With skyrocketing healthcare costs, it can help to have a savings fund built to tackle future medical bills.

A Health Savings Account (HSA) lets you invest for future qualified medical expenses, while getting tax benefits.

So let’s take a look at how the Fidelity HSA holds up.

Fidelity HSA at a glance

| Account minimum | None |

| Maintenance fees | Zero |

| Account types | Self-directed and robo-advisor |

Fidelity HSA benefits

You can open a Fidelity HSA with no account minimum. And Fidelity doesn’t charge any annual account maintenance fees, as many other HSA providers do.

Plus, you receive triple tax benefits.

- Your contributions are tax-free

- Earnings in the account grow tax-free

- Withdraws for qualified medical expenses are tax-free

But keep in mind that any withdraws made for non-qualified expenses would trigger a 20 percent penalty on the withdraw in addition to regular income tax. The penalty would be waived if you’re age 65 or older, however.

How does the Fidelity HSA work?

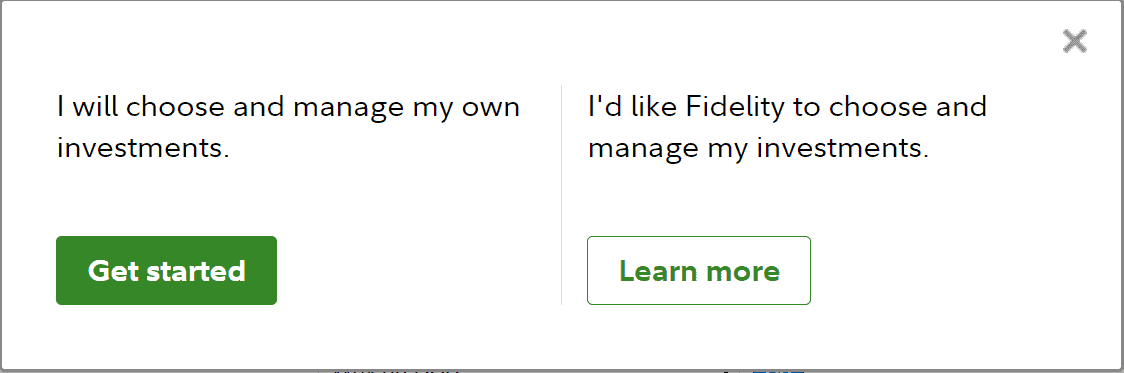

To open an HSA, you’d need to pair it with a high-deductible health plan (HDHP). Afterward, you have two types of Fidelity HSA options.

With a self-directed Fidelity HSA, you get to manage your own account and choose your own investments. Fidelity offers access to virtually the entire universe of securities including the following.

- Stocks (Including fractional shares)

- Bonds

- Exchange-traded funds (ETFs)

- Mutual funds

As a highlight, the firm also lets you invest in its zero-expense-ratio mutual funds. Expense ratios are management fees that could dig into your savings.

You can also explore the firm’s pre-selected HSA Funds to Consider list.

Additionally, you can open an HSA through Fidelity GO. This is a robo-advisor platform. After answering a few questions, the robo-advisor recommends a personalized and diversified investment portfolio for you built with zero-expense-ratio mutual funds. These funds offer exposure to different asset classes including domestic stocks, international stocks, and bonds.

The Fidelity GO HSA is automatically managed, so it can be a good option for those who don’t want to manage and pick their own investments.

But while there’s no minimum to open a Fidelity GO HSA account, you’d need at least $10 to start investing. And you should know that there’s a 0.35% annual management fee for Fidelity GO HSA accounts with balances of $25,000 or more. But this would also give you access to one-one-one, 30-minute calls with individual Fidelity advisors. These individuals can help you map out a financial plan to tackle other financial goals like retirement.

In fact, an HSA allows you to make penalty-free withdrawals for anything after reaching age 65. However, you’d still owe regular income tax on the withdrawal.

Fidelity HSA: The verdict

The Fidelity HSA definitely stands out among the competition. Its zero account minimums and zero maintenance fees make it a top contender for low-cost HSAs. But there are some points to keep in mind like a 0.35% advisory fee on Fidelity GO HSA accounts with balances over $25,000.

How to open a Fidelity HSA account

If you’re interested in a Fidelity HSA, follow these steps.

1. Visit its official page and click on “Open an HSA.”

2. Choose whether you want a self-directed or Fidelity GO account.

3. Select whether you’re an existing customer or new

4. Follow the prompts

Depending on the type of HSA account you’d want and whether you’re a new or existing customer, you’d need to fill out different forms.

But be sure to have the following ready.

- Social Security number

- Address

- Phone number

- Country of citizenship

You’d also need to determine your eligibility. So make sure you have important details regarding the high-deductible health plan you’d like to pair your HSA with.

Why we covered this

Healthcare expenses can be a major burden for many people. So it’s important to have a strategy to prepare for these unexpected obstacles. HSAs can help. But not all providers deliver the same package. So it’s important to do your research. That’s why we took a deep dive into the Fidelity HSA to help you determine if it’s something you may consider.

If you want to learn more about Fidelity, check out our regularly-updated list of Fidelity Investments guides, news, and coverage.

The Easy Way To Retire Early

You can retire early from the lottery, luck, or loving family member who leaves you a fortune.

But for the rest of us, there are dividends. While everyone chases big name dividend kings, they’re missing the real royalty: dividend legends.

It’s a rare class of overlooked income machines that you could buy and hold – forever.

Click here now to see two that could help you retire early, without any luck required.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.