Imagine yourself on a pristine beach, basking in the sun, finally free from the daily grind. Now, picture that dream scenario interrupted by the nagging worry of “how am I going to afford this?”

We all look forward to retirement as a time of relaxation and sunny beaches. However, retirement can also be incredibly stressful if you haven’t planned financially. While saving a specific amount by 40 is a common goal, the reality is much more complicated.

Despite rising living costs and economic uncertainty, saving a significant portion of your income by 40 remains critical to achieving a comfortable and financially independent retirement. Navigating today’s financial landscape is challenging. We’ll explore why reaching a savings target at 40 is important and how to get you there.

Why Saving by 40 is Important

The power of time and compound interest is the driving force behind retirement. Compound interest means that your money earns interest on interest. Because the amount of interest you gain slowly increases, the money in the bank grows exponentially.

The more time your money is saved away, the more time it has to grow.

For example, let’s say you begin saving for retirement at 25 and contribute $5,000 annually with a 7% average annual return. By the time you reach 40, you’ll have accumulated roughly $138,000. If you wait until 40 to save the same amount with the same return, you’ll only have around $43,000 by age 65.

Time matters!

There are also several other benefits that saving by 40 offers:

- Flexibility in Investment Strategies: Having a longer runway allows you to take more risk when investing your retirement savings. Potentially, this could lead to a greater return over the long term.

- Increased Time Frame: A longer timeframe allows you to ride out market fluctuations. Market downturns are inevitable, but with more time, your investments have a greater chance to recover before you retire.

- Building Financial Security: By accumulating a significant savings nest egg before 40, you’ll be less reliant on Social Security or working past retirement age. Simply put, you’ll have better peace of mind after retirement.

While these advantages are hard to argue against, let’s face it: saving for retirement is still hard.

How Much Retirement Savings Should You Have by 40?

Focusing on a specific dollar amount saved by 40 is much less important than consistently saving throughout your career. However, having a common bookmark can still be helpful.

A good rule of thumb is to have around three times your annual salary saved by age 40. Of course, this is just a starting point. Your needs may vary depending on your desired retirement lifestyle, debt, financial goals, and career opportunities.

Some people may stay in a relatively low-paying career until later in life. Others may prioritize buying a house due to the high rent in their area. One reason finances can be so challenging is that they vary dramatically from person to person!

You even need to consider what it costs to retire comfortably in your state.

The Challenges of Saving for Retirement

The road to a comfortable retirement is very bumpy. Today’s economic climate doesn’t make it any smoother, either. If saving for retirement is easy, everyone would do it, and guides like this one wouldn’t be needed! Here are some challenges:

- Rising Cost of Living: The cost of living is practically always increasing. Housing, healthcare, and education put an increasing strain on our budgets. With a larger portion of your income going to daily expenses, saving can feel out of reach. However, inflation only continues to rise. Therefore, it’s even more important to save early! Saving now might be harder than saving for yesterday, but it may be even harder tomorrow.

- Economic Uncertainty: Job insecurity and the ever-present threat of recessions can create anxiety about retirement savings. Committing a chunk of money to savings may seem impossible when you’re worried about job security.

- Debt: Most US consumers have some sort of debt, whether it’s credit cards or student loan debt. Putting larger payments towards this debt may make sense rather than saving for retirement. However, if you do so, you’ll miss out on compound interest. Ultimately, it may save you more money to invest in retirement than pay of debt faster.

There is always something in the way of saving for retirement – and it’s important to recognize that. It’s important to prioritize saving, even if you’re worried about rising inflation or debt.

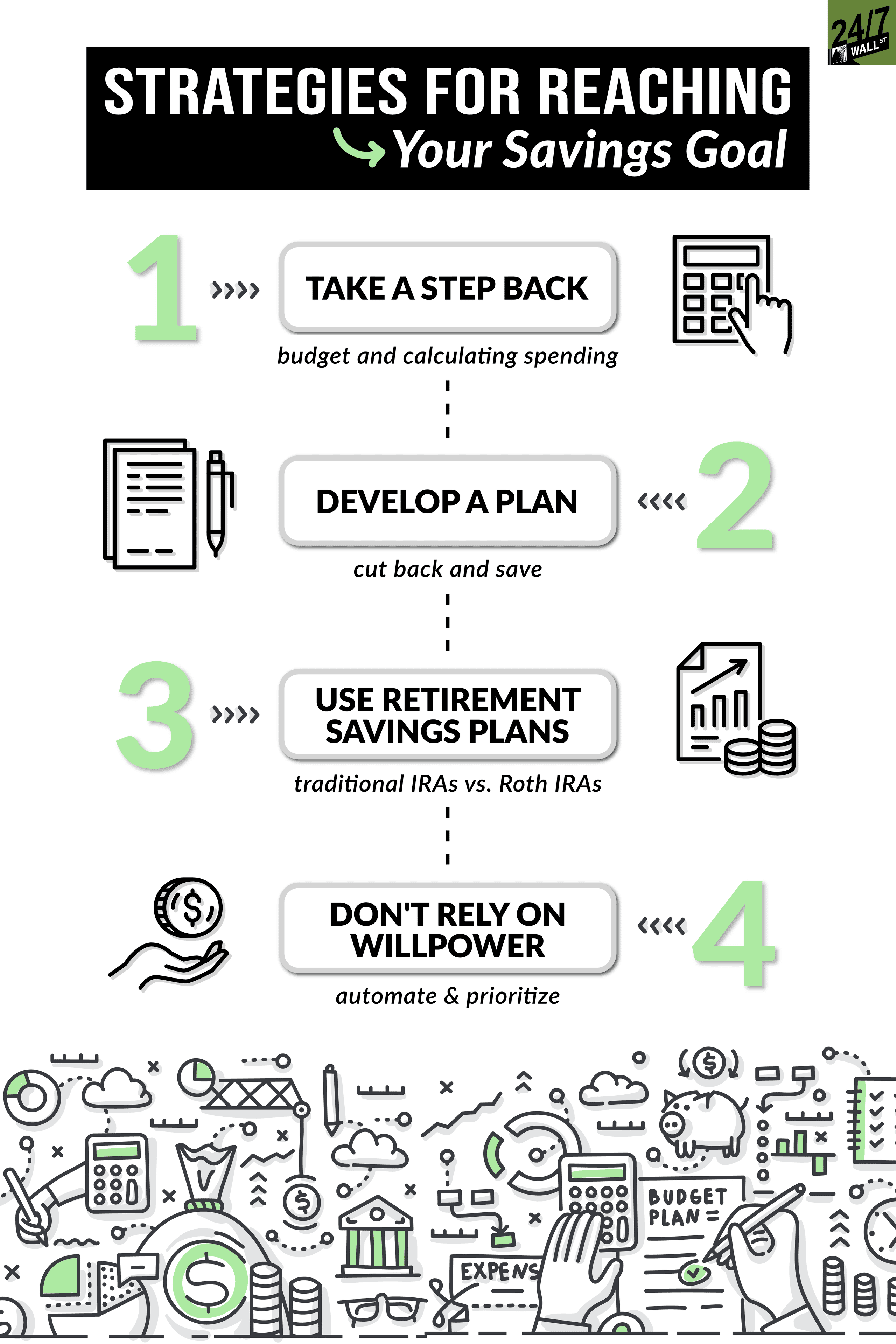

Strategies for Reaching Your Savings Goal

There are tons of challenges and roadblocks to saving for retirement, but these are manageable with the right strategies. Here are our favorite tips for saving for retirement by 40:

1. Take a Step Back

Before you can start saving anything, it’s important to understand your financial situation. It can seem impossible to save when you’re in the middle of everything. However, keeping a budget and calculating your spending can help you find money you didn’t even know you had. You can’t move forward without a clear picture of your financial standing, and you have to take a step back to get that.

You should also consider your investment goals. Are you comfortable with more risk in exchange for potentially higher returns, or do you prioritize security over aggressive growth?

2. Develop a Plan

Now that you know your financial situation, you need to come up with a plan! Consider places you can cut back and save. How do you save enough for your desired retirement lifestyle, with the understanding that inflation will continue to make everything cost more?

You will need more money for retirement than someone who is retiring today. But you also have more time to lean on compound interest.

After determining how much money you can save, make it automatic! The most important part of saving is consistency. Automate contributions to your retirement accounts, such as a 401(k) or IRA, to ensure you save regularly. Even small contributions can add up significantly over time.

Consider exploring ways to increase your income, too. While budgeting is important, you can’t save what you aren’t making! Pursue career advancement opportunities or consider taking on a side hustle.

3. Use Retirement Savings Plans

Many employers offer employer-sponsored retirement plans like 401(k)s. These plans often come with employer matching, which is essentially free money. Take advantage of this benefit by contributing at least enough to capture the full match. We have a whole guide on how much you should have in a 401(k).

If your employer doesn’t offer a retirement plan, we recommend opening an Individual Retirement Account (IRA). These come in two different types:

- Traditional IRAs: These offer tax-deductible contributions and tax-deferred growth.

- Roth IRAs: These allow for contributions with after-tax dollars but offer tax-free withdrawals in retirement.

Which option is right for you depends largely on your current tax situation. If you can afford to pay taxes now, absolutely do so. Many retire only to find a good chunk of their income eaten by taxes. Avoid this with a Roth IRA is possible.

If you don’t have the money to pay the taxes now, don’t avoid saving altogether. Invest in a traditional IRA instead.

4. Don’t Rely on Willpower

Willpower will always fail. You cannot just will yourself to save. Relying on willpower is where so many retirement plans go wrong. Make a budget and determine how much money you can put into savings each month. Then, automate that amount and don’t turn it off.

Automating removes the temptation to spend that money elsewhere and ensures you stay on track with your savings goals. It forces you to cut other areas if you come up with less money. Prioritize your retirement savings.

Smart Investors Are Quietly Loading Up on These “Dividend Legends” (Sponsored)

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.