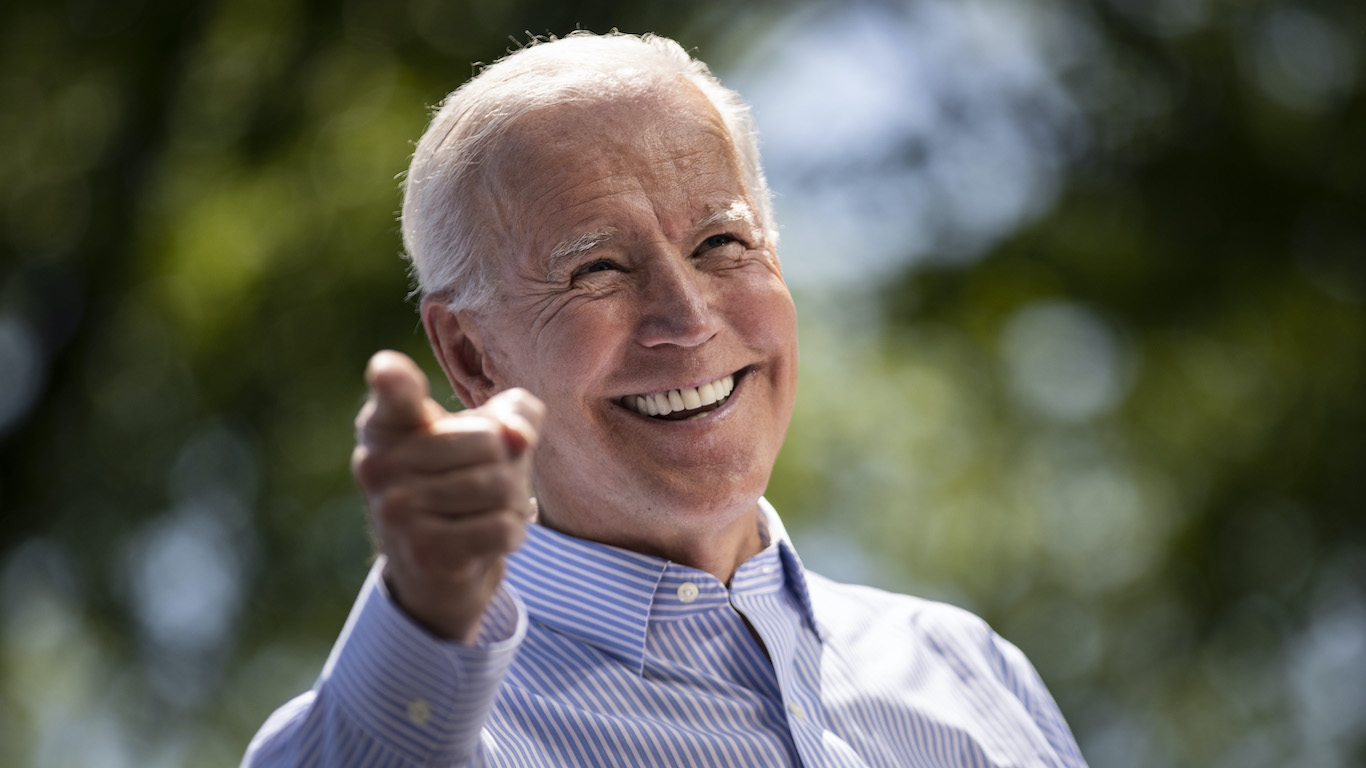

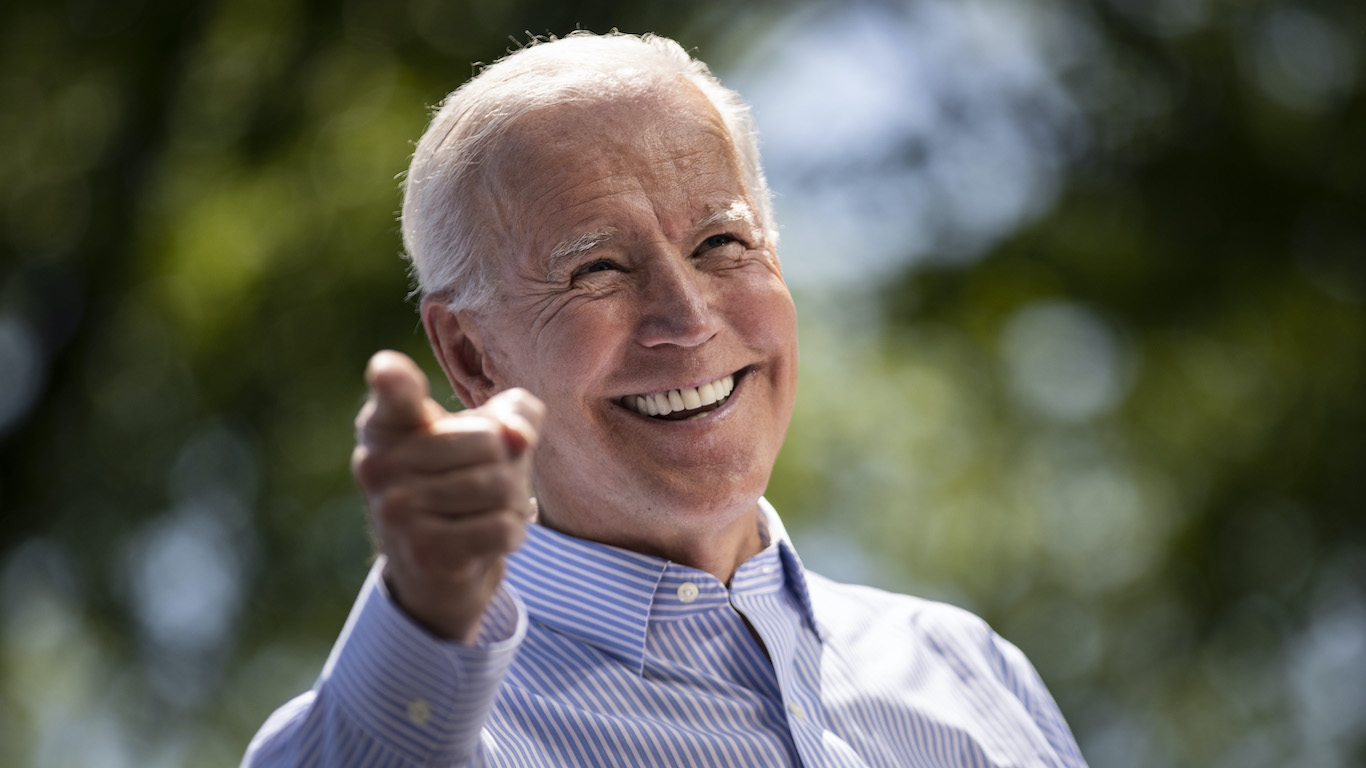

President Joe Biden popped into San Francisco this week to raise funds for his re-election campaign and dole out some $600 million in climate investments to a willing crowd. Returning to Washington, he meets with India Prime Minister Narendra Modi for a state visit and climate talk.

Biden’s campaign is gearing up to go big on infrastructure and climate transition, two of his signature legislative successes this term. But aside from keeping climate in the headlines, the strategy makes almost no headway in swaying moderate right-wing Republicans.

Perhaps the president’s strategists are still playing the long game, waiting for Trump and the other Republican candidates to self-destruct. While anything is possible, it’s more than likely that the GOP will emerge from its convention in Milwaukee next year with either Trump or DeSantis attacking Biden hard from the right on his age, his son, and his spending programs.

At this stage, it makes some sense to tour around and highlight his domestic successes, arguably more than any president since Roosevelt and the New Deal. But there are plenty of Biden skeptics, including among Democrats, who are going to need more than that next year to sign on to another four years of Sleepy Joe.

An overhaul of fossil fuel production is not on the table. If he wants to maintain climate momentum going into 2024, Biden needs a China deal that big business can get behind. Trouble is, Xi Jinping knows that, too.

Fidelity Monitor’s Jack Bowers on being a climate realist, and optimist, too

. . . . Jack Bowers, the editor of Fidelity Monitor and Insights, who has a 35-year record of beating the broad equity market averages, is a rare investor with a positive view of the renewable energy transition, writes Mark Hulbert. While many climate investors are frustrated with the pace of the transition, Bowers thinks it can be done more rapidly and at less cost and economic harm than anyone in the fossil fuel industry expects, in part because of the surge in wind and solar energy usage. Check out his thoughts, along with Mark’s analysis.

Thursday’s subscriber insights

Hope emerges for the U.S. grid fiasco

. . . . A glimmer of light? Not only is the disjointed U.S. transmission grid incapable of handling the increasing number of renewables, it can’t deal with the extreme weather already starting this summer, forecasts NERC. So it’s good to see that eight Northeast States are trying to get their act together by forming a transmission collaborative. Read more here. . . .

SEC delays climate disclosure rule until October

. . . . It’s hard not to view the SEC’s latest delay of its long-awaited climate disclosure rule — now scheduled for October — through anything other than a national political prism.

An October publication will set off a prolonged period of litigation from red state governments, some Wall Street businesses, and other anti-ESG forces that could easily extend past the presidential election of 2024. Some ESG forces could seek to expedite legal proceedings and get it up to the Supreme Court as soon as possible. But the high court’s calendar is already packed from the start of its new term in October through the end of calendar 2023. So even at high speed it’s difficult to see it getting to the Supremes before the spring, meaning a decision would be handed down in June. And that’s only if the SEC allows it to take effect immediately, which is also unlikely.

While divisive, and a major deal for large public U.S. companies, the disclosure ruling is unlikely to make its way to the top of the list of election issues. The Biden camp is clearly betting that the benefits of its infrastructure and climate subsidy spending over the past few years will be visible enough to sway some companies from openly complaining about the rule, which is controversial over its intention of mandating disclosure of corporate supply chain, Scope 3 emissions. In the meantime, it will continue to covertly woo big fossil fuel companies with occasional drilling permits to keep them quiet.

Election games are part of the drama and excitement of Washington D.C., so it’s no surprise the disclosure rule has been co-opted, despite what SEC Chairman Gary Gensler claims. But none of this takes away from the importance of the disclosure requirements, which if they aren’t watered down will allow the U.S. to stay at least on pace with broad disclosure requirements in Europe and to maintain a global leadership position in climate talks.

If they are watered down, then it becomes an entirely different election issue. One that the president doesn’t want to see. . . .

Green advocates to ships: Give a hoot, don’t pollute

. . . . The two main types of non-land transportation — aircraft and boats — each contribute about 3% of global emissions. Air travel is hard to fix in terms of pollution; boats, however, could be easier. However, in part because much seaborne transportation is done outside national boundaries, progress has been slow. That could change at an upcoming meeting of the International Maritime Organization. Read more here. . . .

Anti-ESG funds falter

. . . . Despite the political, war-on-woke fervor that the anti-ESG movement has inspired in many red states, and the obvious impact it’s had on quieting Wall Street and many public companies from their climate campaigns of a few years ago, the idea that a cottage industry in anti-EST investing was ever going to be big always seemed far fetched.

Like the so-called “sin stocks” of the 1980s, the drinks companies and gambling companies and tobacco, etc., the idea of anti-ESG funds was always more of a gimmick than anything else. Strive Asset Management, which was credited with starting the craze in 2021, received more than $300 million in new assets in the week after it announced its intention in an editorial in The Wall Street Journal.

And though the industry has grown to more than $2 billion in assets, according to the Financial Times, new fund sales have been slowing dramatically in recent months. At least one fund has folded, according to the FT story.

It’s hard to build an investment strategy around being against something. Most of the anti-ESG arguments don’t hold water, and even the few that do are hard to craft a theme around. It’s always easier to get people fired up about something then to keep them fired up, especially when you’re dealing with their money.

It may be this is the first sign that the anti-ESG movement is losing steam. . . .

Editor’s picks: Most Americans support climate policies; solar industry faces volatility

Two-thirds of Americans support transformative climate policies

About two-thirds of Americans say they worry about global warming and support policies to reduce it. But most do not realize that their views are so widely shared, according to a report from Yale Climate Connections. The report cites Gregg Sparkman, an assistant professor in the department of psychology and neuroscience at Boston College, as saying, “What we found is that the vast majority of Americans underestimate just how many of their fellow Americans support these transformative climate policies, like a carbon tax or a Green New Deal, or a 100% renewable energy mandate.” YCC says Sparkman’s team asked more than 6,000 Americans to estimate the percentage of other Americans who worry about climate change and support climate policies. They compared those numbers with polling data from Yale and George Mason University. “While actual supporters of climate policies outnumber opponents two to one, we see that Americans think it’s the other way around,” Sparkman says. The report notes that misperception matters because when people feel alone in their views, they are less likely to take action.

Market volatility impacts solar installations

Solar installations hit a new record in the first quarter, as supply chain restraints eased. But experts see continued volatility for the industry through 2024, according to a report from Utility Dive, citing a quarterly market insight from the Solar Energy Industries Association and Wood Mackenzie. The report says the U.S. solar industry installed 6.1 GWdc of new capacity in the first quarter of 2023, setting a record for the traditionally slower first quarter. Installations were 19% lower than the fourth quarter of 2022. The overall trend is for growth in the solar industry nationwide, but disparate forecasts signal the chance of a slight contraction through 2024, based on sales data.

Financial markets and climate change: The discount rate

What is the discount rate on large-scale projects to mitigate climate change? This paper, titled Climate Change in Financial Markets, proposes a model that answers this question. In the model, climate change manifests itself through disasters that destroy capital. The probability of those disasters is endogenous and grows with anthropogenic emissions that evolve with new investments in brown capital. The author shows that large-scale projects or policies aimed at abating climate change should be discounted with a rate significantly lower than the market rate, though this rate is increasing over time. The paper also outlines the additional losses the economy will incur if the policy does not start immediately but instead awaits several years. Finally, results show that only the transition risks rather than the physical risks can explain the green premium and reconcile the theoretical predictions with historical observations. Author: Maria Gelrud, University of Pennsylvania, The Wharton School.

Words to live by . . . .

“The ocean is the lifeblood of our planet. And today, you have pumped [in] new life and hope to give the ocean a fighting chance. … By acting to counter threats to our planet that go beyond national boundaries, you are demonstrating that global threats deserve global action. That countries can come together, in unity, for the common good.” – UN Secretary General António Guterres, addressing attendees of the UN’s global marine diversity treaty conference.

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.