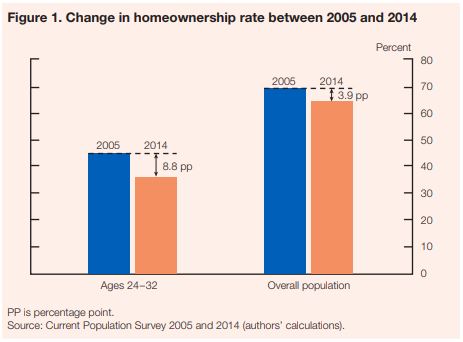

Between 2005 and 2014, the homeownership rate among Americans in an age range of 24 to 32 dropped by 8.8 percentage points, more than double the drop in the number of Americans in the age group. At the same time, outstanding student loan balances have doubled in real terms, from an average debt per capita among Americans in that age group of $5,000 to $10,000. Total student loan debt runs to about $1.4 trillion.

A soon-to-be published study cited in the premier issue of a new publication from the Federal Reserve called Consumer & Community Context found that roughly 20% of the decline in homeownership among young adults is down to the increase in their student debt.

Rising student loan debt in the 10-year period to 2014 reduced the homeownership rate among young adults by two percentage points, implying that just over 20% of the 8.9% drop in the group’s homeownership rate can be attributed to increased student loan debt: “This represents over 400,000 young individuals who would have owned a home in 2014 had it not been for the rise in debt.”

Rising student loan debt affects consumers’ ability to buy homes in many ways. The study highlights the impact of student debt on a consumer’s credit score: Higher student loan debt early in life leads to a lower credit score later in life, other things equal.

The study also found that increased student loan debt causes borrowers to be more likely to default on their student loan debt, loading a major negative effect on their credit scores and affecting their ability to qualify for a mortgage. In addition to restricting homeownership, credit scores affect consumers ability to get car loans, credit cards and other types of credit.

Finally, the authors note that an investment in postsecondary education pays off in the long run, “burdensome student loan debt levels may be lessening” the benefits. Policymakers would do well to consider policies that reduce tuition costs by raising investment in public institutions and that ease the burden of student loan payments through a “more expansive use” of repayments based on a debtor’s income.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.