By Yaser Anwar, CSC of Equity Investment Ideas

Not so long ago I analyzed the ICE/BOT merger, so today wanted to take a look at it technically.

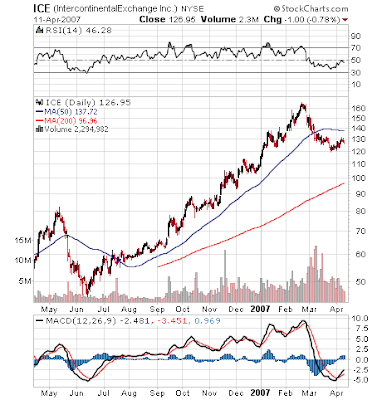

1 year chart

From this chart ICE looks quite dangerous and technically a no-no for those who dwell on the no buying before the 50-day breach level. The only thing positive is the MACD indicating oversold.

3 month chart

From this chart we can say ICE has sustained some heavy heavy selling. The only positive I see is the OBV looking like its bottomed out.

6 month chart

I would keep an eye on the 120 level and be more comfortable establishing a position there, assuming it found some support at that level. The 120 level is where it broke out of, almost 120, at the start of 07, and as the chart will show it has found support there before.

Overall I’d be much more comfortable taking a position once the BOT air has cleared, but if it approaches the 120 level and manages to stay there, I’d like to establish a long-term hold because the fundamental trend/story of exchange consolidation has not slowed. If not BOT, ICE may look to buy OPBL, an energy focused exchange with NMX as 19% holder, and pursue other strategic objectives.

One thing you’ll note is that in all charts the MACD looks oversold, so let’s see if it gets the bounce. The 3 month chart showed ICE witnessing distribution, I would love to see analyst downgrades, which I think will put a short-term bottom in it.

Stay tuned

http://www.equityinvestmentideas.blogspot.com/

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.