Investing

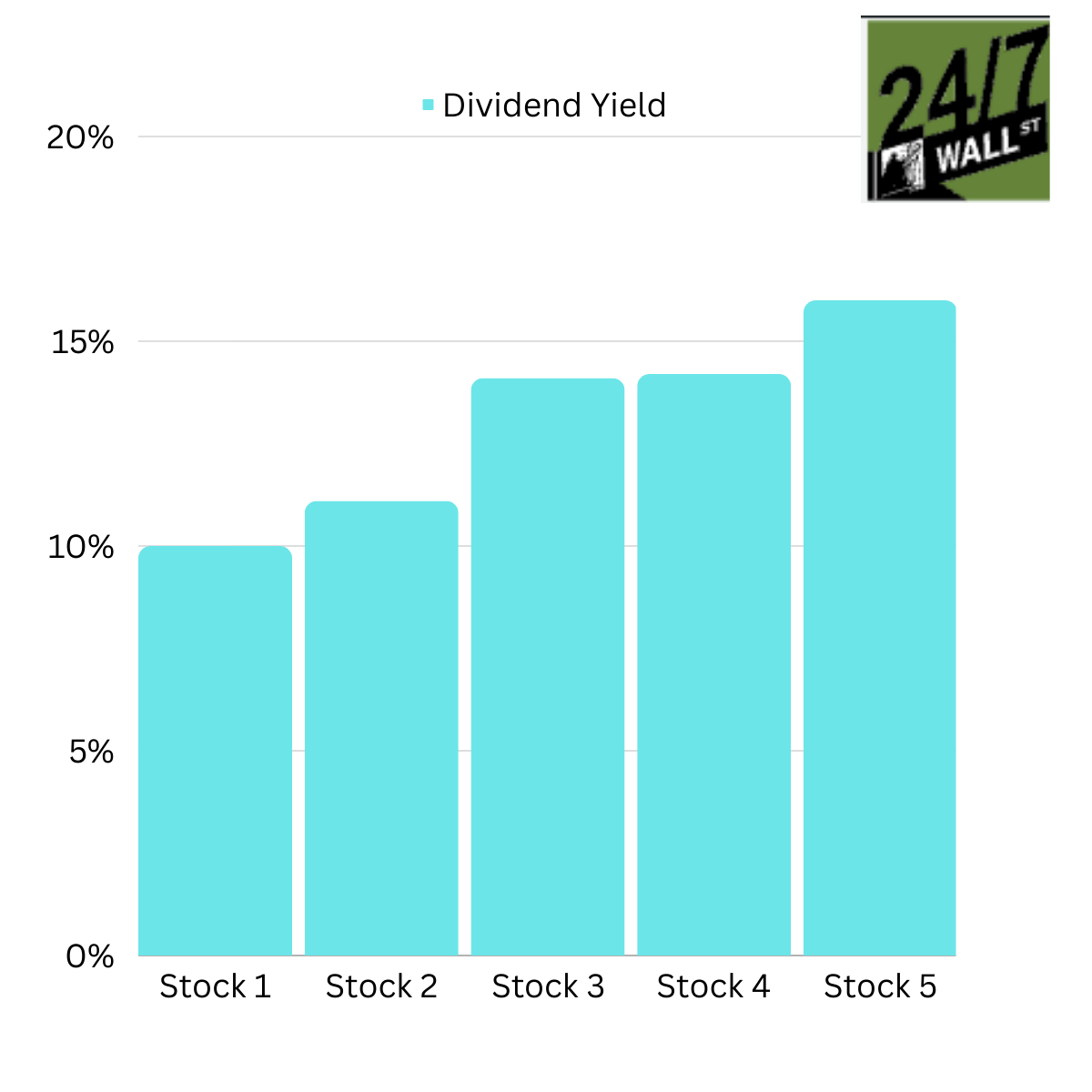

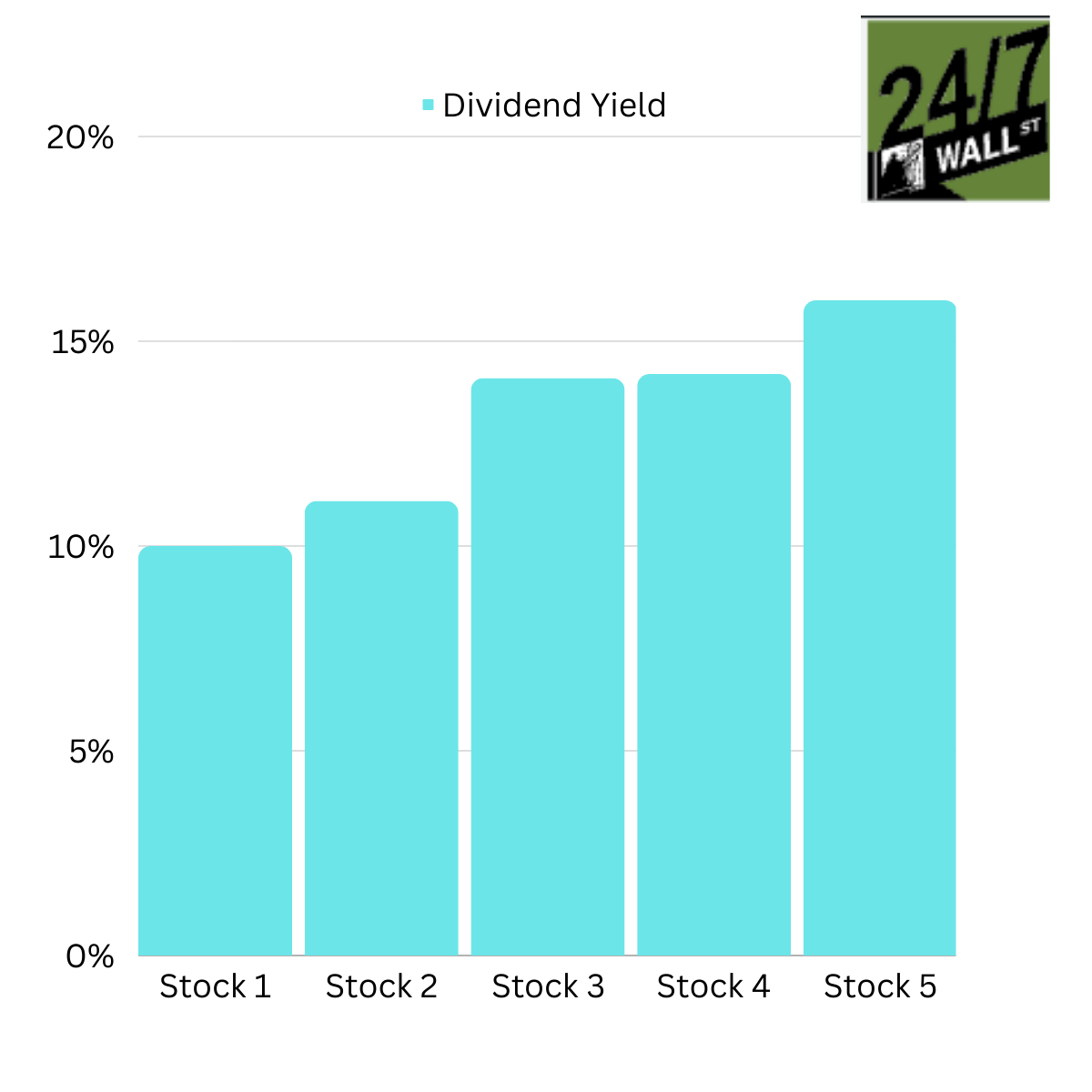

5 ‘Strong Buy’ Stocks Under $20 Paying Huge 10% and Higher Dividends

Published:

Last Updated:

Investors love dividend stocks because they provide dependable income and give investors a great opportunity for solid total return. Total return includes interest, capital gains, dividends, and distributions realized over time. In other words, the actual return on an investment or a portfolio has income and stock appreciation.

At 247 Wall St., we always like to remind our readers about the impact total return has on portfolios because it is one of the best ways to help improve the chances for overall investing success. Again, total return is the combined increase in a stock’s value plus dividends. For instance, if you buy a stock at $20 that pays a 3% dividend, and it goes up to $22 in a year, your total return is 13%—10% for the increase in stock price and 3% for the dividends paid.

We screened our 24/7 Wall St. dividend stock research database and found five stocks trading under $20 that pay a stunning 10% and higher dividends. Passive income investors should load the boat now. All are rated Buy on Wall Street.

This company trades at a ridiculous 6.9 times trailing earnings and pays a massive 14.13% dividend. Arbor Realty Trust (NYSE: ABR) invests in a diversified portfolio of structured finance assets in the multifamily, single-family rental, and commercial real estate markets in the United States.

The company operates in two segments:

Arbor Realty Trust primarily invests in bridge and mezzanine loans, including junior participating interests in first mortgages, preferred and direct equity, real estate-related joint ventures, actual estate-related notes, and various mortgage-related securities.

The company offers bridge financing products to borrowers who seek short-term capital to acquire property, financing by making preferred equity investments in entities that directly or indirectly own real property.

In addition, the company underwrites, originates, sells, and services multifamily mortgage loans through conduit/commercial mortgage-backed securities programs.

This company has traded sideways for a year, looks ready to break out, and pays a 10% dividend. Blue Owl Capital Corporation (NYSE: OBDC) is a business development company. It specializes in direct and fund-of-fund investments.

The fund makes investments in senior secured, direct lending or unsecured loans, subordinated loans or mezzanine loans and also considers equity-related securities, including warrants and preferred stocks, and also pursues preferred equity investments, first lien, unitranche, and second lien term loans and joint equity investments.

Within private equity, it seeks to invest in growth, acquisitions, market or product expansion, refinancings, and recapitalizations.

Blue Owl Capital seeks to invest in middle-market and upper-middle-market companies based in the United States, with EBITDA between $10 million and $250 million annually and annual revenue of $50 million and $2.5 billion at the time of investment. It seeks to invest in assets typically between three and ten years of maturity. It aims to make investments generally between $20 million and $250 million.

This is a well-known name on Wall Street, offering a solid entry point at current levels and paying a massive 14.18 dividend. FS KKR Capital Corp. (NASDAQ: FSK) is a business development company specializing in investments in debt securities. It seeks to purchase interests in loans through secondary market transactions or directly from the target companies as primary market investments.

The company also seeks to invest in first-lien senior secured loans, second-lien secured loans, and, to a lesser extent, subordinated loans or mezzanine loans. In connection with the debt investments, the firm also receives equity interests such as warrants or options as additional consideration.

FS KKR also seeks to purchase minority interests in common or preferred equity in our target companies, either in conjunction with one of the debt investments or through a co-investment with a financial sponsor.

The fund may invest in corporate bonds and similar debt securities opportunistically. The fund does not seek to invest in start-ups, turnaround situations, or companies with speculative business plans. It aims to invest in small and middle-market companies in the United States.

The fund seeks to invest in firms with annual revenue between $10 million to $2.5 billion. It aims to exit from securities by selling them in a privately negotiated over-the-counter market.

The company posted stellar results for the most recent quarter and announced a continuation of a massive stock buyback.

Trading just above a 52-week low, this company pays a stellar 11.06% dividend and has enormous upside potential. Highwood Properties, Inc. (NYSE: HIW) is a fully integrated office real estate investment trust publicly traded (NYSE: HIW).

The company owns, develops, acquires, leases, and manages properties primarily in the best business districts (BBDs) of:

Highwoods Properties’ biggest customers include the U.S. Government, financial services firms, industrial supply retailers, and healthcare companies.

This recent IPO is trading below the initial price and will pay a gigantic 16.33% dividend. Mach Natural Resources (NYSE: MNR) is an independent upstream oil and gas company.

The company is focused on the acquisition, development, and production of oil, natural gas, and natural gas liquids reserves in

The analysts at Raymond James noted that the company is led by Tom Ward, Co-Founder of Chesapeake Energy; Mach is another entrant into the E&P MLP space. MNR is a pure-play operator in the Anadarko Basin, leveraging its strong position (1 million net acres) to become the primary consolidator in the region.

Mach’s midstream position and lower base decline (~20%) allow the company to target a lower reinvestment rate (~30%) relative to the overall industry.

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.