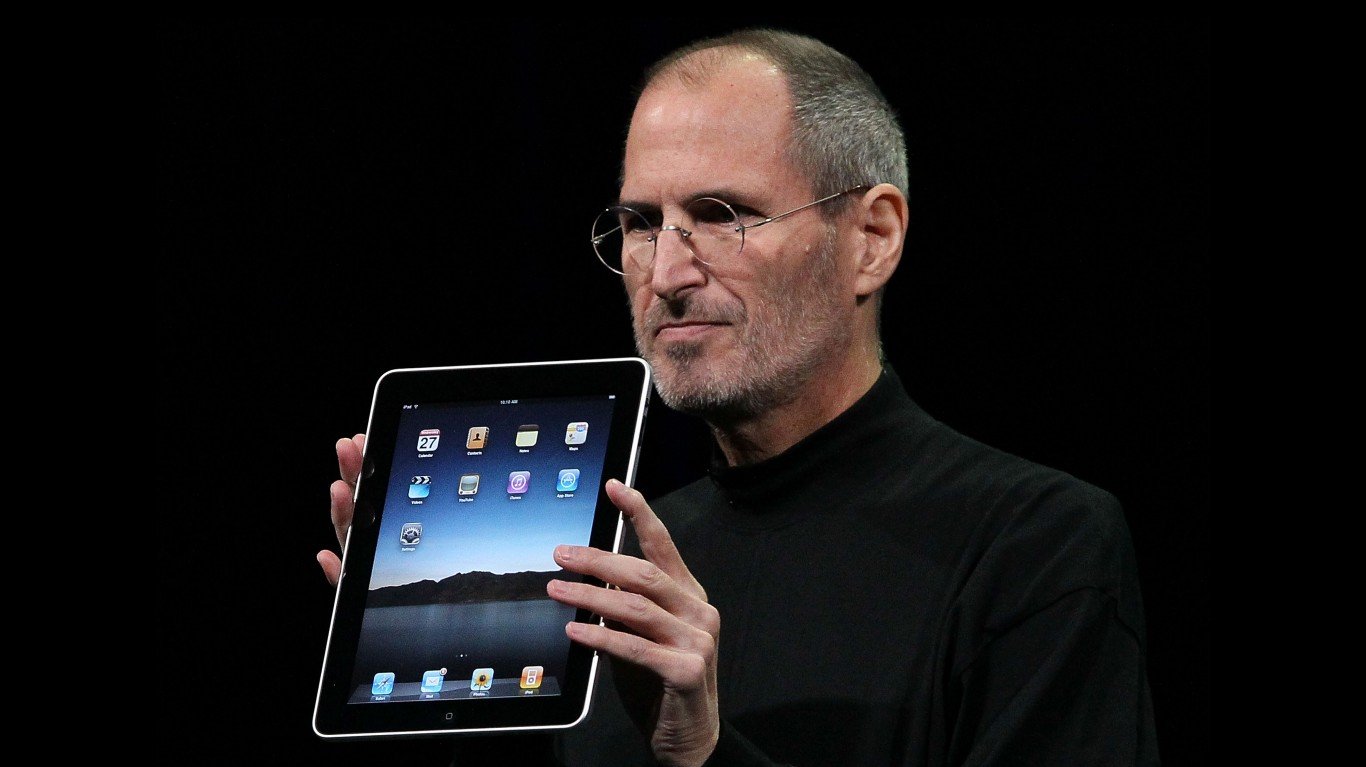

If investors needed more evidence that the era of the personal computer (PC) is coming to an end, they simply need to look at Hewlett-Packard Co.’s (NYSE: HP) earnings. The company is either the largest or second largest PC maker in the world, depending on different measurements. Source: Wikimedia Commons

Source: Wikimedia Commons

Management reported that for HP’s fiscal third quarter, which ended July 11:

Personal Systems revenue was down 13% year over year with a 3.0% operating margin. Commercial revenue decreased 9% and Consumer revenue decreased 22%. Total units were down 11% with Notebooks units down 3% and Desktops units down 20%.

Personal Systems revenue was $8.649 billion in the same quarter of last year, compared with $7.491 billion in the quarter just reported. The drop hit HP hard. Its total revenue for the quarter was $27.585 billion last year, compared to the current quarter at $25.349 billion. Personal Systems operating income was $346 million last year and $222 million in the most recent period. Quarterly net for the entire company was $1.1 billion last year and $854 million in this one.

ALSO READ: RBC’s 5 Top Internet Stocks to Buy for the Rest of 2015

Gartner, a research firm, recently reported that:

Worldwide PC shipments totaled 66.1 million units in the second quarter of 2015 (2Q15), according to the International Data Corporation (IDC) Worldwide Quarterly PC Tracker. This represented a year-on-year decline of -11.8%, about one percent below projections for the quarter.

Based on the data, HP’s drop may be even worse than that balance of the industry. If so, HP is in trouble during the current quarter. Many on Wall Street considered forward forecast numbers to be gloomy:

For the fiscal 2015 fourth quarter, HP estimates non-GAAP diluted net EPS to be in the range of $0.92 to $0.98 and GAAP diluted net EPS to be in the range of $0.12 to $0.18. Fiscal 2015 fourth quarter non-GAAP diluted net EPS estimates exclude after-tax costs of approximately $0.80 per share, related to separation costs, the amortization of intangible assets, restructuring charges, defined benefit plan settlement charges and acquisition-related charges.

Breaking the company into two pieces could not happen too soon:

On August 12, HP introduced the expected members of the boards of directors for both Hewlett Packard Enterprise and HP Inc., effective upon the completion of the separation. Each board will include members of the current HP board, as well as several new directors chosen after a comprehensive review of personal and professional qualifications as they relate to the specific needs of the two new companies.

ALSO READ: 3 Semiconductor Stocks to Buy That Could Outperform Into 2016

ALERT: Take This Retirement Quiz Now (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.