It is mid-month, and the University of Michigan has released its preliminary view on consumer sentiment for the month of September. This is far less of a broad poll compared to the actual consumer confidence reading, but investors know that this remains the first real official public report on live monthly sentiment. Source: Thinkstock

Source: Thinkstock

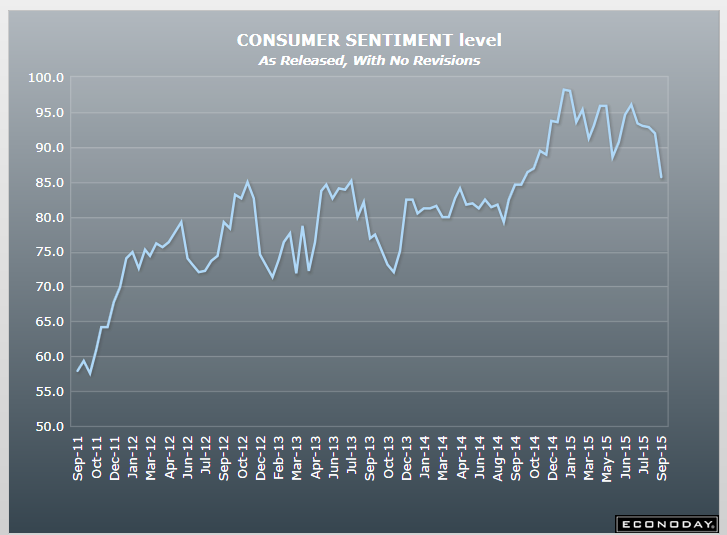

After a mixed inflationary report on the producer price index, this sentiment report quite frankly was a huge disappointment. The University of Michigan said that its Consumer Sentiment Index fell sharply to 85.7 in September, down from 91.9 in July. Bloomberg was calling for a reading of 91.0, and the range was 86.5 to 96.0. Also, the September reading from 2014 was 84.6.

What kept the index from getting worse was that the present conditions were viewed better than the expectations for the coming months. The University of Michigan showed that its Current Index was 100.3, down from 105.1 the prior month. Its Expectations Index was 76.4 in September, down from 83.4 in August.

Another point in the data was the 12-month inflation forecast coming in at 2.9%. For whatever reason, the reading on inflation expectations seems to always be higher than reality in the current cycle. Maybe that is because consumers were taught for years and years that inflation should average 2% to 3% through time.

ALSO READ: America’s Fastest Growing Jobs

Friday’s sentiment report commentary offers a closer view. The report said:

The decline in optimism narrowed in early September from late August as consumers grew somewhat more confident that the underlying strength in the domestic economy would insure a continued expansion. The twin strengths of higher employment and lower prices softened the impact from the losses in household wealth. To be sure, consumers still anticipate a weaker domestic economy due to the global slowdown and are less optimistic about future growth in jobs and wages than they were a few months ago. While the current strength in consumer spending is still likely to persist in the year ahead, the more lasting impact of recent events may be a heightened attentiveness by consumers to potential negative developments. Without this recent shift in focus, consumers would have been more likely to view the Fed’s interest rate hike as confirming their prevailing optimism, but with the shift, it could be taken as a signal for a slower pace of future economic growth.

The equity markets were already weak on Friday. Shortly after the report, the S&P 500 was down 10 points at $1,942.11 and the Dow Jones Industrial Average was down 69 points at 16,261.25.

A graph from Econoday below should illustrate what this sharp drop in sentiment looks like on a longer-term basis.

Source: Econoday

Source: Econoday

ALSO READ: America’s Best Companies to Work For

Smart Investors Are Quietly Loading Up on These “Dividend Legends” (Sponsored)

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.