For the first time since Russia invaded Ukraine nearly 18 months ago, Ukraine has launched an attack against Russia’s oil industry. Citing Ukrainian sources with knowledge of the matter, the Financial Times reported early Friday that a drone strike damaged a Russian vessel outside the Russian Black Sea port of Novorossiysk.

[in-text-ad]

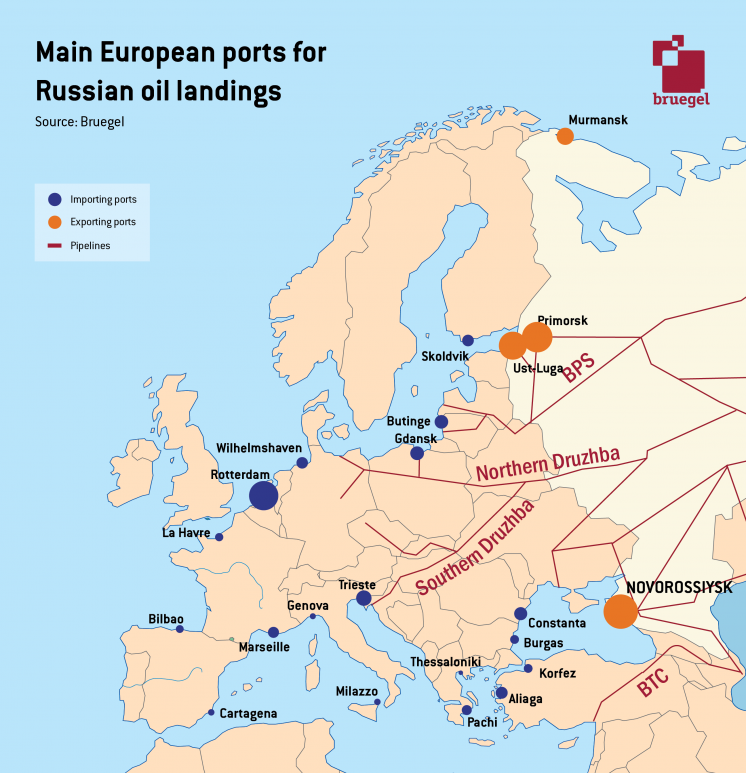

The city is a major oil-exporting base for Russian crude, with a capacity to load 600,000 barrels a day. Novorossiysk is also the termination point for the Caspian Pipeline Consortium, delivering 1.2 million barrels of Kazakhstan’s crude for further export.

Russia recently reimposed a blockade of Ukrainian grain exports, and the drone attack on the Russian vessel could be Ukrainian retaliation for that. The United States has closed its eyes to Ukrainian attacks on Russian cities and bases, provided that the attacks are not carried out with U.S.-supplied weapons. Turkey is the other major drone supplier to Ukraine.

Russian exports of crude oil and petroleum products are estimated at around 7 million barrels per day. The country has pledged to cut exports by 500,000 barrels a day beginning this month, supporting the drive by members of the OPEC+ cartel to drive oil prices higher. According to a Reuters report, Russia already had reduced exports by a similar amount for May, June and July. Saudi Arabia is expected to continue its production cut of 1 million barrels a day into September.

Since late June, Brent crude prices have risen by about $14 a barrel to trade at more than $85 a barrel earlier Friday morning. U.S. West Texas Intermediate crude has added about $16 a barrel in the same period and currently trades at around $82 a barrel. Russian Urals crude has added about $11 a barrel and trades at around $68 a barrel. The Biden administration does not want to see pump prices rising above $4.00 a gallon heading into an election year. To voters, gasoline prices are a thermometer of a poor economy.

Private equity firm KKR & Co. Inc. (NYSE: KKR) reportedly is negotiating to buy publishing house Simon & Schuster from Paramount Global (NASDAQ: PARA). A report published late Thursday in The Wall Street Journal said the talks have reached an advanced point and that the acquisition price is around $1.65 billion.

Penguin Random House had offered to acquire Simon & Schuster for $2.2 billion earlier this year, but the U.S. Department of Justice prevailed in a lawsuit that claimed the deal was anti-competitive. Penguin ended up paying Paramount a $200 million termination fee after the deal was called off.

Simon & Schuster was founded in 1924 and published the work of Ernest Hemingway and F. Scott Fitzgerald. More recently, the company’s leading writers include Stephen King and Walter Isaacson, among many others.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.