Amid escalating tensions between the United States and Russia, East Asia countries and China, and in other areas around the globe, as well as tensions and armed conflicts throughout the Middle East, the production and circulation of military supplies around the world continues to grow.

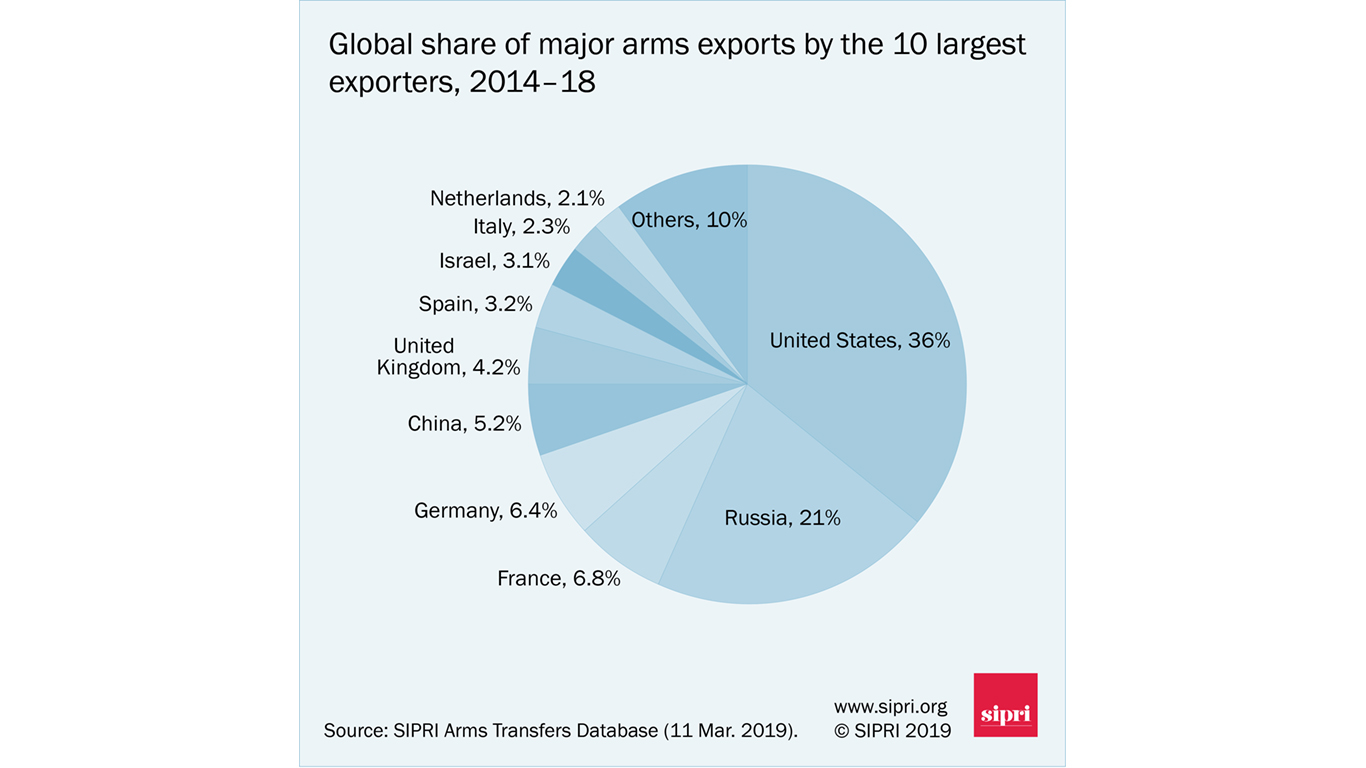

The United States, Russia, France, Germany, and China were the world’s largest exporters of military supplies in the years 2014-2018 — accounting for 75% of all arms exports, according to the latest report on major arms export volumes published by the Stockholm International Peace Research Institute (SIPRI) on March 11.

While all of the exporters on this list are capable of producing arms of all types, about half (13) of the world’s 25 top arms suppliers are also among the world’s 40 largest importers of military equipment.

The main rationale behind a country’s investments in national arms production is “to preserve its autonomy of supply in arms so [it is] not dependent upon other countries to obtain weapons,” said Aude Fleurant, director of the arms and military expenditure programme with SIPRI, in an email to 24/7 Wall St.

How much and to whom these military supplies are exported hinge on each nation’s obligations to military alliances, the leverage that might be wielded by decreasing or increasing flow of arms during conflicts, as well as modernization of existing arms supplies. Here are the countries increasing their major arms exports the fastest, and these are the countries where arms imports are surging.

“In the context of wars or significant political tensions, a supplier can decide to stop transfers of weapons to a country and therefore severely change the balance of power, creating more volatility,” said Fleurant.

To identify the world’s biggest arms dealers and their biggest clients, 24/7 Wall St. reviewed the 12 countries with the highest shares of global arms exports in the five year period 2014-18 from the report on major arms export volumes published by the Stockholm International Peace Research Institute (SIPRI) on March 11. SIPRI identified 67 countries as exporters of major arms in 2014-18. Each country’s major clients, all major arms import and export data, as well as annual military expenditures in 2017, also came from SIPRI. Each country’s GDP per capita in 2016 came from the World Bank.

Click here to see the world’s biggest arms dealers and their biggest clients.

12. Ukraine

> Share of global arms exports (2014-18): 1.3%

> Main client, share of supplier’s total exports: China, 27%

> GDP per capita: $7,894

> Armed forces, total personnel (2016): 292,000

Ukrainian arms exports comprised 1.3% of total global arms exports in 2014-18, down 47% from 2.7% of global arms exports in the five-year period ending 2013. Ukraine’s exports to sub-Saharan Africa fell 79% compared to 2009-13, when Ukraine was the region’s top supplier of military equipment. The country is one of only three on this list of 12 top arms dealers to report a decline in export volume.

China is Ukraine’s biggest client, receiving 27.0% of Ukrainian arms deliveries. Russia and Thailand follow, accounting for 23.0% and 14.0% of Ukraine’s major arms exports respectively. It is notable that Russia is Ukraine’s second biggest arms client and its largest trade partner, despite conflict between the two over Russia’s annexation of Crimea in 2014.

[in-text-ad]

11. South Korea

> Share of global arms exports (2014-18): 1.8%

> Main client, share of supplier’s total exports: Indonesia, 17%

> GDP per capita: $35,938

> Armed forces, total personnel (2016): 634,000

South Korea’s share of global arms exports nearly doubled from 1.0% in the period 2009-13 to 1.8% in 2014-18. South Korea announced late last year revisions to its Defense Acquisition Program Administration (DAPA), aimed at ramping up military exports.

By contrast, imports to the republic shrank over the two periods, from 3.6% of global arms imports to 3.1% — enough for South Korea to remain among the 40 largest importers of military supplies. While U.S. arms exports rose overall, the world military leader’s deliveries to South Korea decreased by the largest amount out of all its clients except for Pakistan.

Click image to enlarge

10. Netherlands

> Share of global arms exports (2014-18): 2.1%

> Main client, share of supplier’s total exports: Jordan, 15%

> GDP per capita: $48,473

> Armed forces, total personnel (2016): 41,310

Like many of the world’s top arms exporters, the Netherlands is relatively affluent. With a GDP per capita of $48,473, the nation is easily among the 25 richest countries in the world.

Like most of the world’s top arms dealers, Dutch military exports rose between 2009-13 and 2014-18 by 16%. Jordan, Indonesia, and the United States were the country’s biggest clients, claiming 15.0%, 15.0%, and 11.0%, respectively, of Dutch arms exports. The Netherlands is also a major supplier of arms to Central America and the Caribbean, accounting for 16% of arms sent to the region. That share is a distant second to Mexico’s exports to the area, which rose dramatically to 72% due to Mexico’s involvement in operations against drug cartels.

9. Italy

> Share of global arms exports (2014-18): 2.3%

> Main client, share of supplier’s total exports: Turkey, 15%

> GDP per capita: $35,220

> Armed forces, total personnel (2016): 356,850

Exports by most major arms producers increased over the most recent five year period, but Italy’s total arms exports dropped by 7% between 2009-13 and 2014-18. Its share of total global arms exports fell from 2.7% to 2.3% between those periods. However, similar to many other countries in Europe, imports of arms to Italy are up substantially. Between the two periods, military supplies flowing to Italy rose by 162%, bringing the country’s share of global arms imports to 1.5% — the 20th largest share.

Italy is home to international defense contractor Leonardo, which with $8.9 billion in arms sales in 2017 ranks as the ninth largest arms manufacturer in the world. Here are the 20 international companies profiting the most from war.

[in-text-ad-2]

8. Israel

> Share of global arms exports (2014-18): 3.1%

> Main client, share of supplier’s total exports: India, 46%

> GDP per capita: $33,132

> Armed forces, total personnel (2016): 184,500

During the 2014-18 period, Israel exported 3.1% of the world’s major military supplies. India — Israel’s top client — received nearly half of all deliveries. Israel’s next biggest clients after India are Azerbaijan, with 17.0% of Israeli exports, and Vietnam, with 8.5%.

Israel’s arms exports rose 60% from 2009-13, and as is the case in just six other countries on this list, imports also rose considerably. Military supplies flowing into Israel rose $354% between 2009-13 and 2014-18 — the largest such increase of any country reviewed by SIPRI. The rise in both exports and imports in Israel reflects Israel’s rising military expenditure, which increased from $14.8 billion in 2016 to $15.5 billion in 2017.

Click image to enlarge

7. Spain

> Share of global arms exports (2014-18): 3.2%

> Main client, share of supplier’s total exports: Australia, 42%

> GDP per capita: $34,272

> Armed forces, total personnel (2016): 197,950

A top 10 global arms supplier, Spain’s share of arms exports rose slightly, by 2.3 percentage points, between the two five year periods through 2013 and 2018. The country’s main client is Australia, which is the fourth largest arms importer based on share of all arms imports. Even as Spain’s largest client, importing 42% of all Spain’s arms exports, Australia received twice as much from the United States.

Spain’s second and third largest clients were Turkey and the world’s largest importer of military supplies: Saudi Arabia.

[in-text-ad]

6. United Kingdom

> Share of global arms exports (2014-18): 4.2%

> Main client, share of supplier’s total exports: Saudi Arabia, 44%

> GDP per capita: $39,753

> Armed forces, total personnel (2016): 150,250

As the world’s largest importer of military supplies, Saudi Arabia is a common top client of exporters on this list. The United Kingdom is one such supplier, with 44% of its exports destined to Saudi Arabia. Oman and Indonesia are the UK’s next largest clients, accounting for 15.0% and 11.0% of UK’s arms exports, respectively.

The United Kingdom’s position as the world’s sixth largest arms exporter is due in no small part to the business of its largest defense contractor, BAE Systems. With 2017 arms sales of $22.9 billion, the company is the fourth largest arms manufacturer in the world. UK-based Rolls-Royce is another contributor, with $4.4 billion in arms sales in 2017. Here are the 20 international companies profiting the most from war.

5. China

> Share of global arms exports (2014-18): 5.2%

> Main client, share of supplier’s total exports: Pakistan, 37%

> GDP per capita: $15,309

> Armed forces, total personnel (2016): 2,695,000

China more than doubled its annual military expenditures over the last decade. Its 2017 spending of $228 billion was second in the world after only the United States. There was a small 2.7% uptick in Chinese exports between the five year periods through 2013 and 2018, in stark contrast to the 195% spike between the periods 2004-2008 and 2009-13. Although China remains among the 40 largest importers of military supplies, its total arms imports declined by 7% between 2009-13 and 2014-18.

China’s reach has expanded considerably over that time, with the number of its arms export clients increasing from 32 in 2004-08 to 41 in 2009-13 to 53 In 2014-18. Pakistan remains China’s biggest client as it has been since 1991, accounting for 37% of Chinese military exports in the period 2014-18. Bangladesh and Algeria are China’s next largest clients, purchasing 16.0% and 11.0% of China’s exports, respectively. China has expanded its arms export business despite political limitations. For example, India, Australia, South Korea, and Vietnam, which are each among the world’s largest importers of major arms, do not procure Chinese arms for political reasons.

4. Germany

> Share of global arms exports (2014-18): 6.4%

> Main client, share of supplier’s total exports: South Korea, 19%

> GDP per capita: $45,229

> Armed forces, total personnel (2016): 179,100

Like most major national arms distributors, Germany is an affluent nation. Its GDP per capita of $45,229 is among the highest in the world. And while Germany is Europe’s largest economy, it spends just 1.2% of its GDP on its armed forces, one of the lowest percentages among countries with large arms industries.

In terms of exports, German arms sales comprise 6.4% of world exports, trailing only three countries. The volume of arms exports from the country increased by 13% between 2009-13 and 2014-18. Approximately 30% of German military supplies went to Asia and Oceania, 27% to other states in Europe, and 25% to the Middle East. Germany’s largest client is South Korea. Ships, and submarines in particular, made up 52% of German arms exports in the 2014-18 period.

[in-text-ad-2]

3. France

> Share of global arms exports (2014-18): 6.8%

> Main client, share of supplier’s total exports: Egypt, 28%

> GDP per capita: $38,606

> Armed forces, total personnel (2016): 306,100

Of France’s 78 clients, Egypt was by far the largest, accounting for 28% of French military exports in the 2014-18 period. France’s next biggest clients were India, with 9.8% of France’s arms exports, and Saudi Arabia, with 7.4%. France’s total arms exports rose by 43% between 2009-13 and 2014-18.

Many of the producers of French military supplies are among the world’s largest arms manufacturers. French industrial conglomerate Naval Group and Paris-based Thales sold $4.1 billion and $9.0 billion worth of arms, respectively, in 2017, each among the top 20 companies worldwide — here are the companies profiting the most from war.

2. Russian Federation

> Share of global arms exports (2014-18): 21.0%

> Main client, share of supplier’s total exports: India, 27%

> GDP per capita: $24,766

> Armed forces, total personnel (2016): 1,454,000

Against the broad trend of rising arms transfers (up 7.8% globally), and unlike most countries reviewed by SIPRI (arms exports were up in 16 out of 25), Russian major arms exports decreased by 17% between 2009-13 and 2014-18. Russia’s arms exports continue to decline, especially when compared to U.S. exports. During the 2009-2013 period, the United States exported 12% more military supplies than Russia, in 2014-18 it exported 75% more.

Still, with 21% of all arms transfers globally originating in Russia, the country remains an arms export superpower. And while the decrease in exports came from general declines in deliveries to long-time major clients Venezuela and India, Russian arms exports to other regions rose. Most notably, major arms exports to Iraq rose by 780%, comprising 46% of Russia’s arms deliveries. Russian exports to the Middle East rose 19%. Most of Russia’s arms exports are delivered to its top three clients: India, China, and Algeria. Forty five other nations receive Russian military equipment.

[in-text-ad]

1. United States

> Share of global arms exports (2014-18): 36.0%

> Main client, share of supplier’s total exports: Saudi Arabia, 22%

> GDP per capita: $54,225

> Armed forces, total personnel (2016): 1,348,400

The United States continues to be far and away the world’s largest supplier of military equipment. U.S. arms exports grew by 29% between 2009-13 and 2014-18, bringing its share of total global exports from 30% to 36%.

Out of the nation’s known 98 clients, the Middle East, and Saudi Arabia in particular, are the biggest, accounting for 52% and 22.0% of U.S. arms exports, respectively. Exports to the region from the United States rose by 134% between 2009-13 and 2014-18.

While capable of producing all types of its own military equipment, the United States is also one of the world’s largest importers of arms. After falling 47% since 2009-13, major arms imports to the United States remained 16th in the world in 2014-18.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.