alternative energy

How much difference will Amazon's investment in carbon removal credits make? Not very much if you agree with this Stanford professor.

Published:

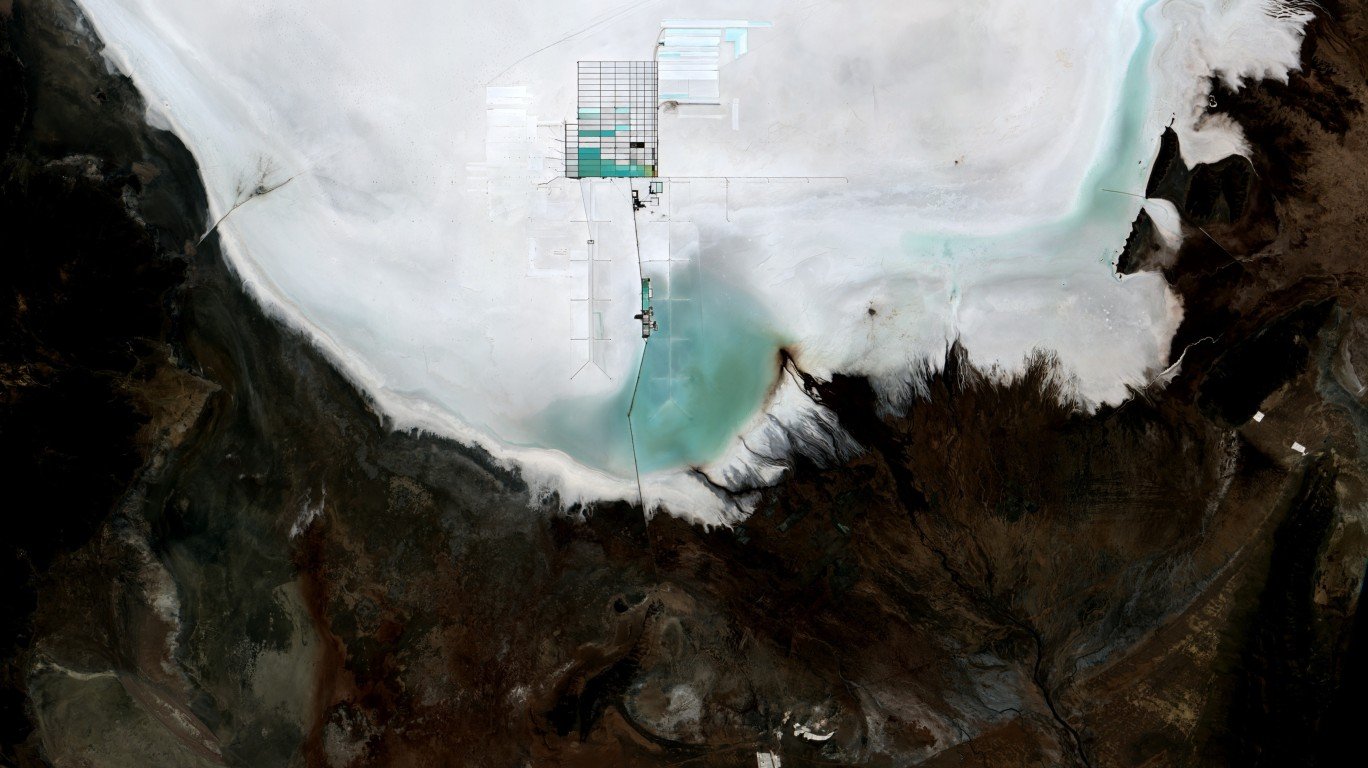

New research indicates that the Thacker Pass mine in northern Nevada contains the world's largest known deposit of lithium, an essential part of electric vehicle batteries.

Published:

Before U.S. markets open on Monday, a lithium-ion battery recycler and a Chinese solar module maker are on deck to report quarterly earnings.

Published:

Crude prices are setting up to rise and people will continue to waste gobs of money on inefficient gasoline-powered cars.

Published:

Chinese EV and battery makers are investing heavily in lithium, trying to guarantee a supply of the material for the expected boom in EV sales by the end of the decade.

Published:

UBS upgraded lithium miner Albemarle and boosted the stock's price target. The analysts are seriously bullish.

Published:

BofA Securities has cut its price objective on two lithium producers and raised it (slightly) on another. The analysts also made two rating changes.

Published:

February's report on U.S. personal income and spending came in as expected Friday morning. Earlier this week, a lease sale for oil and gas drilling in the Gulf of Mexico attracted 40% more in bids...

Published:

Short seller Grizzly Research has issued a report on lithium miner Sigma Lithium blasting the company and its management. Investors do not appear to agree.

Published:

This report was sent to Briefing.com subscribers earlier today. Research calls posted earlier this morning are available here. Upgrades: > Fox Corporation (FOXA) upgraded to Buy from Hold at...

Published:

Canadian renewable energy developer Boralex (US:BRLXF) (CA:BLX) has acquired a 50% stake in five wind farms in Texas and New Mexico for $249.8 million. The wind farms, Hereford Wind Farm I, Longhorn...

Published:

Tech stocks are being dragged lower Friday courtesy of a change to solar net metering rules in California.

Published:

California drivers are consuming less gasoline, and there is a lesson there for policymakers who are serious about reducing carbon emissions.

Published:

AAA has launched a roadside assistance program for EV owners who find themselves in need of a little juice.

Published:

Warren Buffet's buy-and-hold-forever strategy has paid off for him and for long-term investors in Berkshire Hathaway. Here are the top five holdings in his portfolio.

Published: