The Coronavirus was a globalwide epidemic that put millions of companies out of business. When the pandemic triggered lockdowns in the US, the Dow Jones Industrial Average dropped a thousand points in a month. Although the market has since recovered and registered new highs, many analysts have pointed out that the Dow’s new levels are due to a handful of companies out of the Dow 30 skewing the overall numbers, and thus misrepresenting the health of the general economy. This manipulation of data critique is not unlike the way the current administration is blurring employment statistics by counting thousands of part-time jobs in its totals to project the narrative of a healthier labor environment than what the market is actually experiencing.

Among that handful of companies, Microsoft (NASDAQ: MSFT) has been a standout. Like many tech stocks, it did not suffer from any pandemic lockdown related selloffs, and continued to make gains throughout that period, thanks to additional acquisitions, and other business developments, in tandem with the rest of the tech sector.. However, Microsoft, likemany tech stocks would later drop precipitously, some by as much as 75% from those highs, like Netflix (NASDAQ: NFLX), which dropped from a high of $690 per share to $175 over the course of eight months. This was due to a combination of inflation acceleration and geopolitical fears from the war in Ukraine.

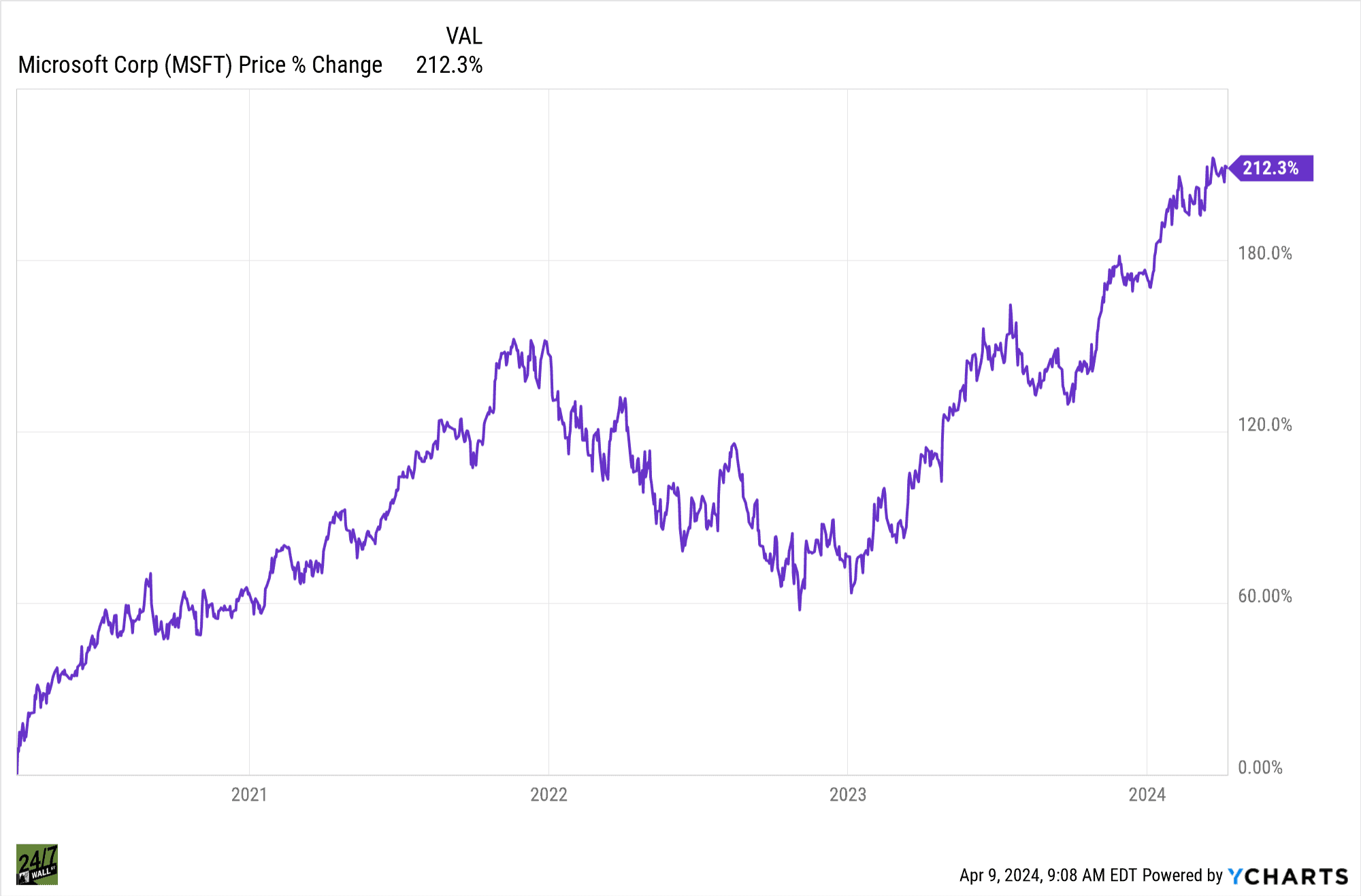

Since the pandemic and the subsequent market crash during 2020, Microsoft has risen over 175% and surpassed rival Apple (NASDAQ: AAPL) in its market cap, which is $3.16 trillion at the time of this writing – and this is inclusive of the aforementioned pullback . Let’s take a look as to why Microsoft has been able to continue its run despite such market turbulence.

Keeping the Virtual Workplace and Gaming Communities Happy

As so many people were forced to spend time indoors, working at home and video gaming took up a bigger portion of their waking hours, and Microsoft’s software and gaming products were at the forefront. Expanding the offering menus to keep customer loyalty and penetrate deeper into untapped markets would be the crux of fulfilling that strategy.

Soon after lockdowns commenced, Microsoft closed a $1.35 billion acquisition of Affirmed Networks for cloud based virtual networking in March. Later in 2020, Microsoft bought video game holding company ZeniMax Media for $7.5 billion. The 4th generation XBOX Series X and Series S consoles would be released in time for Christmas to close out the year.

The following summer, Windows 11 was announced for release in Q3 2021. Purchases of video editing software company Clipchamp, corporate performance metric analysis software company Ally.io, and then, in 2023, the acquisition of Activision Blizzard, the creator of Call of Duty, World of Warcraft, and other popular video games, finally cleared FTC scrutiny and $68.7 billion – all cash – changed hands to make Microsoft “the third largest video game company in revenues, TenCent and Sony”.

Stepping Into The AI Universe

Artificial Intelligence is what has provided the extra horsepower for Microsoft’s continued stock appreciation. Microsoft laid the initial foundation when it acquired exclusive rights to OpenAI’s GPT-3 AI language generator on September 22, 2020. CEO Satya Nadella strategically acquired speech recognition and AI software company Nuance Communications seven months later, and the Microsoft AI path was underway.

Microsoft’s $13 billion investments in OpenAI for ChatGPT applications on its Azure cloud computing platform has been a runaway hit, with Azure AI literally exploding with new subscriptions that will likely fuel additional developments to incorporate Windows 365 in future cloud-based configurations.

Microsoft’s Four Year Stock Performance

The bottom of the stock market came on March 23, 2020 and since then Microsoft is up 212% while the S&P 500 is 148%. If you purchased $10,000 of Microsoft stock at the bottom of the covid crash, you would have $31,230 today compared to $24,800 if invested is the broad market.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.