24/7 Insights

- In the past week, insiders returned to scoop up more shares of a fracking services company and a recreational boat maker.

- A couple of chief executives showed some love for their companies as well.

With the earnings-reporting season having all but concluded, the windows for making insider purchases are generally open. In the past week, insiders returned to scoop up more shares of a fracking services company and a recreational boat maker. A couple of chief executives showed some love for their companies as well. Let’s take a look.

Is Insider Buying Important?

A well-known adage reminds us that corporate insiders and 10% owners really only buy shares of a company because they believe the stock price will rise and they want to profit from it. Thus, insider buying can be an encouraging signal for potential investors. This is all the more so during times of uncertainty in the markets, and even when markets are near all-time highs.

Remember that while earnings-reporting season was in full swing, many insiders were prohibited from buying or selling shares. Below are some of the more notable insider purchases that were reported in the past week, starting with the largest.

Oxford Lane Capital

- Buyer(s): CEO Jonathan Cohen and President Saul Rosenthal

- Total shares: almost 9.3 million

- Price per share: $5.40

- Total cost: around $50.0 million

Oxford Lane Capital Corp. (NASDAQ: OXLC) is a management investment company that primarily invests in fixed-income securities. It increased its monthly distribution by 12.5% when it released its fiscal fourth-quarter results recently. The share price is less than 3% higher since then and up almost 9% year to date. Cohen’s purchase was over 4.6 million shares and lifted his stake to more than 4.8 million shares. Rosenthal bought 2.5 million or so shares directly and over 2.3 million shares via family trust.

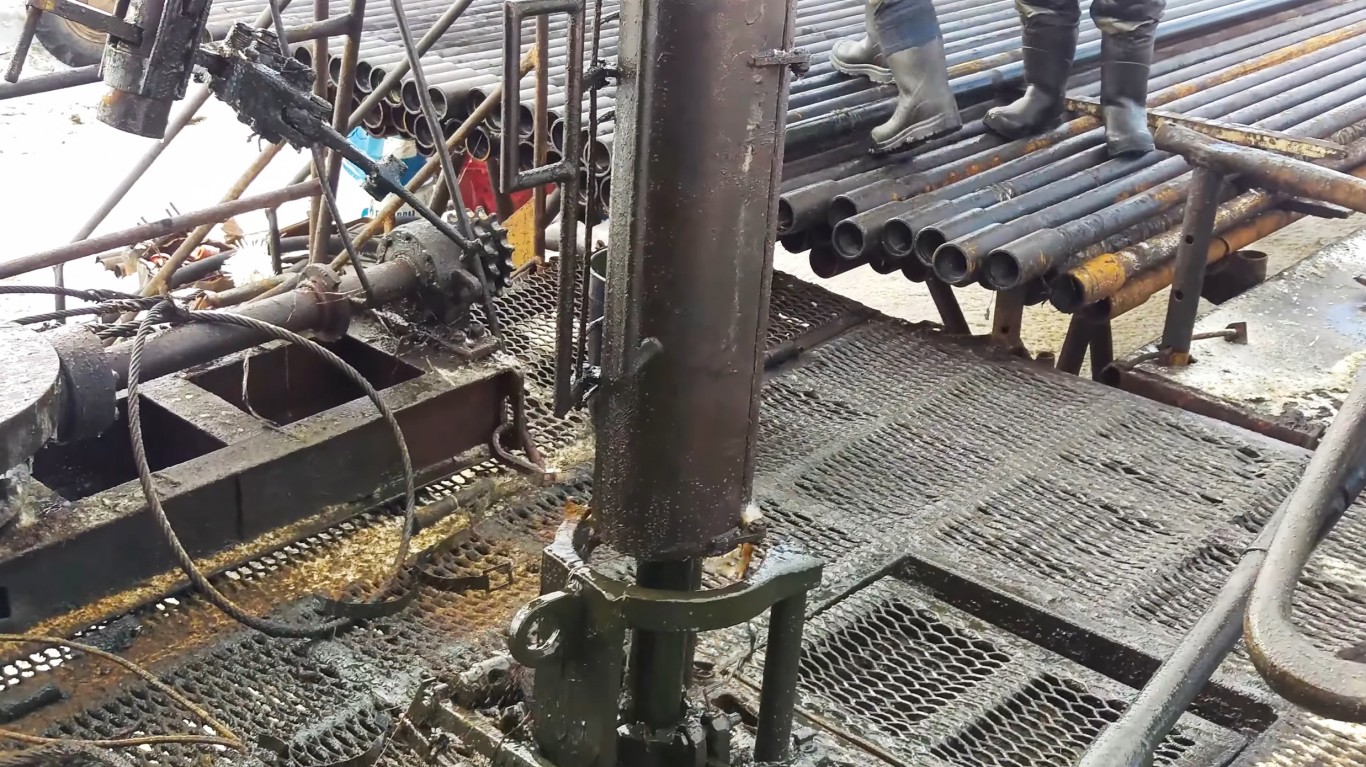

ProFrac

- Buyer(s): 10% owner THRC Holdings

- Total shares: almost 1.5 million

- Price per share: $9.13 to $9.50

- Total cost: over $13.7 million

After picking up more than $14.1 million worth of shares in the prior week, this buyer went back for more. Texas-based hydraulic fracturing services company ProFrac Holding Corp. (NASDAQ: ACDC) named a new chief financial officer recently. Quarterly results posted earlier in the month were in line with expectations. The share price is more than 13% higher since then, and the stock is up more than 12% year to date. The consensus price target of $11.25 is less than the 52-week high of $14.32, but it represents more than 18% upside for the shares in the next 12 months. Yet, only three of seven analysts who cover the stock recommend buying shares.

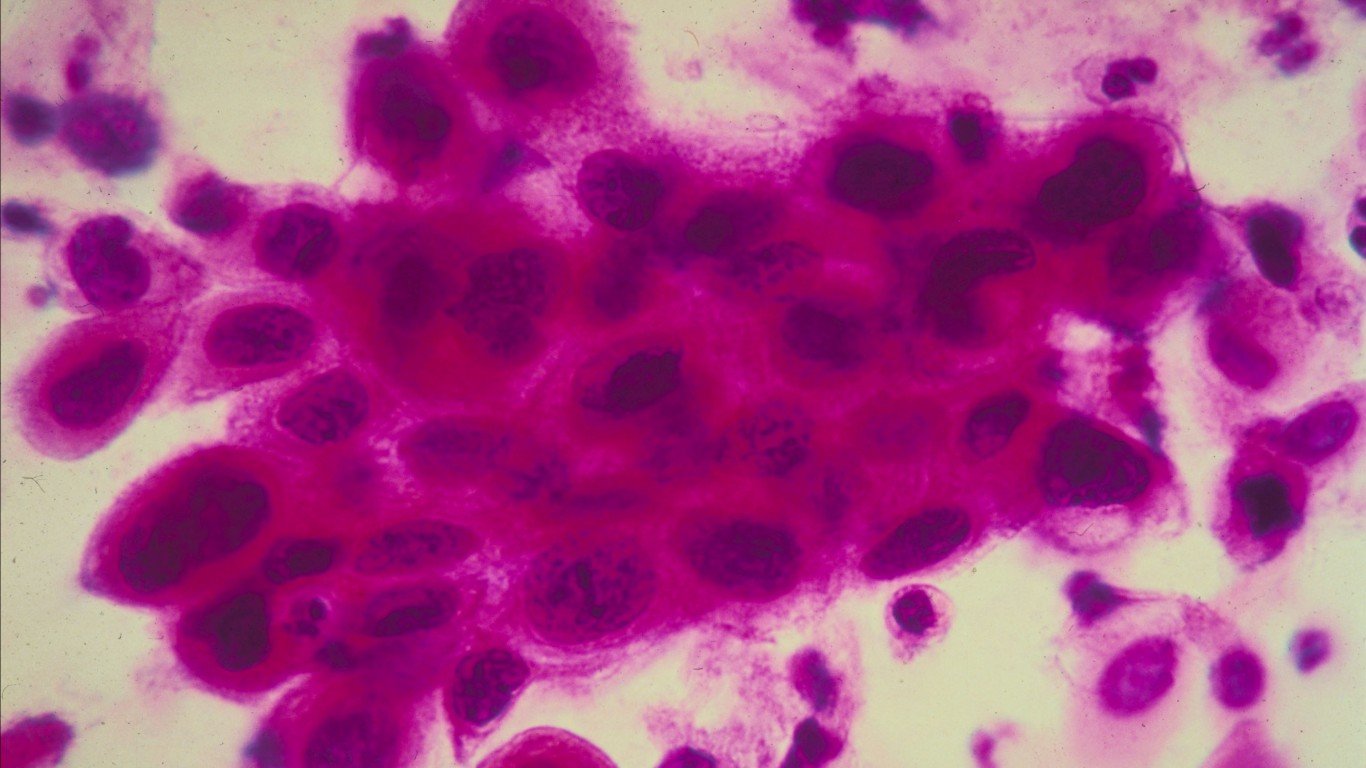

Exelixis

- Buyer(s): a director

- Total shares: 425,000

- Price per share: $20.22 to $20.89

- Total cost: more than $8.7 million

This director bucked a selling trend to boost his stake to over 1.5 million Exelixis Inc. (NASDAQ: EXEL) shares. The California-based biotech recently cleared an overhang by settling patent litigation. It posted disappointing first-quarter results at the end of April. Since then, the stock is down over 9%, despite rising about 4% in the past week. The $26.55 consensus price target is greater than the 52-week high and represents 24% or so upside in the next 12 months. Analysts on average recommend buying shares and have for at least three months. It is also a top pick of hedge fund billionaire Jim Simons.

FTAI Aviation

- Buyer(s): CEO Joseph Adams

- Total shares: 59,000

- Price per share: $82.00

- Total cost: over $4.8 million

This buyer took advantage of an offering of FTAI Aviation Ltd. (NASDAQ: FTAI) stock. The aerospace products manufacturer and aircraft lessor just announced that it will purchase assets from Lockheed Martin. The New York City-based company reported top and bottom line growth in the first quarter and declared a dividend. The stock just hit an all-time of $86.31 and is up about 81% year to date. The share price has overrun the consensus price target, but all of the nine analysts covering the stock recommend buying shares, four of them ratings of Strong Buy.

GeneDx

- Buyer(s): a director

- Total shares: 170,000

- Price per share: $19.56 to $20.61

- Total cost: over $3.4 million

GeneDx Holdings Corp. (NASDAQ: WGS) posted better-than-expected first-quarter results, and the share price is nearly 88% higher since then. The Connecticut-based health care information provider’s stock is up over 650% since the beginning of the year. However, it is well off an all-time high above $850 a share in early 2021, and the share price has overrun the current consensus price target. However, the $24 high price target signals about 17% upside potential.

Also see 10 Life Lessons From Warren Buffett Everyone in Their 20s Should Hear.

Mastercraft Boat

- Buyer(s): 10% owner Coliseum Capital Management

- Total shares: almost 84,000

- Price per share: $20.08 to $20.55

- Total cost: around $1.7 million

After picking up more than $9.5 million worth of Mastercraft Boat Holdings Inc. (NASDAQ: MCFT) shares earlier in May, this beneficial owner returned to the buy window. The Tennessee-based recreational boat maker recently posted fiscal third-quarter results that surpassed projections. And a new chief executive took up the reins back in March. Since the beginning of the year, the stock is down over 7%. The $22.50 consensus price target is less than the 52-week high, but it is 7% or so higher than the current share price. Analysts on average recommend buying shares.

And Other Insider Buying

In the past week or so, some insider buying was reported at Agree Realty, Blackline, Caesars Entertainment, Cencora, Hilton Hotels, Keysight Technologies, Petco Health and Wellness, Rocket Companies, Shutterstock, SoFi Technologies, Sunoco, and Wolfspeed as well.

∴

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.