As 2017 draws to a close, the annual reckoning of which brands will disappear in the coming year is upon us. The fate of a brand depends on brand mismanagement, the whims of the marketplace, and the determination by corporate big-shots as to whether a brand stays or goes.

Each year, 24/7 Wall St. identifies 10 American brands we predict will disappear in the coming year. Factors we consider include declining sales and losses; disclosure by the parent company it might discontinue the brand; rising costs that are unlikely to be recouped through higher prices; sales or mergers of companies; businesses that will likely go into bankruptcy, or from bankruptcy into liquidation; companies that have lost the great majority of their customers; and operations with dwindling market share.

Most of these examples represent some failure, either in the company or the brand, and sometimes in both. Some of the brands on this list are already certain to disappear, with just the last remnants left to dissolve next year. Others are on their way to vanishing, though their destinies will depend on what happens next year.

Click here to see the brands that will disappear in 2018.

It is a challenge for companies to maintain the strength of a brand. Sometimes businesses make decisions that jeopardize the integrity of the brand. While not on the list, Major League Baseball team the Miami Marlins has struggled with its brand for years as various owners have sold off or traded pricey players who were the top performers. This has angered the fanbase, who question the team’s commitment to winning. In the past, Marlins fans have reacted to these moves by staying away from home games and not buying team merchandise.

The brands on this list include automakers, retailers, media companies, television properties, and insurance companies.

Car companies and retailers routinely appear on lists of endangered brands, though for different reasons. Car makers such as General Motors have jettisoned brands such as Pontiac, which lasted for 83 years but had recently fallen out of favor among younger consumers who preferred imports. Infiniti did not wait that long to discontinue the QX70. The vehicle, introduced in 2003, will be discontinued in 2018. Even though sales had been increasing, they were not rising fast enough.

The reason behind the demise of certain retail brands in recent years, on the other hand, has been the shift to online commerce away from brick-and-mortar stores. But it is not the only reason. In the case of Men’s Wearhouse, parent Tailored Brands bought men’s clothier Jos. A. Bank to reduce costs only to become saddled with debt. The move was made against the advice of Men’s Wearhouse founder George Zimmer.

Another way brands disappear is through a merger or if they are purchased. That might be the fate of Aetna, which agreed to be bought by neighborhood drugstore chain CVS for $69 billion in early December.

These are the brands 24/7 Wall St. predicts will disappear in 2018.

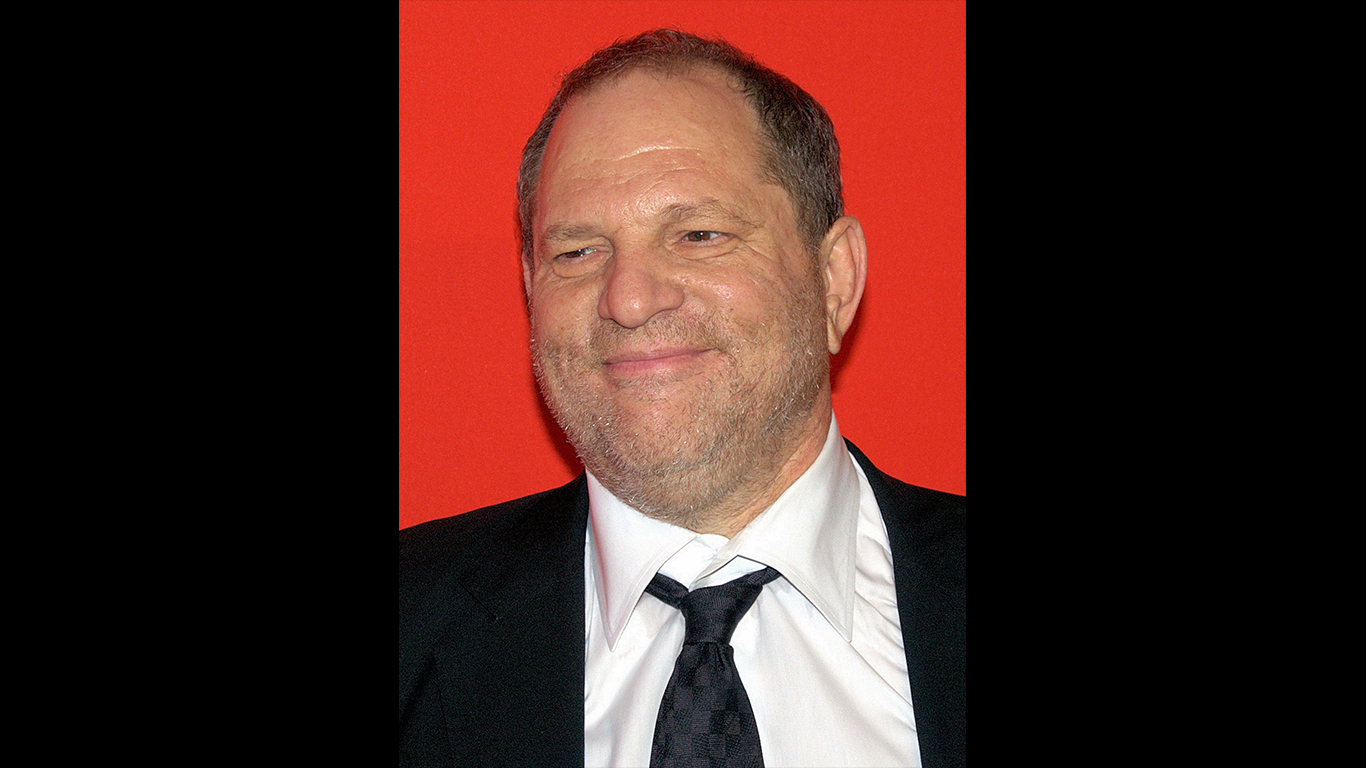

1. The Weinstein Company

The Weinstein Company, helmed by Harvey Weinstein, was among the most storied movie producers in Hollywood history.

The company was started in 2005 by Harvey and his brother Bob. Because of a number of sexual harassment charges made against Harvey, the operations of the Weinstein Company have become untenable.

This does not mean the company is without very valuable assets, which will almost certainly be bought by third parties. Those assets include “Spy Kids,” “The King’s Speech,” “Django Unchained,” “Scary Movie 5,” and more.

There has been speculation that an outsider would invest in The Weinstein Company. In November, two women-led investor groups expressed interest in buying the company. It is a much greater likelihood, though, that the company’s assets would be distributed in a clean and direct purchase.

[in-text-ad]

2. Infiniti QX70

Infiniti QX70 first went on sale in the United States in 2003 and turned heads with its bold design. The QX70 practically invented the crossover sector, a segment consumers cannot get enough of.

Sales of the QX70 in the U.S. market actually climbed 50.3% in the first half of 2017 from the same period a year ago. Yet even though motorists keep buying the QX70, there are shiny new vehicles on the market, such as the QX50 and the QX80, whose sales topped the QX70 over the same six-month period. Infiniti wants to shift resources to newer models, so it is discontinuing its midsize QX70 in 2018.

In explaining the company’s decision to discontinue the QX70, a company spokesman told Motor Trend magazine that “Infiniti is preparing for new and updated crossovers and sport utility vehicles, including the all-new QX50 which we expect will become one of our best-selling products.”

QX70 is Infiniti’s most expensive crossover, and critics in the automobile industry say the QX30, QX60, and the QX50 offer more for less money. Infiniti will focus on the redesigned QX50 compact crossover and the bigger QX80.

Some auto industry observers believe Infiniti’s decision to terminate the QX70 is risky because it remains a solid-selling vehicle.

3. House of Cards

The crown jewel of Netflix’s independently produced content, “House of Cards” — the story of the struggles and rise to power of one of Washington’s most powerful people — is about to film its sixth and final season.

The series’ lead character, Congressman Frank Underwood, is played by Kevin Spacey, who has been bombarded with sexual harassment charges. Spacey will be bumped from the final season, and his character’s wife, Claire Underwood, played by Robin Wright, will become the central character.

The end of the show has come quickly, and it is a shock to Netflix. It was the first Netflix program to be nominated for the Primetime Emmys. Since then, the show, its cast, and crew have been nominated nearly two dozen times.

4. Kmart

Kmart’s fate is intertwined with Sears Holdings, its parent company, which was created in 2005. The parent is controlled by CEO and largest shareholder Eddie Lampert.

Barely a month goes by without some forecast of the retail industry that includes the end of Kmart. Recently, however, the outlook for Kmart has become more dire. Ratings agency Moody’s has sharply increased its odds of Sears Holdings going bankrupt. Despite occasional efforts by Lampert to prop up the company’s balance sheet, its sales are plunging so rapidly that even infusions of capital will not provide a safety net.

In the most recent quarter, parent Sears Holdings posted revenue of $3.7 billion, down from $5 billion in the same quarter the year before. Sears Holdings said the lower revenue was the result of pharmacy closures in open Kmart stores, as well as fewer consumer electronics products available in both Kmart and Sears stores. The company reported a loss of $558 million. Kmart same-store sales fell 13%.

This will be Kmart’s last holiday, at least as an independent brand.

[in-text-ad-2]

5. Men’s Wearhouse

Burdened by a costly purchase of men’s clothier Jos. A. Bank and hurt by changing tastes in men’s clothes, Men’s Wearhouse might be going away in 2018. The brand made famous by founder George Zimmer’s catchphrase, “You’re going to like the way you look. I guarantee it.”

Men’s Wearhouse parent Tailored Brands bought Jos. A. Bank in 2014 for a reported $1.8 billion, betting that the merger would reduce costs. Zimmer had been opposed to the deal, and that had led to his ouster. Zimmer has not gone away quietly. Since he was fired, he has indicated that he wants to take the company private, but no offer has yet been made.

According to a Bloomberg News story earlier this year, Tailored Brands has shed more than half of its value in 2017. Much of this decline has to do with the shift to online shopping and a reduction in customer traffic in stores. It also has to do with more casual dress attitudes in the workplace as millennial workers eschew jackets and ties.

As of December 14, shares of Tailored Brands were down 8.1% so far this year. Apparently, investors do not like the way this stock looks.

6. Diet Pepsi

Changing tastes, health concerns regarding obesity and diabetes, and higher taxes are the main reasons for soda sales draining away in recent years. Diet sodas have not been spared, and sales of Diet Pepsi in particular have tumbled precipitously — and that could lead to its demise in 2018.

The overall trend of declining soda sales has been most problematic for Diet Pepsi, which reported a 9.2% decline in sales volume last year, compared with a 4.3% drop for Diet Coke, according to beverage industry publication Beverage Digest.

Diet sodas were introduced to attract consumers who balked at sugary and full-calorie sodas. However, in recent years, concerns were raised over possible health effects of artificial sweeteners such as aspartame in the zero-calorie drinks.

Pepsi tried to address the concerns over aspartame as well as the drop in volume in 2016 by introducing a diet soda without aspartame. The new product failed to live up to expectations.

Soda’s image was not helped when former First Lady Michelle Obama promoted a campaign to encourage kids to consume more water and drink less soda.

Soft drinks have also been in the crosshairs of politicians. In recent years, cities such as Philadelphia, Pennsylvania, and Berkeley, California, have passed taxes on sugary drinks to discourage their consumption.

[in-text-ad]

7. Aetna

Aetna is as good as gone as an independent company. Pharmacy and managed care company CVS Healthcare announced in early December that it agreed to buy Aetna for $69 billion in what would be the biggest acquisition in 2017.

CVS wants to buy Aetna to get millions of Aetna members to CVS’s retail pharmacies and minute clinics. CVS is also making the deal to give it more leverage in the event Amazon enters the retail pharmacy business.

Aetna, the nation’s third-biggest health insurer, reported third-quarter revenue of $15 billion and net income of $838 million. Aetna has nearly 47 million customers. The predecessor to the managed health care and health insurance operation was founded in 1853 as Aetna Life Insurance Company.

One person who might not be unhappy about the demise of Aetna is current CEO Mark Bertolini, who could make as much as $500 million in stock and cash when the deal closes.

8. Sears

The cratering of the Sears brand is not that different from Sears Holdings’ stablemate Kmart. However, Sears is in worse shape. Its same-store sales in its fiscal third quarter fell a breathtaking 17%.

Like other legacy retailers, Sears has been crippled by a crowded bricks-and-mortar industry and the rise of e-commerce, particularly Amazon. While competitors like JC Penney and Macy’s have largely halted their dropping sales, Sears has not come close to a bottom.

Sears’ primary solution to its sales challenge has been to close stores. Most recently, parent company Sears Holdings shuttered 18 Sears locations. The company said it will have to shrink its store count further next year. Some portion of Sears stores could in theory survive a breakup of the company, but the brand is so badly tarnished, it is hard to see the value of it for a new owner.

9. Fiat

Fiat is one of six brands parent Fiat Chrysler sells in the United States. Although the brand sells well in its native Italy, with a market share of about 20%, Fiat sold only 1,733 units in the U.S. market in November, down 28% from the same month in 2016. That is barely a fraction of the 154,919 cars and light trucks Fiat Chrysler sold in America last month. A recovery of sales is nearly impossible.

The brand consistently receives poor quality reviews from well-known consumer research firms, particularly Consumer Reports and J.D. Power. Consumer Reports recently named the Fiat 500 one of its 10 “least reliable” cars.

Consumer Reports editors conceded that the headroom in Fiat was good, but they thought the ride was “choppy” and the cabin “noisy.” They also felt the steering wheel was place too far away from the driver and said the vehicle’s rear seats were tight and difficult to access. They derided the cargo area as “minuscule.”

[in-text-ad-2]

10. Volkswagen Touareg

The Volkswagen Touareg made a splashy debut in 2004, winning Motor Trend magazine’s SUV of the year award. More than a decade later, Volkswagen is focusing on newer models such as the Atlas SUV, so the carmaker is going to phase out the Touareg next year.

When the Touareg arrived 13 years ago, the car industry lauded its smooth ride and responsive handling that made it feel more like a car than an SUV. As an SUV, the vehicle has sufficient cargo space, ample ground clearance, and is known for its off-road drivability. The Toureg also offers a 10-year/100,000-mile powertrain warranty. The Touareg’s base cost is $49,495 and it aims at a more premium audience.

Critics like its safety features and comfortable and upscale interior, but say the Touareg’s V6 engine feels underpowered and its fuel economy is left to be desired. They also criticize the fact that the vehicle only seats five and has no third row, unlike the next-generation Atlas.

Lately, the vehicle has been having difficulty finding its audience. VW has not sold more than 1,000 Touaregs in a single month since December 2012. So far this year, sales have been down nine out of 11 months from the same period of a year ago.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.