There are few marketing slogans more seductive than “buy now, pay later.” Instant gratification. Getting something you cannot afford with nothing but a promise and a signature (and these days often not even that) — who can resist?

Historians believe that the Sumerians invented the concept of credit, around 3000 B.C. Interest on loans was typically paid with livestock — a loan of 30 head of cattle would be repaid with 31 or more. We have come a long way since then. Today, we use plastic for everything from bagels and lattes to first-class tickets to Australia (and probably sometimes livestock too), and pay interest — sometimes quite a bit of interest — in dollars and cents.

Click here for 10 ways you should never use your credit card

According to credit reporting bureau Experian, the average American has 3.1 credit cards and maintains an overall balance of $6,354. Total credit card debt in this country is now about $829 billion, according to the Federal Reserve Bank of New York’s Center for Microeconomic Data. About 8% of the balances owed are now 90 days or more delinquent.

Clearly, we charge many of our purchases on our cards, and clearly we cannot always pay for them in a timely manner, if at all. While almost any kind of product or service can be bought with plastic — including some you would not expect — there are ways in which cards probably should not be used, even if it is possible to do so.

The key to sensible credit card use is to consider the potential interest costs and fees and compare them with alternate methods of financing; to research the potential effects of this particular credit card use on your credit rating; and to avoid charging something that you will not be able to pay for within a reasonable period of time.

For information on potentially problematic credit card uses, we consulted numerous credit reporting and financial advice websites, including Experian, Equifax, WalletHub, NerdWallet, The Street, Go Banking Rates, Credit Card Insider, and Credit Cards.com. We also drew statistical and other information from the Federal Reserve, the Federal Reserve Bank of New York, the Internal Revenue Service, the CIO Council, Standard & Poor, FICO, CNBC, Investopedia, and Forbes.

1. Buying stocks

When buying stocks with a credit card, the purchaser needs to balance the potential return against the potential cost — that is, interest and other fees from accounts that aren’t paid in full each month. Since the inception of the S&P 500 in 1928, the companies listed have returned an average rate of about 7% annually, when adjusted for inflation. According to the Federal Reserve, the average interest rate for credit card accounts that assess interest is 15.54%. While some cards may offer 0% APR for a limited period of time, rates can reach as high as 25% or more, depending on the card and on a person’s credit rating and payment record. Unless the card account is kept current, there is literally no percentage in buying stocks on credit.

[in-text-ad]

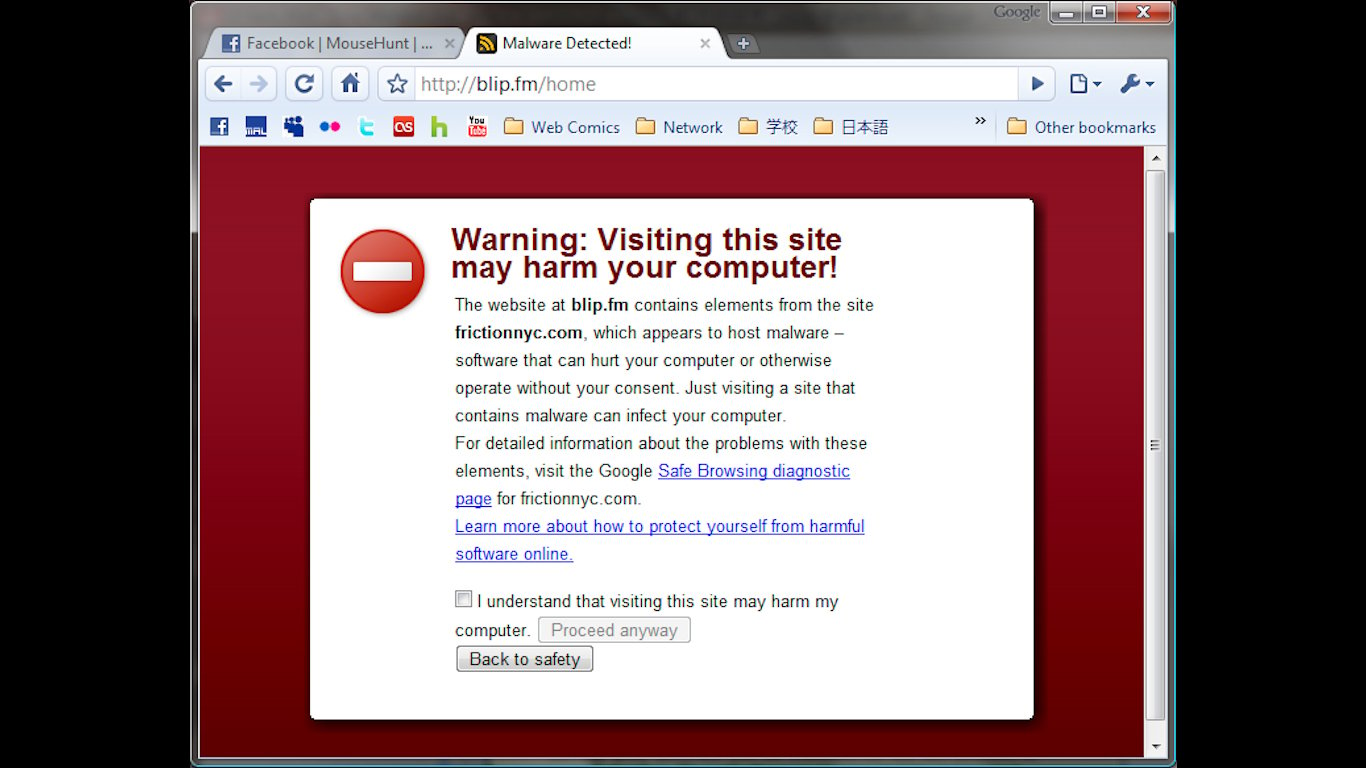

2. Buying anything from unsecured websites

This one is just common sense. Sending credit card numbers or any other personal information to a website whose address begins with HTTP (for hypertext transfer protocol) instead of HTTPS — the “S” means secure — is risky behavior. Not all HTTP addresses are compromised, but the chances of your credit card information and other personal data being intercepted by “man-in-the-middle” hackers are greatly increased with HTTP sites, especially when you use your computer in a public place, like an airport or a coffee shop.

A properly configured HTTPS connection obscures user data, assures that the user is connected to the “real” website in question and not an impersonator, and ensures the integrity of data transferred between user and website.

3. Charging business start-up expenses

What is wrong with using cards to get a business started? It has certainly been done often enough. Film director Kevin Smith spread expenditures across “about a dozen credit cards” (he told Stephen Lowenstein for his book “My First Movie”) to finance his debut feature, the 1994 cult hit “Clerks.” Brian Chesky, co-founder of Airbnb, racked up $25,000 in credit card debt to launch the game-changing hospitality site in 2007. There are countless other examples.

Sometimes, the gambit pays off, obviously. But often it does not. Advisors say that using credit cards makes sense if you know that you can pay off the debt in a timely manner — for instance, if you need to buy inventory that you can turn around quickly and sell for more than you charged. Otherwise, interest rates and potential penalties are too high to make this kind of financing worthwhile.

4. Making down payments on anything

It is tempting to use a credit card to make a down payment on a car, a boat, or even a house. Think of all the points or airline miles you can accumulate! But unless you are using the card just to get the points and can pay off the whole amount charged as soon as the bill comes due, this is not a good idea.

The APR on new car loans is currently 5.05% over 48 months, 4.99% over 60. Very few credit cards offer rates that low, so the wiser financial approach would be to make the smallest down payment possible with cash and finance the balance. If you do not have the cash, maybe you cannot afford the car. (Not all car dealerships — CarMax, for example — will let you use a card, anyway.)

Charging the down payment on property is an even worse idea. Few people have credit card limits large enough to come up with the typical house down payment of 10% to 20%, and even those who do would likely see a negative impact on their credit rating. Maxing out even one credit card could trigger a 40 points or more drop in your FICO score, a metric used in more than 90% of lending decisions in the United States. In any case, you cannot charge a house down payment directly on your card: It has to be done by means of a cash advance, which is also a bad idea (see No. 10), or through a mobile payment service like Venmo, which will add a 3% surcharge to your payment.

[in-text-ad-2]

5. Making “sin” purchases

Credit cards can be used at sex shops, on porn websites, and even to hire the services of prostitutes. Billing from these sources may be disguised as “consulting fees” or something equally anonymous, but all card purchases are recorded on a virtual database, and hackers and law enforcement can usually trace the charges back. You should also bear in mind that you can be more easily discovered if you use your card to buy gifts meant for someone who is not your mate of record — or to use it to pay for motel rooms or fancy dinners in places you shouldn’t be. A good rule of thumb is that if you would not post it on your social media, you should not put it on your credit card.

6. Paying income tax

Federal law prohibits the IRS from receiving tax payments with credit cards directly, but the government has made arrangements with three private firms to accept and pass along such payments. Added fees for card use range from 1.87% to 1.99% of the amount paid. If you owe $5,000 to the IRS, for example, the added fee would be about $100. Also, not all IRS forms can be paid by credit card (though the most common, the 1040, can), and the number of payments allowed through this means each year is limited.

Credit cards are also accepted through tax preparation software with built-in e-file and e-pay functions, but those interest rates can be even higher (2.49% for TurboTax, for instance).

Considering the processing fees and interest, an option that might be preferable to using plastic is an IRS installment agreement, which spreads out payments for as long as 72 months. These agreements come with a set-up fee, and both compounded interest and penalty fees are assessed monthly. Still, these options might still be cheaper.

[in-text-ad]

7. Paying medical bills

Medical bills can be stunningly high, even with insurance — they are the leading cause of personal bankruptcy in America — so why add interest on top of the initial amount? Hospitals and doctors’ offices will frequently work with patients or their families to set up interest-free payment plans or even renegotiate rates. Most hospitals also have financial-assistance plans, even for those above the poverty line.

Even if you can’t make arrangements to pay off the debt, it doesn’t make sense to charge it. Health care providers generally do not report medical debt to the major credit bureaus — Experian, Equifax, and TransUnion — and thus late or unpaid bills are not usually a factor in determining credit scores. Even if a debt has been turned over to a collection agency, new rules instituted in 2017 establish a 180-day waiting period before the debt appears on your credit report — and it disappears entirely the moment the debt is discharged.

8. Paying off other credit cards

When paying a credit card bill, you should not just charge it on another credit card. There are ways around this problem, but none are ideal. One way is to use your card for a cash advance, deposit the money in your bank account, and pay the bill from there. Another is to use one of the convenience checks credit cards sometimes send to customers. Both processes will incur fees, and both advances and checks usually incur a higher APR than regular purchases.

Another way is to transfer the credit card balance to a new card. A number of cards offer 0% APR for a period of time (15 to 20 months is typical), so moving a debt accruing high interest to a card with 0% APR can be a good idea. You have to pay close attention to expiration dates for the 0% rate, though, and be careful never to be late with a payment (which automatically triggers a considerably higher APR). And, of course, one day you will run out of cards and have to pay the total sum or sink back into an interest-accruing account.

9. Paying college tuition

In the case of paying college tuition with a card, again, it is the interest rates charged by the credit cards used that make this a bad deal. Student loans are a much better method of paying for an education. Current federal interest rates for direct loans range from 5.05% to 7.6%, and it is hard (if not impossible) to beat that with a card. To make matters worse, many schools will add a 2% to 3% processing fee to the tab for credit card payments.

[in-text-ad-2]

10. Taking cash advances

If possible, it makes much more sense to use a credit card directly to make a purchase or pay for services. Credit cards usually charge higher APRs on cash advances than on straight purchases. Even if a card’s regular rate is as low as 12%, the cash advance interest could be twice that — and there is sometimes a transaction fee added. (Obviously, this advice does not apply to a credit card that also functions as an ATM card, though in that case you might be subject to bank fees, especially if you use an ATM machine that does not belong to your bank.)

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.