Shares of Apple Inc. (NYSE: AAPL) sold short for the period that ended November 15 fell 19% to 44.5 million. Apple was the 15th most shorted stock traded on the Nasdaq.

It is always hard to say why investors pull away from bets against a stock. The stock is up 6.2% this year to $112. However, it has traded almost flat for the past three months, and it is flat for the past month as well

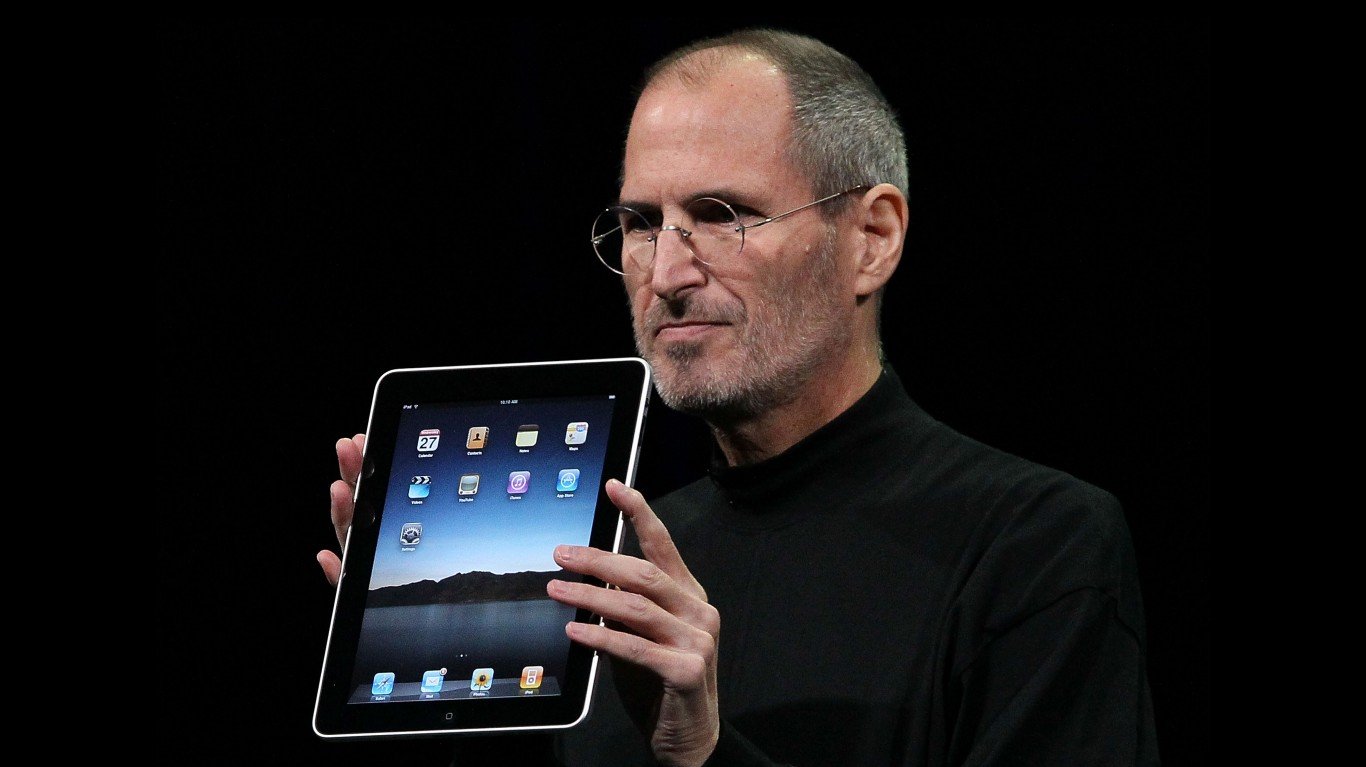

All gambles on Apple’s stock now are based on holiday sales of the iPhone 7. There are as many guesses about this as there are analysts. In other words, there is no simple consensus.

Apple’s shares dropped recently due to concern that Donald Trump would attack the company because so many of the components of its products are made overseas. Many experts said it was far too early to panic.

Canaccord Genuity’s Mike Walkley recently wrote, according to Barron’s:

[W]e believe these trends should enable the iPhone installed base to exceed 570 million [units] exiting C2016, and this impressive installed base should drive strong future iPhone replacement sales and earnings, as well as cash flow generation to fund strong long-term capital returns.

If so, a reason not to bet against the shares.

Sponsored: Want to Retire Early? Start Here

Want retirement to come a few years earlier than you’d planned? Orare you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.