The software-as-a-service (Saas) industry reeling today after Salesforce (NYSE:CRM) released 1st quarter earnings and confirmed 2024 will be a more difficult year than anticipated. Chief among the issues Salesforce revealed was customer spending hesitancies, either kicking projects down the road or significantly reducing there scope.

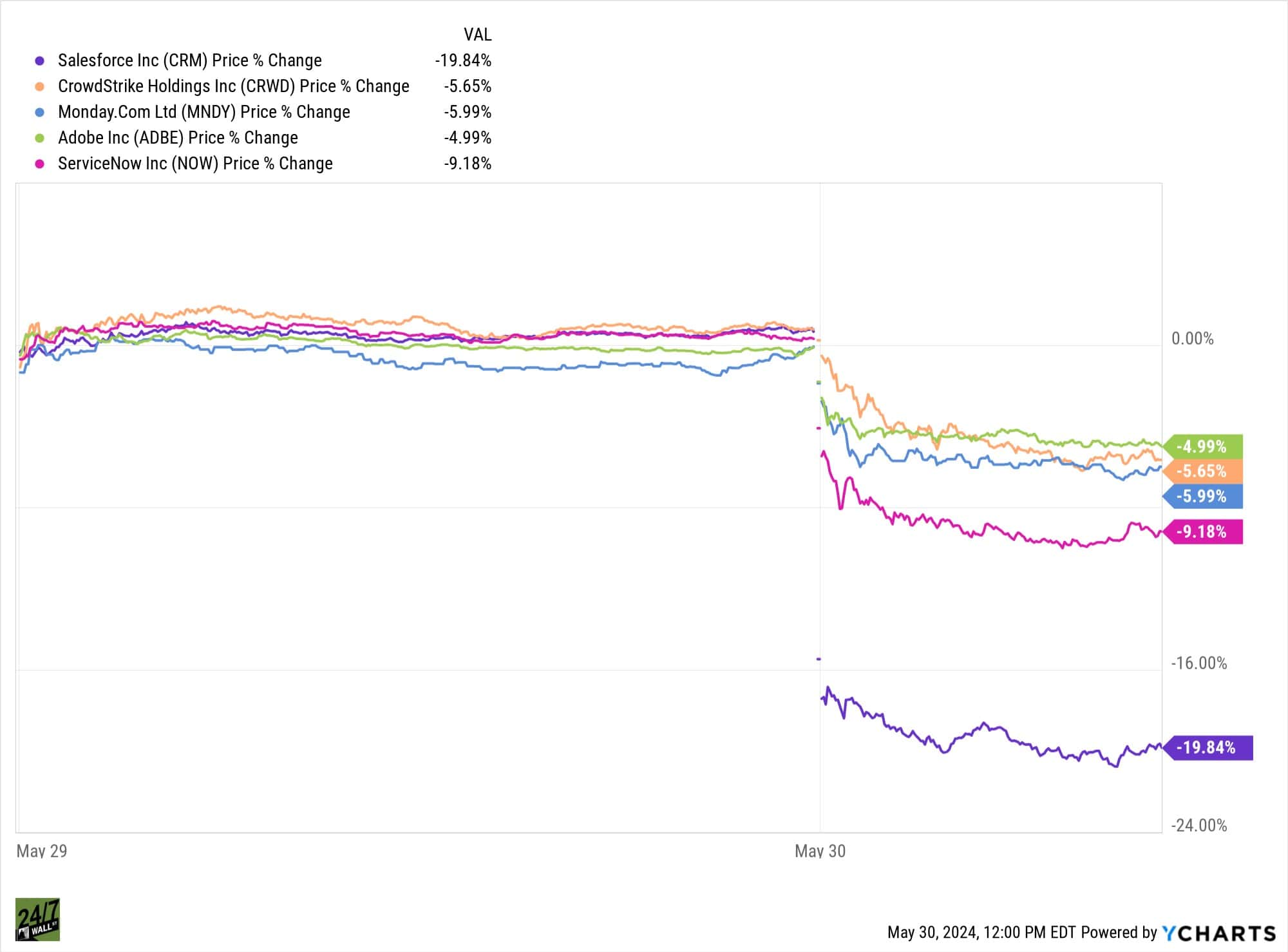

Shares of Salesforce dropped 20% after the market opened Thursday but it was not alone. Crowdstrike (NASDAQ: CRWD), Monday.com (NASDAQ: MNDY) , Adobe (NASDAQ: ADBE), ServiceNow (NASDAQ:NOW), among others were were also down big as Wall Street expects all SaaS companies to experience softer than expected guidance for the next year.

Salesforce (CRM) Earnings Report

Salesforce reported Q1 FY25 earnings after the market closed Wednesday and what followed was the worst trading day for the company in 20 years. Revenue of $9.13 billion was up 11% year-over-year and earnings per share of $2.44 was not far off the mark, but both were on the low side of the estimated range.

Salesforce CFO Amy Weaver stated the company expects headwinds to persists, “we’re assuming that the conditions we saw in Q1 continue throughout our fiscal year”. While the quarter numbers are not stellar, the drop in share price is from investors weighing a high multiple stock in a weakening environment and deciding to pull some cash out.

Are Saas Stocks a Buy?

Savvy investors relish opportunities to find market overreactions and buy stocks they love when prices drop. After Salesforce lost over $30 billion in market capitalization, Wall Street analysts reiterated their stock price estimates for the stock.

Analysts from Raymond James, UBS, BMO Capital, Stifel, Morgan Stanley. among others did not lower their guidance and believe the headwinds are temporary and still see Salesforce as a consensus “Buy” with a 1.84 recommendation. Of the 45 analysts covering CRM, 24 rate the stock a “Strong Buy” with a price target of $315 over the next 12 months.

Crowdstrike is covered by 46 Wall Street analysts and over the past 3 months, the consensus recommendation is a “Buy” with a score of 1.42. The average price target is $399.05 (17% upside) with a high forecast of $540.00 and a low forecast of $300.00.

Adobe is covered by 34 analysts and with a a consensus score of 1.842, the stock is a “Moderate Buy“. The average price target is $614.33 (28% upside) with a high forecast of $711.99 and a low forecast of $445.00.

Monday.com has a consensus score of 1.68 by the 18 analysts covering the stock which makes the stock a “Moderate Buy”. The average price target is $259.67 (8% upside) with a high forecast of $300.00 and a low forecast of $220.00.

Service Now stock is a “Buy” with a consensus score of 1.42 by the 36 analysts covering the stock. The consensus price is $859 per share which is a 17% increase from todays price. The high estimate is $950 and the low forecast is $734.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.