By Steve Harry

In all the talk about the $2 trillion Congress is considering to support the people out of work due to the corona virus, there has been little said about where the money comes from. The U.S. government is not Jesus and we are not talking fishes and loaves. Anyway, I don’t believe in miracles.

The government isn’t sitting on a big emergency cash reserve, or it wouldn’t be running a $1 trillion budget deficit. Will it just print the money?

Apparently, that is exactly what it will do. On Sunday night, 60 Minutes had an interview with Neil Kashkari, President of the Federal Reserved Bank of Minneapolis. He said Congress has “literally” given the Federal Reserve the authority to print money. He was not asked about the possible ill effects of doing so.

What happens when the government prints money is inflation. Money is a claim on goods and services. All government can do is take away one person’s claim and give it to someone else. Printing money and giving it out to part of the population increases that group’s claim at the expense of the rest, and it does so by increasing prices. That general increase in prices is called inflation. The people who get the new money will be better off, but the dollar’s buying power will go down for them, as well.

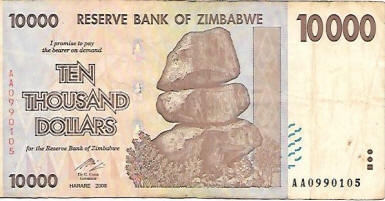

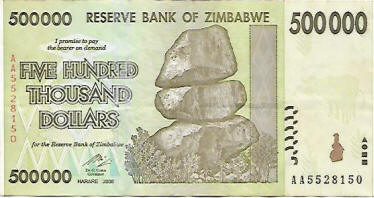

A few years ago, I tagged along on a church trip to Zimbabwe, one of the most prosperous nations in Africa until a revolution in the 1980s put Robert Mugabe in charge. He managed to destroy industry and agriculture and when tax revenues tanked, the government printed money. Inflation resulted, with people needing a wheelbarrow of currency to buy groceries. Eventually, the Zimbabwean currency was abandoned altogether and U.S. dollars were used. When we visited the little town of Victoria Falls in 2014, men approached us on the street hawking large denominations of Zimbabwean currency. We were able to purchase them for a few U.S. dollars:

The administrative expenses caused by constantly increasing prices is enormous, and the only people not touched by the loss in buying power are those whose wealth is in real estate and other durable goods. Inflation is costly and indiscriminate.

Rather than printing money to rescue the people who’ve lost income due to the stay-at-home order, the government should increase taxes. Income tax rates should be increased and made more progressive. Loopholes should be closed and special treatment of investment income should be ended. A hefty wealth and/or luxury tax should be imposed. A carbon tax should be considered. Taxes designed to raise the amount needed in the most equitable manner possible is better than devaluing the currency through inflation.

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.