Robinhood has done a fantastic job of marketing itself to new and young traders as well as long-time savers and investors. If you’re just learning about Robinhood, or you’ve been looking for a better alternative than what you have, chances are your interest has been piqued by the unprecedented perks offered by Robinhood.

If you’re worried you’ve made a mistake by investing with your current institution, you’re not alone. You might feel like you’re being ripped off by your current company, or you just want to take advantage of some of the account benefits at Robinhood that you don’t have right now. If you’ve decided that a transfer is in your best interest, but you don’t know what to do, you’ve come to the right place. This is everything you need to know about moving your account from Interactive Brokers to Robinhood.

What is Robinhood?

Robinhood is an online trading platform that launched with its smartphone app in 2015. At the time of launch, its commission-free trading and simple design made it an attractive alternative to expensive legacy trading firms. Young and new traders alike flocked to the platform.

While it began as just a trading platform for stocks, Robinhood now offers trading in cryptocurrencies, IRA investments, and more. See our review of Robinhood’s IRA accounts.

For normal traders, Robinhood doesn’t charge any account fees or commissions. This lowered the barrier of entry for those who wanted to trade stocks but didn’t want to pay the high costs that other institutions charged their customers (some charged up to $10 per trade and required a large minimum balance to begin). Robinhood had no minimum balance requirement and let you trade for as much or as little as you wanted. As a result, most other large trading brokers eliminated or reduced their account and commission fees in order to retain customers and compete with Robinhood.

A generous referral program and low-cost model continue to contribute to Robinhood’s success. Additional benefits are available to those who pay for Robinhood Gold. Learn more about whether a Gold account is right for you.

Why Transfer Your Account to Robinhood?

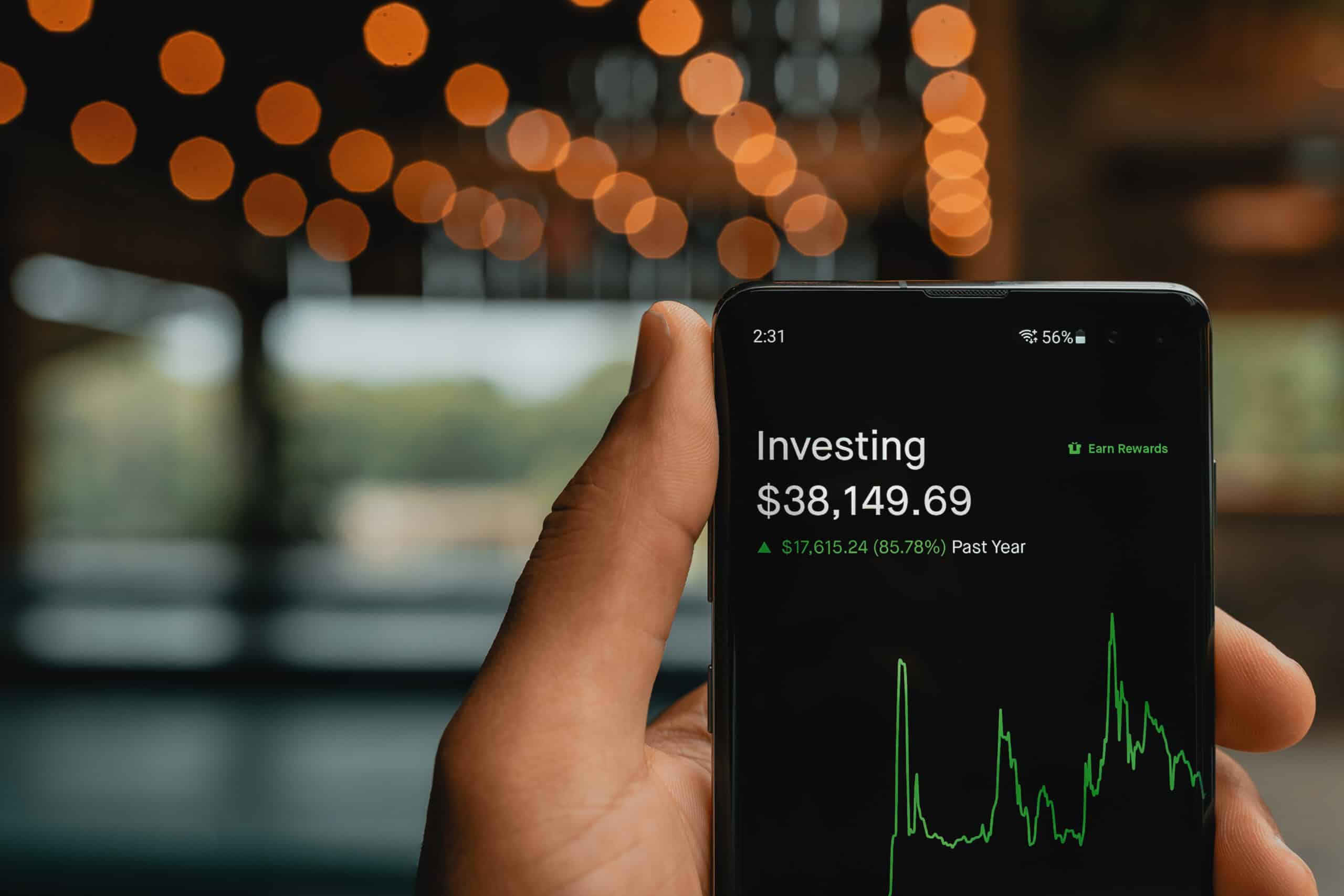

Depending on what type of account you have, the benefits you will see by transferring it to Robinhood will differ. All Robinhood accounts qualify for a free money match.

For example, if you want to transfer your stock trading account, along with your existing shares, you will earn a free stock from Robinhood with the creation of your account (if you haven’t already). Also, you can enjoy commission-free trading and no account fees or balance requirements.

If you want to transfer an existing IRA to Robinhood, it will match 3% of your transfer or account rollover (until April 2024 with a Robinhood Gold account, otherwise it is a 1% match), and will match up to 3% of your contributions to your retirement account. Free accounts earn a 1% match on every contribution and Gold accounts earn a 3% match. See how to qualify for the 3% match here.

You can also choose to have your uninvested cash participate in Robinhood’s Cash Sweep program, which deposits your money in participating banks to earn interest and qualify for FDIC insurance. This is a free program to sign up for. Learn more about the Cash Sweep program.

If your current broker charges you fees to trade or keep cash in your account, not only does transferring to Robinhood save you that money, but you will actually be earning money passively instead.

Robinhood is only able to accept transfers of stocks, ETFs, options contracts that don’t expire within the next seven days, cash balances, and margin balances. You can also transfer your existing IRA to a new Robinhood IRA account. You cannot transfer fractional shares, cryptocurrency, mutual funds, bonds, annuities, and futures. A good rule of thumb is that if you can buy or sell or trade the asset on Robinhood, then you can transfer it.

In order to transfer your account to Robinhood, you will need to initiate something known as an ACATS. Most companies will charge you a fee for taking your money away from them, even though the process costs them nothing and requires no effort on their end (one last attempt to get you to stay, or punish you for leaving), but Robinhood will reimburse the cost of the transfer up to $75 for transfers of at least $7,500.

What is an ACAT?

ACATS stands for Automated Customer Account Transfer Service, and it does exactly what it sounds like. There are no physical forms you need to fill out and most of the process is done automatically on your behalf. The ACATS system is operated by the Depository Trust & Clearing Corporation which is owned collectively by all participating financial institutions and banks and handles most of the securities transactions between United States companies.

All you need to begin an ACATS is two compatible accounts (the original and the destination account) and the account information for both.

How to Transfer Your Account to Robinhood

Before you begin transferring your Interactive Brokers holdings to Robinhood, you will need to first create a Robinhood account and verify your Interactive Brokers account information. This will save you time and frustration later.

In order to create a Robinhood account, all you need is a smartphone to download the app and proof of your age (must be at least 18), identity, and residence. Currently, only United States citizens can sign up for Robinhood, though it has plans to launch in the United Kingdom soon. The sign-up process includes linking your bank to the app.

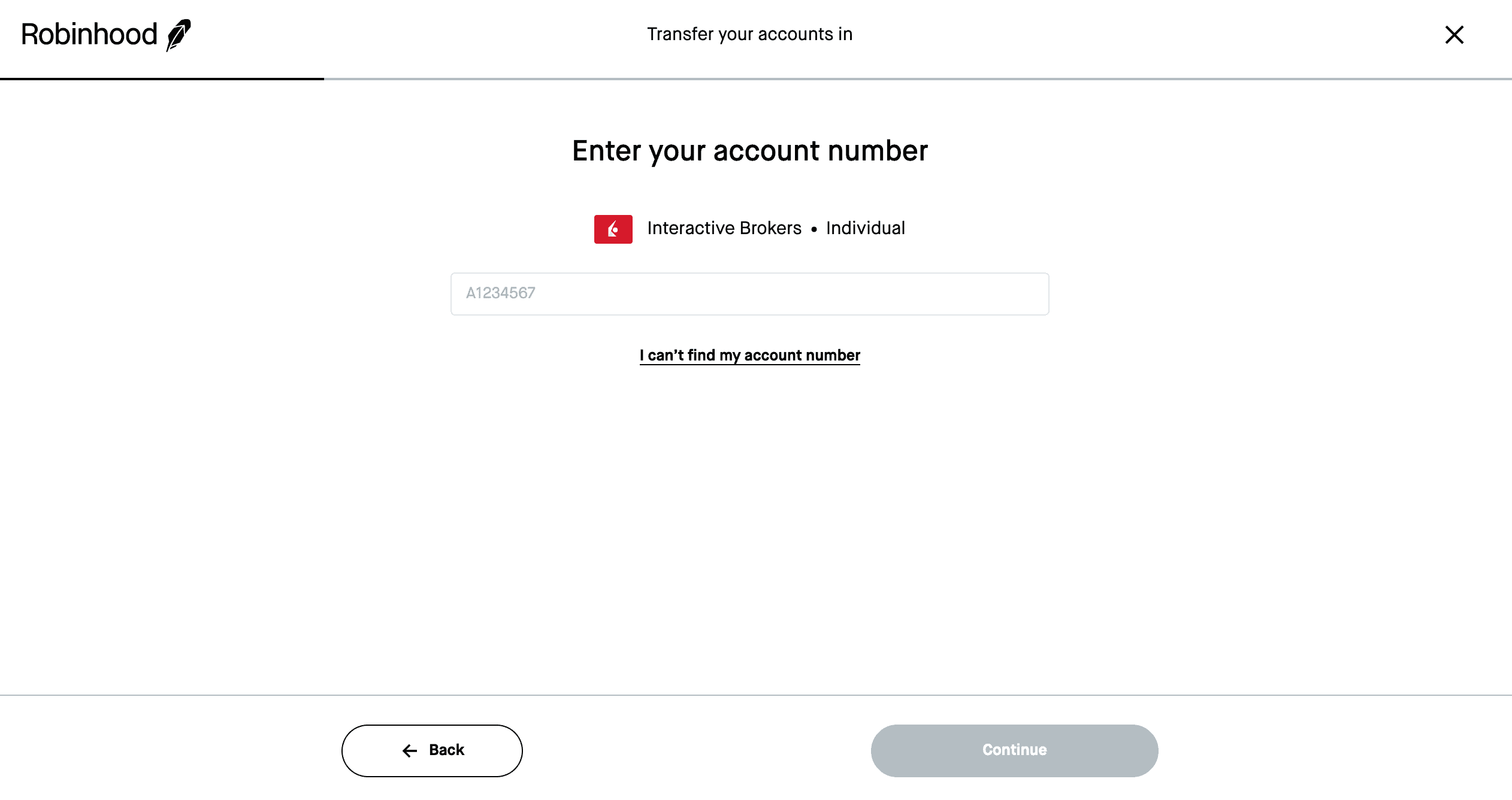

Once your account is set up and you have your Interactive Brokers account information it is time to initiate the ACATS. An ACATS is a request sent by Robinhood to your existing account holder, so everything will be managed from within the Robinhood app. There should be no reason to contact Interactive Brokers itself.

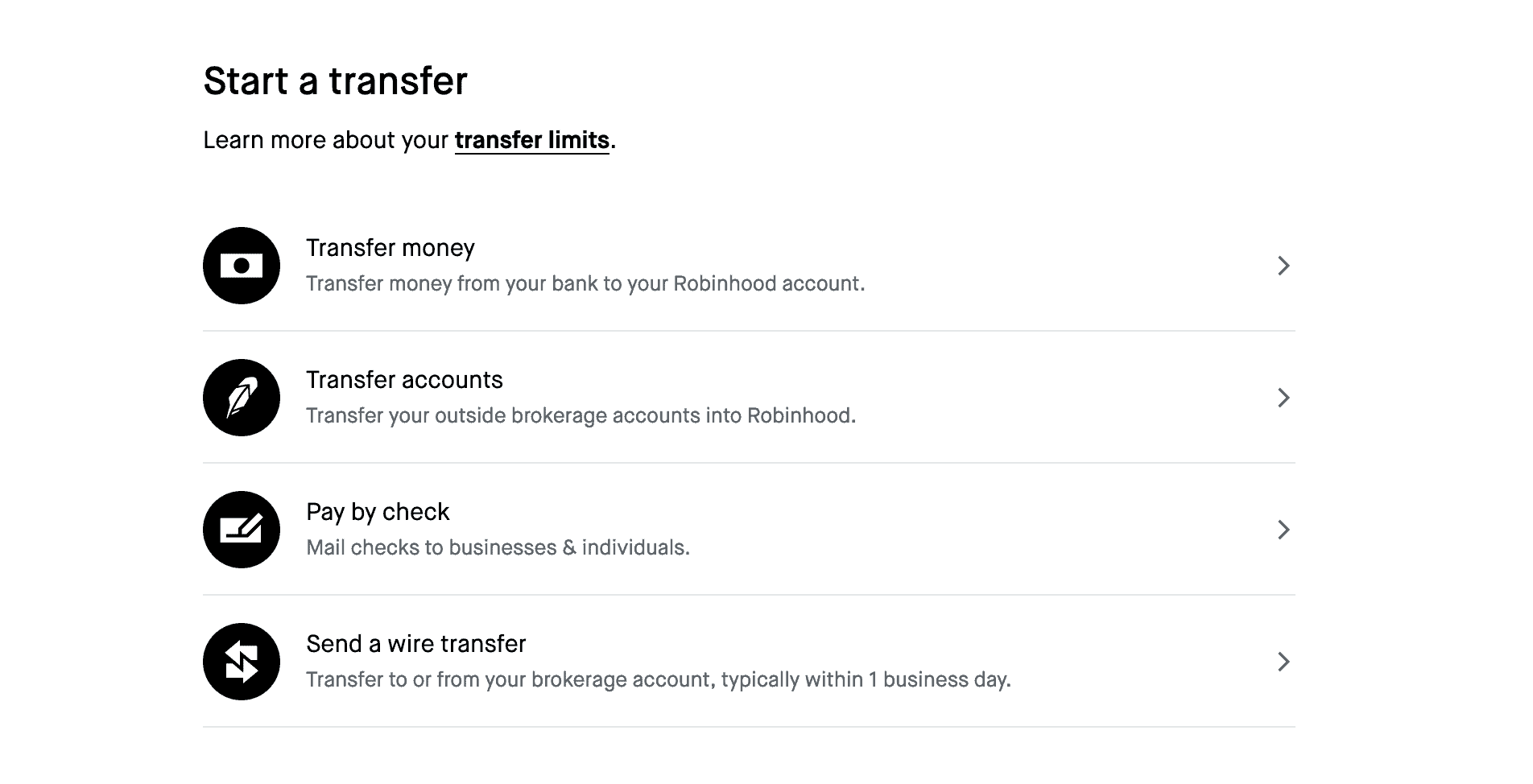

Within the app, go to your account tab (the person icon), and then select Transfers. Under the transfers menu, you will want to pick the Transfer accounts option. You will then select Interactive Brokers from the list of brokerages and input your account number then type the name associated with the account. Make sure that the name on your brokerage account matches the name on your Robinhood account or the transfer will be rejected.

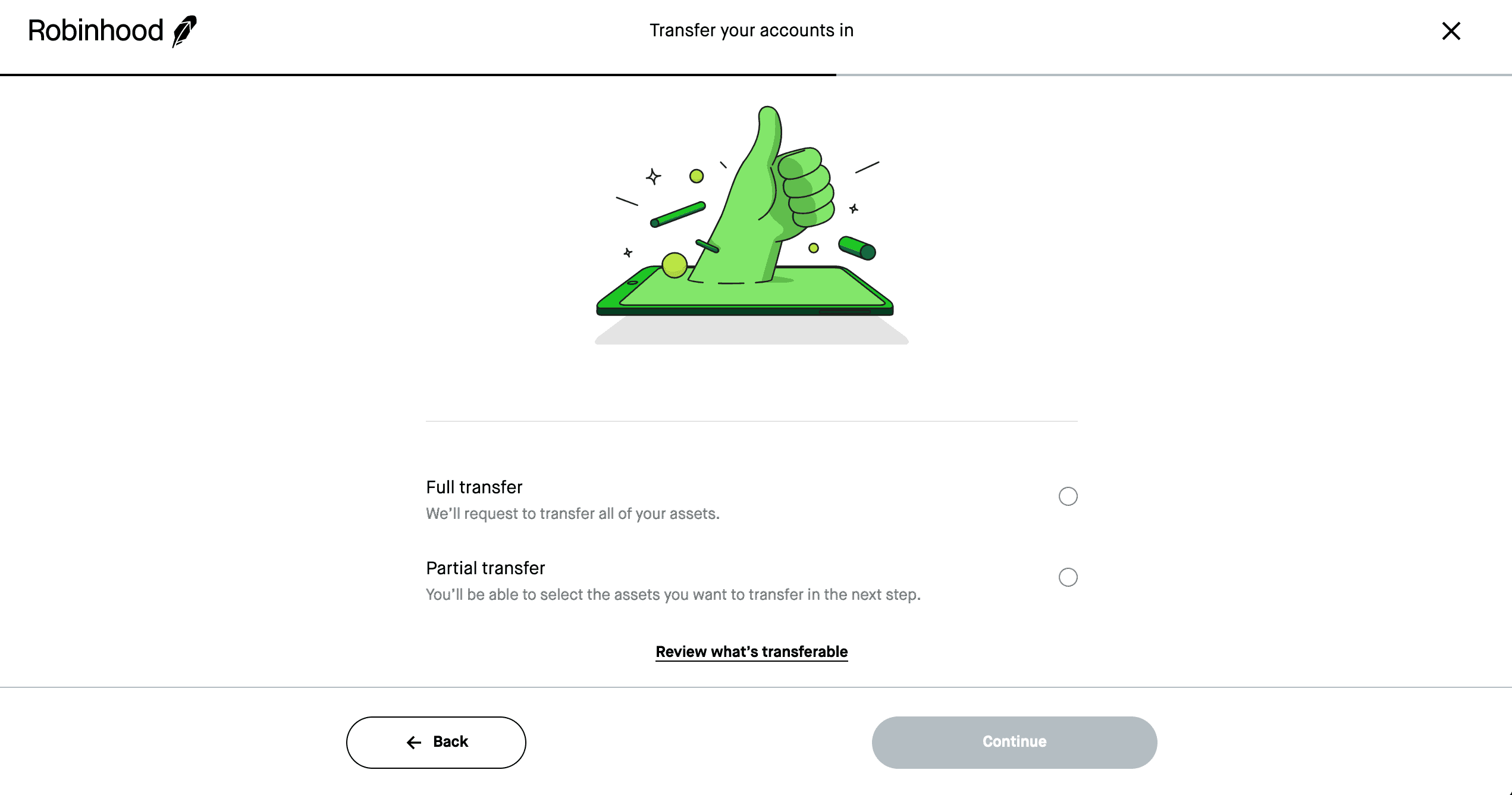

Robinhood supports full or partial account transfers. If you have an account with Interactive Brokers that includes assets you can’t transfer, then select the partial account transfer and select only the assets that Robinhood will accept.

Follow the prompts to complete the ACATS request.

Once the process is complete, Robinhood will send a request to Interactive Brokers to transfer the account. Once the request is accepted, your money and holdings will be unavailable until the transfer is complete. This can take anywhere from five to seven business days. If there are any issues or your request is rejected, Robinhood will let you know. Otherwise, you will see your assets appear in Robinhood eventually.

Additional funds might continue to appear in your account for months after the transfer is completed. These can be interest payments that were not processed in time to be included with your initial transfer.

Remember to close your Interactive Brokers account if you no longer want to keep it, as the ACAT request does not automatically close your account for you.

That’s it! As long as you have the correct information and make sure you’re transferring the correct assets, there should be no problem with your ACATS request. If you have other accounts at other brokers, like Fidelity Investments, learn how to transfer your account here.

If you’re curious about any other part of the Robinhood process, check out this page: a regularly updated list of all our Robinhood guides, news coverage, and lists of benefits.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.