After U.S. markets closed Thursday, Broadcom Inc. (NASDAQ: AVGO) reported better-than-expected earnings per share of $10.54 (versus estimated $10.43) for its fiscal third quarter, but revenue failed to meet expectations even though sales rose by 4.5% year over year. Broadcom also issued in-line revenue guidance for the fourth quarter that ends in October.

CEO Hock Tan said third-quarter results were “driven by demand for next generation networking technologies as hyperscale customers scale out and network their AI clusters within data centers.” The stock closed up 3.4% on Thursday but traded down about 2.5% in Friday’s premarket and 4.1% after the opening bell.

Shares of Intel Corp. (NASDAQ: INTC) rose by about 1.8% on Thursday, after CEO Pat Gelsinger told a technology conference audience that an improving PC market is giving the company confidence that it can reach its third-quarter revenue and earnings guidance. Gelsinger, while giving Nvidia Corp. (NASDAQ: NVDA) credit for anticipating the generative AI revolution, said Intel is soon going to be winning orders for its own accelerator chips.

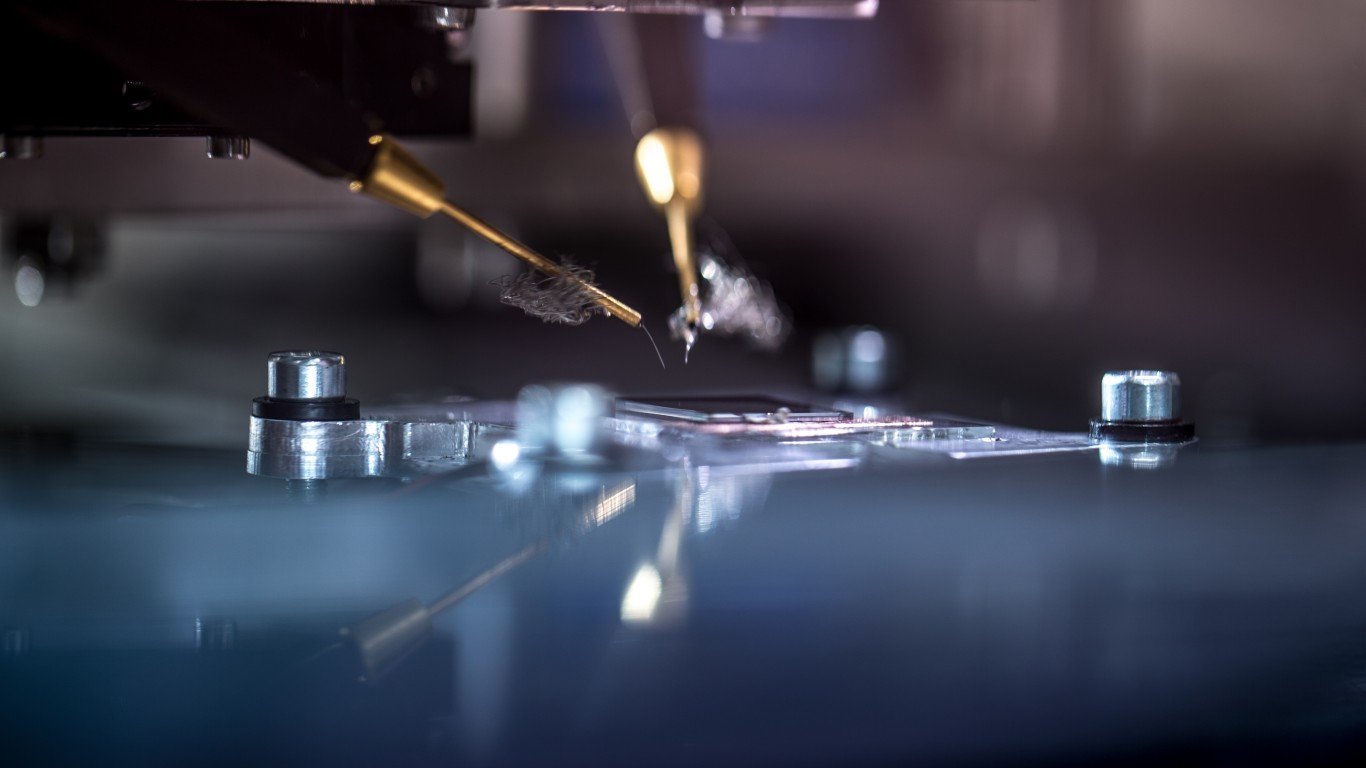

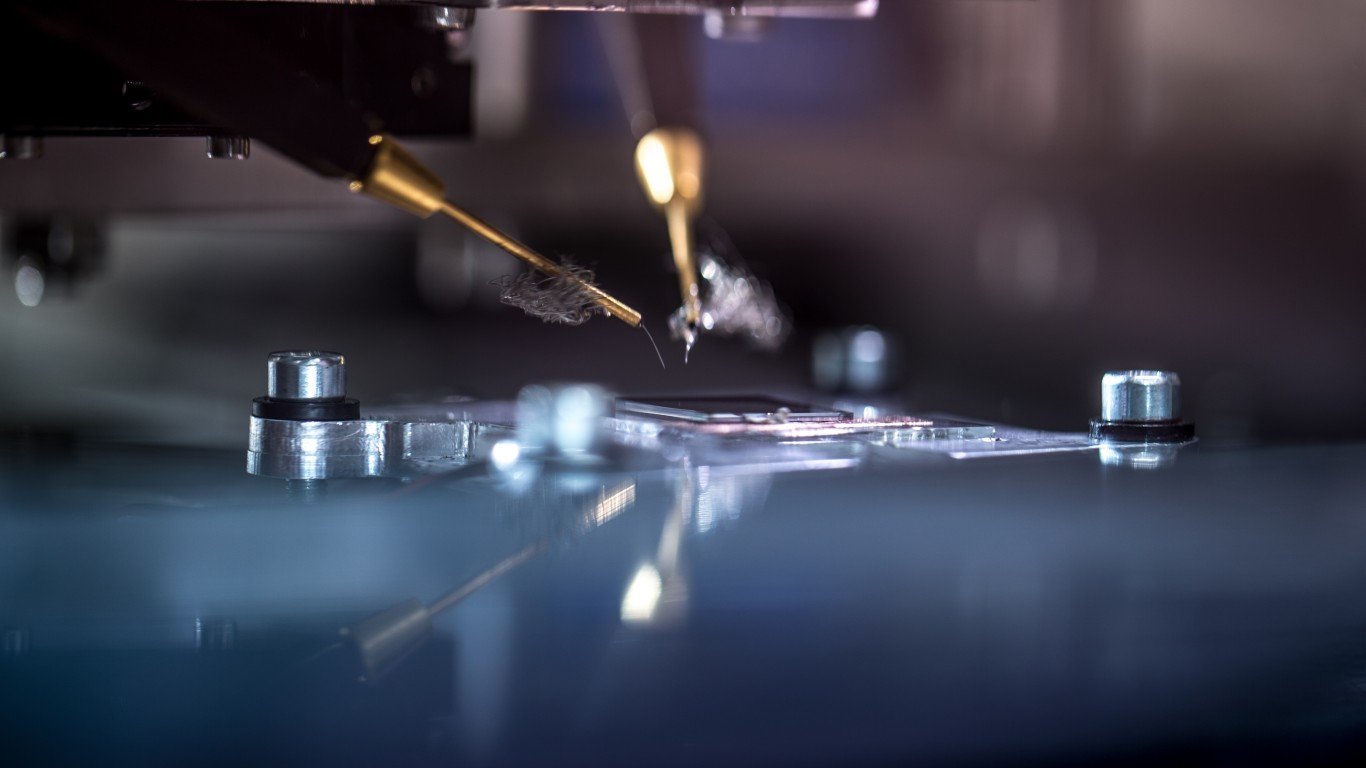

Intel has also received a large, prepaid order for the company to build its 1.8- and 20-nanometer chip production line. In March, the company said it expects to begin high-volume production of the 18-nm chips in the second half of next year. The new order has led to an accelerated completion schedule for Intel’s new Arizona fab.

Rival Taiwan Semiconductor will begin shipping 3-nm chips in quantity this quarter and plans to begin trial production of 2-nm chips late next year with volume production set for 2025.

In the much nearer term (in fact, Friday), U.S. restrictions took effect on exporting advanced chips and chipmaking equipment to some Middle Eastern countries. Both Nvidia and Advanced Micro Devices Inc. (NASDAQ: AMD) have said that the new restrictions would have no material impact on their financial results. The two chipmakers, along with Intel, have already said they would produce less powerful chips for export to the Chinese market, the target of the original restrictions imposed a year ago.

Netherlands-based semiconductor equipment manufacturer ASML N.V. (NASDAQ: ASML) will be able to continue shipping its most advanced chipmaking machines to China until the end of this year, the company said on Thursday. ASML does not expect to receive licenses allowing it to export the machines to China after the beginning of the new year. ASML would have been unable to ship the equipment to Chinese customers beginning September 1, but it received a four-month extension to meet its previously contracted obligations.

Finally, pigeons are faster than a gigabit fiber network connection. Don’t take our word for it, check out the results of empirical testing.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.