Cryptocurrencies have had a solid run this year after a not-so-memorable 2022. The Fed’s aggressive interest rate hikes to battle multi-decade-high inflation saw the cryptocurrency market taking a hit last year. This year has been good as favorable macroeconomic conditions have helped cryptocurrencies, including Bitcoin (BTC), make a solid rebound.

However, Bitcoin price fell below $29,500 on Jul 26 after the Fed increased interest rates by 25 basis points. Earlier this year, Bitcoin soared to a 13-month high of $31,500 driven by robust demand from institutional buyers.

The scenario is exactly opposite to that of last year. The Fed has increased interest rates by 525 basis points since March 2021, which raised doubts about the potential of Bitcoin.

Besides, a series of unfortunate events like the Terra Luna crash and a major fraud that resulted in FTX’s bankruptcy raised concerns about the future of cryptocurrencies.

The flash crash on Wednesday was expected as market participants were almost certain about the Fed’s rate hike. Growth assets like technology stocks, consumer discretionary stocks and cryptocurrencies are adversely affected by higher interest rates. So, this may not entirely come as a shock.

Bitcoin’s price has surged 78.1% year to date and hovered around the $30,000 mark almost through July. Economists had forecast that Bitcoin would bounce back in 2023 and gather further momentum in the second half.

This is because macroeconomic conditions are a lot more favorable now. Economic data indicates that inflation has started cooling. Although the Fed increased interest rates once again, slowing inflation has raised hopes that the latest interest rate hike could be the last in the central bank’s current monetary tightening cycle.

This bodes well for the overall cryptocurrency market.

Stocks to Watch

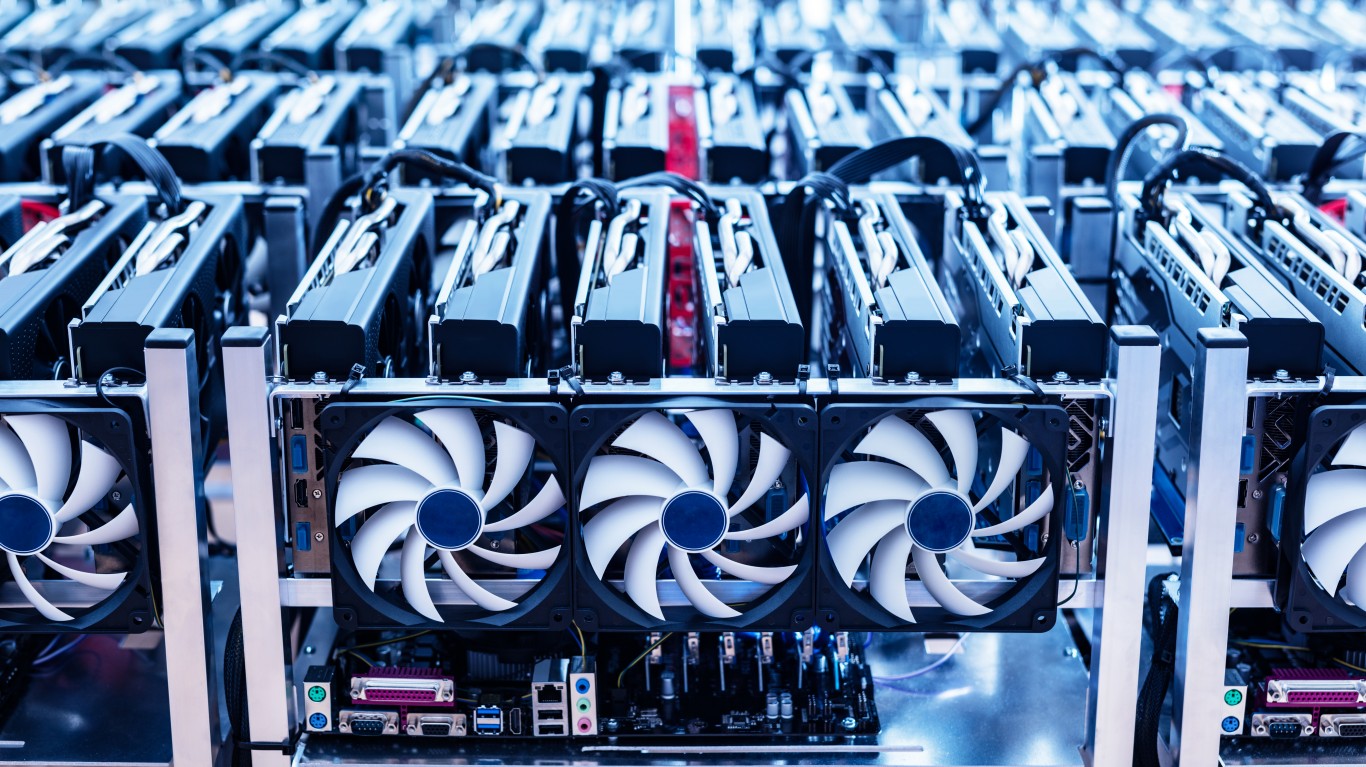

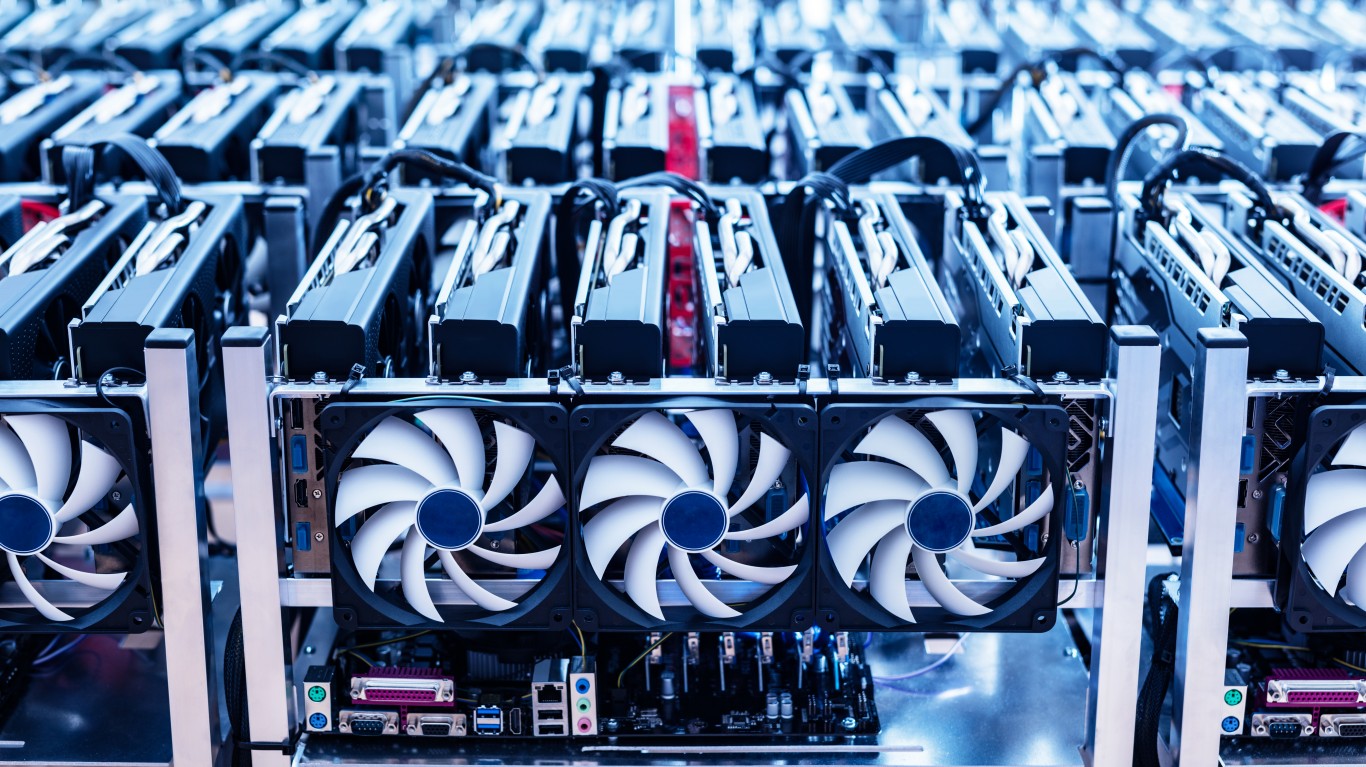

HIVE Blockchain Technologies Ltd. (HIVE – USD) operates as a cryptocurrency mining firm. The company validates transactions on blockchain networks. It also provides crypto mining and builds bridges between crypto and traditional capital markets.

HIVE Blockchain’s expected earnings growth rate for the current year is 78.1%. Shares of HIVE have gained 35.5% in the past 30 days. HIVE presently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Stronghold Digital Mining, Inc. SDIG is a vertically integrated Bitcoin mining company. SDIG focuses on mining Bitcoin in the United States.

Stronghold Digital Mining’s expected earnings growth rate for next year is 92.7%. Shares of SDIG have gained 138% in the past 30 days. Stronghold Digital Mining presently carries a Zacks Rank #2 (Buy).

Bitfarms Ltd. BITF is a Bitcoin mining company. BITF provides vertically integrated mining operations with onsite technical repair, proprietary data analytics, and company-owned electrical engineering and installation services to deliver operational performance and uptime.

Bitfarms’ expected earnings growth rate for the current year is 86.1%. Shares of BITF have gained 29.7% in the past 30 days. BITF presently has a Zacks Rank #3 (Hold).

Bitfarms Ltd. (BITF): Free Stock Analysis Report

Stronghold Digital Mining, Inc. (SDIG): Free Stock Analysis Report

To read this article on Zacks.com click here.

This article originally appeared on Zacks

Sponsored: Want to Retire Early? Start Here

Want retirement to come a few years earlier than you’d planned? Orare you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.