After a year like 2023, investors are probably still taking the proverbial victory lap, and with good reason, with the Nasdaq up a stunning 43% and the S&P 500 up 24%. However, the tide could turn this year, as inflation remains very sticky, as evidenced by the March consumer price index report.

While the S&P 500 and the Nasdaq are up almost 7% this year and the Dow Jones Industrials just under 2%, the market may be set for a substantial correction. With relentless inflation, geopolitical concerns worldwide, an election year filled with seemingly the most animus in decades, campus unrest like the 1960s, and more, it may be time to head to a safer investing ground.

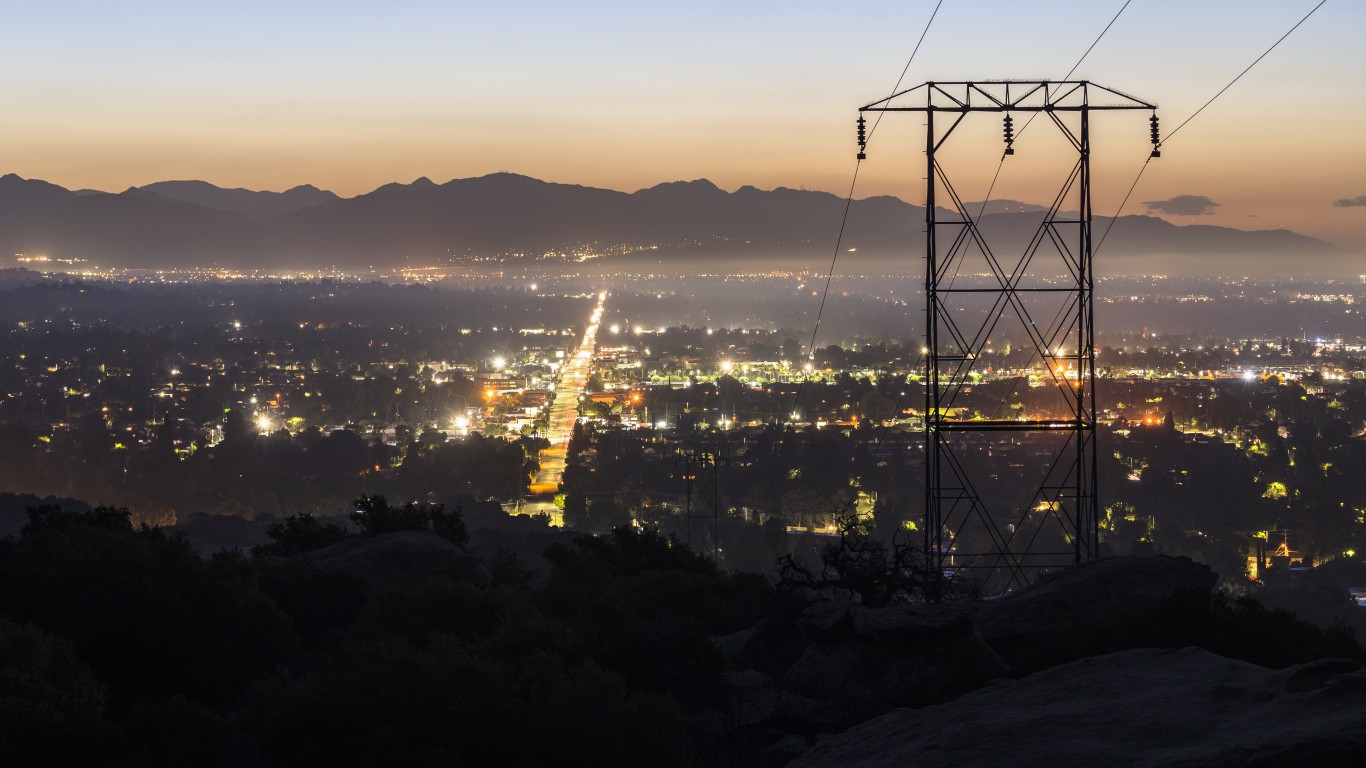

While interest rates are probably not set to come down until the fall at the earliest, one sector that was a victim of rising rates last year may benefit from their decline this year: utility stocks. Everyone needs power, regardless of the economy.

We screened our 24/7 Wall St. utility stock research and found five top buy-rated companies on Wall Street. These companies pay reliable and among the highest dividends in the sector to shareholders and have a proven track record of stability and growth, instilling trust in their potential as investment options.

Why are we covering utility stocks?

Equities will be hit if the major stock market indices significantly decline. However, history shows that stodgy utility stocks will likely hold their ground much better than high-flying technology stocks, especially those chasing Artificial Intelligence mania. With a product that is always in demand and the summer heat right around the corner, high-yielding utilities may be the best idea now for worried investors.

American Electric Power

This industry-leading utility pays investors a hefty 4.08% dividend. American Electric Power Co. Inc. (NYSE: AEP) is an electric public utility holding company that generates, transmits, and distributes electricity for sale to retail and wholesale customers in the United States.

It operates through

- Vertically Integrated Utilities

- Transmission and Distribution Utilities

- AEP Transmission Holdco

- Generation & Marketing segments

The company generates electricity using:

- Coal

- Lignite

- Natural gas

- Renewable energy

- Nuclear energy

- Hydro

- Solar energy

- Wind and other energy sources

It also supplies and markets electric power wholesale to other electric utility companies, rural electric cooperatives, municipalities, and other market participants.

Black Hills

This Dividend King is way off the radar for many but is among the safest plays now and pays a hefty 4.77% dividend. Through its subsidiaries, Black Hills Corp. (NYSE: BKH) operates as an electric and natural gas utility company in the United States.

It operates in two segments:

- Electric Utilities

- Gas Utilities

The Electric Utilities segment generates, transmits, and distributes electricity to approximately 220,000 electric utility customers in:

- Colorado

- Montana

- South Dakota

- Wyoming

The company also owns and operates 1,482 megawatts of generation capacity and 0,024 miles of electric transmission and distribution lines.

The Gas Utilities segment distributes natural gas to approximately 1,107,000 natural gas utility customers in:

- Arkansas

- Colorado

- Iowa

- Kansas

- Nebraska

- Wyoming

In addition, the company owns and operates 4,713 miles of intrastate gas transmission pipelines, 42,222 miles of gas distribution mains and service lines, seven natural gas storage sites, approximately 50,000 horsepower of compression, and 515 miles of gathering lines.

Black Hills also constructs and maintains gas infrastructure facilities for gas transportation customers, provides appliance repair services to residential utility customers, and constructs electrical systems for large industrial customers.

Lastly, it produces electric power through wind, natural gas, coal-fired generating plants, and coal at its coal mine near Gillette, Wyoming.

Dominion Energy

Many of the Wall Street firms we cover are still very positive on utilities, and this company pays a strong 5.21% dividend.

Dominion Energy Inc. (NYSE: D) operates through four segments:

- Dominion Energy Virginia

- Gas Distribution

- Dominion Energy South Carolina

- Contracted Assets

The Dominion Energy Virginia segment generates, transmits, and distributes regulated electricity to residential, commercial, industrial, and governmental customers in Virginia and North Carolina.

The Gas Distribution segment engages in

- Regulated natural gas gathering

- Transportation

- Distribution and sales activities

- Distributes nonregulated renewable natural gas

This segment serves residential, commercial, and industrial customers.

The Dominion Energy South Carolina segment:

- Generates

- Transmits

- Distributes electricity and natural gas to residential, commercial, and industrial customers in South Carolina.

The company’s portfolio of assets included approximately:

- 30.2 gigawatts of electric generating capacity

- 10,500 miles of electric transmission lines

- 85,600 miles of electric distribution lines

- 94,200 miles of gas distribution lines

- Dominion serves approximately 7 million customers.

Duke Energy

This is another excellent idea now, located in a growing part of the country and paying a hefty 4.14% dividend. Duke Energy Corp. (NYSE: DUK) and its subsidiaries operate as an energy company in the United States.

It operates through two segments:

- Electric Utilities and Infrastructure (EU&I)

- Gas Utilities and Infrastructure (GU&I)

The EU&I segment generates, transmits, distributes, and sells electricity in the Carolinas, Florida, and the Midwest.

To develop electricity, Duke Energy uses the following:

- Coal

- Hydroelectric

- Natural gas

- Oil

- Solar and wind sources

- Renewables

- Nuclear fuel

This segment also sells electricity to municipalities, electric cooperative utilities, and load-serving entities.

The GU&I segment distributes natural gas to

- Residential

- Commercial

- Industrial

- Power generation natural gas customers

The segment also invests in pipeline transmission projects, renewable natural gas projects, and natural gas storage facilities.

Entergy

This top utility stock always makes sense for conservative investors and pays a rich 4.25% dividend. Together with its subsidiaries, Entergy Corp. (NYSE: ETR) produces and distributes electricity in the United States.

It operates in two segments:

- Utility

- Entergy Wholesale Commodities

The Utility segment generates, transmits, distributes, and sells electric power in portions of:

- Arkansas

- Louisiana

- Mississippi

- Texas

- And the city of New Orleans

The company also distributes natural gas.

The Entergy Wholesale Commodities segment is involved in:

- The ownership, operation, and decommissioning of nuclear power plants located in the northern United States

- Sale of electric power to wholesale customers

- Provision of services to other nuclear power plant owners

- Ownership of interests in non-nuclear power plants that sell electric power to wholesale customers

The company generates electricity through gas, nuclear, coal, hydro, and solar sources. It sells energy to retail power providers, utilities, electric power co-operatives, power trading organizations, and other power generation companies.

Its power plants have approximately 24,000 megawatts (MW) of electric generating capacity, which includes 5,000 MW of nuclear power.

The company delivers electricity to 3 million utility customers in Arkansas, Louisiana, Mississippi, and Texas.

Exelon

This top utility stock makes good sense now for conservative accounts and pays a dependable 4.02% dividend. Exelon Corp. (NYSE: EXC) is a utility services holding company engaged in the energy distribution and transmission businesses in the United States and Canada.

The company purchases and regulates retail sales of electricity and natural gas and the transmission and distribution of electricity and natural gas to retail customers.

It also offers support services, including:

- Legal

- Human resources

- Information technology

- Supply management

- Financial

- Engineering

- Customer operations

- Distribution and transmission planning

- Asset management

- System operations

- Power procurement services

The company serves:

- Distribution utilities

- Municipalities

- Cooperatives

- Financial institutions

- Commercial, industrial, governmental, and residential customers.

∴

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.