24/7 Wall Street Insights

- Unlike the declining stocks of some of its pharmaceutical rivals, Eli Lilly has continually beat analysts’ forecasts and prospered accordingly.

- In 5 Years, Eli Lilly has gained +732 points, equal to +618%, from $118 to $850.

- Eli Lilly has had 4 previous stock splits: 1997, 1995, 1989, and 1986 – all 2-for-1. A new one, before reaching $1,000, may be due.

- For investors seeking dividends, click here for a free report on two high dividend stocks.

Indiana headquartered pharmaceutical titan Eli Lilly & Co. (NYSE: LLY) has been leaving its competition in the dust. Over the past 5 years, Eli Lilly is up +618%, outpacing the S&P 500 every year from 2021 – 2023 by over 30 points. In the same period, Johnson & Johnson (NYSE: JNJ) has been essentially flat, and Pfizer (NYSE: PFE) is down -15%. Shareholders who have ridden Eli Lilly up over the past five years are sitting on a $732 per share profit at the time of this writing.

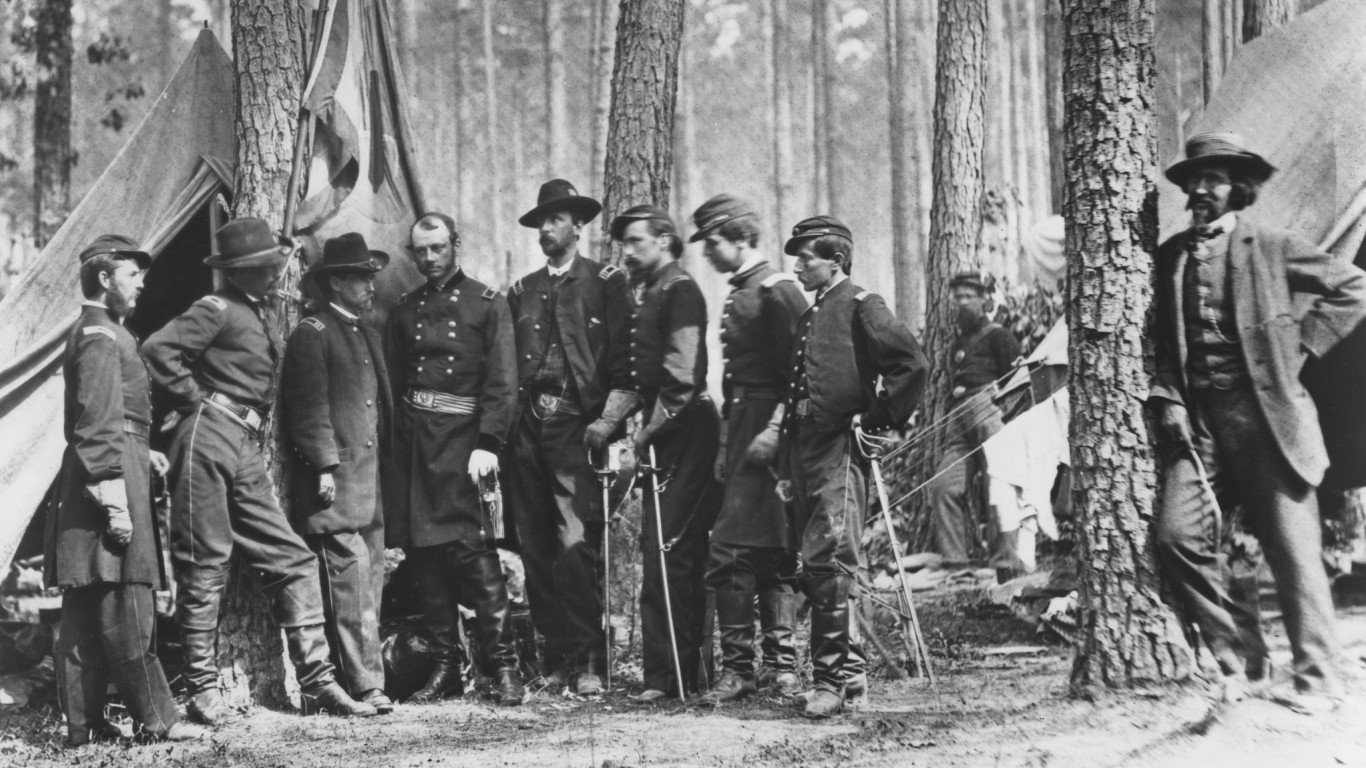

In the Shadow of The Civil War

Eli Lilly & Co. was founded in 1876 by Union Army Civil War veteran Eli Lilly, who was a chemist by trade. Starting with making quinine for malaria and the invention of coatings and flavorings for more palatable medicines, Lilly would soon become an American pharmaceutical industry cornerstone. Antifungals, antibiotics, polio vaccines, and further innovations would continue to fuel Eli Lilly’s growth.

Treating Ailments In Contemporary Fashion

During the 20th century, many diseases and ailments that had plagued society for centuries finally found clinically effective treatment with an Eli Lilly manufactured drug that could offer meaningful amelioration when used on a consistent basis. A partial list of current drugs includes:

Erectile dysfunction – Cialis

Diabetes – Mounjaro

Schizophrenia, Bipolar Disorder – Zyprexa

Obesity – Zepbound

Metastatic Breast Cancer – Verzenio

Not a One Trick Pony

The consistent success achieved by these and a slew of other Eli Lilly drugs have been the key drivers to the stock’s consistent gains. Along the way, some unusual projects have also showcased the financial savvy of Eli Lilly executive management:

- Eli Lilly acquired failing cosmetics brand Elizabeth Arden for $38 million. Implementing greatly needed changes in management and operational policies, Eli Lilly sold Elizabeth Arden to Fabergé for $657 million.

- In anticipation of the power of HMOs for prescription drug allocations, Eli Lilly acquired PCS Systems, one of the largest US prescription drug benefits managers, in 1994.

More Irons In The Fire

Due to insufficient supply of Zepbound, Eli Lilly has committed $9 billion for a new manufacturing plant. Goldman Sachs reported that the weight loss drug market was $130 billion at the start of 2024. The obesity drug market is anticipated to rise as much as 16 times by 2030, and Mounjaro is expected to explode as well with it. If so, Eli Lilly could see a doubling of revenues solely from Mounjaro.

Currently on the FDA’s table are efficacy reviews of Eli Lilly’s dementia therapy, Donanemab. Clinical Phase 3 trial results have shown significant statistical improvements, so an FDA approval would add another arrow to the Eli Lilly quiver.

Additionally, Mirikizumab, which is already in active use for ulcerative colitis, is in Phase 3 trials for treatment of Crohn’s Disease. The results thus far showed that 43% of patients whose symptoms failed to change under biologics achieved clinical remission after a year’s worth of Mirikizumab.

Eli Lilly is also collaborating with Aktis Oncology to develop cancer tumor targeting radiopharmaceuticals. Eli Lilly already owns radiopharmaceutical company Point Biopharma Global Inc.

Why Eli Lilly Is Primed For A Forward Stock Split

With its stock price at $850 and with such strong demand for its products, Eli Lilly is closing in on a near term $1,000 per share price. As such, there are several justifications for a stock split that a number of analysts have identified:

- Eli Lilly has had a total of 4 previous 2-for-1 forward stock splits in the past in 1986, 1989, 1995, and 1997. It has been 27 years since the last split.

- Reducing the price back to near $100, when the current +732 point run started, could justify an 8 or 9-for-1 forward split. This would be a much friendlier admission price for retail investors, many of whom are likely Eli Lilly drug patients.

- Growth from sales of Mounjaro and Zepbound alone can justify continued revenue and earnings growth. Adding Zyprexa’s increased demand and the money making potential from Donanemab and Mirikizumab could easily double revenues and earnings.

- Unlike rivals such as Pfizer, Moderna and Johnson & Johnson, Eli Lilly did not have a widely distributed mRNA based vaccine. New Congressional investigation disclosures tied to Covid-19’s origins and the published links of myocarditis to the mRNA vaccines and their subsequent boosters will likely increase throughout the year. This will be a potential Damocles Sword of legal liability for those companies, a worry Eli Lilly does not share.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.