On October 30th On Semiconductor (Nasdaq: ON) – sometimes spelled onsemi – is set to release its third quarter earnings.

The stock is off about 20% since the end of July as rising interest rates punish the semiconductor space. Yet, if you zoom out On Semiconductor is up nearly 500% in the past five years and has performed admirably in very difficult market conditions the past two years.

And even with that run up, I place On Semiconductor among my “conviction buy list” of stocks I’ve been adding to across the past year. Let’s dive into why you shouldn’t overlook this stock.

1. Positioned Well for Mega-Trends

Advances in artificial intelligence are all anyone in the technology world has talked about in the past year, but On Semiconductor can give you exposure to some trends you might be missing.

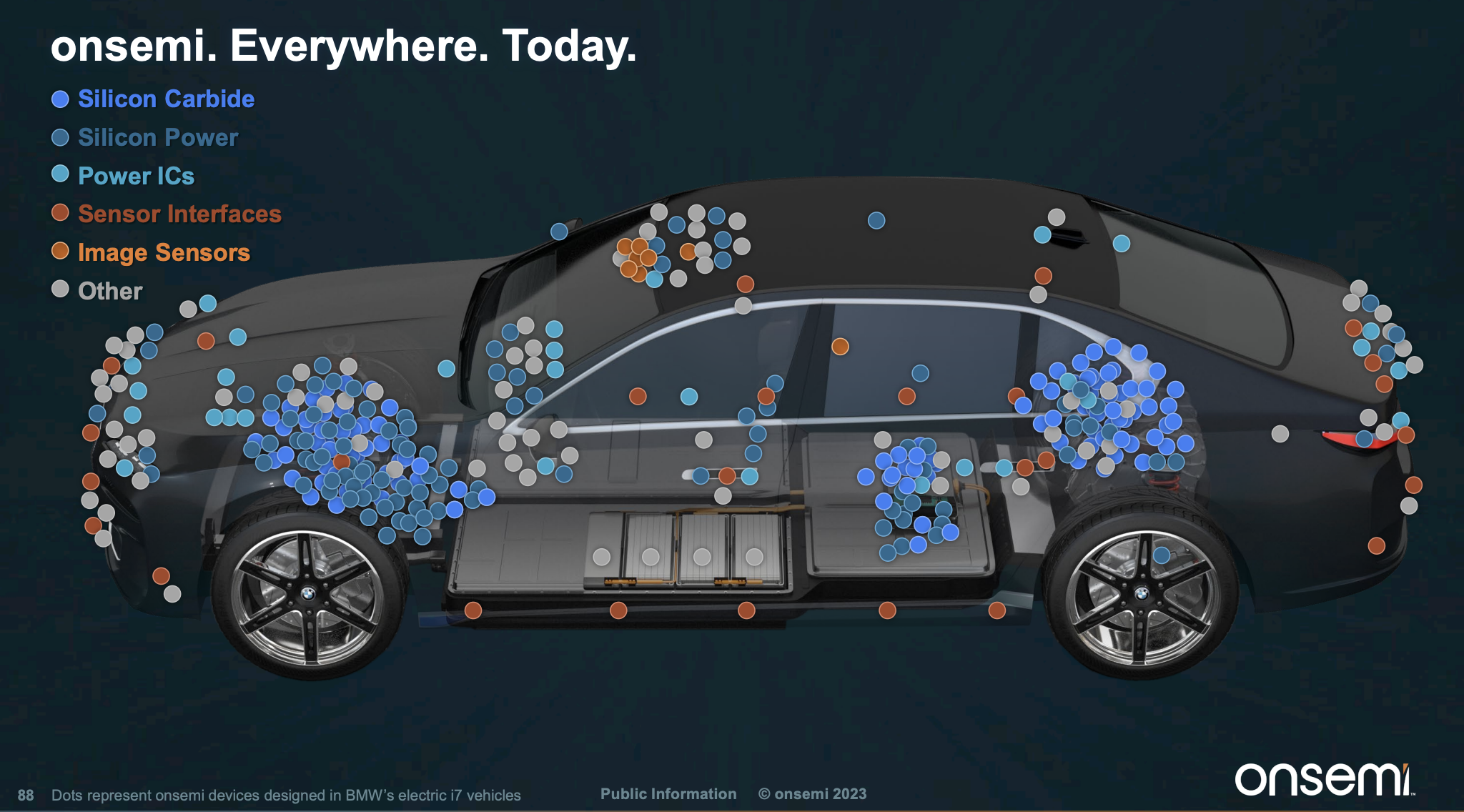

The first is electric vehicles. On Semiconductor has a portfolio of products that benefit greatly as the value of electronics explodes in semi-autonomous electric vehicles. They lead in some key markets such as producing 68% of image sensors in driver assistance systems.

The image below comes from their Investor Day Presentation and shows the incredible number of chips On Semiconductor has in BMW’s electric cars.

Here’s the bottom line: While On Semiconductor’s electronics content in older internal combustion engine cars was as low as $50, their opportunity in electric cars stretches up to $1,800 per car. Then sensors in self-driving cars add a whole extra layer of opportunity. On Semiconductor can give you exposure to the growth of EVs without having to buy the actual car companies, many of which are still struggling to make money on these cars.

The second mega-trend is Silicon Carbide (SiC). While SiC remains a smaller market today, thanks to growth in the energy and EV markets, McKinsey estimates it will grow at a 26% compounded annual growth rate (CAGR) through 2030.

Thanks to a #2 position globally in this market, On Semiconductor is projecting SiC growth rates of 38% from 2022 to 2027. Last year its SiC business grew at a sweltering 70% growth rate.

2. Proven Execution

Semiconductors are seeing strong growth globally as they’re increasingly used in almost every end market. Yet, it’s a field where great leadership is at a premium. You want to see companies that are efficiently run.

On that basis, On Semiconductor is incredibly attractive. Operating margins have surged from 14% in 2019 to 35% in 2022. At the same time, free cash flow has grown by ten-fold. It was $160 million in 2019, and today is at $1.6 billion.

3. Attractive Value

Now, I know what you might be thinking. “Semiconductors are extremely cyclical, and should I really be purchasing one that’s up nearly 500% across the past five years?”

That’s an entirely fair statement. No stock is perfect and all carry risks. In the case of On Semiconductor, the greatest risk would be that end markets like the automotive sector saw a huge boom during the Covid years and may be in store for some lean times.

To that, I’d respond:

- While On Semiconductor has seen its shares skyrocket over the past five years, its profits have grown 10X alongside them. That leaves the company trading for about 23 times free cash flow, which is lower than several semiconductor companies with similar levels of growth.

- While automotives may see decelerating growth, electronic vehicles continue to be a focus for every major company. EV sales are still just 7.9% of US automotive sales and have plenty of room to grow.

- Growth projections for On Semiconductor aren’t outlandish in the years to come. 2023 is expected to be flat from 2022 revenues and 2024 is projected at 7% growth. If the company had massive growth projections baked in it would be a bit more worry, but Wall Street expects near-term deceleration and that’s already baked into the share price.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.