 2014-

> Current status: 1-yr stock performance (NASDAQ: NKLA): -66%

Despite beating revenue expectations in the third quarter reported in November 2022, Nikola Motor lowered production guidance. The better-than-expected revenue was due to producing 75 heavy EV trucks in the third quarter, of which 63 were delivered to dealers. Still, the company produced about a third of what it had previously said it would and had to recall in September 2022 all 93 Tre BEVs because of a seat belt defect. Other problems plaguing the company include the founder being found guilty of fraud in October 2022.

[in-text-ad]

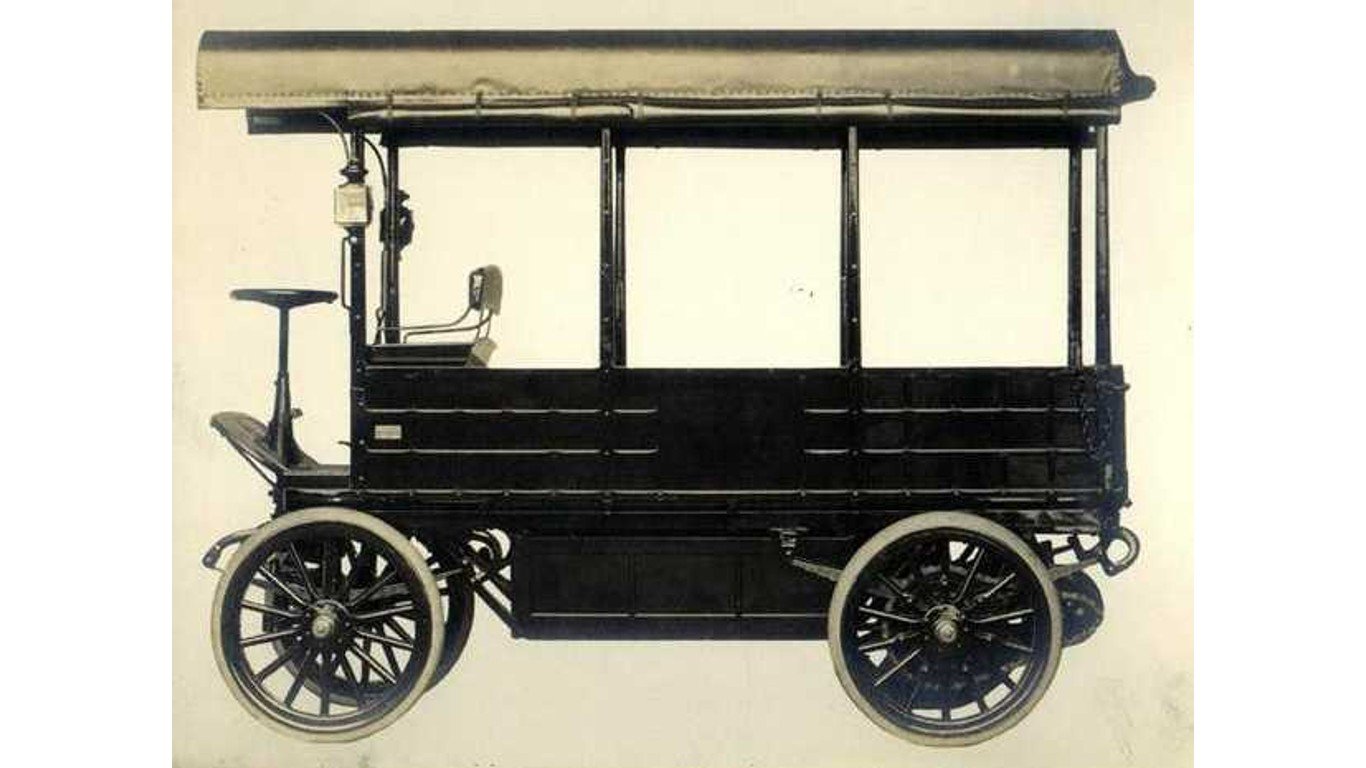

Rauch and Lang

> Headquarters: Cleveland, OH

> Years in business: 1905-1932

> Current status: Defunct

Rauch and Lang was one of the first electric car manufacturers. Between 1905 and 1932, it manufactured cars like the Stanhope, a coupe powered by a 40-cell battery priced at $2,250. Unfortunately, Rauch and Lang could not compete with less expensive, mass-produced gas-powered cars.

Studebaker

> Headquarters: South Bend, IN

> Years in business: 1852-1966

> Current status: Produced the Studebaker Electric from 1902-1911

Studebaker Corp. was launched in 1852 and was a leading supplier of horse-drawn wagons to the U.S. Army during the Civil War. In 1902, it began manufacturing an electric car, though production only lasted nine years. By the mid-1950s, Studebaker merged with automaker Packard, but could not compete with the Big Three car makers. It closed its factories in March 1966 after 114 years in business.

Sponsored: Want to Retire Early? Here’s a Great First Step

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.