Short sellers often have it in for companies, entities, funds and even sectors. But what is interesting is when the short sellers target entities with high dividends. Master limited partnerships (MLPs) fit right into this category, even if their high “yields” are actually distributions made up from income and composed of a return of capital. Source: Thinkstock

Source: Thinkstock

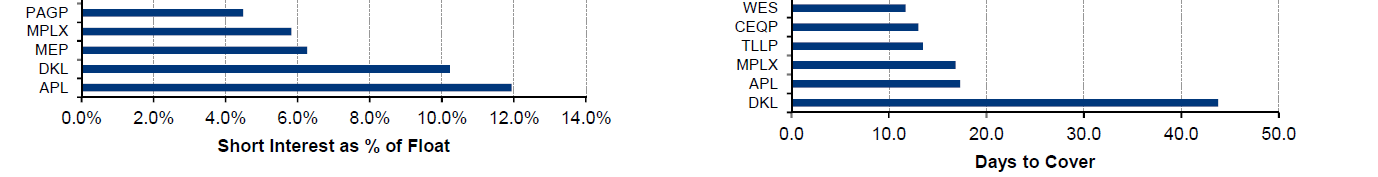

For a short seller to target an MLP or any other high dividend company, that short seller is also effectively on the hook for the dividend or distribution payment. As of the end of May, it turns out that Atlas Pipeline Partners L.P. (NYSE: APL) and Delek Logistics Partners L.P. (NYSE: DKL) were the two largest targets of short sellers.

Atlas Pipeline Partners L.P. (NYSE: APL) is in the higher payout rates, with its distribution indicating close to a 7.5% yield equivalent. Trading at $32.81, this MLP is way down from its high as the 52-week range is $28.88 to $40.06. The consensus analyst price target is $35.38 here, and Atlas Pipeline is also worth $2.65 billion. Atlas has had its ups and downs in 2014 and it is down for the year, but no single implosion event has been seen. While many MLPs have raised their payouts when they can, Atlas Pipeline Partners has had the same $0.62 payout now for four quarters in a row.

Delek Logistics Partners L.P. (NYSE: DKL) is smaller all the way around. Its market cap is $855 million and its payout is shown to be a yield equivalent of 4.8%. At $35.80, this MLP is very close to its highs, as the 52-week range is $28.70 to $36.20. Its consensus analyst price target is up at $37.00. Delek is up so far in 2014 rather than down like Atlas, and its chart does not signal any imminent danger signs. Delek raised its most recent dividend and payout.

ALSO READ: Short Sellers Get Selective in High-Yield Defensive Dividend Stocks

Now look at a snippet (see below) from a larger Merrill Lynch short interest table covering MLPs. Atlas is the leader in the short interest with almost 12% of its float short, and it is second (behind Delek) in days to cover with a reading above 15. Atlas’s short interest rose some 12.7% to 8,447,824 units as of May 30, from a short interest of 7,498,809 units as of May 15.

The same snippet shows Delek right behind Atlas Pipeline with more than 10% of its float short, but with it as the de facto leader in the days to cover ratio, with that reading running close to 48 days now. Delek saw its short interest rise by more than 300% in late May, rising to 889,892 units as of May 30 from 214,252 units as of May 15.

Source: Merrill Lynch

Source: Merrill Lynch

Sometimes the short interest shows things that most traders do not know about. And sometimes it merely indicates a randomness.

ALSO READ: Short Sellers Change Oil and Gas Bets as Crude Oil Approaches $105

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.