The initial public offering (IPO) market dried up in the wake of the financial crisis of 2007 and 2008. However, by 2010, things looked up, as the economy was stabilizing and investor confidence was renewed. A total of 190 companies went public in the United States in 2010, compared to 79 the year before and just 62 in 2008.

Perhaps the biggest name to come public that year was General Motors Co. (NYSE: GM), returning to the market after a bankruptcy and government bailout. In addition, the Tesla Inc. (NASDAQ: TSLA) IPO was one of the more widely covered and popular ones. The year also had its share of notable tech IPOs including Molycorp, HiSoft Technology and RealPage, as well as a strong showing from Chinese firms.

The following companies all had IPOs in 2010 and are still public. We have ranked them by how well the stocks have performed since then (as of the close on December 27 and split-adjusted).

(Also see how 16 stocks with IPOs in 1996 have fared since then.)

Express

- Company: Express Inc. (NYSE: EXPR)

- IPO date: May 12

- IPO price: $17

- Post-IPO performance: −97.1%

Shares of this Ohio-based fashion retailer priced below the expected range of $18 to $20 per share. The share price dropped 16% in the first few weeks of trading but ended 2010 more than $15 higher. In the past five years, the stock is down about 92%. The new chief executive admitted to merchandising missteps in the third-quarter report. Only one of nine analysts recommends buying shares.

Quad

- Company: Quad/Graphics Inc. (NYSE: QUAD)

- IPO date: July 6

- IPO price: ~$48

- Post-IPO performance: −86.6%

This business services company was formerly known as Quad/Graphics, and its IPO was part of an acquisition of a publicly traded competitor. The stock traded mostly below the IPO price, not only for the rest of 2010, but since then. However, this is one of the largest commercial printing companies in the world, and the consensus price target of the two analysts who follow the stock indicates 40% or so upside potential in the coming year.

Green Dot

- Company: Green Dot Corp. (NYSE: GDOT)

- IPO date: July 22

- IPO price: $36

- Post-IPO performance: −76.5%

This fintech company is based in Austin, Texas, and its valuation when it went public was $2 billion. The share price was about 29% higher by the end of 2010. Over the past five years, the stock has pulled back around 87%. Shares changed hands at a multiyear low of $7.30 after the third-quarter report last month. Green Dot has appointed a new chief technology officer since then, and analysts on average anticipate the stock can rise more than 27% in the next year.

Vera Bradley

- Company: Vera Bradley Inc. (NASDAQ: VRA)

- IPO date: October 21

- IPO price: $16

- Post-IPO performance: −71.5%

This specialty retailer priced its shares in the initial offering at the top of the expected price range. Shares were over 60% higher two months after the IPO. However, since the spring of 2012, they have traded below the IPO price. Since the beginning of 2023, though, they have gained about 70%, even though third-quarter results were mixed. Analysts are cautious, with a consensus Hold rating and a mean price target that suggests less than 6% additional upside.

Hudson Pacific Properties

- Company: Hudson Pacific Properties Inc. (NYSE: HPP)

- IPO date: June 29

- IPO price: $17

- Post-IPO performance: −47.7%

This Los Angeles-based real estate investment trust raised $210.5 million in its summer IPO. The share price drifted lower and ended 2010 down more than 14%. The stock headed in the right direction starting in 2012, until the pandemic. Shares hit an all-time low near $4 last summer but have more than doubled since then, benefiting from the end of Hollywood strikes and talk of federal rate cuts. Analysts on average recommend buying shares.

Pacific Biosciences of California

- Company: Pacific Biosciences of California Inc. (NASDAQ: PACB)

- IPO date: October 27

- IPO price: $16

- Post-IPO performance: −39.9%

This genetic-sequencing-focused biotech is also known as PacBio. Shares retreated more than 30% in the first month of trading. They jumped after the FTC blocked a buyout of PacBio by Illumina in late 2019, but especially during the pandemic. The stock is up about 23% year to date, about the same as the S&P 500. It is a Cathie Wood pick, and the consensus analyst price target signals nearly 24% upside in the coming year.

QuinStreet

- Company: QuinStreet Inc. (NYSE: QNST)

- IPO date: February 11

- IPO price: $15

- Post-IPO performance: −10.6%

This online marketing company raised $150 million in its IPO, compared with an earlier estimate of $250 million, after reducing its IPO price by more than 20%. Despite an initial dip, the share price ended 2010 about 28% higher. In the past six months, the stock has seen a gain of about 55%. The chief financial officer sold some shares before Christmas. On last look, the consensus price target was only modestly higher than the current share price.

General Motors

- Company: General Motors Co. (NYSE: GM)

- IPO date: November 18

- IPO price: $33

- Post-IPO performance: 5.5%

This IPO was heralded as one of America’s most iconic companies (and the auto industry overall) rising from the ashes of its 2009 bankruptcy. The IPO raised over $20 billion. The share price struggled to find its footing, though, despite an end-of-the-year pop of about 5%. In the past year, the stock is more than 8% higher, while the Dow Jones industrials are up over 13%. Like all automakers that are not Tesla, GM has found the shift to electric vehicles to be a challenge. Hitting the $42.49 consensus price target would be a gain of over 17%.

MakeMyTrip

- Company: MakeMyTrip Ltd. (NASDAQ: MMYT)

- IPO date: August 12

- IPO price: $14

- Post-IPO performance: 38.1%

This is India’s largest travel portal. It benefited from strong travel demand in its most recently reported quarter, and recently entered the car rental business with an acquisition. However, the stock struggled to keep above the IPO price since then, until recently. It is up more than 70% since the beginning of 2023 and trading near the consensus price target. However, some analysts still see multi-bagger returns potential.

MaxLinear

- Company: MaxLinear Inc. (NASDAQ: MXL)

- IPO date: March 23

- IPO price: $14

- Post-IPO performance: 40.2%

The system-on-chip semiconductor maker collected about $92 million from the offering, more than twice as much as earlier expectations. Yet, the stock dropped almost 40% in the first six months of trading. The share price peaked near $78 in late 2021 and, in the past year, the stock has retreated about 27%. It took a hit after each of the past two quarterly results but has trended higher in recent weeks, overrunning the consensus price target.

Sensata Technologies

- Company: Sensata Technologies Holding PLC (NYSE: ST)

- IPO date: March 11

- IPO price: $18

- Post-IPO performance: 110.5%

By the end of 2010, this stock had jumped more than 62%. The stock hit a high above $65 in early 2022 and has retreated more than 40% since then. Analysts have been looking for shares of this Massachusetts-based scientific equipment maker to turn around. The company installed a new chief financial officer recently, but its guidance in the third quarter underwhelmed. The consensus analyst recommendation for now is Hold.

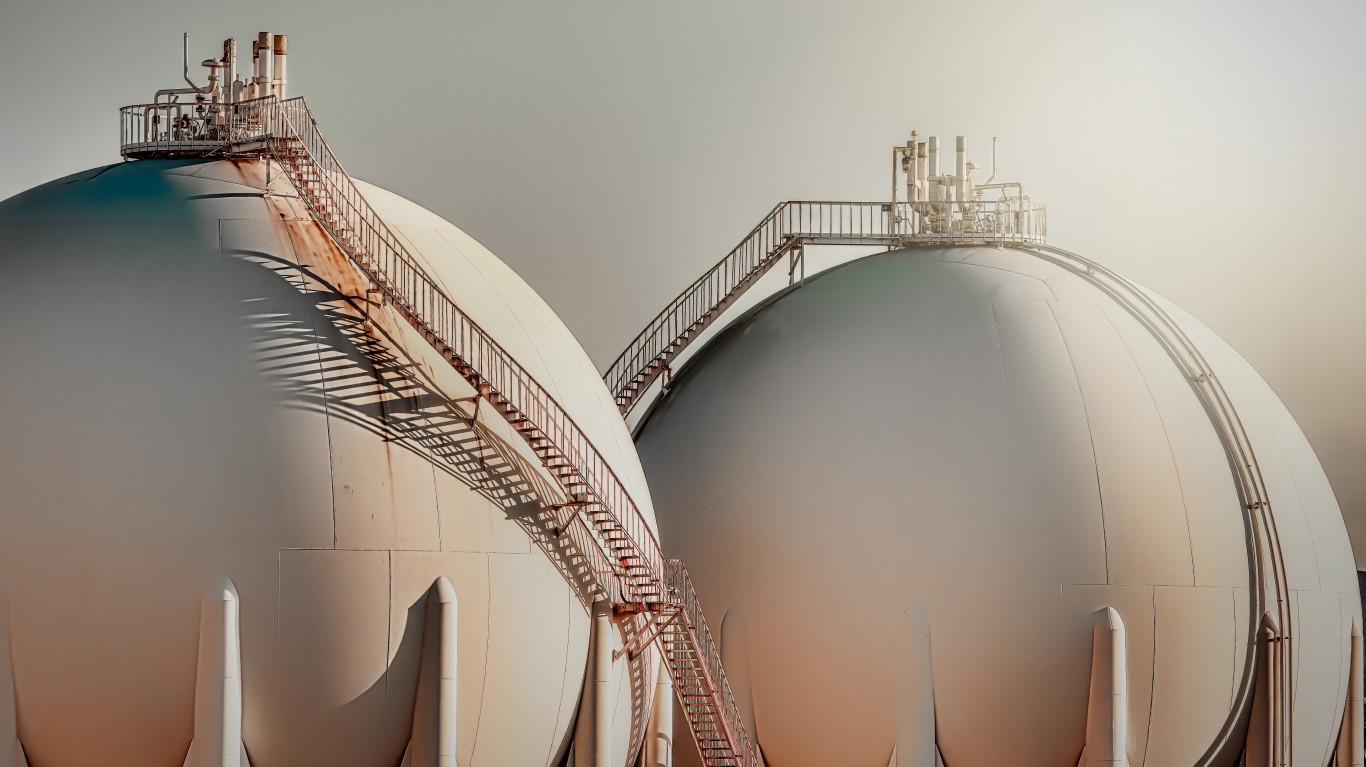

Targa Resources

- Company: Targa Resources Corp. (NYSE: TRGP)

- IPO date: December 7

- IPO price: $22

- Post-IPO performance: 224.7%

This midstream natural gas company raised around $360 million in its IPO. The stock rose about 31% in its first six months of trading, and it reached an all-time high near $161 per share in 2014. The shares are up about 19% year to date, outperforming the Dow Jones industrial average. The company increased its dividend by 50% for 2024. The consensus price target is up at $107.70, which would be a gain of more than 23% for the shares.

JinkoSolar

- Company: JinkoSolar Holding Co. Ltd. (NYSE: JKS)

- IPO date: May 14

- IPO price: $11

- Post-IPO performance: 240.2%

JinkoSolar raised over $64 million from its IPO. The share price dipped right out of the gate but then surged more than 250% before the end of the year. The stock has been in retreat since early this year but may have bottomed near $25 after its third-quarter report in October. The Chinese solar module producer just extended its share repurchase program, and the $40.59 consensus priced target signals about 11% upside potential.

LyondellBasell Industries

- Company: LyondellBasell Industries N.V. (NYSE: LYB)

- IPO date: October 14

- IPO price: ~$26

- Post-IPO performance: 259.2%

By the end of 2010, shares of this chemicals giant were up more than 27%. They peaked near $122 apiece and were last seen changing hands above $96, having outperformed the Dow year to date. This London-based company pays out a dividend yield of over 5%. Yet, on average, analysts currently recommend holding shares.

Envestnet

- Company: Envestnet Inc. (NYSE: ENV)

- IPO date: July 29

- IPO price: $9

- Post-IPO performance: 393.7%

Since sinking to a multiyear low near $33 following a mixed third-quarter report in November, shares are up more than 44%. The $56.25 consensus price target represents about 13% further upside. Six out of 10 analysts recommend buying shares of the Pennsylvania-based wealth management services provider.

Cboe Global Markets

- Company: Cboe Global Markets Inc. (CBOE)

- IPO date: June 15

- IPO price: ~$32

- Post-IPO performance: 439.5%

Cboe initially traded on Nasdaq, and shares struggled at first, ending 2010 almost 30% lower than the IPO price. Shares have mostly marched higher ever since, hitting an all-time high of $183.74 recently. Trading volumes were strong in the most recent quarterly results, but analysts are cautious, with nine out of 13 rating the stock at Hold, and a consensus price target less than 3% higher than the current share price.

Booz Allen Hamilton

- Company: Booz Allen Hamilton Holding Corp. (NYSE: BAH)

- IPO date: November 18

- IPO price: $17

- Post-IPO performance: 556.1%

The IPO of 14 million shares of common stock brought in $238 million for the consulting services provider. But shares drifted lower for the first year, before rising to reach an all-time high of $131.28 recently. The consensus price target is higher at $134.65. This is both a defense and an artificial intelligence play, and the company is due to post its most recent quarterly results in early January.

SS&C Technologies

- Company: SS&C Technologies Holdings Inc. (NASDAQ: SSNC)

- IPO date: March 31

- IPO price: $15

- Post-IPO performance: 711.9%

Shares of this software company are up more than 19% in the past year, but note that the Nasdaq is over 43% higher in that time. The stock peaked at over $84 a share in early 2022. All but one of the 12 analysts who follow the stock recommend buying shares, though the $63.44 consensus target suggests they see limited upside potential at this time.

Primerica

- Company: Primerica Inc. (NYSE: PRI)

- IPO date: March 31

- IPO price: $15

- Post-IPO performance: 768.7%

In the wake of the IPO, shares of this financial company jumped almost 30%. They recently reached an all-time high of $220.00. Primerica also has announced a $35 billion share buyback program and appointed a new chief financial officer recently. Hitting the consensus price target of $225.80 would be a gain of nearly 10%.

H World

- Company: H World Group Ltd. (NASDAQ: HTHT)

- IPO date: March 26

- IPO price: $12.25

- Post-IPO performance: 782.0%

This hotel management company was known as HanTing Hotel Group when it went public. In the past year, the stock has pulled back more than 21% and hit a new 52-week low this past week. The Shanghai-based company posted strong revenue results in its third-quarter report, and analysts who follow the stock on average recommend buying the shares.

FleetCor Technologies

- Company: FleetCor Technologies Inc. (NYSE: FLT)

- IPO date: December 15

- IPO price: $23

- Post-IPO performance: 815.2%

This Atlanta-based digital payments company posted mixed third-quarter results and lowered its profit forecast. However, the stock is up over 19% since then and more than 52% higher year to date. The all-time high share price is almost $330, and the $287.88 consensus price target signals less than 3% upside potential in the next 12 months.

KKR

- Company: KKR & Co. Inc. (NYSE: KKR)

- IPO date: July 15

- IPO price: ~$10

- Post-IPO performance: 820.9%

Also known as Kohlberg Kravis Roberts, this investment management company saw its shares stumble for a couple of months after the IPO before taking off. They recently hit an all-time high of $85.66 and are up about 77% year to date. Most of that gain for the year has come since KKR posted better than expected third-quarter earnings. Ten out of 14 analysts recommend buying shares.

Generac

- Company: Generac Holdings Inc. (NYSE: GNRC)

- IPO date: February 11

- IPO price: $13

- Post-IPO performance: 870.1%

Shares priced at the low end of the expected range, and the Wisconsin-based company raised about $270 million in the IPO. The stock was both down 17% and up 28% before the end of 2010. Shares surged to a high of over $520 during the pandemic but were last seen trading around $130. They are up more than 35% since the better than expected quarterly report in November. Analysts currently see about 5% more upside potential.

Walker & Dunlop

- Company: Walker & Dunlop Inc. (NYSE: WD)

- IPO date: December 15

- IPO price: $10

- Post-IPO performance: 1,021.4%

In the month following the IPO, shares of this real estate lender increased more than 7%. They peaked above $156 apiece in 2022 and were last seen changing hands at around $113. The stock has easily outperformed the S&P 500 in the past year, but analysts remain cautious. They have a consensus Hold rating and a mean price target barely higher than the current share price.

Fabrinet

- Company: Fabrinet (NYSE: FN)

- IPO date: June 25

- IPO price: $10

- Post-IPO performance: 1,751.2%

After this maker of optical and electronic components went public, the share price doubled by the end of the year. It reached an all-time high of nearly $200 this past week, after easily outperforming the broader markets in the past six months. The stock has overrun the consensus price target. Fabrinet’s most recent quarterly results were better than expected, and the consensus recommendation is to buy shares.

NXP Semiconductors

- Company: NXP Semiconductors N.V. (NASDAQ: NXPI)

- IPO date: August 6

- IPO price: $14

- Post-IPO performance: 1,994.8%

This Dutch semiconductor maker is an AI and an EV play. It is also another stock trading near an all-time high, which seems to have tempted the CEO and other executives to sell some shares recently. The consensus Hold rating and mean price target that is less than the current share price indicate that analysts are cautious as well.

Tesla

- Company: Tesla Inc. (NASDAQ: TSLA)

- IPO date: June 29

- IPO price: $17

- Post-IPO performance: 16,356.6%

And finally, another of the most anticipated IPOs of 2010. The IPO price was higher than initially expected, and Tesla raised around $226 million through this offering. Shares ended 2010 more than 11% higher, which was about half the gain seen by the S&P 500. The all-time high is over $414 a share, but they were last seen changing hands for around $262. This is well above the consensus price target, though the high price target is near $345. Note that this is one of the so-called Magnificent Seven stocks that carried the market this year.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.