24/7 Wall Street Insights

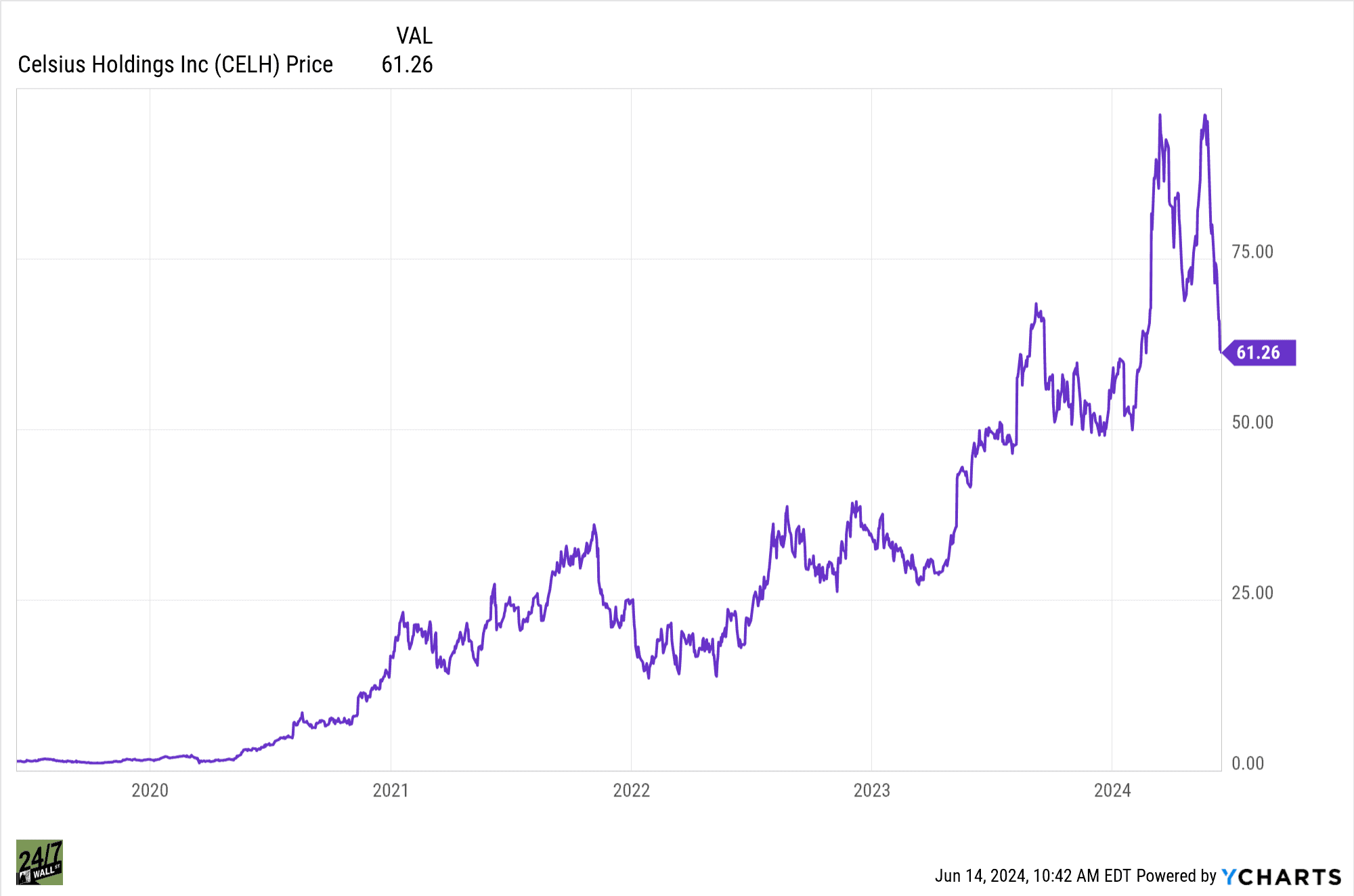

- Sports drink brand Celsius has impressively gained 5,000% over the past 5 years.

- Celsius stock has a history of wide price swings by as much as 40 or more points.

- Some analysts have a Celsius price target of $110, a price within reach of its $98.95 high of May 19th.

- A run from the Celsius stock price of $61.20 at the time of this writing to $110 would equate to an 80% gain.

- For investors seeking dividends, click here for a free report on two high dividend stocks.

An 8 ounce cup of coffee has roughly 90 mg. of caffeine. Celsius Holdings (NASDAQ: CELH) has built a prosperous business on its popular sugar-free, green tea extract and guarana drinks, which contain 200-300 mg. of caffeine. High caffeine drinks have become popular amongst athletes for improved competitive physical ability boosts and with techno-heads, who revel in the mental acuity lift effect of caffeine on the brain.

Celsius Holdings’ beverages are an exception to competitors like Red Bull, which boasts 37 grams of sugar and 111 mg. of caffeine per 12 oz. can. For example, Celsius’ Live Fit Sparkling Raspberry Peach contains 90% of the FDA’s Recommended Daily Allowance (RDA) for Vitamin C, 130% for Riboflavin, and 120% for Vitamin B6. The healthy, zero-calorie, sweetener-free angle has propelled Celsius to a market cap of $14.5 billion since its founding in 2004. 24/7 Wall Street has published past articles referencing Celsius Holdings.

Revenues Spark Analyst Coverage

Celsius Holdings’ first 14 years was a slow process of developing its brand. Founded by Steve Haley, it was regarded as a niche product beverage mostly available in gyms and fitness centers. Six years ago, CFO John Fieldy assumed the CEO position, and that’s when Celsius took off on a caffeine-fueled growth explosion. In 2018, Celsius was a $53 million company with miniscule market share. Today, Celsius’ market share has expanded to nearly 12%, revenue in 2023 topped $1.3 billion, and Celsius beverages are found on the shelves of Walmart and in the refrigerators of 7-Eleven, Jersey Mike’s and Dunkin’ Donuts.

Celsius has quickly become a force in the $19 billion U.S. energy drink space. Touting Celsius’ healthy ingredients and exotic flavors, like Sparkling Green Apple Cherry and Mango Passionfruit, Fieldy posits, has attracted new buyers outside of the general power drink fan base. Celsius’ breakout subsequently caught the attention of analysts like Jeffries, Morgan Stanley, Stifel, Wedbush, and TD Cowen, with “buy”, “outperform” ratings.

The Analysts Weigh In

Celsius Holdings released its Q1 2024 financials in May, 2024. The company impressively posted a 37% year over year revenue increase at $355.7 million. Earnings, more than doubled to $0.27 cents per share. The big story was that Celsius’ sales accounted for 47% of the total growth in the energy drink category for the quarter, year over year. The analysts have since digested the data and announced their 12 month price targets, which include:

- Maxim Group: $110.00

- Stifel Europe: $85.00

- Bank of America: $84.00

- Morgan Stanley: $68.00

Taking a Ride on the Cyclone

The rapid rise and descent price history of Celsius has likely given investors similar adrenaline rushes and nausea-induced dry heaves.

- Starting in 2020, Celsius stock would soar from $4.50 to $61.00 in 12 months.

- It would continue climbing to reach $108 by the end of October, 2021, then drop over 50% to $45 by late January, 2022.

- Celsius would make another run up to over $108 by August, back to $84 by March 2023, then explode to reach $198 in September, 2023, almost a 150% gain in 6 months.

- Entering into a 3-for-1 forward split in November, 2023, the stock would settle in a post-split $49-60 range.

- Between January 28 and March 10, 2024, the stock would then trade between a low of $49.46 and a high of $99.62, nearly doubling over the span of under 45 days.

- Celsius would proceed to plummet 28 points to $67.53 by April, then climb back to $98.00 by May 19, then plunging again to as low as $59.39 as of June 9th.

Gearing Up For the Next Run

Several technical analysts believe that Celsius is clearly in “oversold” territory. This is due to some recent indicators:

- One chart and quantitative analyst noted that “CELH has flashed four similar signals over the past three years, after which the stock was higher one month later 50% of the time, averaging a large 12% gain.”

- BNK Invest also noted that Celsius’ Relative Strength index (RSI) was 29.96 which was in technical oversold territory. The further the stock falls below 30, the greater the potential bounceback on renewed buying.

- Celsius’ July 19th $35 call options recorded the highest amount of implied volatility amongst all equity options on June 12th. The added premium value from this volatility indicates that traders expect to collect fat premiums from call option buyers betting on Celsius to jump back solidly before mid-July. Given Celsius’ past history of huge double-digit gains within monthly timeframes, they might be right.

Among the announcements that Celsius could make to add fuel to the next rocket launch are brand expansions. Fieldly has hinted in previous interviews that the company was looking into functional water, hydration, protein shakes or bars and “some type of confectionary”, as potential options. Celsius has already dallied with Fast, a protein bar sold only in Finland, which it might consider unveiling in the US.

If the $99.62 recent high price is approached in the anticipated next big Celsius price runup, such an announcement could be akin to the proverbial shot of espresso caffeine bomb. The Maxim Group target of $110 could easily be hit and surpassed. And a run of 80% would still be less than some of the other ones that Celsius has made over the past 24 months.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.