Shares of Apple (NASDAQ: AAPL) could hit $240, according to bullish analysts on the stock. Today, it trades at $190. Apple’s all-time high is just below $200. According to Tip Ranks, 33 analysts have posted ratings on Apple in the last three months. Apple is still the world’s greatest stock.

Some investors are anxious about Apple. Its most recent earnings were not spectacular. In the most recently reported quarter, revenue dropped 1% to $89.5 billion. EPS was up 13% to $1.46.

However, the top line was not the problem. The iPhone has been the engine of Apple’s financial results. iPhone sales revenue barely rose in the quarter, from $42.6 billion in 2022 to $43.8 billion. Additionally, China is one of Apple’s largest iPhone markets and the world’s largest smartphone market. For the quarter, China’s revenue was $15.1 billion, down from $15.5 billion a year ago.

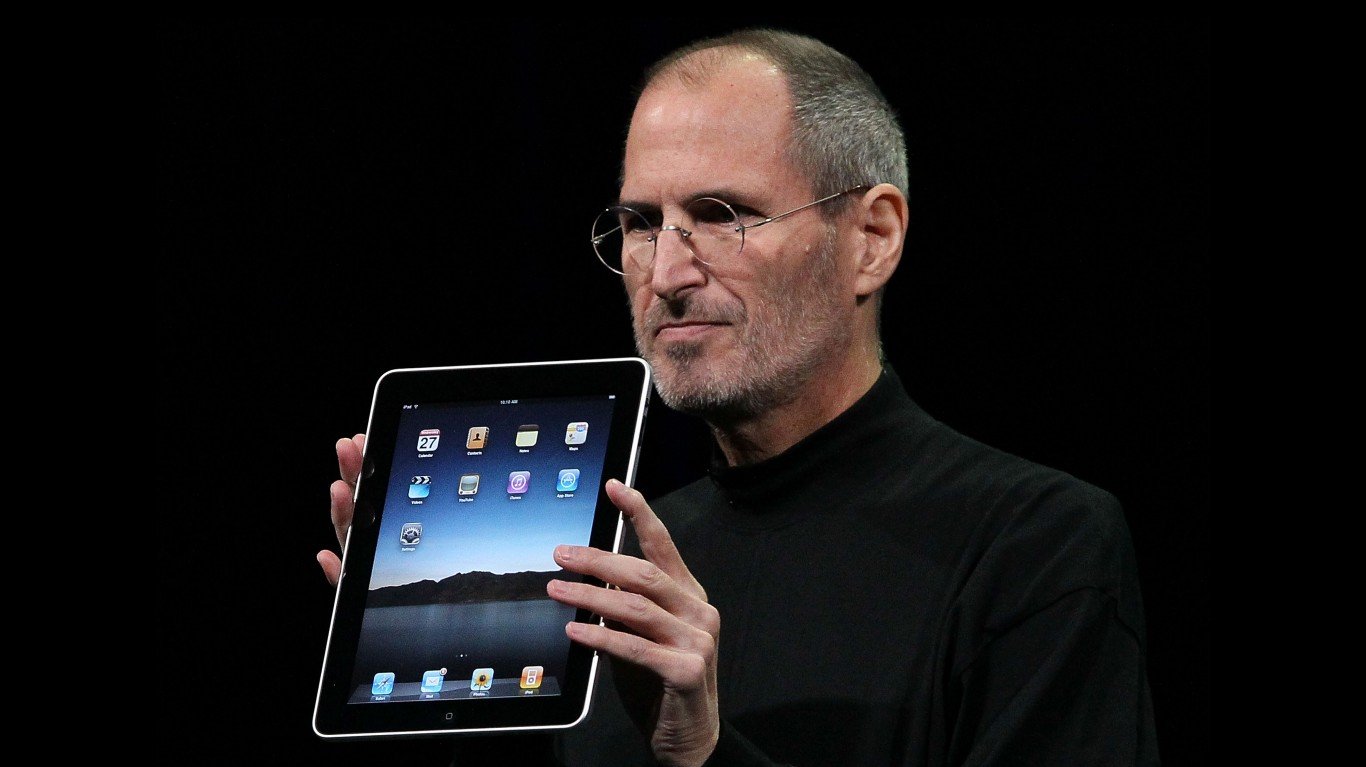

The iPhone 15 is part of Apple’s usual cadence of introducing a new model once a year, usually in September. With each new generation comes the concern that it is not enough of an upgrade in features compared to the immediately previous version. At some point, will consumers decide that buying a new iPhone is not worth the price without a quantum leap in what the device will do? Apple’s new chips could be a key to this success.

iPhone 15 sales are off to a slow start in China. Part of the reason is that local smartphone companies do well. The largest of these are Vivo, Oppo, and Huawei. Apple does not have similar competition in any other market.

On the plus side, Apple’s services division continues to grow. Revenue rose to $22.3 billion last quarter from $19.2 billion in the same period a year ago. This part of Apple includes iCloud, Music, Fitness+, Pay, Apple Card, and Apple TV+. According to TechCrunch, Apple has about one billion service subscribers.

Much of the debate about Apple is about whether its services revenue can offset any sales problems with the iPhone.

So, if Apple’s stock hits the $240 per share forecast, the iPhone probably won’t carry it there.

Smart Investors Are Quietly Loading Up on These “Dividend Legends” (Sponsored)

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.