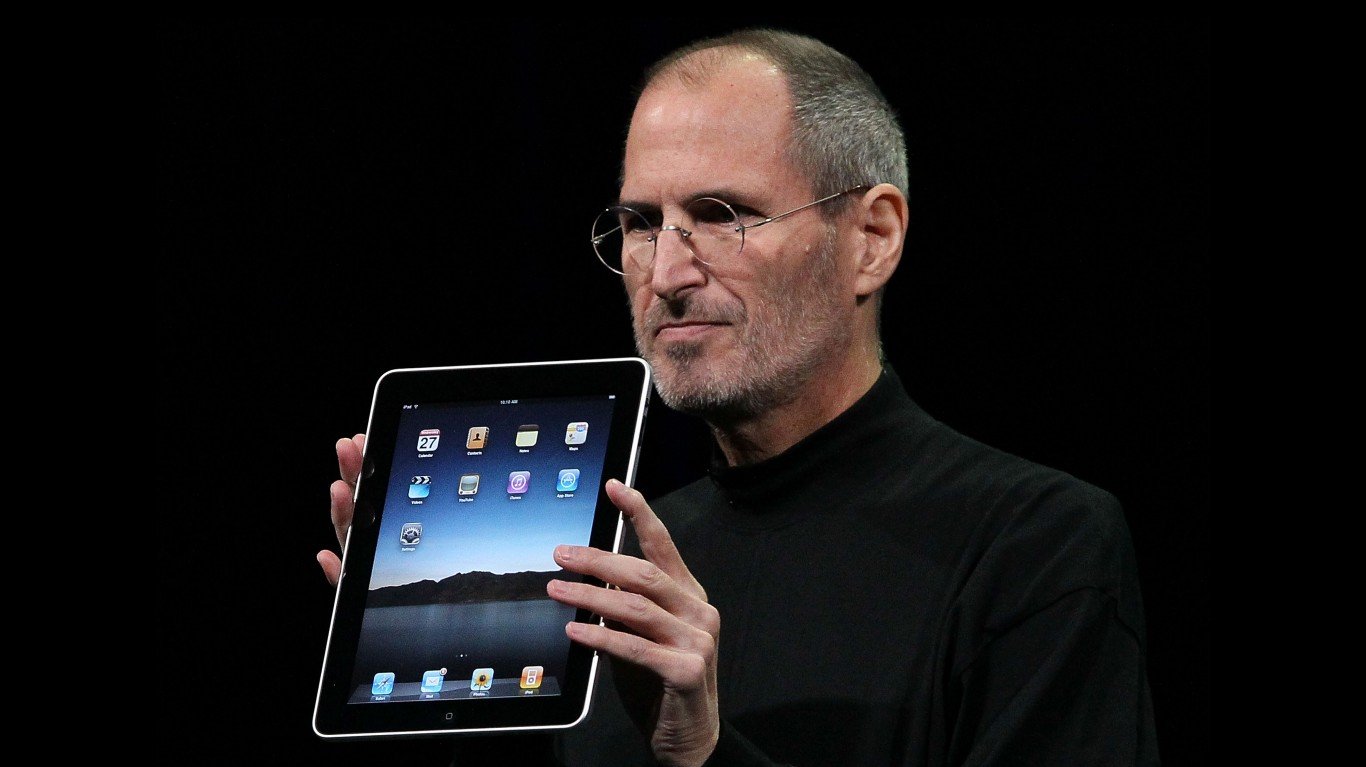

Barnes & Noble Inc. (NYSE: BKS) believes that a light, high-definition version of its Nook e-reader tablet will do what Samsung and other large electronics firms have not. It will take substantial market share from the Apple Inc. (NASDAQ: AAPL) iPad and the numerous versions of the Amazon.com Inc. (NASDAQ: AMZN) Kindle. Barnes & Noble does not have the brand equity and distribution systems the other two have, so the feature set of its machine means very little. Source: courtesy Barnes & Noble Inc.

Source: courtesy Barnes & Noble Inc.

The new Nook comes in several flavors. One model sells for $199. That is the 7-inch Nook HD tablet with 8 gigabytes of memory. A more expensive version, the $299 9-inch Nook HD+ tablet, rounds out the top of the line. The machines are priced to aggressively compete with Amazon and Apple, which means they are, in some cases, priced low enough to be attractive, based on comparisons of what a consumer would pay.

But Barnes & Noble does not have websites like Apple and Amazon do. These online destinations attract tens of millions of unique visitors a month. People may visit them to buy other products and services, but the two companies have a way to market their products that cannot be matched because of these huge Internet footprints.

The iPad and Kindle have their own ecosystems as well, which may make their services as attractive as their machines. Apple’s is by far the largest, with hundreds of thousand of apps that allow iPad owners to customize their machines to an extraordinary level. Amazon has its own, smaller app store, as well as the most visited e-book library in the world. Add to that its VOD capacity, and, although it cannot match Apple, it has an extraordinary number of features compared to anything Barnes & Noble can launch.

Barnes & Noble lost in consumer electronics because it relied on its bricks-and-mortar model for too long. There is no going back.

Douglas A. McIntyre

Smart Investors Are Quietly Loading Up on These “Dividend Legends”

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.