Cities like New York, San Francisco, and Washington D.C. are commonly referred to as “superstar cities” — innovation hubs that are home to major companies in industries like defense, finance, and technology. Companies in these cities pay top dollar to attract talent from across the country and around the world, thus contributing to skyrocketing living costs that are often well above what the typical American can afford.

The overall cost of living ranges from 18% to 28% higher than average in these cities. Housing can be particularly unaffordable, with rents costing at least 50% more on average. These are the cities where the middle class can no longer afford housing.

Living in a major city, and benefitting from the concentration of jobs, amenities, and culture, does not have to break the bank, however. There are dozens of cities nationwide with a lower than average cost of living and with relatively affordable housing markets — and many of them are growing rapidly.

Using data from the U.S. Census Bureau and the Bureau of Economic Analysis, 24/7 Wall St. identified the 50 most affordable metropolitan areas Americans are moving to. In each of the metro areas on this list, the overall cost of living is lower than the national average, and typical housing costs are more in line with area incomes than average across all cities. Additionally, between 2010 and 2018, far more people have moved to these cities than have left.

Not only are people moving to these cities, but many are also choosing to start families in these areas. About half of the cities on this list also reported higher than average natural population growth — meaning there were more births than deaths between 2010 and 2018. Not surprisingly, many of these cities are among the fastest growing in the United States. Here is a closer look at America’s 25 fastest growing cities.

Click here to see America’s cheapest cities where everyone wants to live right now

Click here to read our methodology

50. Atlanta-Sandy Springs-Roswell, GA

> Total population: 5,949,951

> Pop. growth due to net migration, 2010-2018: +6.7% (+351,958)

> Cost of living: 3.2% less than nat’l avg.

> Median home value: $233,700

> Median household income: $69,464 (top 25%)

[in-text-ad]

49. Savannah, GA

> Total population: 389,494

> Pop. growth due to net migration, 2010-2018: +6.9% (+23,958)

> Cost of living: 6.1% less than nat’l avg.

> Median home value: $205,600

> Median household income: $58,178

48. Gainesville, GA

> Total population: 202,148

> Pop. growth due to net migration, 2010-2018: +7.1% (+12,744)

> Cost of living: 11.5% less than nat’l avg.

> Median home value: $217,900

> Median household income: $61,699

47. Panama City, FL

> Total population: 201,451

> Pop. growth due to net migration, 2010-2018: +7.2% (+13,302)

> Cost of living: 6.1% less than nat’l avg.

> Median home value: $175,000

> Median household income: $51,842

[in-text-ad-2]

46. Iowa City, IA

> Total population: 173,401

> Pop. growth due to net migration, 2010-2018: +7.3% (+11,156)

> Cost of living: 5.7% less than nat’l avg.

> Median home value: $225,300

> Median household income: $64,635 (top 25%)

45. Spartanburg, SC

> Total population: 341,298

> Pop. growth due to net migration, 2010-2018: +7.4% (+23,140)

> Cost of living: 11.6% less than nat’l avg.

> Median home value: $147,800

> Median household income: $51,853

[in-text-ad]

44. Greenville-Anderson-Mauldin, SC

> Total population: 906,626

> Pop. growth due to net migration, 2010-2018: +7.6% (+62,935)

> Cost of living: 10.1% less than nat’l avg.

> Median home value: $169,100

> Median household income: $55,790

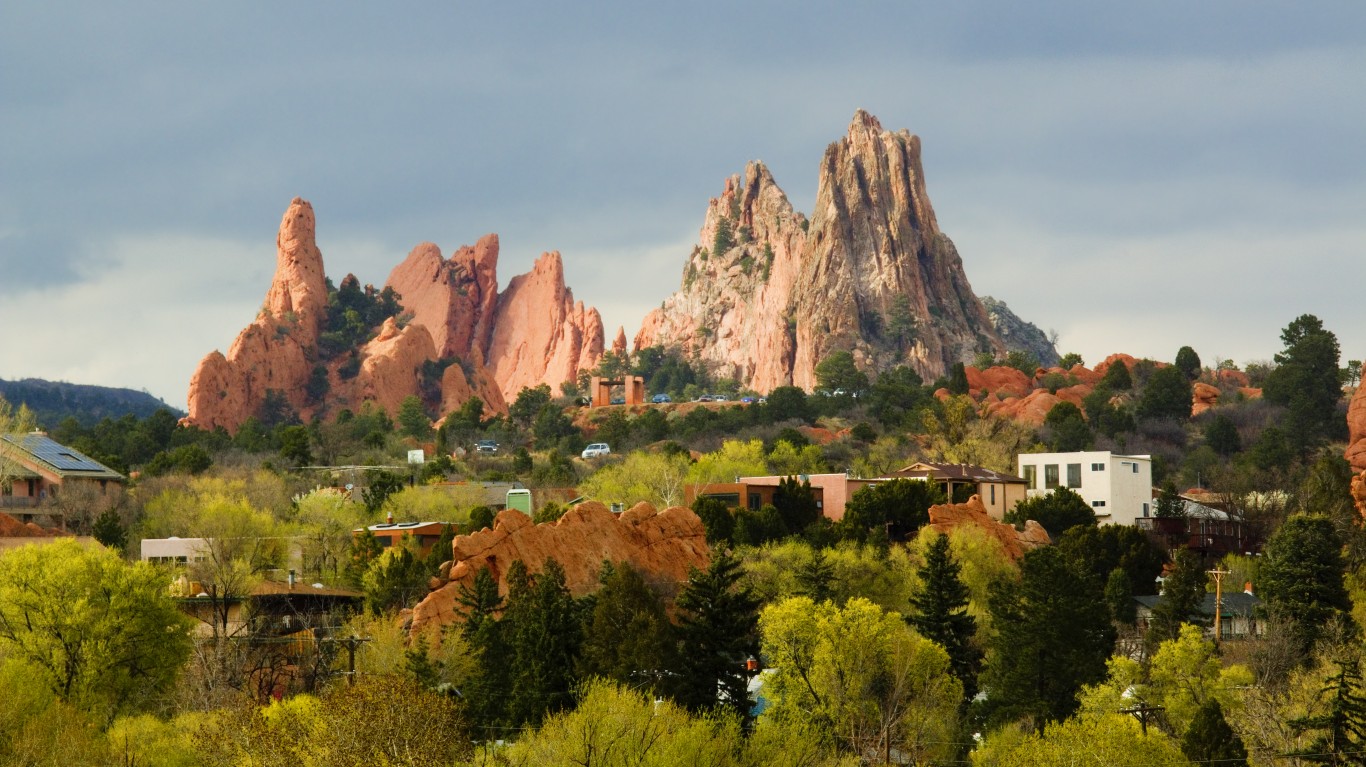

43. Colorado Springs, CO

> Total population: 738,939

> Pop. growth due to net migration, 2010-2018: +7.7% (+50,027)

> Cost of living: 0.4% less than nat’l avg.

> Median home value: $290,100 (top 25%)

> Median household income: $67,430 (top 25%)

42. Huntsville, AL

> Total population: 462,693

> Pop. growth due to net migration, 2010-2018: +7.9% (+32,831)

> Cost of living: 10.1% less than nat’l avg.

> Median home value: $187,000

> Median household income: $63,765 (top 25%)

[in-text-ad-2]

41. Pensacola-Ferry Pass-Brent, FL

> Total population: 494,883

> Pop. growth due to net migration, 2010-2018: +8.0% (+35,963)

> Cost of living: 7.7% less than nat’l avg.

> Median home value: $169,800

> Median household income: $57,998

40. Odessa, TX

> Total population: 162,124

> Pop. growth due to net migration, 2010-2018: +8.3% (+11,351)

> Cost of living: 4.2% less than nat’l avg.

> Median home value: $148,000

> Median household income: $64,165 (top 25%)

[in-text-ad]

39. College Station-Bryan, TX

> Total population: 262,431

> Pop. growth due to net migration, 2010-2018: +8.3% (+19,042)

> Cost of living: 6.7% less than nat’l avg.

> Median home value: $213,100

> Median household income: $50,512

38. Kennewick-Richland, WA

> Total population: 296,224

> Pop. growth due to net migration, 2010-2018: +8.5% (+21,491)

> Cost of living: 3.4% less than nat’l avg.

> Median home value: $248,600 (top 25%)

> Median household income: $64,908 (top 25%)

37. Bowling Green, KY

> Total population: 177,432

> Pop. growth due to net migration, 2010-2018: +8.5% (+13,518)

> Cost of living: 14.8% less than nat’l avg.

> Median home value: $166,600

> Median household income: $51,365

[in-text-ad-2]

36. Lake Havasu City-Kingman, AZ

> Total population: 209,550

> Pop. growth due to net migration, 2010-2018: +8.6% (+17,225)

> Cost of living: 8.8% less than nat’l avg.

> Median home value: $189,300

> Median household income: $46,060 (bottom 25%)

35. Des Moines-West Des Moines, IA

> Total population: 655,409

> Pop. growth due to net migration, 2010-2018: +8.6% (+49,051)

> Cost of living: 6.5% less than nat’l avg.

> Median home value: $195,300

> Median household income: $71,352 (top 25%)

[in-text-ad]

34. Sioux Falls, SD

> Total population: 265,653

> Pop. growth due to net migration, 2010-2018: +8.7% (+19,823)

> Cost of living: 8.4% less than nat’l avg.

> Median home value: $199,500

> Median household income: $61,196

33. Burlington, NC

> Total population: 166,436

> Pop. growth due to net migration, 2010-2018: +8.9% (+13,430)

> Cost of living: 10.9% less than nat’l avg.

> Median home value: $151,900

> Median household income: $49,979 (bottom 25%)

32. Durham-Chapel Hill, NC

> Total population: 575,412

> Pop. growth due to net migration, 2010-2018: +9.0% (+45,535)

> Cost of living: 4.8% less than nat’l avg.

> Median home value: $250,200 (top 25%)

> Median household income: $62,114

[in-text-ad-2]

31. Bismarck, ND

> Total population: 132,678

> Pop. growth due to net migration, 2010-2018: +9.6% (+11,045)

> Cost of living: 7% less than nat’l avg.

> Median home value: $258,700 (top 25%)

> Median household income: $70,550 (top 25%)

30. Salisbury, MD-DE

> Total population: 409,979

> Pop. growth due to net migration, 2010-2018: +9.6% (+35,981)

> Cost of living: 11.5% less than nat’l avg.

> Median home value: $231,800

> Median household income: $59,214

[in-text-ad]

29. Sherman-Denison, TX

> Total population: 133,991

> Pop. growth due to net migration, 2010-2018: +9.8% (+11,842)

> Cost of living: 8.1% less than nat’l avg.

> Median home value: $163,100

> Median household income: $51,158

28. Fargo, ND-MN

> Total population: 245,471

> Pop. growth due to net migration, 2010-2018: +10.2% (+21,211)

> Cost of living: 8.3% less than nat’l avg.

> Median home value: $221,400

> Median household income: $65,073 (top 25%)

27. Phoenix-Mesa-Scottsdale, AZ

> Total population: 4,857,962

> Pop. growth due to net migration, 2010-2018: +10.4% (+435,114)

> Cost of living: 2.3% less than nat’l avg.

> Median home value: $267,000 (top 25%)

> Median household income: $64,427 (top 25%)

[in-text-ad-2]

26. Jacksonville, FL

> Total population: 1,534,701

> Pop. growth due to net migration, 2010-2018: +10.4% (+140,382)

> Cost of living: 4.6% less than nat’l avg.

> Median home value: $217,200

> Median household income: $60,238

25. Nashville-Davidson–Murfreesboro–Franklin, TN

> Total population: 1,930,961

> Pop. growth due to net migration, 2010-2018: +10.7% (+178,958)

> Cost of living: 4.7% less than nat’l avg.

> Median home value: $261,900 (top 25%)

> Median household income: $65,919 (top 25%)

[in-text-ad]

24. San Antonio-New Braunfels, TX

> Total population: 2,518,036

> Pop. growth due to net migration, 2010-2018: +11.2% (+239,501)

> Cost of living: 5.6% less than nat’l avg.

> Median home value: $182,000

> Median household income: $57,379

23. Charlotte-Concord-Gastonia, NC-SC

> Total population: 2,569,213

> Pop. growth due to net migration, 2010-2018: +11.3% (+250,067)

> Cost of living: 6.2% less than nat’l avg.

> Median home value: $215,500

> Median household income: $62,068

22. Sebring, FL

> Total population: 105,424

> Pop. growth due to net migration, 2010-2018: +11.7% (+11,590)

> Cost of living: 16.8% less than nat’l avg.

> Median home value: $105,800 (bottom 10%)

> Median household income: $39,796 (bottom 10%)

[in-text-ad-2]

21. Fayetteville-Springdale-Rogers, AR-MO

> Total population: 549,128

> Pop. growth due to net migration, 2010-2018: +11.9% (+55,068)

> Cost of living: 10.6% less than nat’l avg.

> Median home value: $173,600

> Median household income: $57,911

20. Ocala, FL

> Total population: 359,977

> Pop. growth due to net migration, 2010-2018: +11.9% (+39,511)

> Cost of living: 9.5% less than nat’l avg.

> Median home value: $150,600

> Median household income: $44,576 (bottom 10%)

[in-text-ad]

19. Auburn-Opelika, AL

> Total population: 163,941

> Pop. growth due to net migration, 2010-2018: +12.0% (+16,848)

> Cost of living: 15.6% less than nat’l avg.

> Median home value: $182,700

> Median household income: $46,456 (bottom 25%)

18. Palm Bay-Melbourne-Titusville, FL

> Total population: 596,849

> Pop. growth due to net migration, 2010-2018: +12.3% (+66,747)

> Cost of living: 4.1% less than nat’l avg.

> Median home value: $221,300

> Median household income: $57,888

17. Tampa-St. Petersburg-Clearwater, FL

> Total population: 3,142,663

> Pop. growth due to net migration, 2010-2018: +12.4% (+344,163)

> Cost of living: 1.1% less than nat’l avg.

> Median home value: $210,000

> Median household income: $54,912

[in-text-ad-2]

16. Boise City, ID

> Total population: 730,426

> Pop. growth due to net migration, 2010-2018: +12.9% (+79,539)

> Cost of living: 5.8% less than nat’l avg.

> Median home value: $264,400 (top 25%)

> Median household income: $61,407

15. Homosassa Springs, FL

> Total population: 147,929

> Pop. growth due to net migration, 2010-2018: +13.0% (+18,293)

> Cost of living: 13% less than nat’l avg.

> Median home value: $137,600 (bottom 25%)

> Median household income: $39,964 (bottom 10%)

[in-text-ad]

14. Charleston-North Charleston, SC

> Total population: 787,643

> Pop. growth due to net migration, 2010-2018: +13.5% (+89,826)

> Cost of living: 3.8% less than nat’l avg.

> Median home value: $252,900 (top 25%)

> Median household income: $64,283 (top 25%)

13. Crestview-Fort Walton Beach-Destin, FL

> Total population: 278,644

> Pop. growth due to net migration, 2010-2018: +13.9% (+32,718)

> Cost of living: 5.7% less than nat’l avg.

> Median home value: $238,600

> Median household income: $63,710 (top 25%)

12. Raleigh, NC

> Total population: 1,362,540

> Pop. growth due to net migration, 2010-2018: +14.1% (+159,756)

> Cost of living: 3.8% less than nat’l avg.

> Median home value: $267,600 (top 25%)

> Median household income: $75,165 (top 10%)

[in-text-ad-2]

11. Deltona-Daytona Beach-Ormond Beach, FL

> Total population: 659,605

> Pop. growth due to net migration, 2010-2018: +14.8% (+87,461)

> Cost of living: 4.7% less than nat’l avg.

> Median home value: $199,400

> Median household income: $51,364

10. Port St. Lucie, FL

> Total population: 482,040

> Pop. growth due to net migration, 2010-2018: +14.8% (+62,896)

> Cost of living: 3% less than nat’l avg.

> Median home value: $233,300

> Median household income: $55,714

[in-text-ad]

9. Lakeland-Winter Haven, FL

> Total population: 708,009

> Pop. growth due to net migration, 2010-2018: +16.0% (+96,548)

> Cost of living: 7% less than nat’l avg.

> Median home value: $161,300

> Median household income: $51,670

8. Orlando-Kissimmee-Sanford, FL

> Total population: 2,572,962

> Pop. growth due to net migration, 2010-2018: +16.1% (+344,022)

> Cost of living: 1.7% less than nat’l avg.

> Median home value: $242,500

> Median household income: $58,610

7. Greeley, CO

> Total population: 314,305

> Pop. growth due to net migration, 2010-2018: +16.3% (+41,180)

> Cost of living: 0.8% less than nat’l avg.

> Median home value: $325,400 (top 10%)

> Median household income: $75,938 (top 10%)

[in-text-ad-2]

6. Sebastian-Vero Beach, FL

> Total population: 157,413

> Pop. growth due to net migration, 2010-2018: +17.9% (+24,647)

> Cost of living: 8.2% less than nat’l avg.

> Median home value: $220,800

> Median household income: $57,508

5. Daphne-Fairhope-Foley, AL

> Total population: 218,022

> Pop. growth due to net migration, 2010-2018: +18.5% (+33,655)

> Cost of living: 9.2% less than nat’l avg.

> Median home value: $193,800

> Median household income: $56,813

[in-text-ad]

4. North Port-Sarasota-Bradenton, FL

> Total population: 821,573

> Pop. growth due to net migration, 2010-2018: +20.1% (+140,889)

> Cost of living: 0.1% less than nat’l avg.

> Median home value: $257,600 (top 25%)

> Median household income: $60,921

3. Cape Coral-Fort Myers, FL

> Total population: 754,610

> Pop. growth due to net migration, 2010-2018: +21.9% (+135,696)

> Cost of living: 3.3% less than nat’l avg.

> Median home value: $235,000

> Median household income: $56,129

2. Punta Gorda, FL

> Total population: 184,998

> Pop. growth due to net migration, 2010-2018: +22.8% (+36,551)

> Cost of living: 4.5% less than nat’l avg.

> Median home value: $206,600

> Median household income: $52,927

[in-text-ad-2]

1. Myrtle Beach-Conway-North Myrtle Beach, SC-NC

> Total population: 480,891

> Pop. growth due to net migration, 2010-2018: +28.0% (+105,460)

> Cost of living: 8.1% less than nat’l avg.

> Median home value: $194,700

> Median household income: $51,580

Methodology

To identify America’s cheapest cities where everyone wants to live, 24/7 Wall St. considered three factors: cost of living, housing affordability, and population growth from migration. Of the 383 U.S. metro areas, we considered only those with a regional price parity — or cost of living — below the national average. Metro areas also had to have a housing affordability ratio — median home value divided by median annual household income — below the average ratio across all metro areas of 4.46. Finally, we ranked the 50 metro areas by the largest population growth due to net migration between 2010 and 2018.

Median household income and median home values are from the 2018 American Community Survey from the U.S. Census Bureau. July 1, 2018 population estimates and population change between 2010 and 2018 are from the Census Bureau’s Population Estimates Program. Regional price parity, or cost of living, is from the Bureau of Economic Analysis.

Percentile ranks for median household income and median home value are provided for context and were calculated against all 383 U.S. metro areas.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.