Apple’s (NASDAQ: AAPL) stock was up 50% last year, against a rise of 21% by the S&P 500. In the process, it broke through the $3 trillion market cap barrier, making it the world’s most valuable public corporation. So far, 2024 has been a different story. Apple’s stock has dropped over 5% in just a few days.

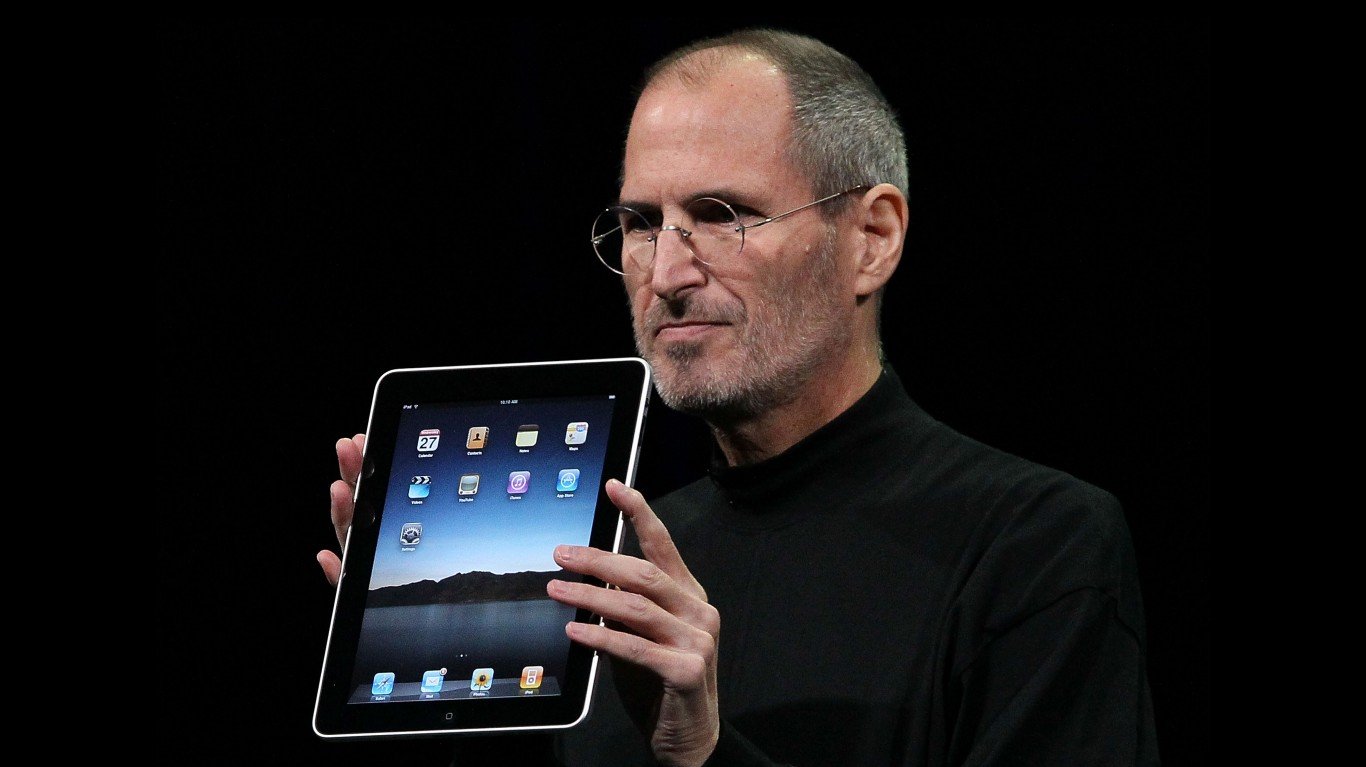

The success of the iPhone 15 fueled Apple’s run last year. It was released in September, as iPhones usually are. Apple also posted tremendous results for its Services business, which is its diversification away from hardware. Other hardware, primarily Watch, iPad, and Mac, posted uninspiring results.

Apple will report its Fiscal Year 24 First Quarter results on February 1. Until then, how the company did during the holidays can only be an educated guess. In the last quarter reported, Apple’s revenue was down 1% to $89.5 billion. EPS rose 13% to $1.46. Tim Cook, Apple’s CEO, said, “Today, Apple is pleased to report a September quarter revenue record for iPhone and an all-time revenue record in Services.” Indeed, in a flat quarter as measured by revenue, Services rose from $19.2 billion in the period a year ago to $22.3 billion.

Hardware sales in the quarter caused some anxiety. iPhone revenue was $48.5 billion, up from $42.6 billion in the year-ago period. Mac revenue was a major disappointment. It fell from $11.5 billion in the year-ago period to $7.6 billion. Wearables, Home, and Accessories dropped slightly from $9.7 billion to $9.3 billion. iPad revenue dropped from $7.2 billion to $6.4 billion.

Services revenue continues to grow as Apple adds to this portfolio. Among the most recent additions is AppleTV+, the company’s effort to compete with Netflix, Amazon, and streaming services from several large media companies. It will be a hard mountain to climb because of the number of competitors and the market share of Netflix (NASDAQ: NFLX) and Amazon (NASDAQ: AMZN).

Wall St.’s worries about Apple have started to create rare stock downgrades. Piper Sandler downgraded Apple to “neutral” from “overweight” and slashed its price target to $205, down from $220. The stock trades at $181 now. Barclays cut Apple’s rating to “underweight” and its price target to $160. It is exceedingly rare that analysts have price targets below a company’s current share price. Apple’s stock could still reach $200.

The primary worry about Apple is sales of its flagship iPhone, which has carried the company’s financial results for over a decade. At least two risks have emerged. The first is the iPhone upgrades may not change enough features to get customers to pay for the largest models. The other is that competition in China, the world’s largest smartphone market, is heating up. CounterPoint Research issues its data for the third quarter of 2023. Apple had 15% market share. Local smartphone company HONOR has a market share of 19%. OPPO has the same. Vivo has a share of 15%, and Huawei’s share is 14%.

Can Apple repeat its 2023 market performance? As of now, it looks like a hard climb.

Smart Investors Are Quietly Loading Up on These “Dividend Legends” (Sponsored)

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.