Investors have not been getting enough of stock splits in 2024. Of course, a stock split does not change anything fundamentally about a business or the value a shareholder gains from a split, but it does signal how a company is doing.

When stocks split, it’s typically because the share price has been spiking and the split can create more liquidity for investors. Conversely if a stock is declining, a reverse stock split can be executed to keep the stock from trading for pennies.

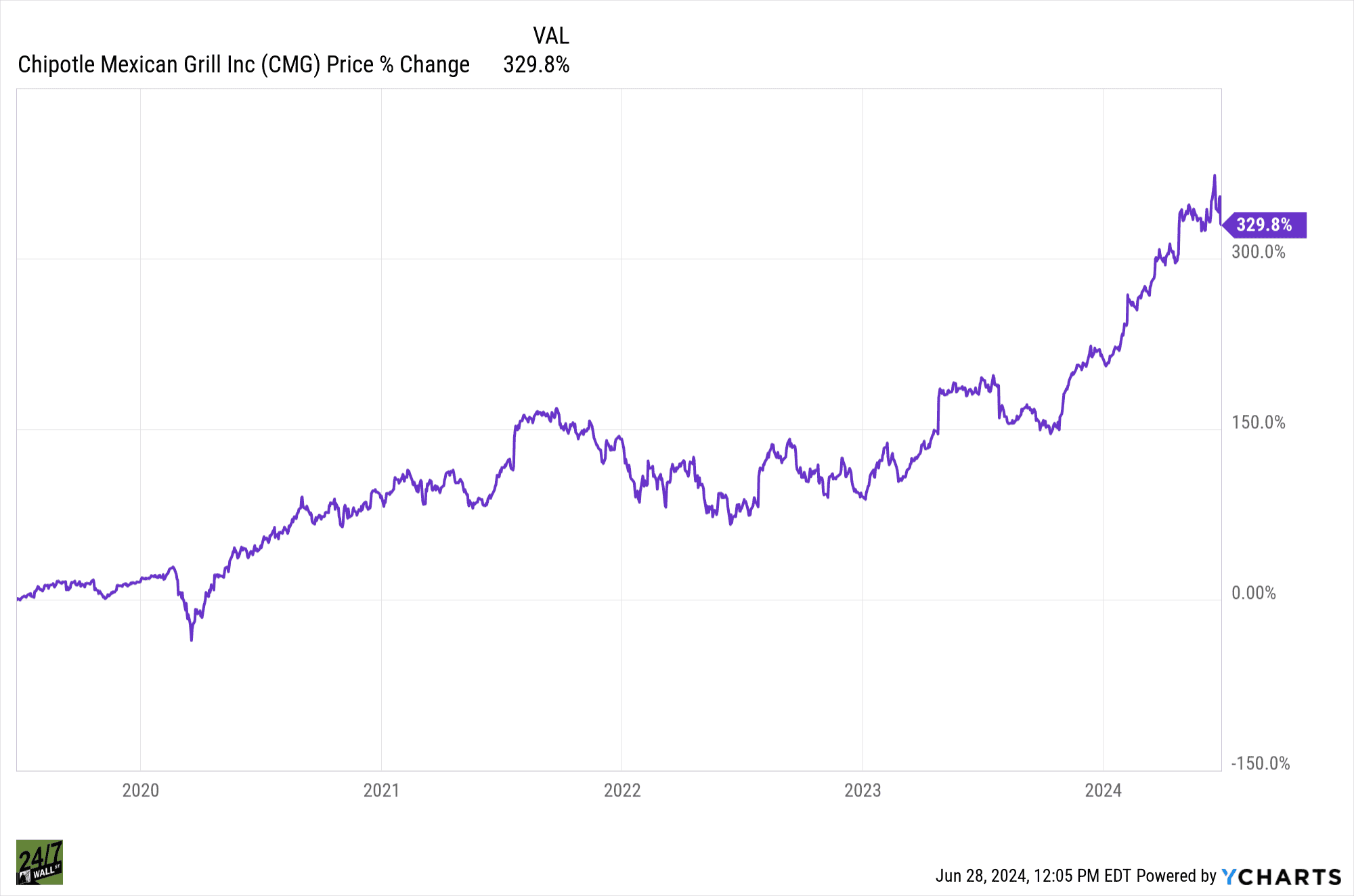

Stock-Split Stock #1: Chipotle Mexican Grill

The biggest stock split of the week, and besides tech giants NVIDIA (NASDAQ: NVDA) and Broadcom’s (NASDAQ: AVGO) 10-to-1 stock splits, one of the biggest of the year was Chipotle’s (NYSE: CMG) 50-to-1 split that took effect on Wednesday.

CMG’s 5 year chart is simply impressive as the stock gained 70% annualized gains as operating income increased fivefold ($336 million to 1.63 billion). While management announced the 50 to 1 stock split in March, it wasn’t until trading on June 26th that the split was official.

This was Chipotle’s first stock split in the company’s history and after trading over $3000 per share, pre-split, it will give management more flexibility in awarding share grants for employees and to draw in more retail investors who might overwise be spooked at a high ticker price.

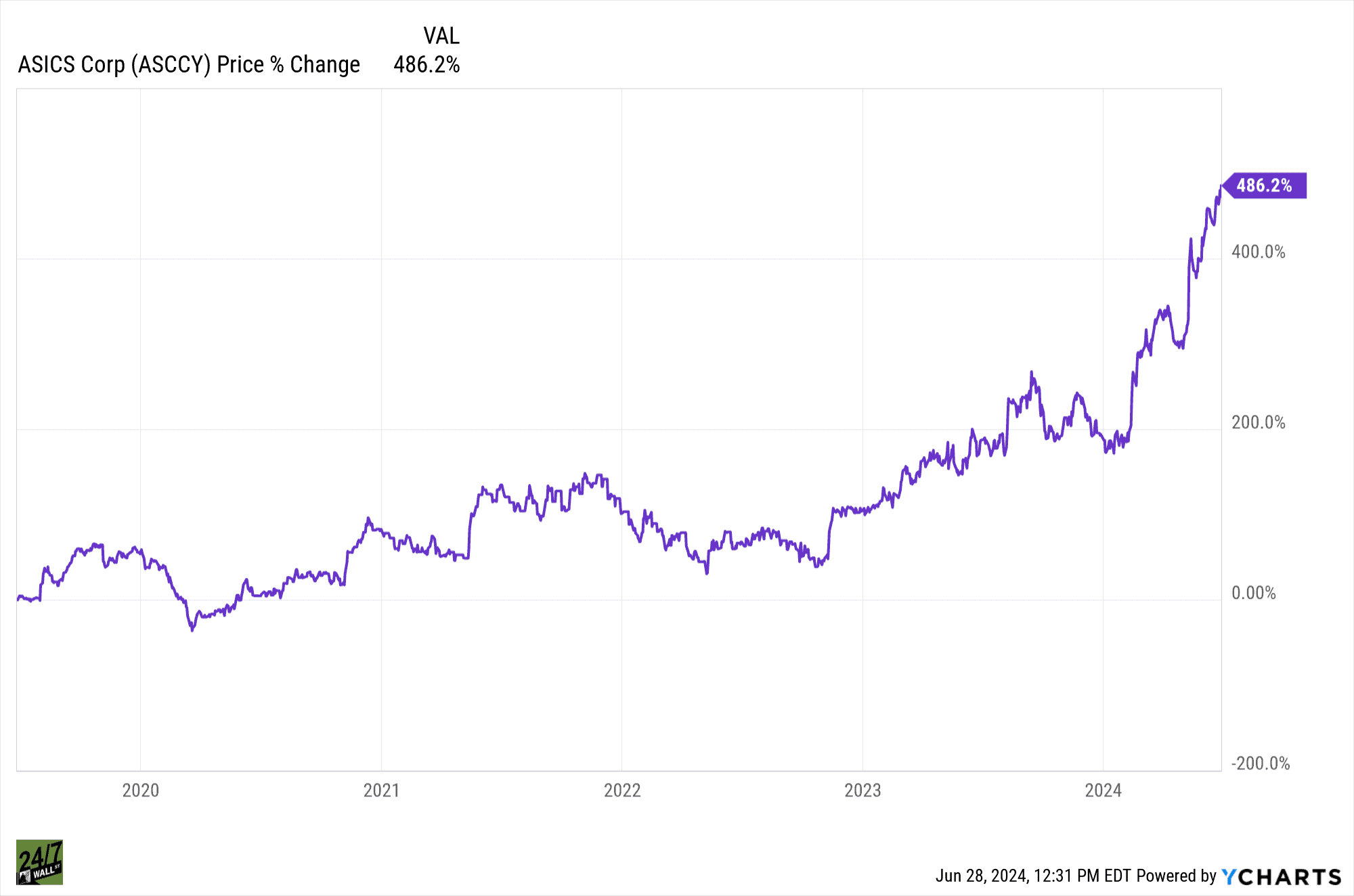

Stock-Split Stock #2: ASICS Corp

Japanese sports equipment and footwear company ASICS (OTCMKTS: ASCCY) announced a 4-to-1 stock split after a Board of Directors meeting on May 10 and will be in effect as trading kicks off after this weekend. The stock is up 486% over the past 5 years and management aims to make shares more accessible to shareholders by increasing liquidity. The split will also bring about a revised dividend from $0.49 to $0.56 per share pre-split.

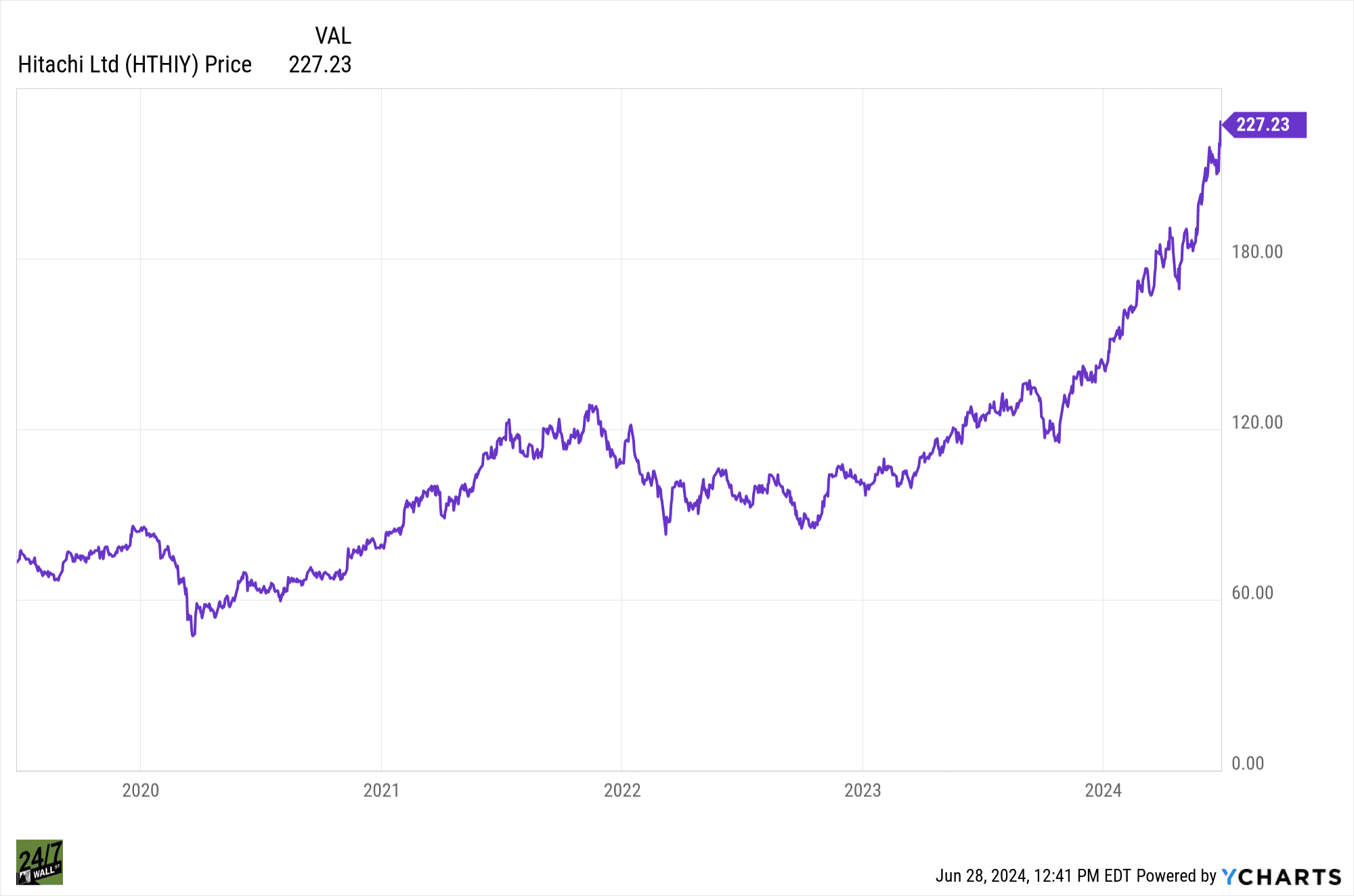

Stock-Split Stock #3: Hitachi, LTD

Hitachi LTD (OTCMKTS: HTHIY), the Japanese conglomerate which plays an integral part in a number of key areas throughout Japan and internationally, announced a 5-to-1 stock split in April and went into effect Friday. As is the theme with stock splits, Hitachi’s stock price is up 220% over the past 5 years and management is using the split to entice a broader investing base.

Even after a solid 5-year run, the current Wall Street price target for next summer is $241 per share or a 7% increase over the share price today.

Stock splits are strong indicators of effective management by making shares more accessible to investors and allowing for better liquidity to reward employees. While the splits don’t change the value of a company, a stock price increase that allows the splits to occur are signs of good management and investors should take note of winners. Finding quality leadership teams is a great way to find quality long term, buy and hold investments.

ALERT: Take This Retirement Quiz Now (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.